- Turkey

- /

- Electric Utilities

- /

- IBSE:ENJSA

Three Value Stocks That May Offer Attractive Entry Points In December 2024

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced a mixed performance, with U.S. indices showing moderate gains despite declining consumer confidence and manufacturing data. In this environment of fluctuating economic indicators, identifying undervalued stocks can be an appealing strategy for investors seeking opportunities that may offer attractive entry points.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7288.65 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Atlas Arteria (ASX:ALX) | A$4.83 | A$9.64 | 49.9% |

| Cettire (ASX:CTT) | A$1.51 | A$3.01 | 49.9% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.53 | CN¥9.01 | 49.7% |

| Merus Power Oyj (HLSE:MERUS) | €3.71 | €7.39 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.05 | US$129.48 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.53 | CN¥126.49 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.88 | 49.7% |

Let's explore several standout options from the results in the screener.

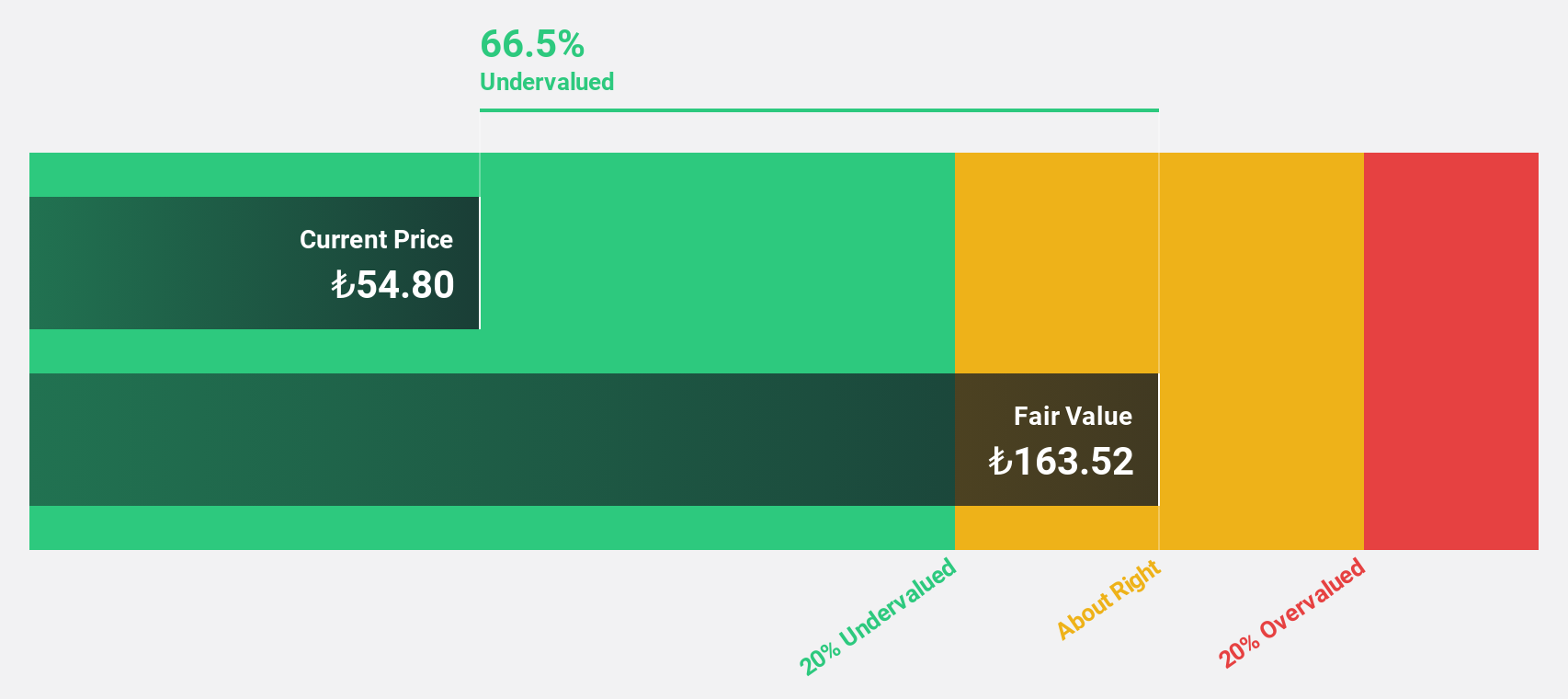

Enerjisa Enerji (IBSE:ENJSA)

Overview: Enerjisa Enerji A.S. operates in Turkey, providing electricity distribution, retail sales, and customer solutions through its subsidiaries, with a market cap of TRY73.93 billion.

Operations: The company's revenue segments include TRY59.22 billion from retail, TRY5.56 billion from customer solutions, and TRY56.18 billion from distribution/retail in Turkey.

Estimated Discount To Fair Value: 29.4%

Enerjisa Enerji is trading at TRY62.6, significantly below its estimated fair value of TRY88.62, suggesting it may be undervalued based on cash flows. Despite being forecast to grow revenue at 24.3% annually and become profitable within three years, recent financial results show a net loss of TRY934.96 million for Q3 2024 with declining sales year-over-year, raising concerns about earnings coverage for interest payments and dividend sustainability.

- According our earnings growth report, there's an indication that Enerjisa Enerji might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Enerjisa Enerji.

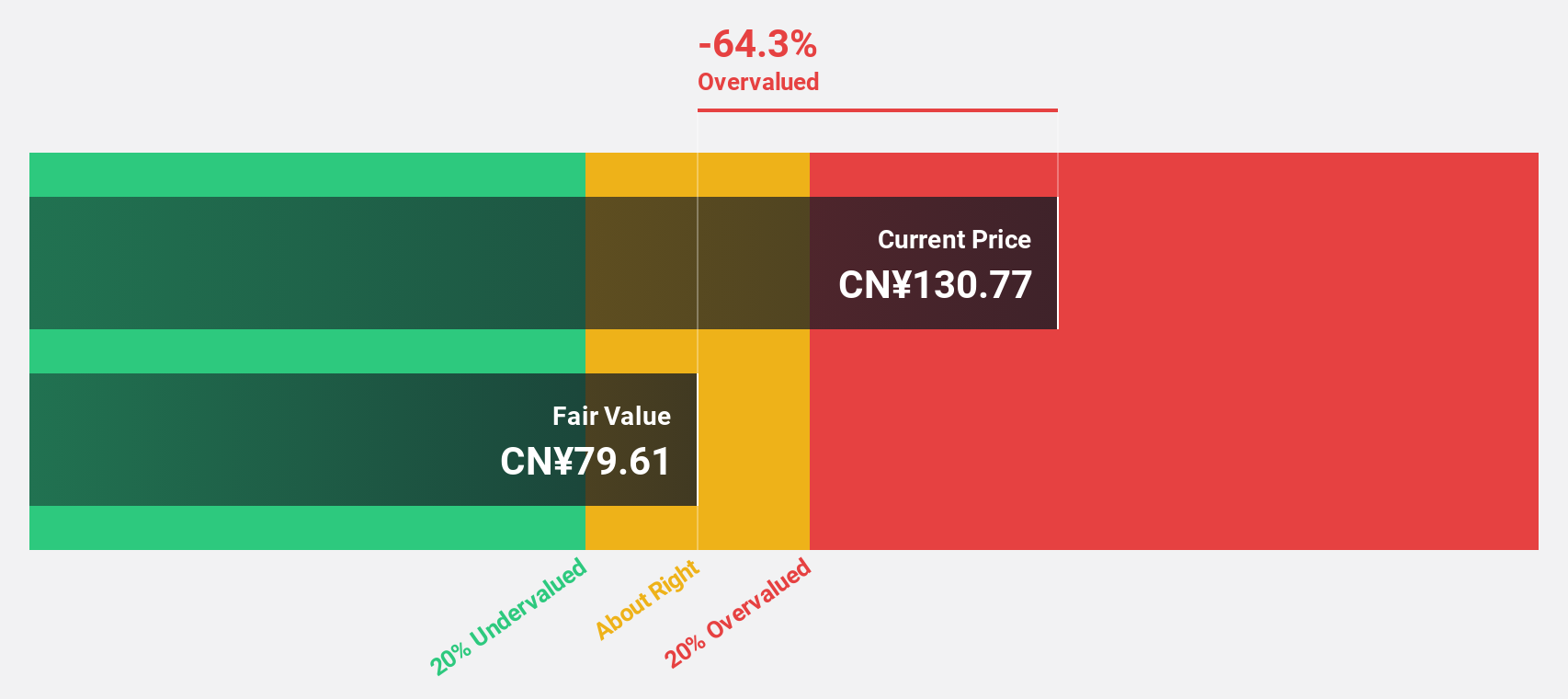

Seres GroupLtd (SHSE:601127)

Overview: Seres Group Co., Ltd. engages in the research, development, manufacturing, sales, and supply of automobiles and auto parts in China, with a market capitalization of CN¥203 billion.

Operations: The company's revenue primarily comes from its automobile industry segment, which generated CN¥125.79 billion.

Estimated Discount To Fair Value: 16.5%

Seres Group Ltd. is trading at CN¥134.8, which is 16.5% below its estimated fair value of CN¥161.38, indicating potential undervaluation based on cash flows. The company has recently turned profitable with net income of CN¥4.04 billion for the first nine months of 2024, a significant improvement from a loss last year, and earnings are forecast to grow significantly over the next three years, outpacing market averages.

- Our earnings growth report unveils the potential for significant increases in Seres GroupLtd's future results.

- Navigate through the intricacies of Seres GroupLtd with our comprehensive financial health report here.

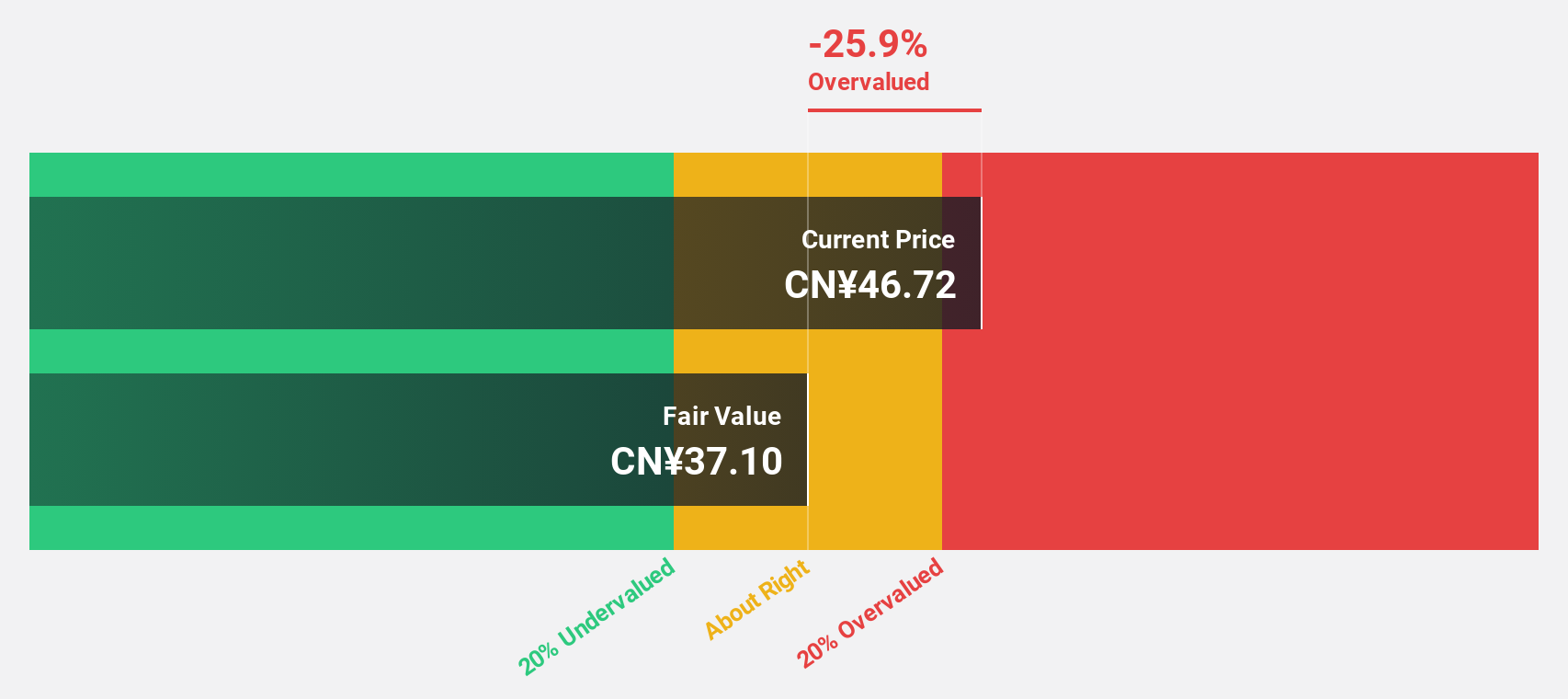

Winner Medical (SZSE:300888)

Overview: Winner Medical Co., Ltd. focuses on the R&D, manufacturing, and marketing of cotton-based medical dressings and disposables in China, with a market cap of CN¥24.66 billion.

Operations: Revenue segments for the company include cotton-based medical dressings and medical disposables, as well as consumer products, all primarily within China.

Estimated Discount To Fair Value: 11.4%

Winner Medical is trading at CN¥42.34, slightly below its estimated fair value of CN¥47.81, suggesting potential undervaluation based on cash flows. Despite a significant drop in net income to CN¥552.97 million for the first nine months of 2024 from last year, earnings are expected to grow substantially by 72.55% annually over the next three years, surpassing market averages and indicating future profitability despite current challenges in dividend coverage and return on equity forecasts.

- Our expertly prepared growth report on Winner Medical implies its future financial outlook may be stronger than recent results.

- Take a closer look at Winner Medical's balance sheet health here in our report.

Where To Now?

- Discover the full array of 886 Undervalued Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enerjisa Enerji might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ENJSA

Enerjisa Enerji

Engages in the provision of electricity distribution, retail sales, and customer solutions in Turkey.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)