- Turkey

- /

- Electronic Equipment and Components

- /

- IBSE:INDES

3 Dividend Stocks With Yields Up To 4.8% For Your Portfolio

Reviewed by Simply Wall St

In a week marked by mixed performances in major U.S. stock indexes and significant geopolitical developments, such as the no-confidence vote impacting France's government, investors are navigating a complex economic landscape. With growth stocks outperforming value stocks and key sectors like consumer discretionary and information technology showing gains, the search for stable income sources becomes crucial amid these fluctuations. In this context, dividend stocks can offer reliable income streams, making them an attractive option for portfolios seeking stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleury Michon SA is engaged in the production and sale of food products both in France and internationally, with a market cap of €108.46 million.

Operations: Fleury Michon's revenue primarily comes from its Division GMS France, generating €679.59 million, and its International Division, contributing €91.20 million.

Dividend Yield: 4.9%

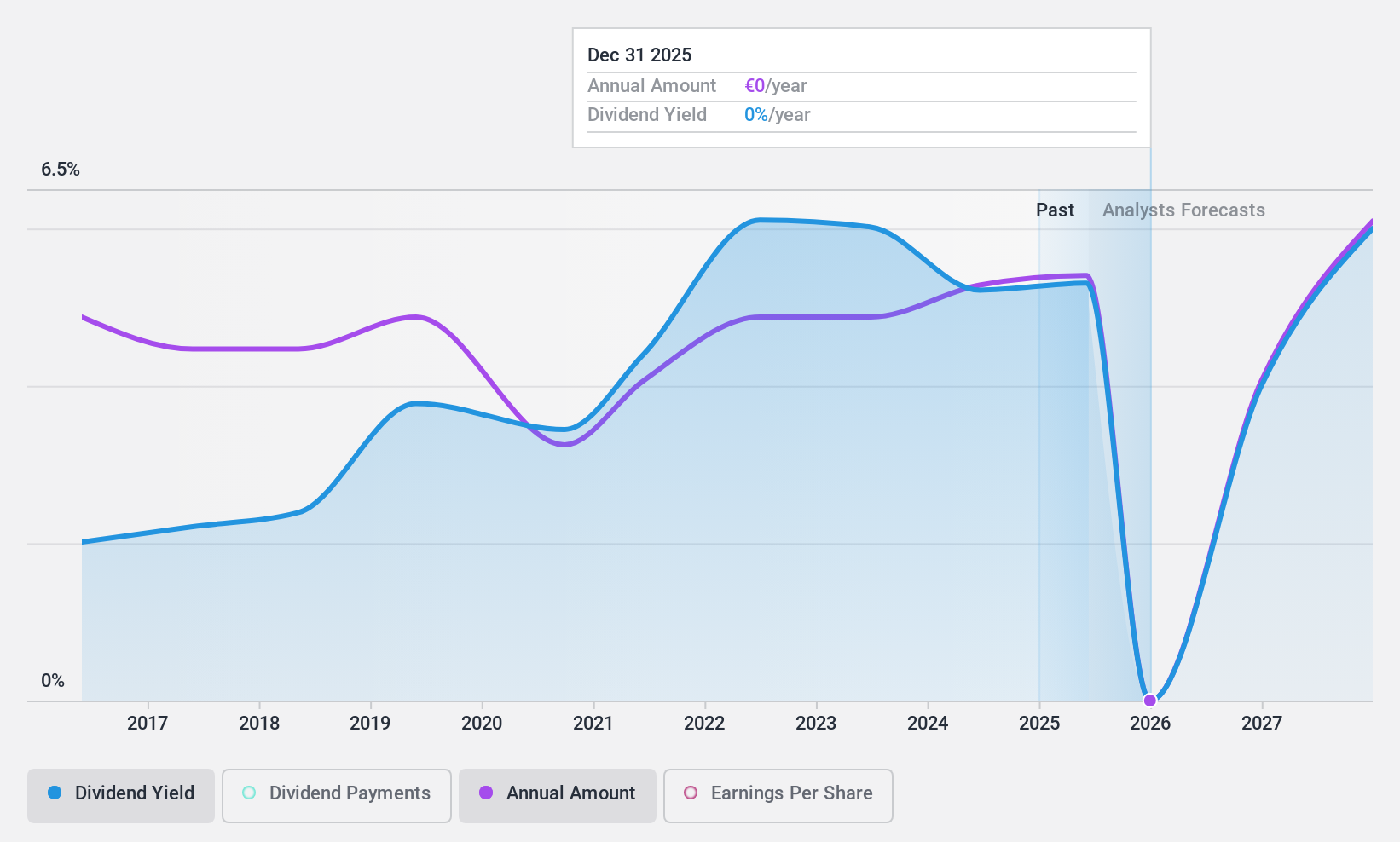

Fleury Michon's dividend payout appears sustainable, with a low cash payout ratio of 12.6% and an earnings payout ratio of 34.1%, indicating dividends are well-covered by both earnings and cash flows. However, despite a decade-long increase in dividends, the payments have been volatile and unreliable, with significant fluctuations over the past ten years. The current dividend yield is 4.85%, which is below the top quartile of French market dividend payers at 5.8%.

- Get an in-depth perspective on Fleury Michon's performance by reading our dividend report here.

- Our valuation report unveils the possibility Fleury Michon's shares may be trading at a discount.

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi (IBSE:INDES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi is a company that distributes IT products in Turkey, with a market cap of TRY5.48 billion.

Operations: The company's revenue segments include Information Technologies and Telecom, generating TRY46.05 billion, and Logistics and Rental, contributing TRY242.36 million.

Dividend Yield: 4.7%

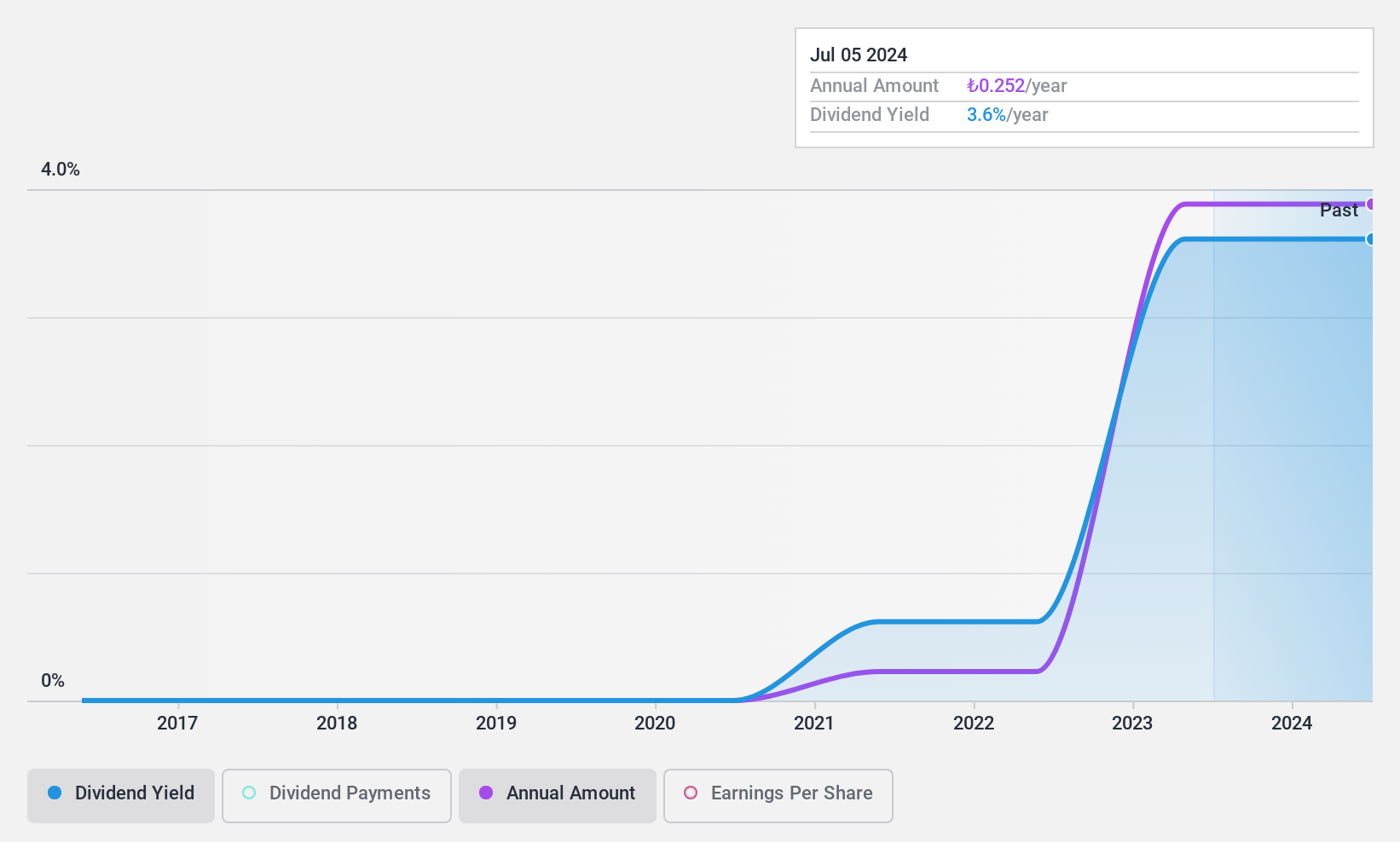

Indeks Bilgisayar's dividends are well-supported, with a payout ratio of 43% and a cash payout ratio of 35.9%, indicating strong coverage by both earnings and cash flows. The dividend yield is competitive at 4.66%, placing it in the top quartile among Turkish dividend payers. Despite only four years of payments, dividends have been stable and growing. Recent earnings show significant growth, with third-quarter net income rising to TRY 146.07 million from TRY 10.92 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi.

- In light of our recent valuation report, it seems possible that Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi is trading beyond its estimated value.

Shinsho (TSE:8075)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinsho Corporation is involved in the global import, export, and trade of iron and steel, ferrous raw materials, nonferrous metals, machinery, information industry products, and welding products with a market cap of ¥54.51 billion.

Operations: Shinsho Corporation's revenue segments consist of Steel at ¥261.26 billion, Welding Material at ¥29.06 billion, Non-Ferrous Metal at ¥187.46 billion, Steel Raw Materials at ¥81.58 billion, and Machinery & Information at ¥59.07 billion.

Dividend Yield: 4.8%

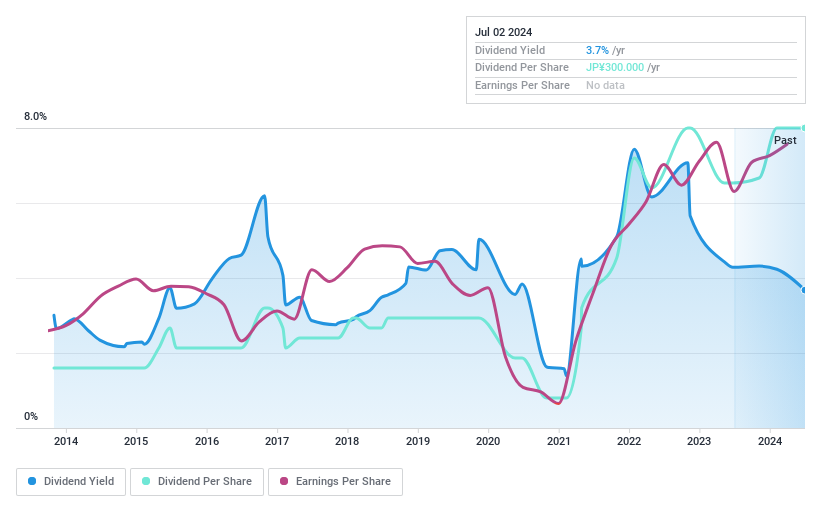

Shinsho Corporation's dividend yield of 4.85% ranks in the top 25% of Japanese dividend payers. The company recently increased its interim dividend to ¥150 per share, up from ¥125 the previous year, reflecting a commitment to returning value to shareholders. Despite an unstable track record over the past decade, dividends are well-covered by earnings (payout ratio: 30%) and cash flows (cash payout ratio: 17.3%). However, high debt levels and large one-off items may impact financial stability.

- Take a closer look at Shinsho's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Shinsho is trading behind its estimated value.

Turning Ideas Into Actions

- Explore the 1938 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:INDES

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi

Distributes IT products in Turkey.

Flawless balance sheet average dividend payer.