As global markets navigate a mixed bag of economic indicators, with U.S. consumer confidence dipping and European stocks seeing modest gains, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such an environment, selecting dividend stocks that offer consistent payouts and have strong fundamentals can be particularly appealing for those looking to weather market fluctuations while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Orascom Construction (DIFX:OC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orascom Construction PLC, with a market cap of $676.90 million, operates as an engineering and construction contractor focusing on infrastructure, industrial, and high-end commercial projects across the United States, the Middle East, Africa, and Central Asia.

Operations: Orascom Construction PLC generates its revenue primarily from two segments: $1.78 billion from the USA and $1.54 billion from the MENA region.

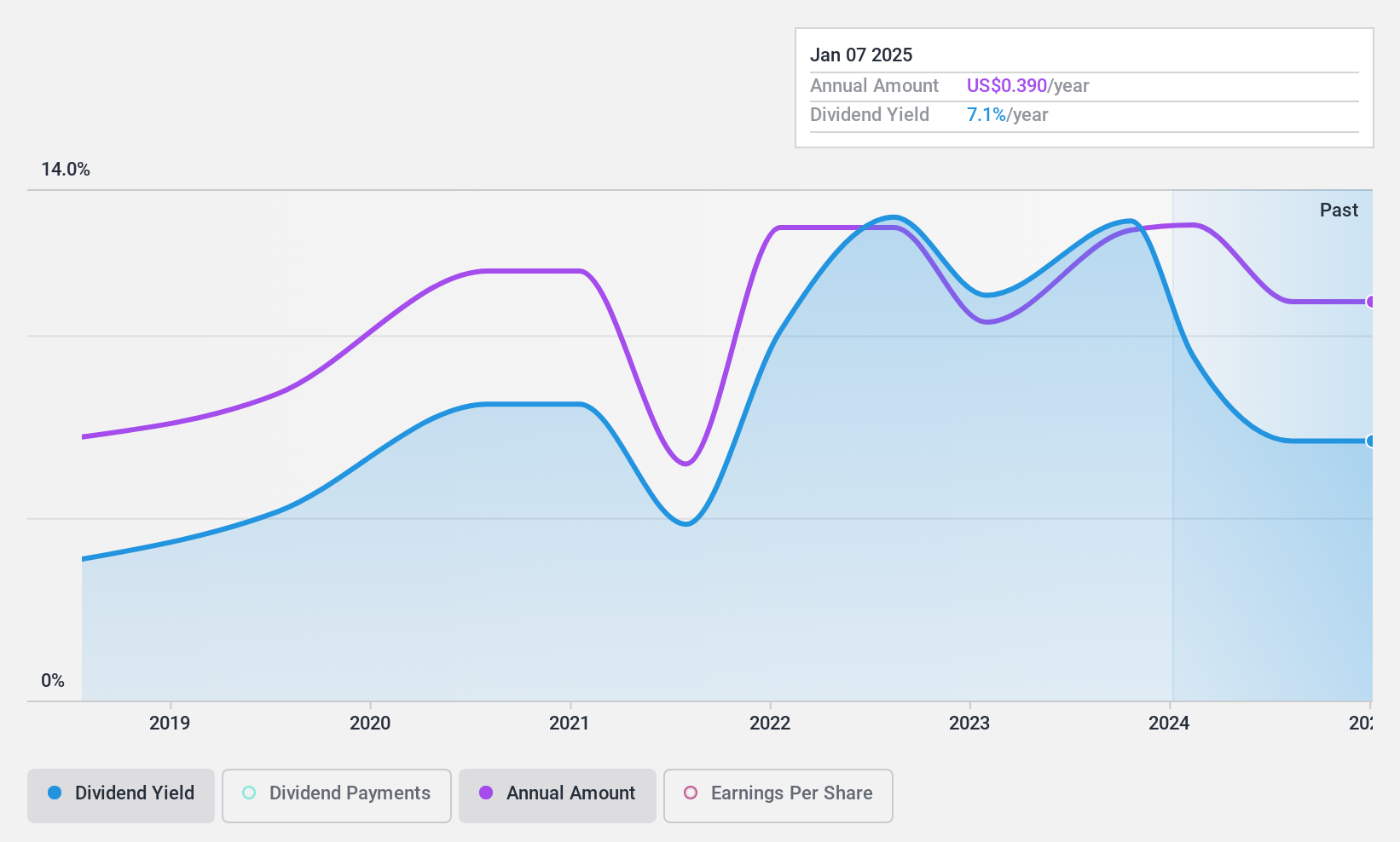

Dividend Yield: 6.4%

Orascom Construction's dividend, yielding 6.35%, ranks in the top 25% of AE market payers. With a payout ratio of 16.9% and cash payout ratio at 8.7%, dividends are well-covered by earnings and cash flows. However, the dividend history is short (7 years) and volatile, with significant fluctuations over time. Recent Q3 earnings showed improvement with net income rising to US$21.6 million from US$16.1 million year-on-year, indicating potential financial resilience despite past volatility in dividends.

- Click to explore a detailed breakdown of our findings in Orascom Construction's dividend report.

- Our expertly prepared valuation report Orascom Construction implies its share price may be lower than expected.

Ulusoy Un Sanayi ve Ticaret (IBSE:ULUUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ulusoy Un Sanayi ve Ticaret A.S. is a Turkish company engaged in the production and sale of wheat flour, with a market capitalization of TRY4.79 billion.

Operations: Ulusoy Un Sanayi ve Ticaret A.S. generates revenue through its segments, with Flour Production and Agricultural Commodity Trade contributing TRY33.39 billion and Licensed Warehousing adding TRY76.25 million.

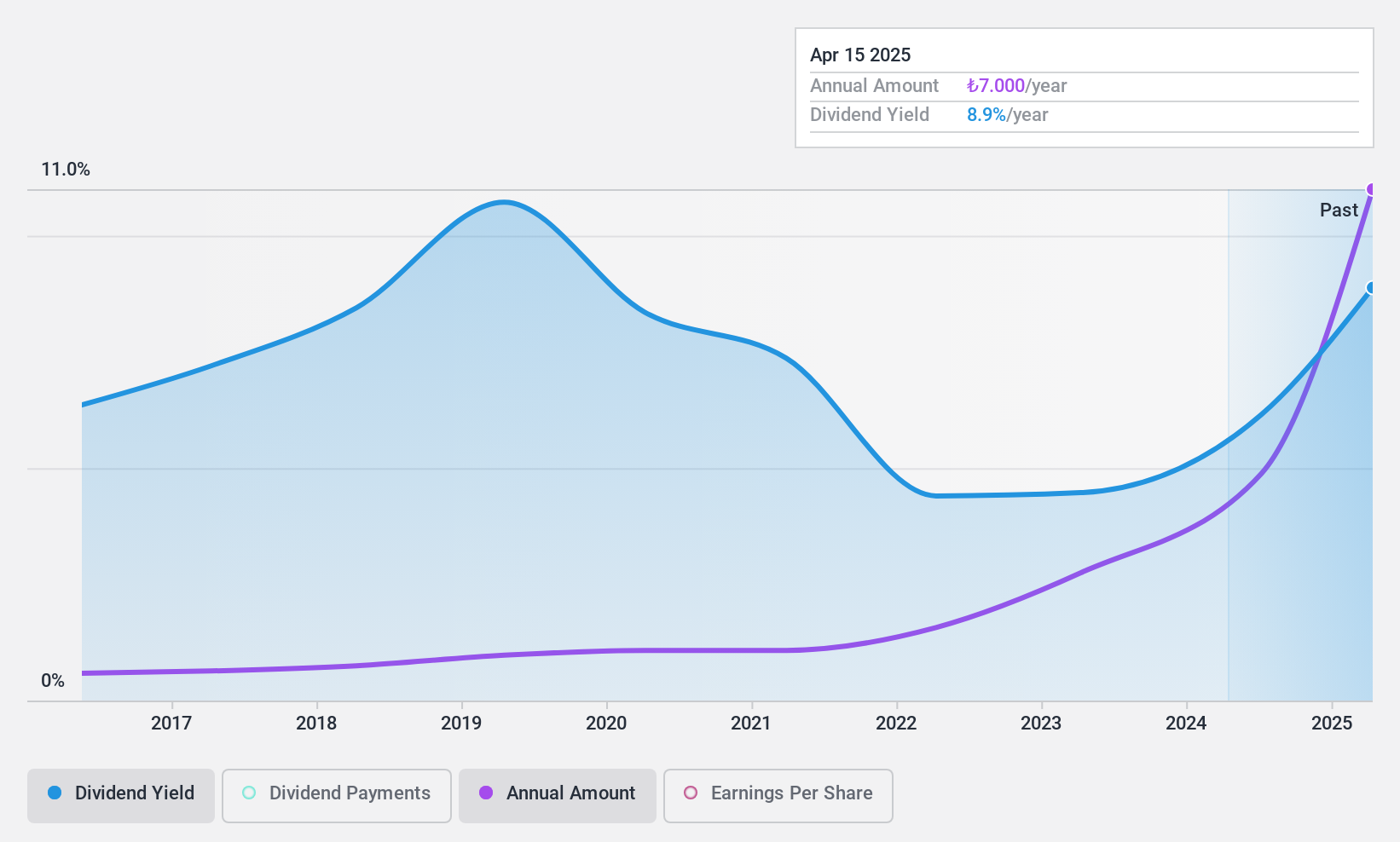

Dividend Yield: 4.4%

Ulusoy Un Sanayi ve Ticaret's dividend yield of 4.35% is among the top 25% in the Turkish market. Despite stable payments, its two-year dividend history lacks growth and reliability. The company's dividends are well-covered by earnings (payout ratio of 40.4%) and cash flows (cash payout ratio of 5.6%). Recent Q3 results showed a net loss reduction to TRY 158.39 million from TRY 325.3 million year-on-year, reflecting ongoing financial challenges amidst stable dividends.

- Dive into the specifics of Ulusoy Un Sanayi ve Ticaret here with our thorough dividend report.

- Our valuation report here indicates Ulusoy Un Sanayi ve Ticaret may be undervalued.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector and has a market capitalization of TRY14.72 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from the Ankamall Shopping Mall, contributing TRY1.96 billion, and the CP Ankara Hotel, contributing TRY154.24 million.

Dividend Yield: 5%

Yeni Gimat Gayrimenkul Yatirim Ortakligi's dividend yield of 4.99% ranks in the top 25% in Turkey, with payments well-covered by earnings (payout ratio of 0.9%) and cash flows (cash payout ratio of 10.8%). Despite only nine years of dividend history, payments have been stable and growing. Recent Q3 results showed sales increased to TRY 904.11 million from TRY 215.73 million year-on-year, though net income declined significantly to TRY 563.8 million from TRY 2,482.99 million a year ago.

- Unlock comprehensive insights into our analysis of Yeni Gimat Gayrimenkul Yatirim Ortakligi stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Yeni Gimat Gayrimenkul Yatirim Ortakligi is priced lower than what may be justified by its financials.

Next Steps

- Embark on your investment journey to our 1948 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ULUUN

Excellent balance sheet, good value and pays a dividend.