- China

- /

- Entertainment

- /

- SZSE:002247

Undiscovered Gems Three Small Caps With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of choppy markets and inflation concerns, small-cap stocks have recently underperformed their large-cap counterparts, with the Russell 2000 Index slipping into correction territory. In such volatile times, identifying promising small-cap stocks requires a keen eye for companies that demonstrate strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sectors mainly in Turkey, with a market capitalization of TRY24.99 billion.

Operations: AgeSA generates revenue primarily from its Life Insurance - Pension and Life Insurance - Retirement segments, with TRY3.65 billion and TRY3.14 billion respectively. The company also incurs a negative revenue adjustment of TRY741.43 million in the Life Insurance - Cumulative Life segment.

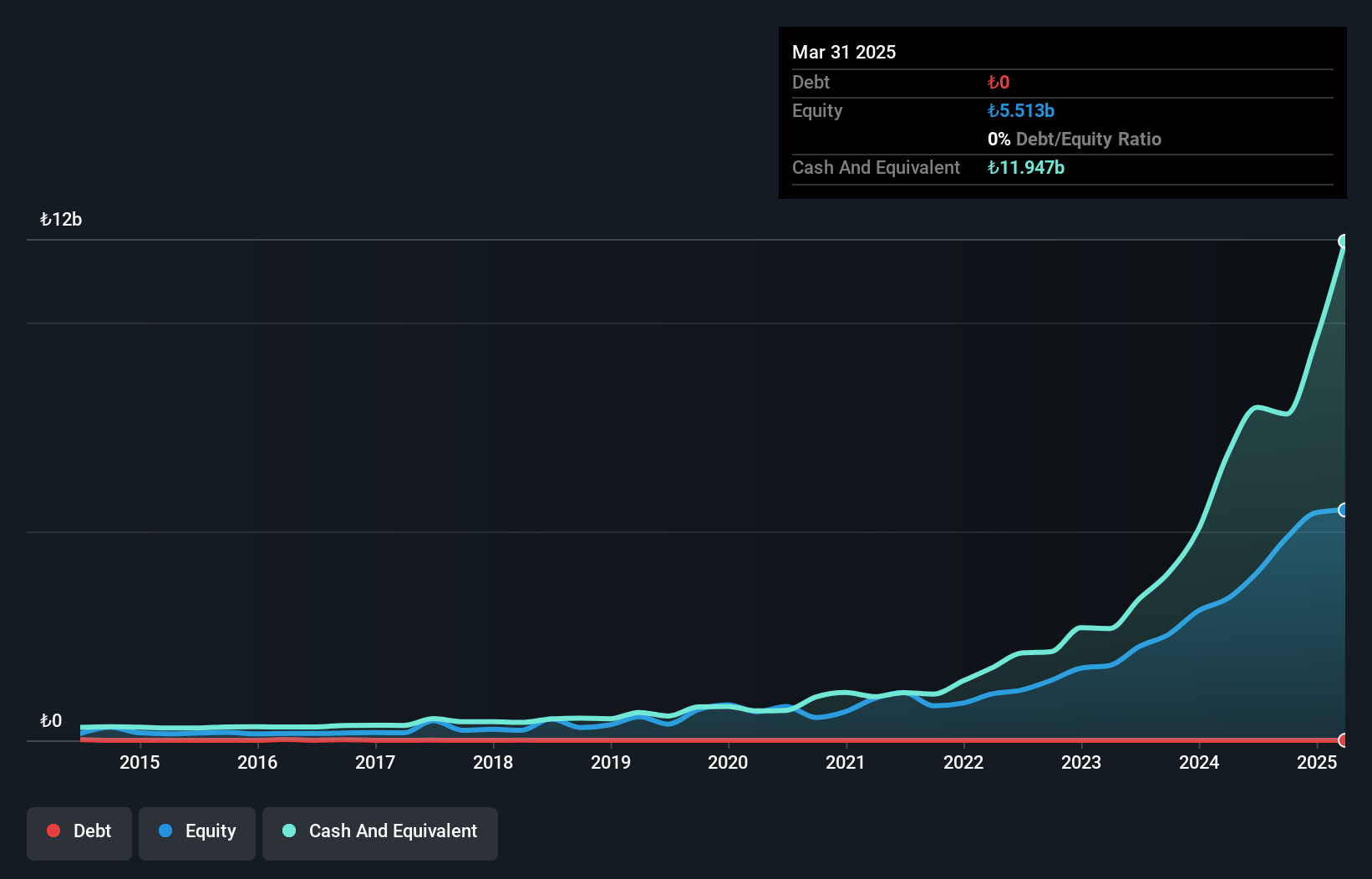

AgeSA Hayat ve Emeklilik Anonim Sirketi, a nimble player in the insurance sector, showcases robust financial health with earnings growth of 88% over the past year, outpacing the industry average of 79.1%. The company is debt-free and boasts high-quality earnings, offering stability in its operations. Its price-to-earnings ratio stands at 10.9x, undercutting the TR market's 15.4x benchmark, hinting at potential value for investors. Recent performance highlights include a net income surge to TRY 715 million for Q3 from TRY 274 million last year and basic EPS rising to TRY 3.98 from TRY 1.52 previously.

Pasifik Eurasia Lojistik Dis Ticaret (IBSE:PASEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pasifik Eurasia Lojistik Dis Ticaret A.S. operates in the logistics sector, focusing on railroad transportation, with a market capitalization of TRY19.49 billion.

Operations: Pasifik Eurasia generates revenue primarily from its railroad transportation segment, which recorded TRY665.02 million. The company's financial performance is reflected in its market capitalization of TRY19.49 billion.

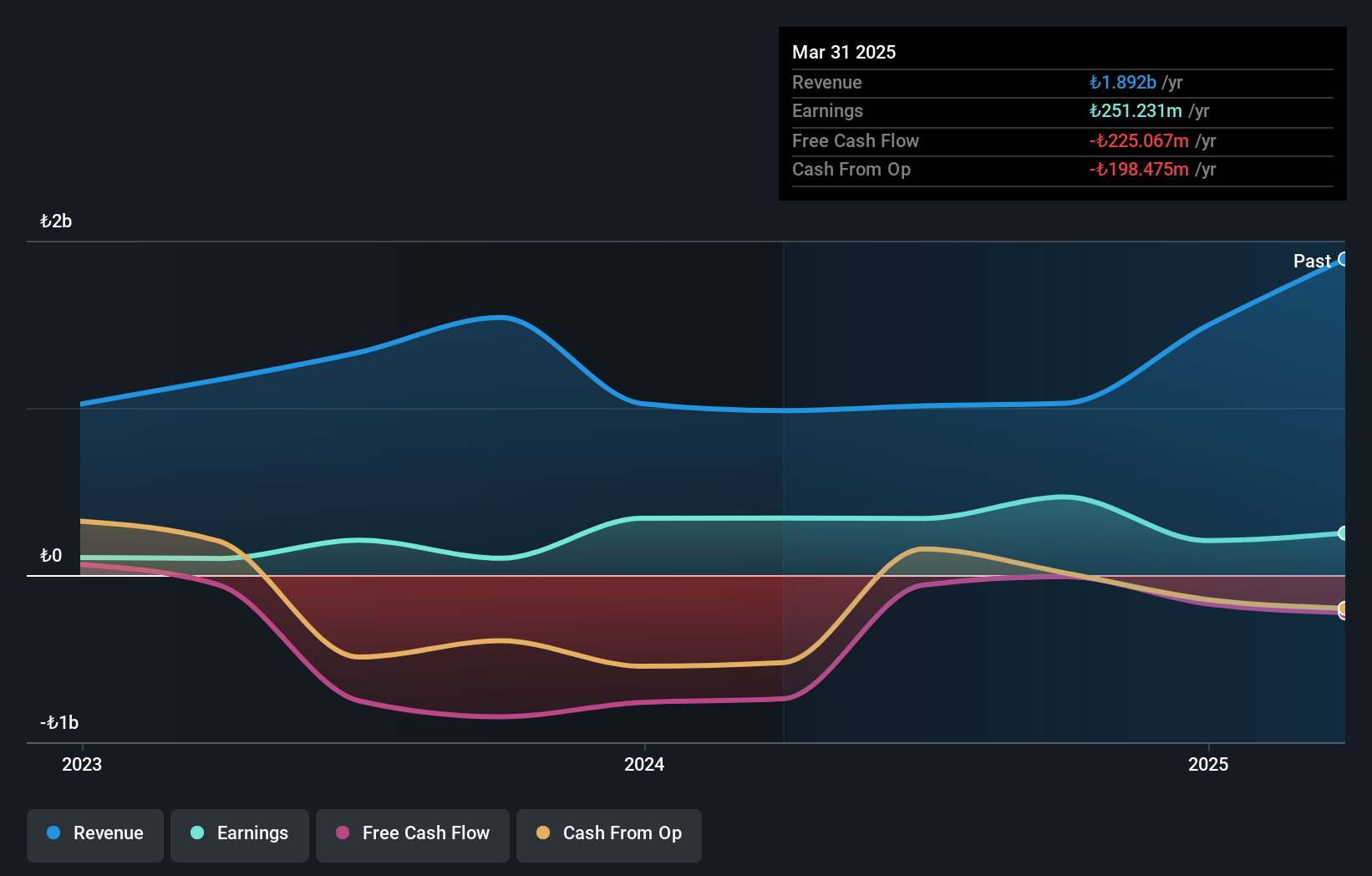

Pasifik Eurasia Lojistik Dis Ticaret's recent performance paints a promising picture, with earnings surging 259% over the past year, outpacing the Transportation industry's growth of 37.2%. The company reported TRY 329.08 million in sales for Q3 2024, up from TRY 314.11 million the previous year, and turned a net income of TRY 26.19 million from a significant loss last year. Its basic earnings per share rose to TRY 0.055 from a loss per share of TRY 0.4 previously, indicating improved profitability and high-quality earnings that cover interest obligations comfortably while maintaining more cash than total debt levels suggest financial robustness in its operations.

