In a week marked by mixed performances across major U.S. stock indexes, the Russell 2000 Index saw a decline following its recent outperformance against larger-cap peers, highlighting the volatility and unique opportunities within the small-cap sector. As investors navigate these fluctuating market conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering hidden gems that may thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Aksa Akrilik Kimya Sanayii (IBSE:AKSA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aksa Akrilik Kimya Sanayii A.S., along with its subsidiaries, is involved in the manufacturing and sale of textiles, chemicals, and other industrial products both in Turkey and internationally, with a market cap of TRY42.35 billion.

Operations: Aksa generates revenue primarily from its Fibres segment, contributing TRY18.91 billion, and the Energy segment, adding TRY1.17 billion.

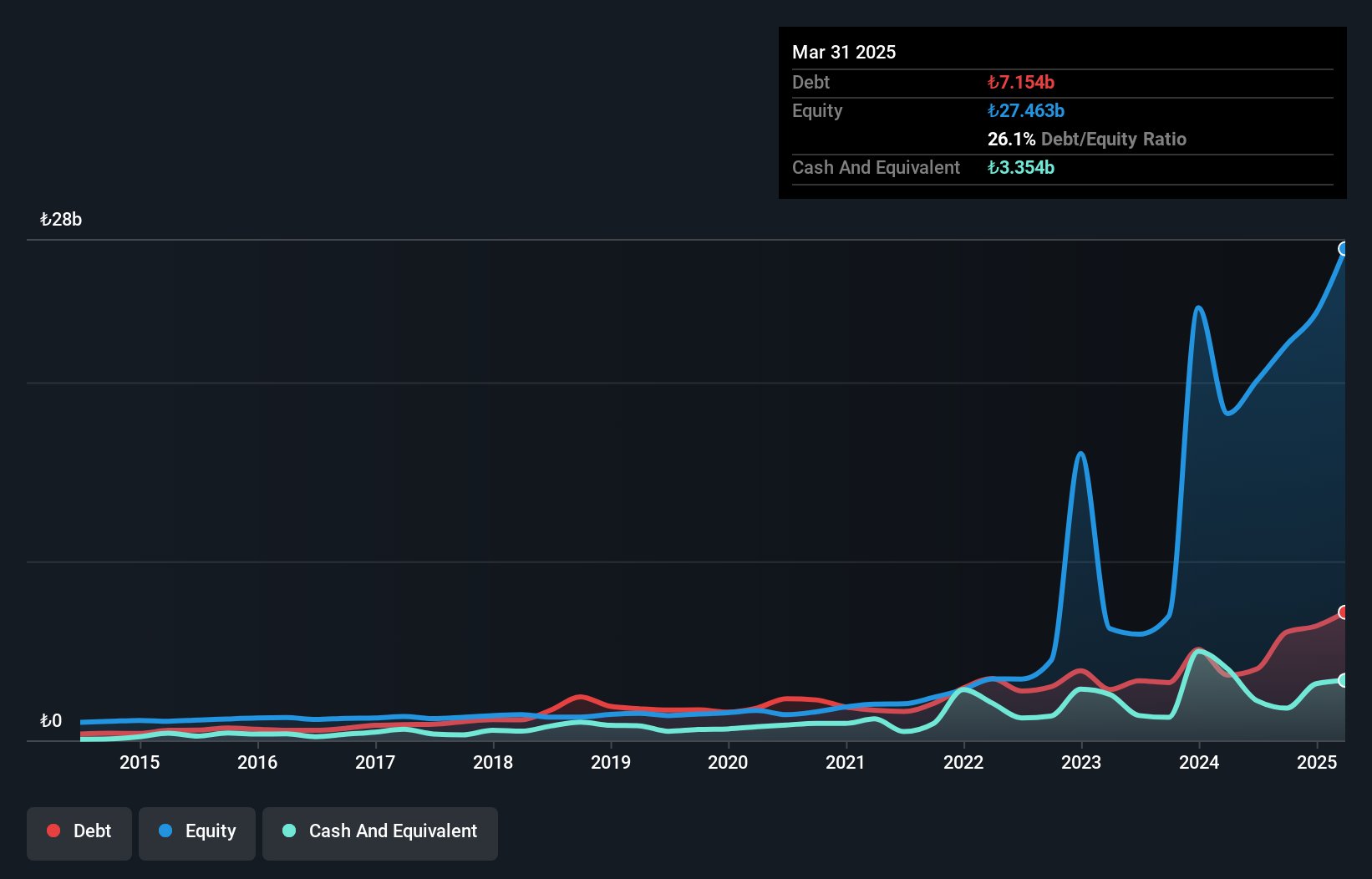

Aksa Akrilik Kimya Sanayii, a prominent player in its niche, showcases an intriguing profile with a Price-To-Earnings ratio of 15.2x, which is favorable compared to the TR market's 15.9x. The company's net debt to equity ratio stands at a satisfactory 19.2%, reflecting prudent financial management as it has decreased from 115.3% over five years. Despite reporting third-quarter sales of TRY 6,077 million down from TRY 7,698 million last year, Aksa turned around its profitability with a net income of TRY 286 million against the previous year's loss of TRY 150 million and earnings per share rising to TRY 0.07 from a loss per share of TRY 0.04 last year.

- Unlock comprehensive insights into our analysis of Aksa Akrilik Kimya Sanayii stock in this health report.

Learn about Aksa Akrilik Kimya Sanayii's historical performance.

Kustur Kusadasi Turizm Endüstrisi (IBSE:KSTUR)

Simply Wall St Value Rating: ★★★★★★

Overview: Kustur Kusadasi Turizm Endüstrisi A.S. operates holiday clubs in Turkey and has a market capitalization of TRY12.73 billion.

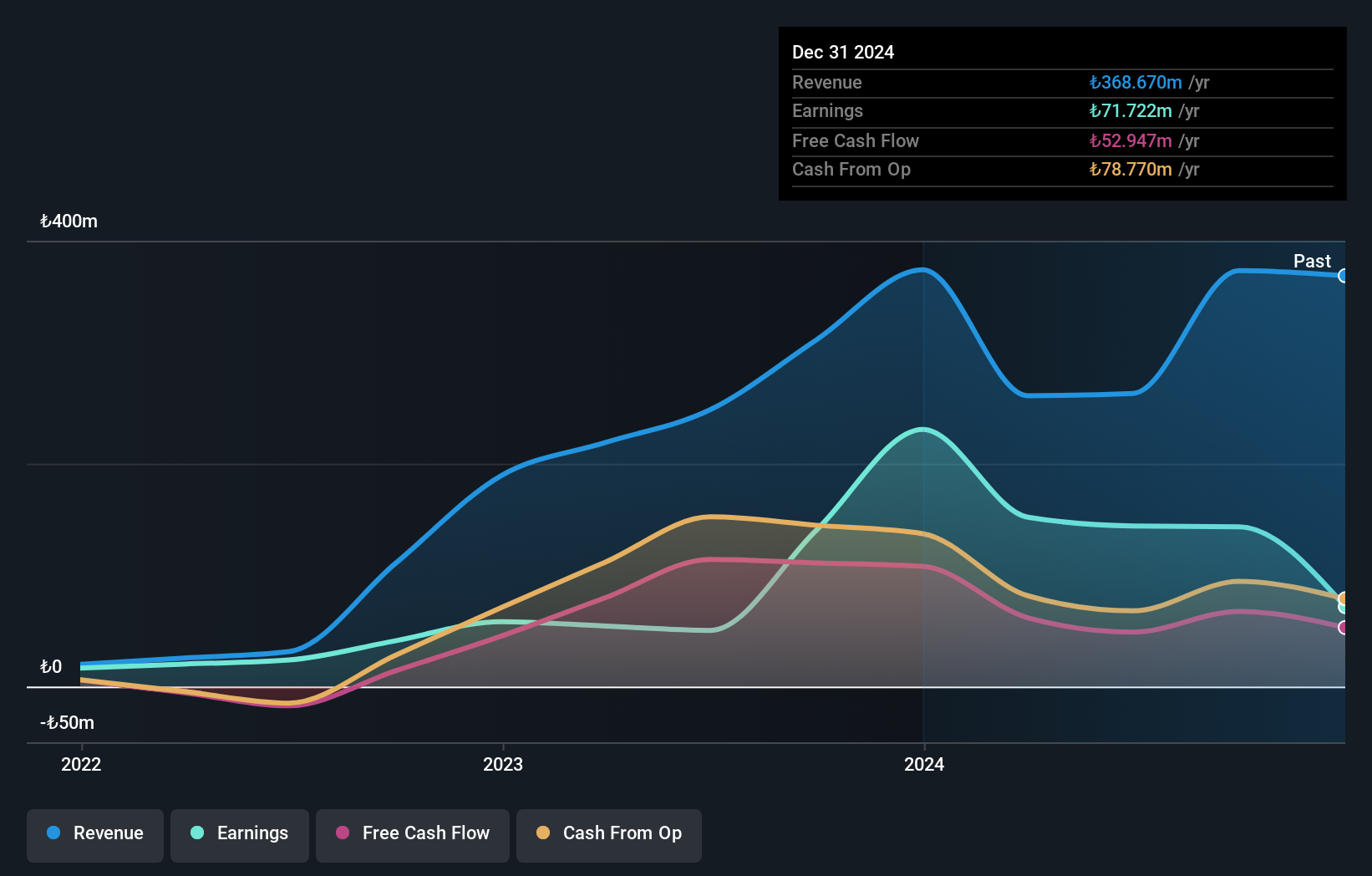

Operations: The company's primary revenue stream is from its casinos and resorts segment, generating TRY262.96 million.

Kustur Kusadasi Turizm Endüstrisi, a player in the hospitality sector, has shown impressive earnings growth of 186% over the past year, outpacing its industry. Despite recent volatility in share price, this debt-free company benefits from high-quality non-cash earnings. Its levered free cash flow rose significantly to US$98.25 million by September 2023 from US$14.07 million a year earlier. Capital expenditure seems to be on an upward trend, reaching US$31.49 million recently, which might impact future cash flow positively if investments pay off. Notably added to the S&P Global BMI Index in September 2024, Kustur's position could attract more investor attention moving forward.

Zhejiang Garden BiopharmaceuticalLtd (SZSE:300401)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Garden Biopharmaceutical Co., Ltd. operates in the biopharmaceutical industry with a market cap of CN¥8.66 billion.

Operations: The company generates revenue primarily from its biopharmaceutical products. It has a market capitalization of CN¥8.66 billion, reflecting its scale in the industry.

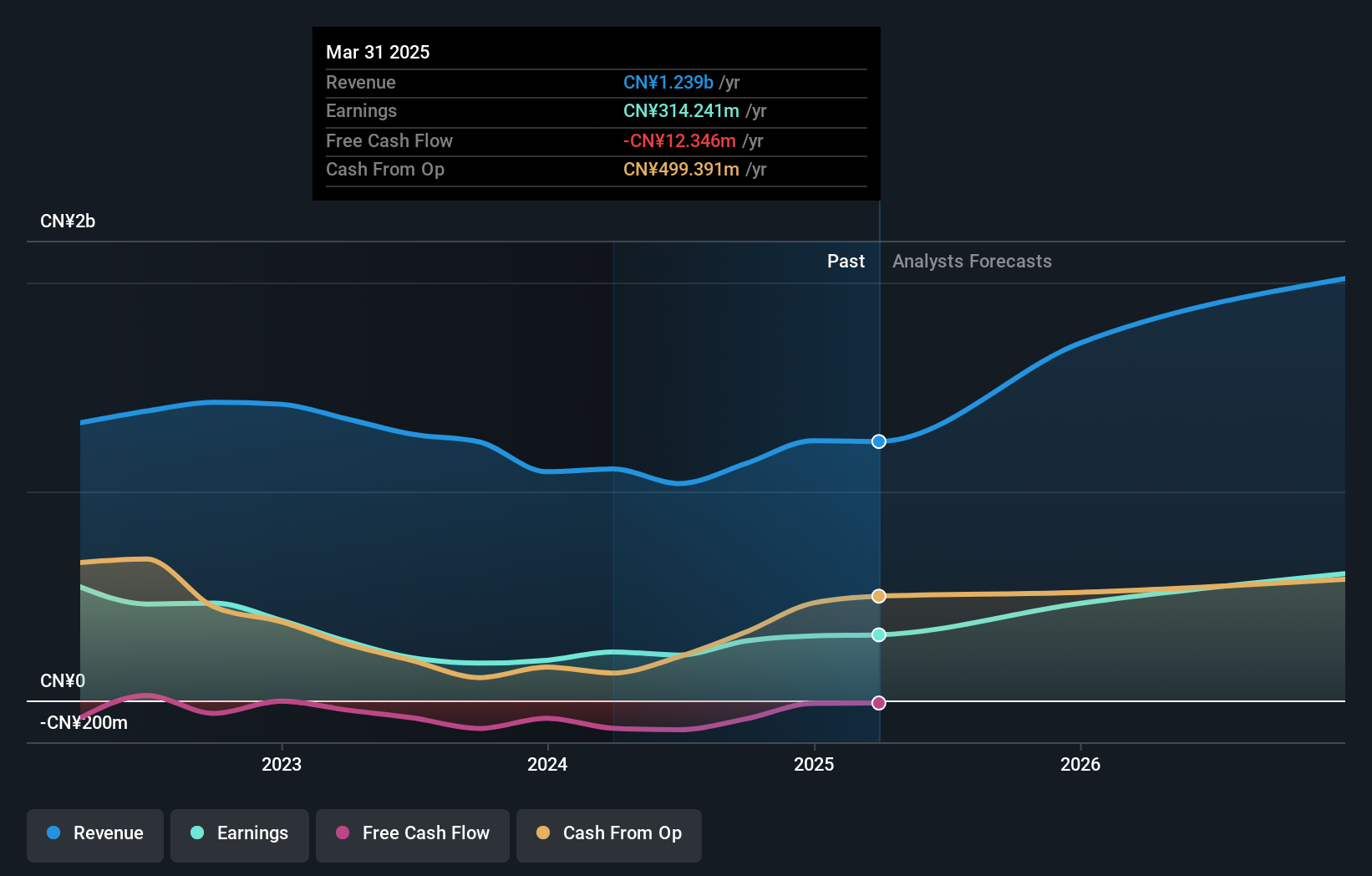

Zhejiang Garden Biopharmaceutical has shown impressive growth, with earnings rising 59.3% over the past year, outpacing the broader pharmaceuticals industry. The company's debt-to-equity ratio climbed from 8.8% to 55.6% in five years, yet interest on debt is well covered by EBIT at a multiple of 12x. A significant one-off gain of CN¥86.9 million influenced recent financial results, and while free cash flow remains negative, net income increased to CN¥241 million from CN¥149 million year-on-year for nine months ending September 2024. With a price-to-earnings ratio of 30.4x below the market average, it offers potential value for investors seeking opportunities in smaller companies within the pharmaceutical sector.

Make It Happen

- Click this link to deep-dive into the 4628 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKSA

Aksa Akrilik Kimya Sanayii

Manufactures and sells textiles, chemicals, and other industrial products in Turkey and internationally.

Undervalued average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)