The Middle East stock markets have recently seen significant activity, with Dubai's main share index hitting fresh record highs and a series of strategic business agreements boosting investor confidence. As regional indices continue to reflect robust economic engagements and technological advancements, identifying promising stocks in this dynamic landscape involves looking for companies that can leverage these growth opportunities effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 46.96% | 55.76% | ★★★★★★ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 29.47% | 42.38% | -38.36% | ★★★★★★ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | 5.19% | -13.40% | ★★★★★☆ |

| Birlesim Mühendislik Isitma Sogutma Havalandirma Sanayi ve Ticaret Anonim Sirketi | 44.20% | 44.21% | -32.62% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 41.13% | 45.34% | 43.51% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 53.26% | 26.61% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

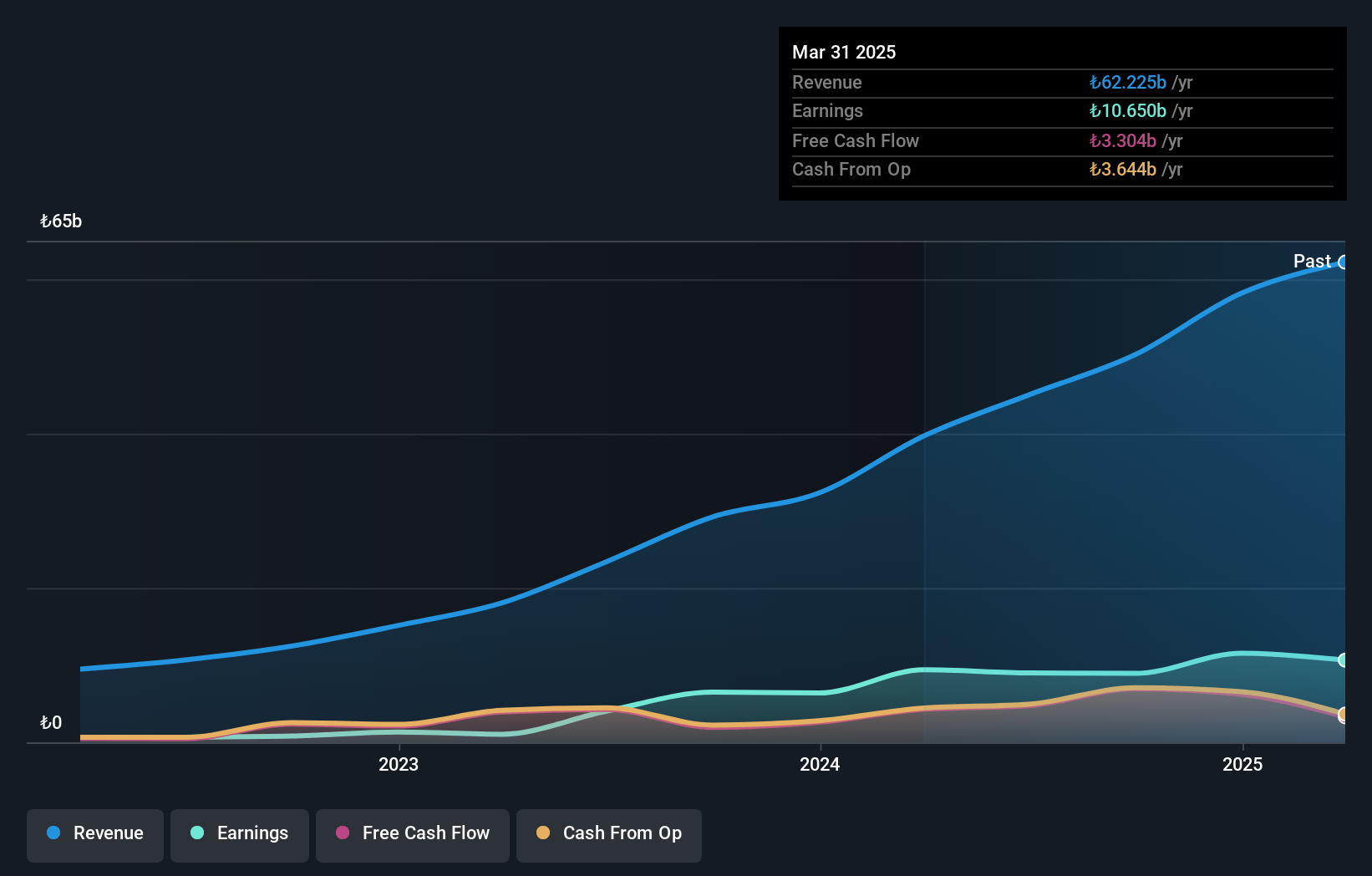

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY47.45 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from its Motor Vehicles and Disease/Health insurance segments, which contribute TRY14.17 billion and TRY10.38 billion respectively. The company also earns significant income from Motor Vehicles Liability insurance, amounting to TRY9.16 billion, while Fire and Natural Disasters insurance adds TRY5.25 billion to its revenue streams.

Anadolu Sigorta, a smaller player in the insurance sector, shows promising potential with earnings growing 65% annually over the past five years. Despite a recent dip in net income to TRY 1.98 billion for Q1 2025 from TRY 2.87 billion a year prior, it remains debt-free and boasts high-quality earnings. Its basic earnings per share dropped to TRY 3.95 from TRY 5.73 last year, yet its free cash flow is positive at TRY 4.74 billion as of mid-2024, suggesting robust operational efficiency and financial health amidst industry challenges.

National Company for Learning and Education (SASE:4291)

Simply Wall St Value Rating: ★★★★☆☆

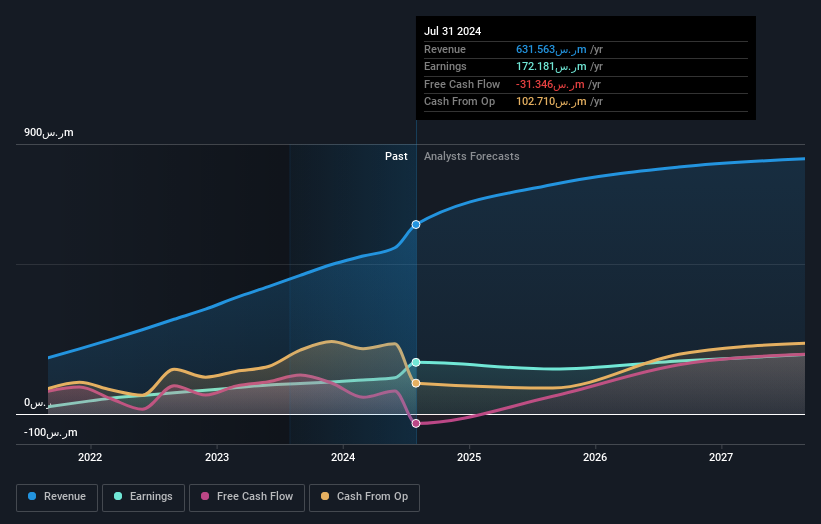

Overview: National Company for Learning and Education operates a network of educational institutions across various levels in Saudi Arabia, with a market capitalization of SAR 6.79 billion.

Operations: The company's revenue streams primarily come from its network of schools, with Al Qairwan Schools and Ar Rawabi Schools contributing SAR 91.19 million and SAR 90.94 million, respectively.

National Company for Learning and Education demonstrates robust growth, with earnings surging 71.9% over the past year, outpacing the Consumer Services industry average of 5.3%. The firm reported a net income of SAR 40 million for Q2 2025, up from SAR 34 million in the previous year, with basic earnings per share rising to SAR 0.93 from SAR 0.79. A notable reduction in its debt-to-equity ratio from 8.2% to just under half at 4% over five years indicates prudent financial management, while its EBIT comfortably covers interest payments by a factor of twelve times, suggesting strong operational efficiency and stability moving forward.

Turpaz Industries (TASE:TRPZ)

Simply Wall St Value Rating: ★★★★☆☆

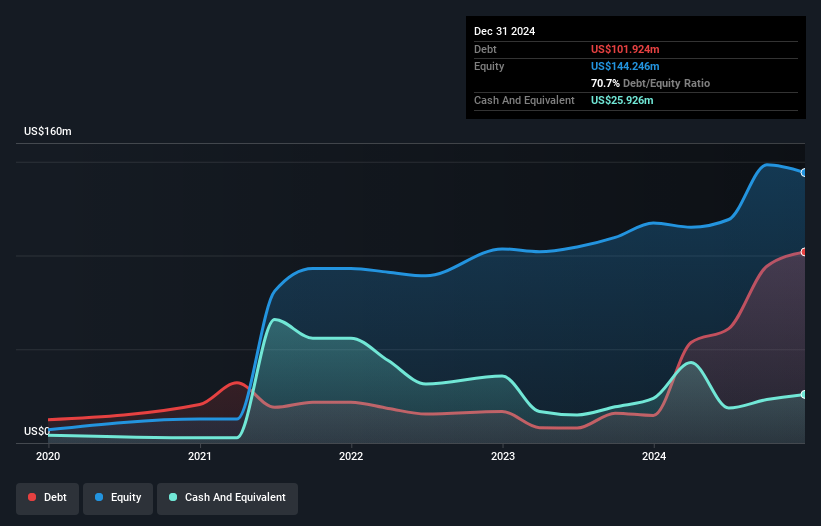

Overview: Turpaz Industries Ltd, along with its subsidiaries, focuses on the development, production, marketing, and sale of scents across various regions globally and has a market capitalization of approximately ₪2.93 billion.

Operations: Turpaz Industries generates revenue primarily from its Taste segment, contributing $135.54 million, and its Fragrance segment, which adds $34.95 million. The Specialty Fine Ingredients segment also contributes $18.46 million to the total revenue stream.

Turpaz Industries, a nimble player in the chemicals sector, has shown resilience with its debt to equity ratio dropping from 174.9% to 70.7% over five years, although its net debt to equity remains high at 52.7%. The company reported a robust earnings growth of 10.2%, outpacing the industry average of 9.7%. Recent expansion into the UK market through strategic mergers aims to bolster their flavor extracts business for vaping and food sectors, potentially enhancing their product portfolio and customer base globally. Turpaz's interest payments are well covered by EBIT at a comfortable 6.1x coverage ratio.

- Dive into the specifics of Turpaz Industries here with our thorough health report.

Explore historical data to track Turpaz Industries' performance over time in our Past section.

Next Steps

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 244 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Offers non-life insurance products in Turkey.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives