- Turkey

- /

- Industrial REITs

- /

- IBSE:RYGYO

Exploring Reysas Gayrimenkul Yatirim Ortakligi And 2 Other Promising Small Caps

Reviewed by Simply Wall St

In a climate where U.S. consumer confidence has seen its steepest drop since 2021 and growth stocks have struggled amid regulatory uncertainties, small-cap stocks often present unique opportunities for investors seeking potential in less crowded spaces. As market sentiment remains cautious due to inflationary pressures and geopolitical tensions, identifying promising small-cap companies like Reysas Gayrimenkul Yatirim Ortakligi can be crucial for those looking to capitalize on niche markets with growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| PSC | 20.97% | 1.17% | 10.86% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★☆☆

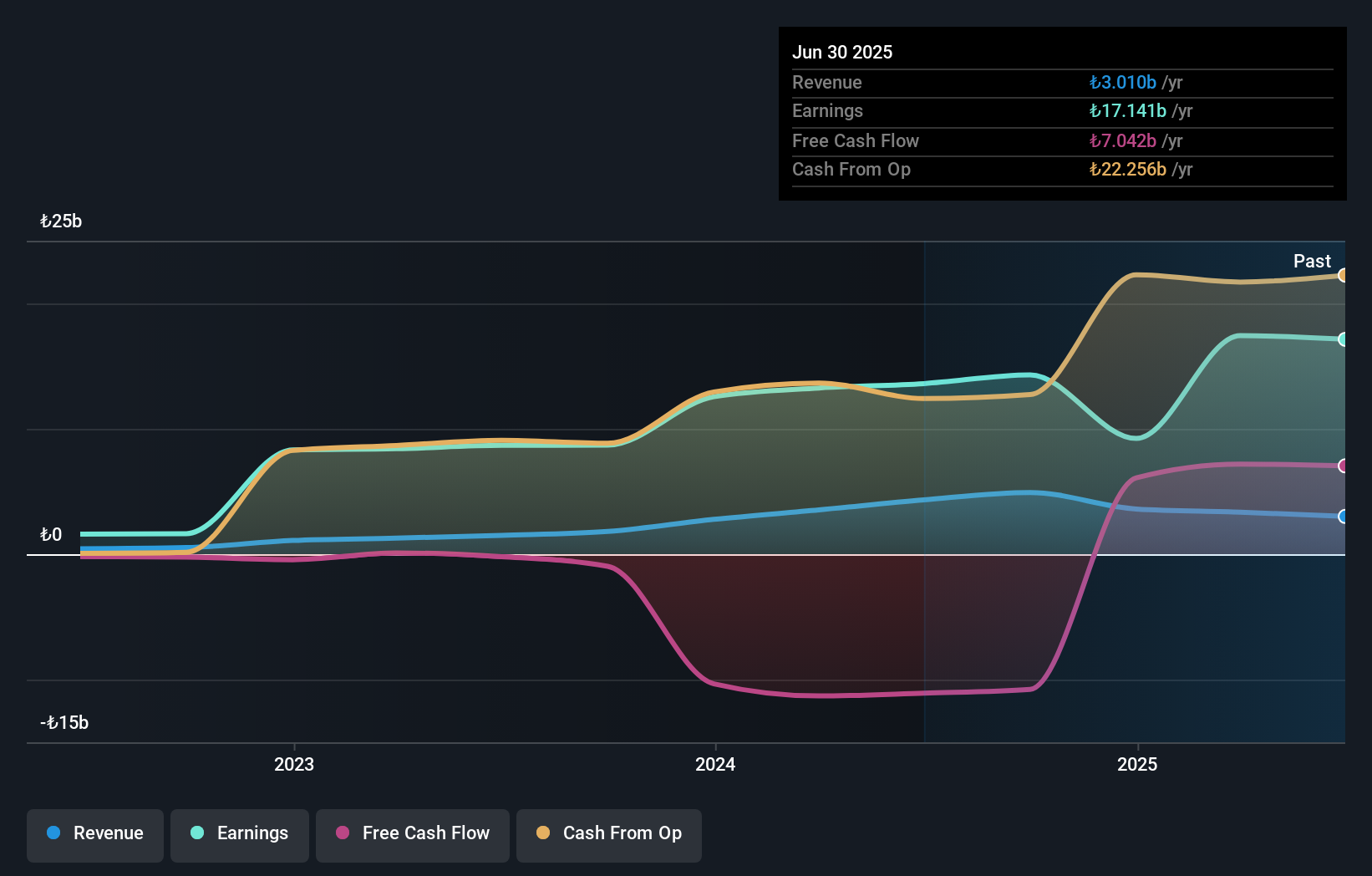

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust focusing on commercial properties, with a market cap of TRY31.70 billion.

Operations: RYGYO generates revenue primarily from its commercial real estate investments, amounting to TRY3.53 billion.

Earnings for RYGYO have surged by 115.7% in the past year, outpacing the Industrial REITs industry growth of 5.8%. The company, trading at 54.5% below its estimated fair value, presents a compelling valuation opportunity. With a net debt to equity ratio of 5.9%, its financial structure is deemed satisfactory and reflects significant improvement from 79.8% five years ago to just 8.7%. Additionally, RYGYO's high level of non-cash earnings suggests robust quality in past earnings performance, while interest coverage remains strong due to higher earnings than interest expenses paid out.

Chongqing Fuling Electric Power Industrial (SHSE:600452)

Simply Wall St Value Rating: ★★★★★★

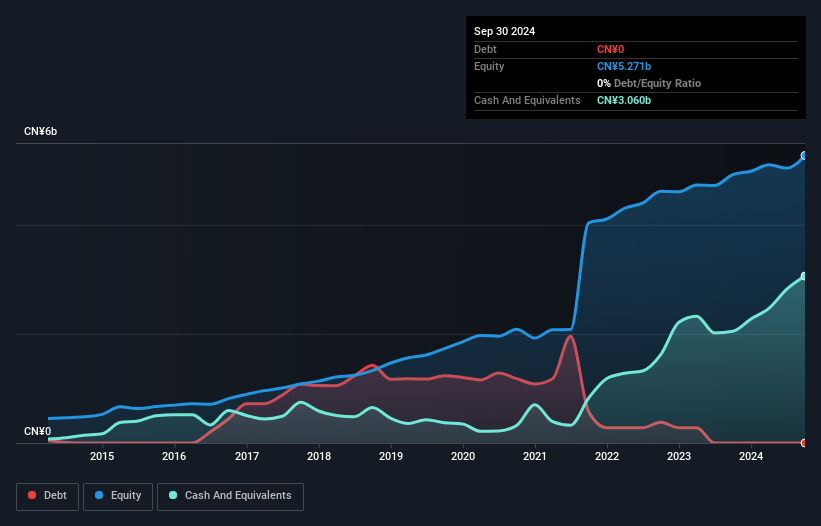

Overview: Chongqing Fuling Electric Power Industrial Co., Ltd. operates in the electric power industry and has a market capitalization of CN¥14.29 billion.

Operations: The company generates revenue primarily from its electric power operations. It incurs costs related to production and distribution, impacting its profitability. The net profit margin reflects the company's ability to manage these costs effectively.

Chongqing Fuling Electric Power Industrial, a smaller player in the electric utilities space, stands out with its debt-free status, contrasting sharply with a 71.1% debt to equity ratio five years ago. The company has shown consistent earnings growth at 5.4% annually over the past five years, though recent growth of 14% slightly lags behind industry peers at 15.2%. Trading at nearly half its estimated fair value suggests potential undervaluation in the market's eyes. With high-quality earnings and positive free cash flow, it seems well-positioned financially despite not leading its industry in growth rates.

EDION (TSE:2730)

Simply Wall St Value Rating: ★★★★★★

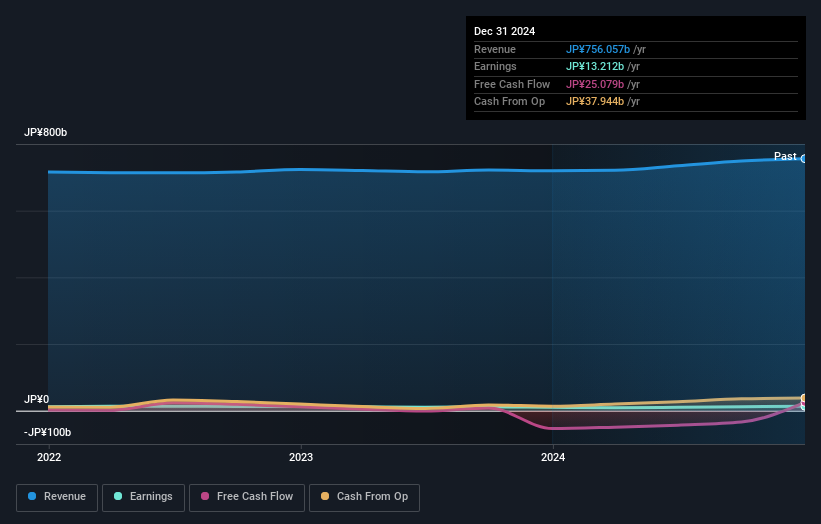

Overview: EDION Corporation, along with its subsidiaries, operates as a home appliance retailer in Japan and has a market capitalization of approximately ¥190.16 billion.

Operations: The company generates revenue primarily from the sales of home electric appliances, amounting to ¥756.06 billion.

Edion's financial landscape presents a compelling narrative, with its recent earnings growth of 31.3% outpacing the Specialty Retail industry at 9.5%. Trading at 58% below estimated fair value, it suggests potential undervaluation, while its interest payments are well covered by EBIT at an impressive 86 times coverage. The company has also been active in share repurchases, completing a buyback of over two million shares for ¥4.58 billion recently. Despite a historical annual earnings decline of 5.5%, Edion's satisfactory net debt to equity ratio of 28.8% indicates prudent financial management and stability moving forward.

- Delve into the full analysis health report here for a deeper understanding of EDION.

Understand EDION's track record by examining our Past report.

Seize The Opportunity

- Investigate our full lineup of 3194 Global Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:RYGYO

Reysas Gayrimenkul Yatirim Ortakligi

Reysas Gayrimenkul Yatirim Ortakligi A.S.

Solid track record and good value.

Market Insights

Community Narratives