- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4180

Middle Eastern Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

Most Gulf markets have recently shown gains, buoyed by investor optimism ahead of key U.S. labor data that could influence global monetary policy. In this context, the concept of penny stocks—once a mainstream term but now more niche—remains relevant as it highlights smaller or less-established companies with potential for growth. By focusing on those with strong financials and a clear growth trajectory, investors can uncover valuable opportunities in these often-overlooked segments of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.79 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.65 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.70 | ₪333.02M | ✅ 3 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.90 | TRY1.35B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.12 | AED2.22B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.84 | AED12.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.865 | AED526.14M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.817 | ₪209.42M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

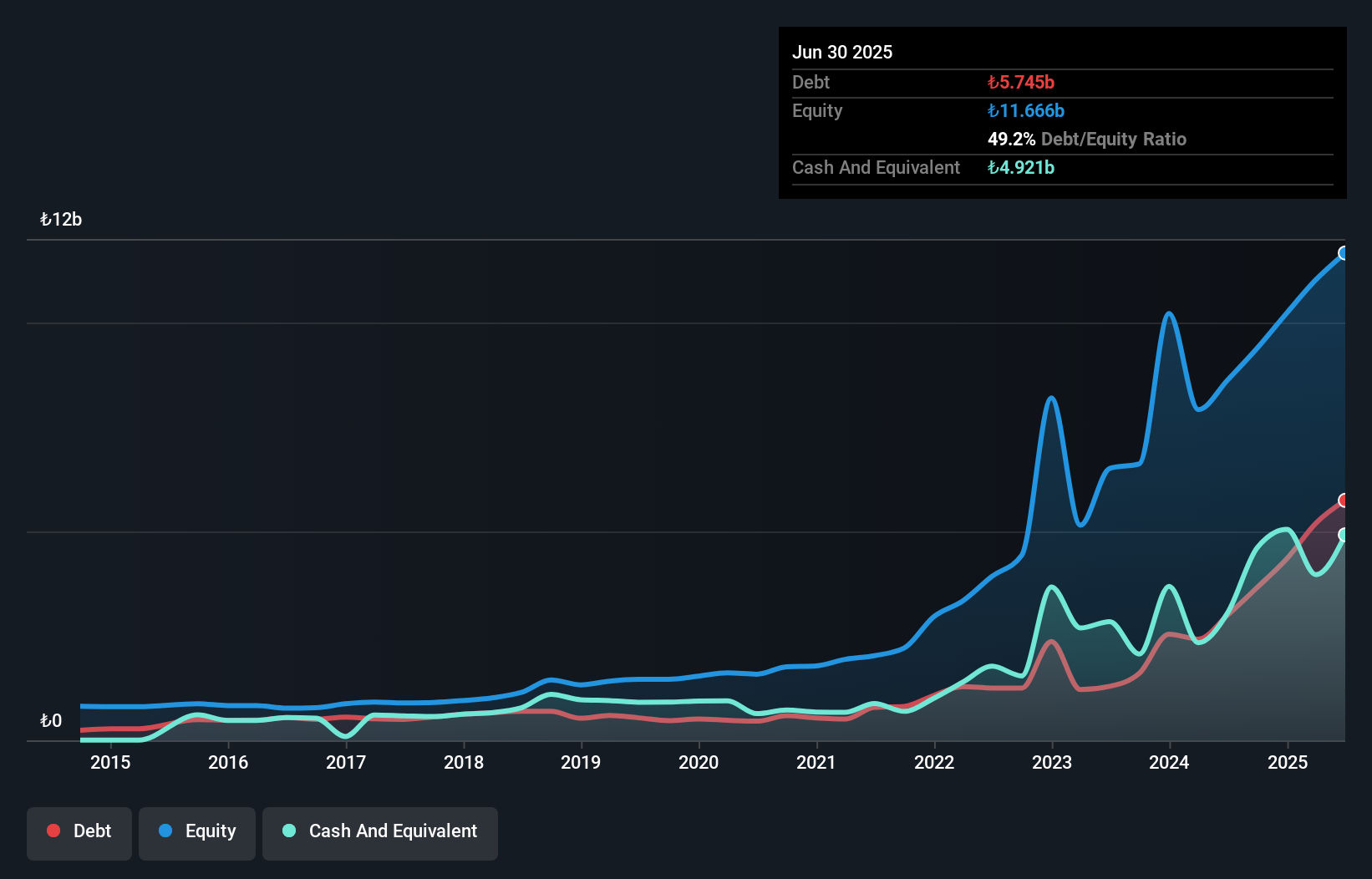

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSD Holding A.S. operates through its subsidiaries in finance, shipping, energy, and education sectors, with a market cap of TRY4.85 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: TRY4.85B

GSD Holding A.S. operates across diverse sectors, including finance and shipping, with a market cap of TRY4.85 billion. The company has recently become profitable but reported a net loss for the latest quarter amid declining sales compared to the previous year. Despite this setback, GSD Holding maintains satisfactory debt levels with short-term assets exceeding both long and short-term liabilities, ensuring liquidity stability. While its Return on Equity is low at 1.9%, interest coverage remains strong, mitigating immediate financial concerns. The board is experienced; however, there is insufficient data on management tenure to assess leadership stability fully.

- Dive into the specifics of GSD Holding here with our thorough balance sheet health report.

- Gain insights into GSD Holding's historical outcomes by reviewing our past performance report.

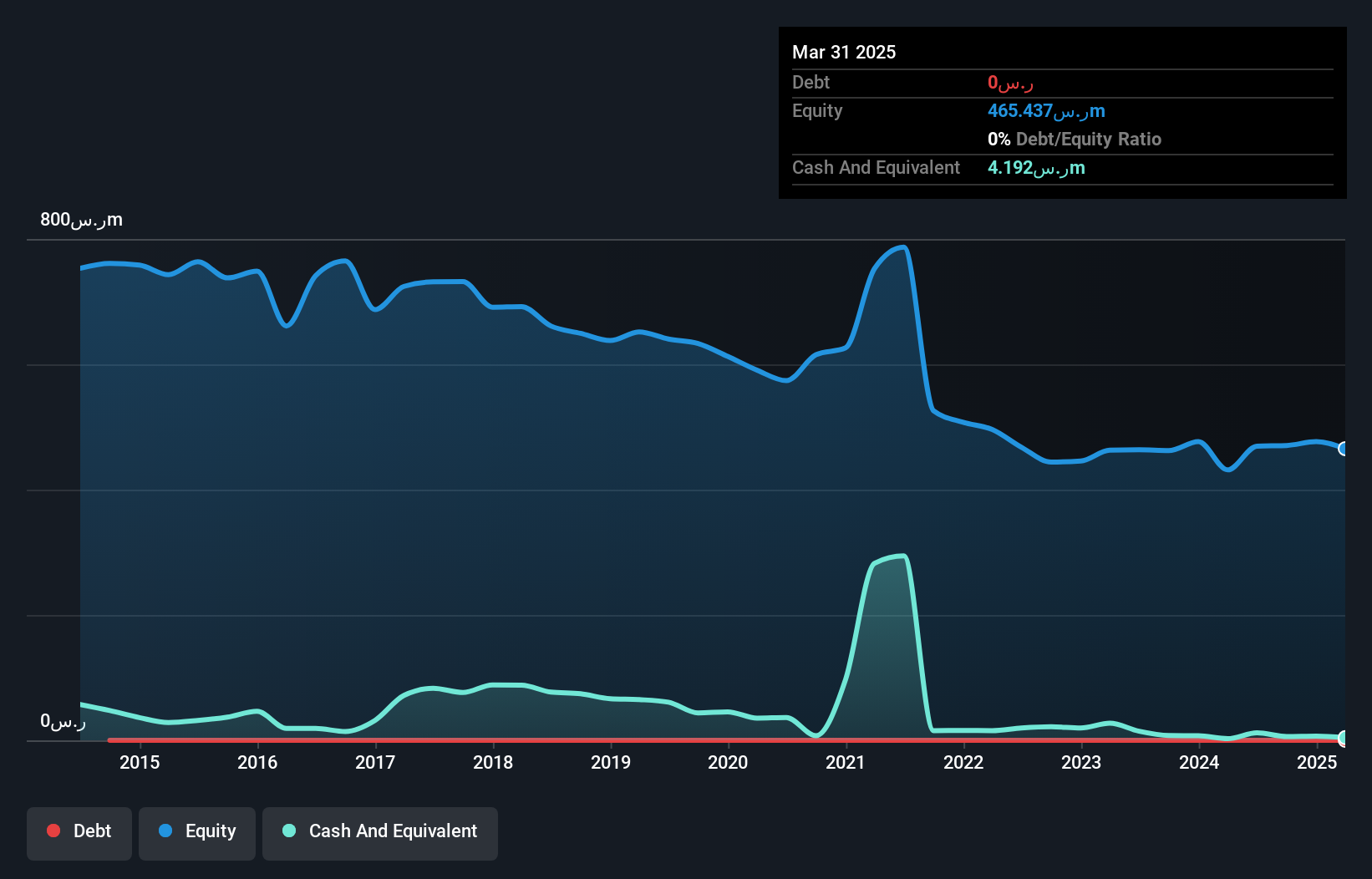

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products, with a market cap of SAR833.25 million.

Operations: The company generates its revenue from operations within Saudi Arabia, amounting to SAR42.67 million.

Market Cap: SAR833.25M

Fitaihi Holding Group, with a market cap of SAR833.25 million, operates in Saudi Arabia's luxury sector, offering gold and jewelry. The company is debt-free and maintains strong liquidity with short-term assets of SAR113.3 million surpassing liabilities. Despite stable weekly volatility at 4%, its Return on Equity remains low at 2.2%. Recent earnings show a decline in sales to SAR8.68 million for Q2 2025 compared to the previous year, alongside reduced net income of SAR7.23 million from SAR8.03 million previously, reflecting challenges in maintaining past profit margins amidst fluctuating revenue streams.

- Unlock comprehensive insights into our analysis of Fitaihi Holding Group stock in this financial health report.

- Understand Fitaihi Holding Group's track record by examining our performance history report.

Alarum Technologies (TASE:ALAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alarum Technologies Ltd. offers web data collection solutions across various regions including the Americas, Europe, Southeast Asia, the Middle East, and Africa with a market cap of ₪333.02 million.

Operations: The company generates revenue primarily from its web data collection segment, which amounts to $29.83 million.

Market Cap: ₪333.02M

Alarum Technologies Ltd., with a market cap of ₪333.02 million, focuses on web data collection, generating US$29.83 million in revenue. Despite a recent dip in half-year sales to US$15.92 million from US$17.26 million, the company remains profitable with net income of US$0.695 million and stable earnings per share at US$0.01. The firm forecasts strong revenue growth for Q3 2025, expecting an increase of approximately 78% year-over-year to around $12.8 million±7%. Alarum's debt is well-managed with cash flow coverage at 408%, though its share price has shown high volatility recently.

- Take a closer look at Alarum Technologies' potential here in our financial health report.

- Examine Alarum Technologies' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Explore the 80 names from our Middle Eastern Penny Stocks screener here.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4180

Fitaihi Holding Group

Provides gold, jewelry, and luxury products primarily in Saudi Arabia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives