As global markets react to the Trump administration's policy shifts and AI investment announcements, major indices like the S&P 500 have reached new highs, reflecting investor optimism amid a complex economic landscape. In such an environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Orion Oyj (HLSE:ORNBV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orion Oyj is a company that develops, manufactures, and markets human and veterinary pharmaceuticals as well as active pharmaceutical ingredients (APIs) across Finland, Scandinavia, Europe, North America, and internationally with a market cap of €7.26 billion.

Operations: Orion Oyj's revenue from its Pharmaceuticals segment amounts to €1.43 billion.

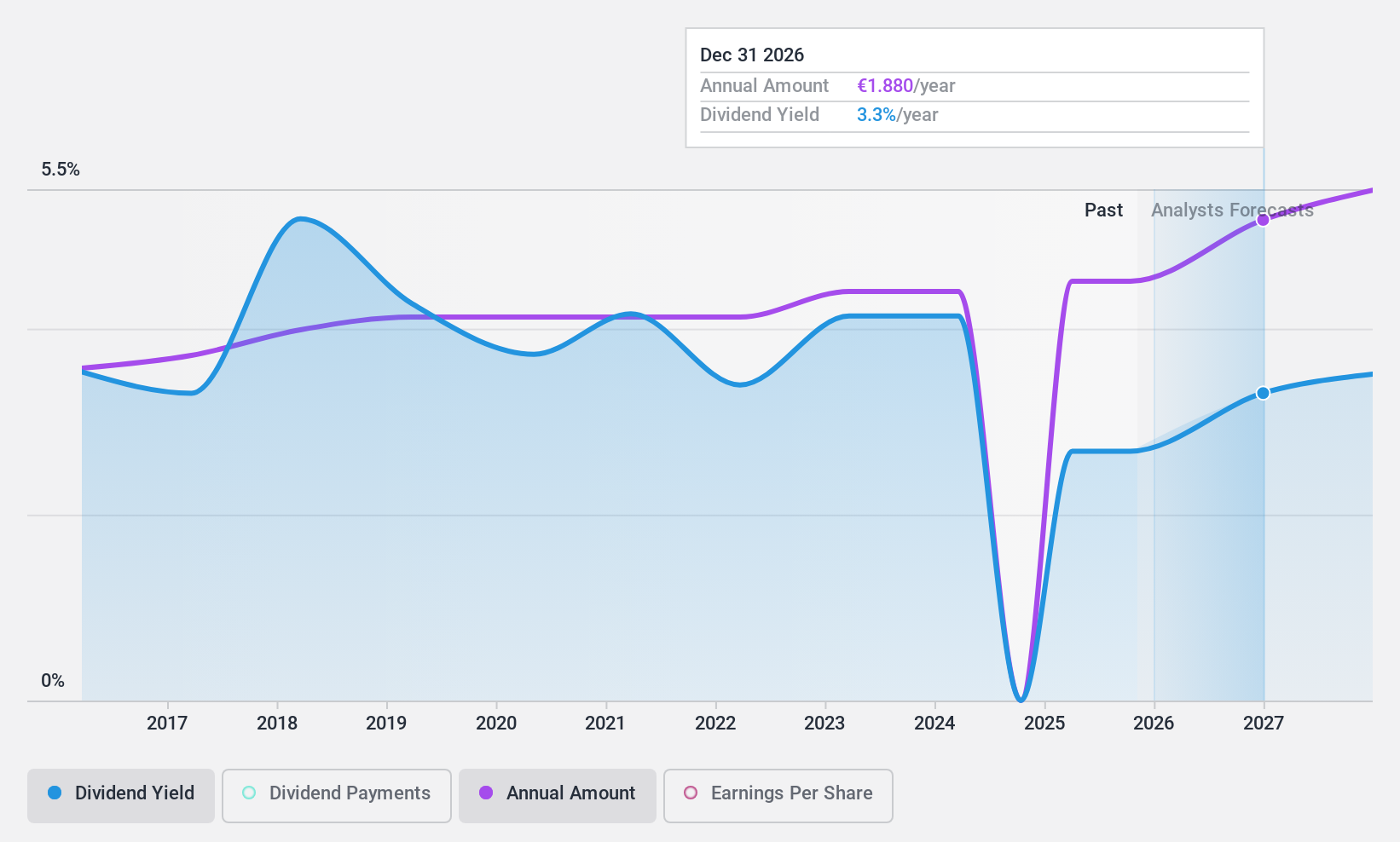

Dividend Yield: 3.1%

Orion Oyj's dividend profile shows mixed attributes. While the company's dividends have been stable and growing over the past decade, a high cash payout ratio of 132.9% indicates dividends are not well covered by free cash flows, though they are reasonably covered by earnings with a payout ratio of 68.6%. Recent strategic alliances and raised earnings guidance suggest growth potential, but its dividend yield of 3.09% is below top-tier Finnish market payers.

- Click here to discover the nuances of Orion Oyj with our detailed analytical dividend report.

- According our valuation report, there's an indication that Orion Oyj's share price might be on the cheaper side.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector with a market cap of TRY15.85 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from the Ankamall Shopping Mall, contributing TRY1.96 billion, and the CP Ankara Hotel, contributing TRY154.24 million.

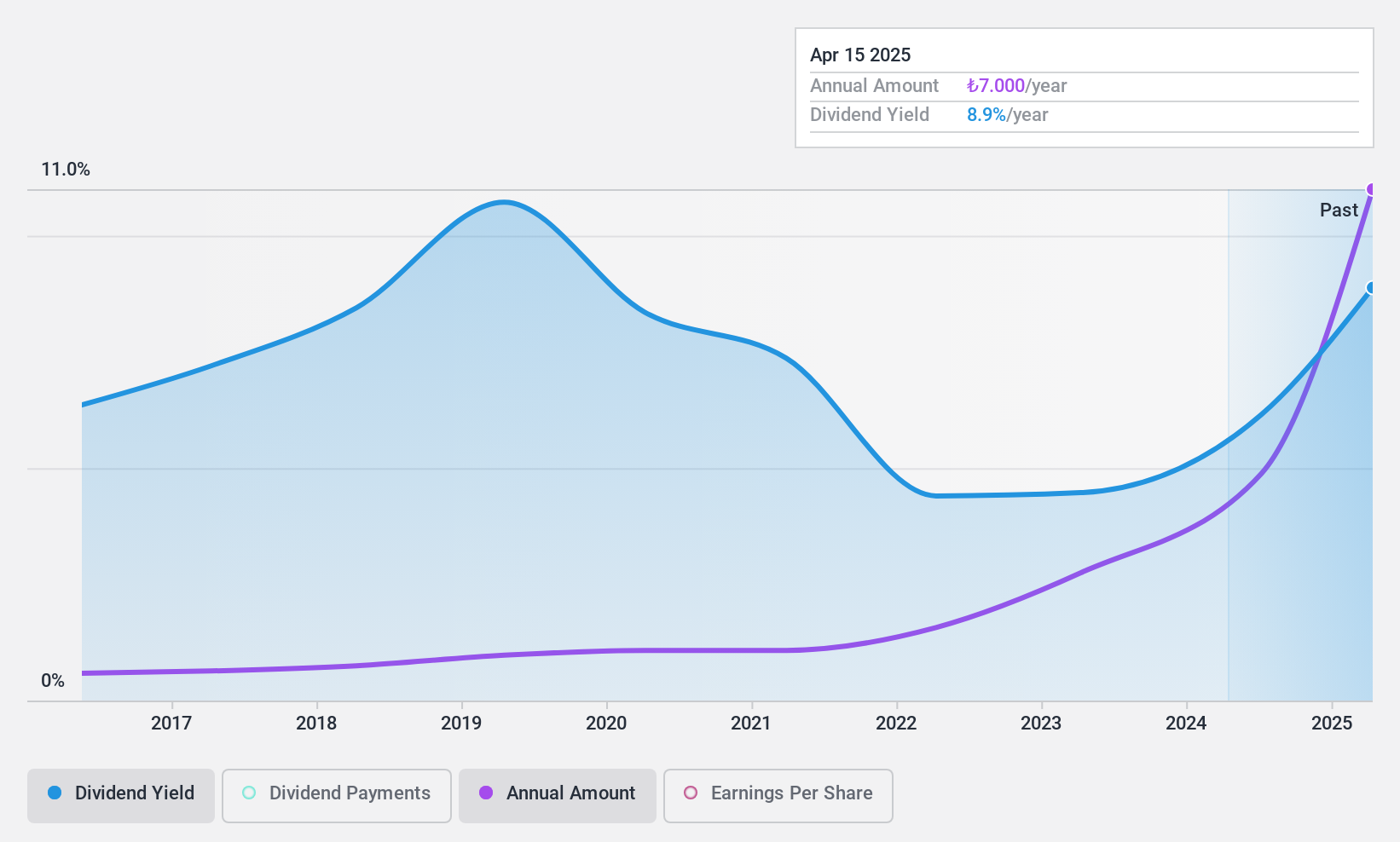

Dividend Yield: 4.5%

Yeni Gimat Gayrimenkul Yatirim Ortakligi offers an attractive dividend profile with a yield of 4.51%, placing it in the top 25% of Turkish market payers. Despite only nine years of dividend history, payments have been stable and growing, supported by low payout ratios—0.9% from earnings and 10.8% from cash flows—indicating sustainability. Recent earnings showed a decline in net income to TRY 563.8 million for Q3 but robust sales growth suggests potential resilience in revenue generation.

- Dive into the specifics of Yeni Gimat Gayrimenkul Yatirim Ortakligi here with our thorough dividend report.

- Our valuation report unveils the possibility Yeni Gimat Gayrimenkul Yatirim Ortakligi's shares may be trading at a discount.

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nitto Fuji Flour Milling Co., Ltd. manufactures and sells flour products in Japan with a market cap of ¥59.57 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd.'s revenue is primarily derived from its Flour Milling and Food Business, which accounts for ¥60.61 billion, complemented by the Restaurant Business at ¥11.30 billion and the Transportation Business contributing ¥1.99 billion.

Dividend Yield: 4.3%

Nitto Fuji Flour Milling Ltd. offers a dividend yield of 4.29%, ranking in the top 25% of Japanese market payers. The dividends are supported by a payout ratio of 57.3% from earnings and 58.7% from cash flows, suggesting coverage is adequate despite an unstable track record with volatility over the past decade. Trading significantly below its estimated fair value, the stock may present an opportunity for value-conscious investors seeking income, though dividend reliability remains a concern.

- Click to explore a detailed breakdown of our findings in Nitto Fuji Flour MillingLtd's dividend report.

- Our comprehensive valuation report raises the possibility that Nitto Fuji Flour MillingLtd is priced lower than what may be justified by its financials.

Make It Happen

- Click this link to deep-dive into the 1938 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ORNBV

Orion Oyj

Develops, manufactures, and markets human and veterinary pharmaceuticals and active pharmaceutical ingredients (APIs) in Finland, Scandinavia, rest of Europe, North America, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives