As global markets grapple with geopolitical tensions, tariff uncertainties, and mixed economic signals from major regions, investors are increasingly seeking stability amid the volatility. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them a compelling choice for those looking to navigate uncertain market waters.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.11% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and internationally, with a market cap of SGD285.60 million.

Operations: Multi-Chem Limited generates revenue from distributing IT products in Singapore (SGD389.78 million), Greater China, Australia (SGD46.00 million), and India (SGD68.30 million), along with a PCB business segment in Singapore (SGD1.63 million).

Dividend Yield: 8.3%

Multi-Chem offers an attractive dividend yield, positioned in the top 25% of Singapore's market. Its dividends are supported by earnings and cash flows, with payout ratios at 79.8% and 72.7%, respectively. Despite a history of volatility in dividend payments over the past decade, there has been growth in dividends during this period. The stock is trading significantly below its estimated fair value, but its unstable dividend track record necessitates cautious consideration from investors seeking reliable income streams.

- Get an in-depth perspective on Multi-Chem's performance by reading our dividend report here.

- According our valuation report, there's an indication that Multi-Chem's share price might be on the cheaper side.

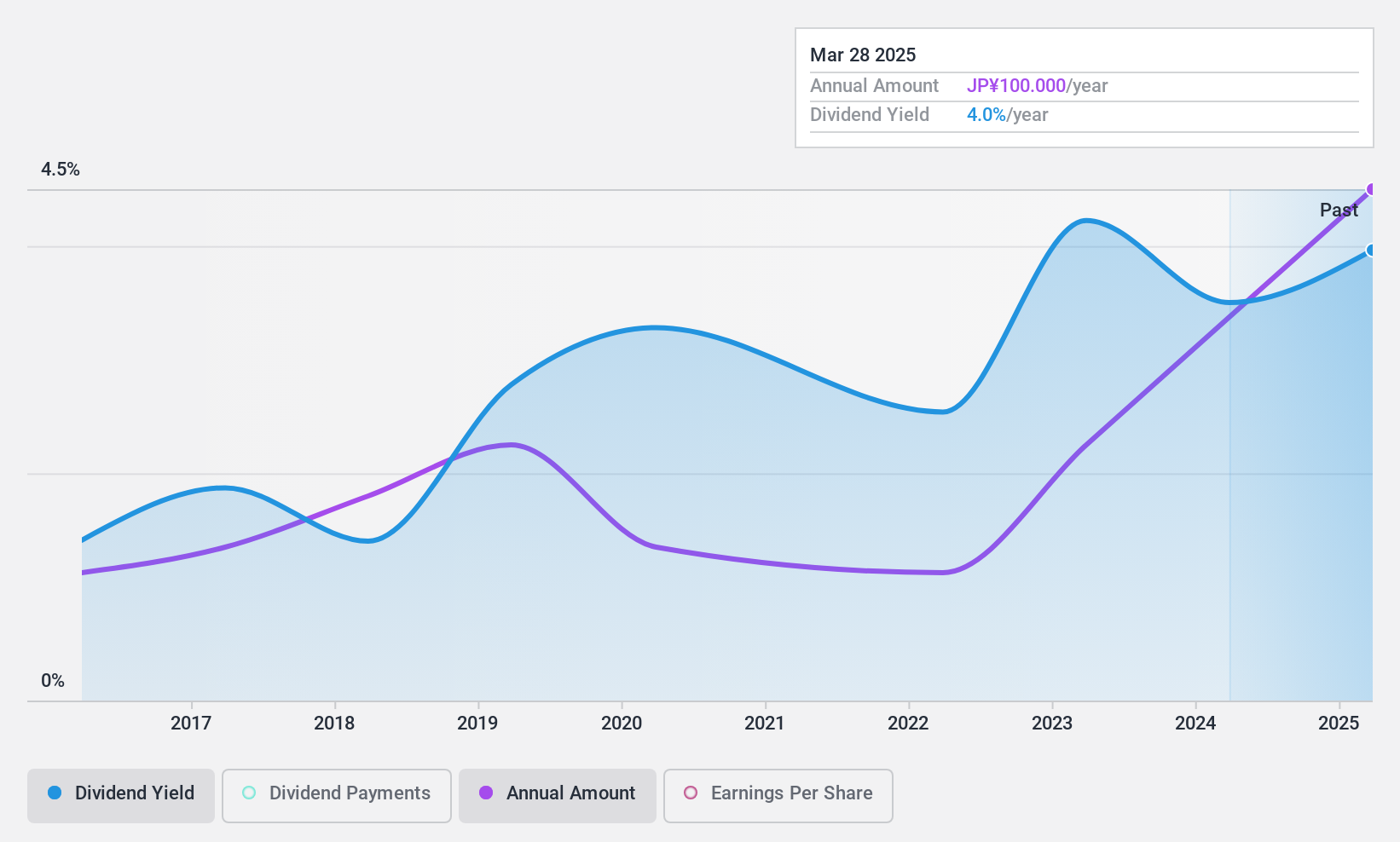

Ashimori Industry (TSE:3526)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ashimori Industry Co., Ltd. manufactures and sells automotive safety systems both in Japan and internationally, with a market cap of ¥17.97 billion.

Operations: Ashimori Industry Co., Ltd.'s revenue is primarily derived from its Automotive Safety Parts Business, which contributes ¥52.12 billion, and its Functional Product Business, which generates ¥20.07 billion.

Dividend Yield: 3.2%

Ashimori Industry's dividend payments, while covered by earnings and cash flows with low payout ratios of 21.2% and 25.7%, respectively, have been volatile over the past decade, experiencing drops of over 20%. Despite this instability, dividends have increased during this period. The stock trades at a significant discount to its estimated fair value but offers a lower yield (3.24%) compared to top-tier Japanese dividend payers (3.83%), warranting careful evaluation for income-focused investors.

- Unlock comprehensive insights into our analysis of Ashimori Industry stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ashimori Industry shares in the market.

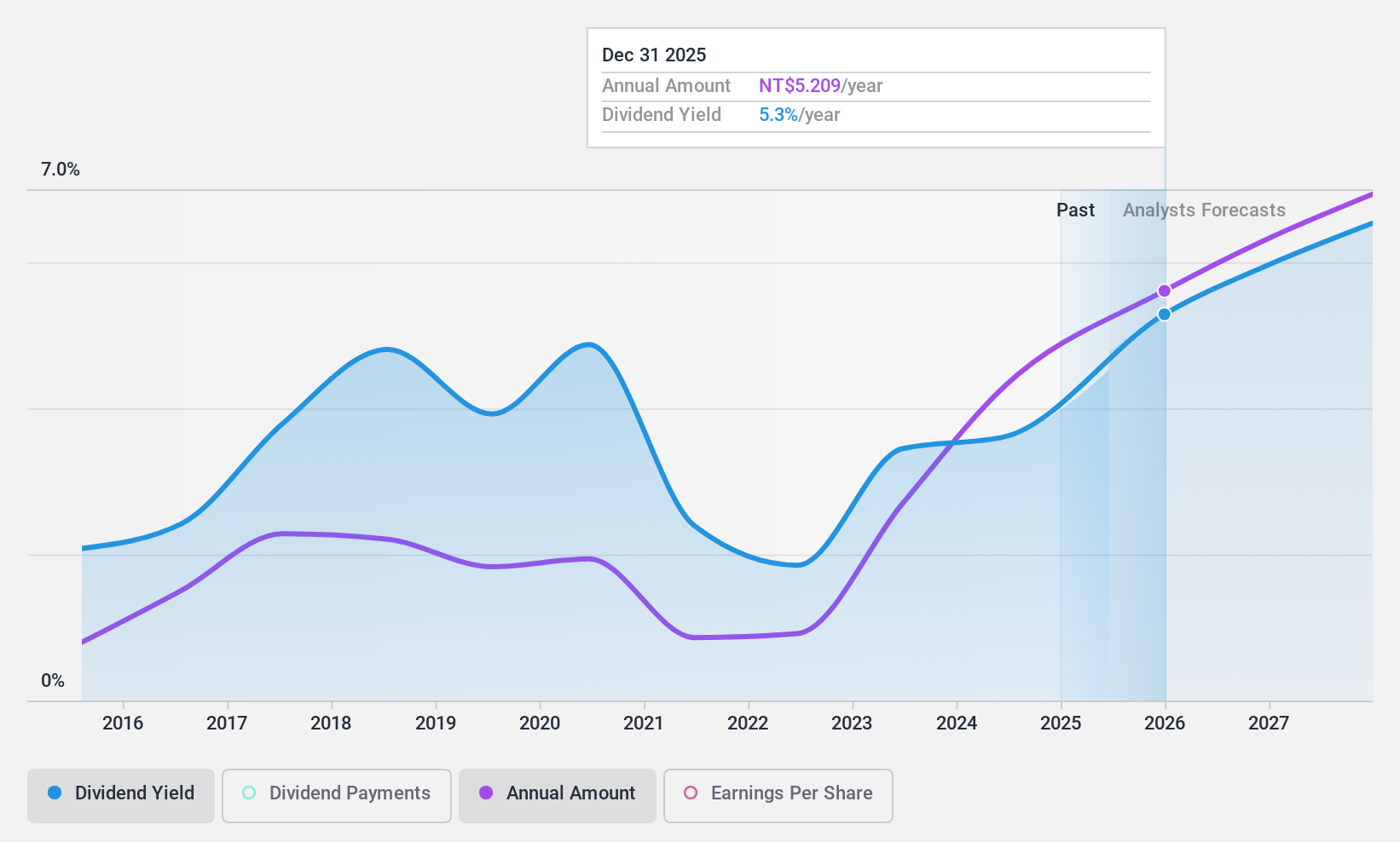

Tong Yang Industry (TWSE:1319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Industry Co., Ltd. manufactures and sells automobile and motorcycle parts, components, and models in Taiwan, China, the United States, and internationally with a market cap of NT$66.54 billion.

Operations: Tong Yang Industry Co., Ltd. generates revenue primarily through its manufacturing and sales operations of automotive and motorcycle parts, components, and models across Taiwan, China, the United States, and other international markets.

Dividend Yield: 3.6%

Tong Yang Industry's dividends are supported by earnings and cash flows, with a payout ratio of 60.8% and a cash payout ratio of 79.8%. However, the dividend history is marked by volatility over the past decade, including significant annual drops. Despite this instability, dividend payments have grown during this period. The stock trades at a notable discount to its estimated fair value but offers a lower yield (3.56%) compared to top-tier Taiwanese dividend payers (4.31%).

- Delve into the full analysis dividend report here for a deeper understanding of Tong Yang Industry.

- Our valuation report here indicates Tong Yang Industry may be undervalued.

Turning Ideas Into Actions

- Dive into all 2008 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology (IT) products in Singapore, Australia, India, Vietnam, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)