Zhejiang Juli Culture DevelopmentLtd (SZSE:002247)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Juli Culture Development Co., Ltd. operates in the cultural and entertainment industry, with a market cap of CN¥2.33 billion.

Operations: Juli Culture Development generates revenue primarily from its cultural and entertainment activities. The company has reported a net profit margin of 12.5% in the most recent period, reflecting its ability to manage costs relative to income effectively.

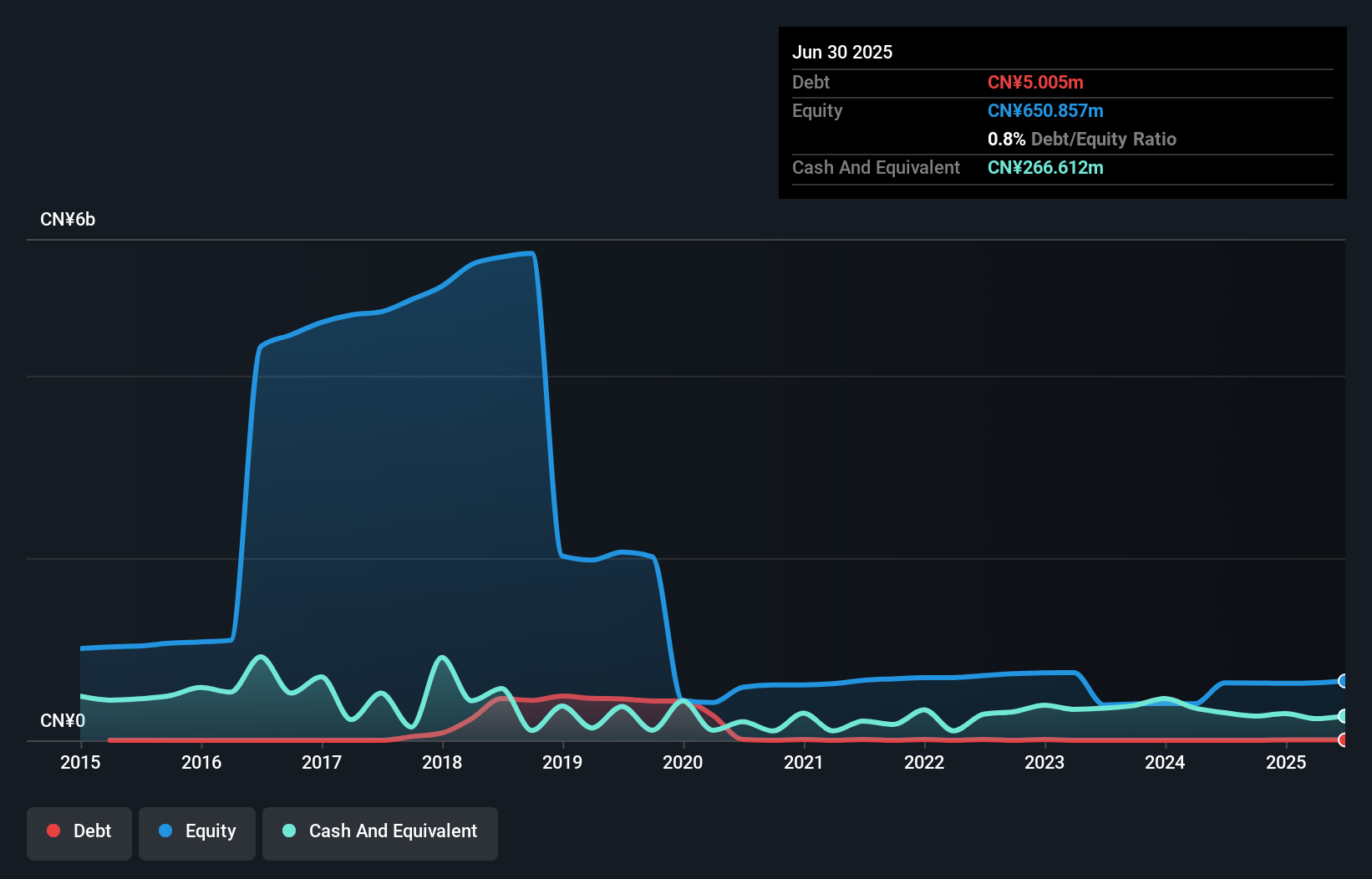

Zhejiang Juli Culture Development, a nimble player in the entertainment sector, has shown resilience by turning profitable this year with net income reaching CNY 220.53 million from a previous loss of CNY 342.53 million. The company boasts a debt-free status, contrasting its past debt-to-equity ratio of 21.4%, which likely supports its robust financial health and enhances flexibility. Its price-to-earnings ratio stands at an attractive 10.3x compared to the broader CN market's 34.1x, suggesting potential undervaluation despite volatile share prices recently observed over three months.

Make It Happen

- Access the full spectrum of 4620 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang Juli Culture DevelopmentLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Juli Culture DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002247

Zhejiang Juli Culture DevelopmentLtd

Zhejiang Juli Culture Development Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives