- India

- /

- Construction

- /

- NSEI:INOXGREEN

Undiscovered Gems And 2 More Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced mixed results with small-cap stocks showing resilience compared to their larger counterparts. As major indices like the S&P 600 for small-cap stocks held up better amid cautious earnings from tech giants, investors are increasingly looking towards smaller companies with robust fundamentals as potential opportunities. In this environment, identifying stocks that combine strong financial health with growth potential can be particularly rewarding for those seeking undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey, offering individual and group life insurance, retirement plans, and personal accident insurance services, with a market cap of TRY38.70 billion.

Operations: The company generates revenue primarily through its individual and group life insurance, retirement plans, and personal accident insurance services in Turkey. Its market capitalization is TRY38.70 billion.

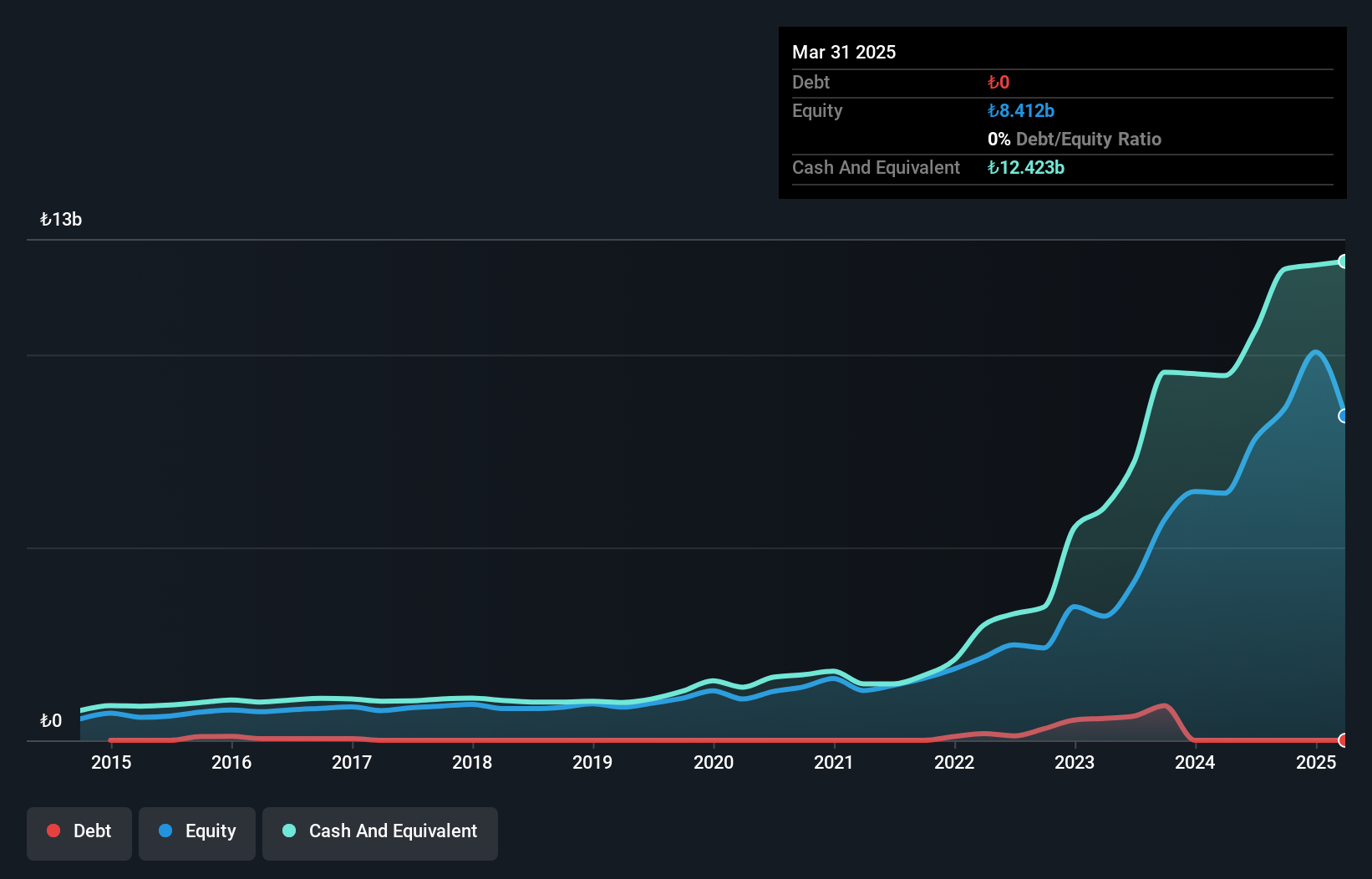

Anadolu Hayat Emeklilik, a notable player in the insurance sector, showcases robust financial health with no debt and high-quality earnings. Over the past five years, its earnings have impressively grown by 51% annually. Despite recent growth of 43.5% not outpacing the broader insurance industry at 52.2%, it remains competitive with a price-to-earnings ratio of 10.1x, below Turkey's market average of 14.4x. Recent inclusion in major indices like S&P Global BMI and FTSE All-World highlights its growing recognition. For Q3 2024, net income reached TRY 776 million compared to TRY 735 million last year, reflecting steady progress.

Inox Green Energy Services (NSEI:INOXGREEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Inox Green Energy Services Limited specializes in offering operation and maintenance services, along with common infrastructure facilities for wind turbine generators in India, with a market capitalization of ₹63.85 billion.

Operations: Inox Green Energy Services generates revenue primarily from its operation and maintenance services, amounting to ₹1.71 billion. The cost structure and specific financial trends are not detailed beyond this revenue figure.

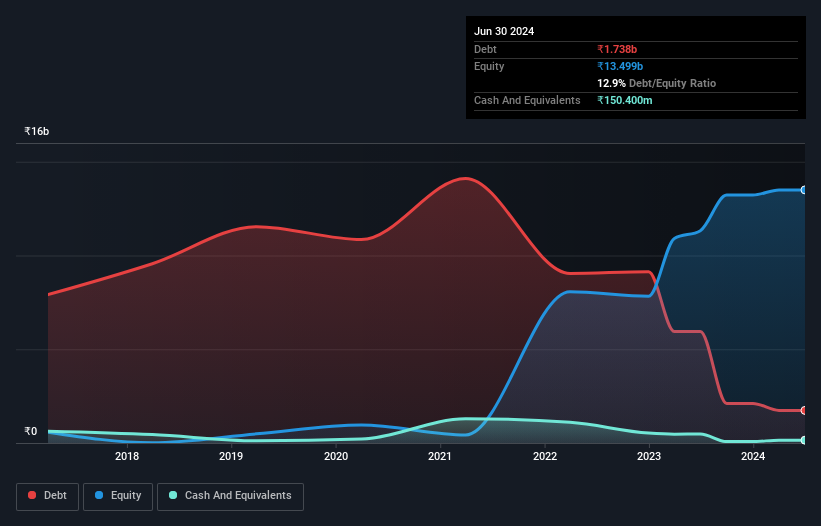

Inox Green has been making waves with impressive earnings growth of 440% over the past year, significantly outpacing the construction industry average of 37.6%. The company's debt to equity ratio has dramatically improved from a staggering 1538.9% to just 8.7% over five years, indicating a solid reduction in leverage. Despite high-quality earnings and profitability, interest payments are not well covered by EBIT at only 1.9x coverage, suggesting room for improvement in financial management. Recent quarterly results showed net income rising to INR 63.9 million from INR 57.7 million a year ago, reflecting steady progress amidst volatility in share price performance.

Saudi Azm for Communication and Information Technology (SASE:9534)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR1.67 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: Saudi Azm's revenue is primarily derived from Enterprise Services (SAR116.12 million) and Proprietary Technologies (SAR58.94 million), with additional contributions from Advisory and Platforms for Third Parties segments. The company's net profit margin shows notable trends that are key to understanding its financial health.

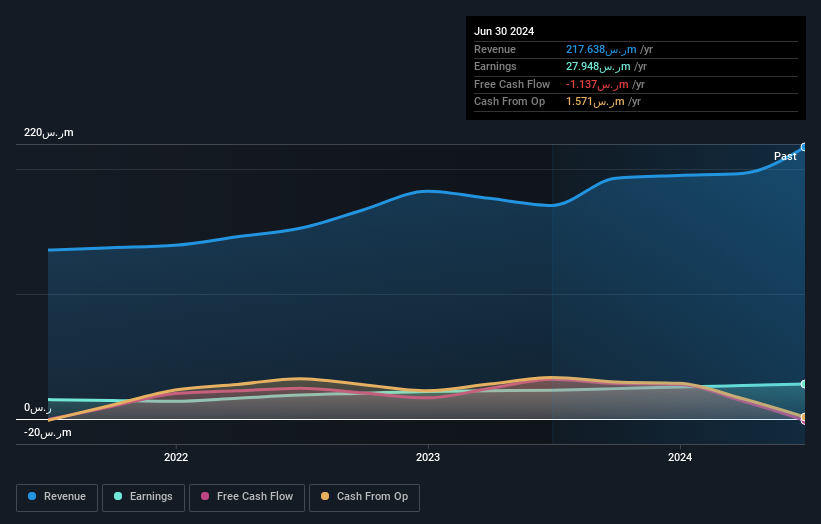

Saudi Azm for Communication and Information Technology has shown promising growth, with sales reaching SAR 217.64 million this year, up from SAR 170.83 million last year. Net income also rose to SAR 27.95 million compared to the previous year's SAR 23.08 million, reflecting a solid earnings performance with basic earnings per share increasing from SAR 0.39 to SAR 0.47. The company's debt management is commendable, reducing its debt-to-equity ratio significantly over five years from 137% to just over 12%, while maintaining a strong interest coverage ratio of about 24 times EBIT, indicating robust financial health amidst industry competition.

Seize The Opportunity

- Click this link to deep-dive into the 4738 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INOXGREEN

Inox Green Energy Services

Provides operation and maintenance services and common infrastructure facilities for wind turbine generators in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives