- Saudi Arabia

- /

- Food

- /

- SASE:2286

Uncovering Hidden Gems in the Middle East with Promising Potential

Reviewed by Simply Wall St

As Gulf markets experience gains buoyed by hopes of U.S. interest rate cuts, the region remains cautiously optimistic amid ongoing trade tensions and fluctuating oil prices. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is involved in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market capitalization of TRY56.12 billion.

Operations: Türk Tuborg generates revenue primarily from its alcoholic beverages segment, amounting to TRY31.16 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

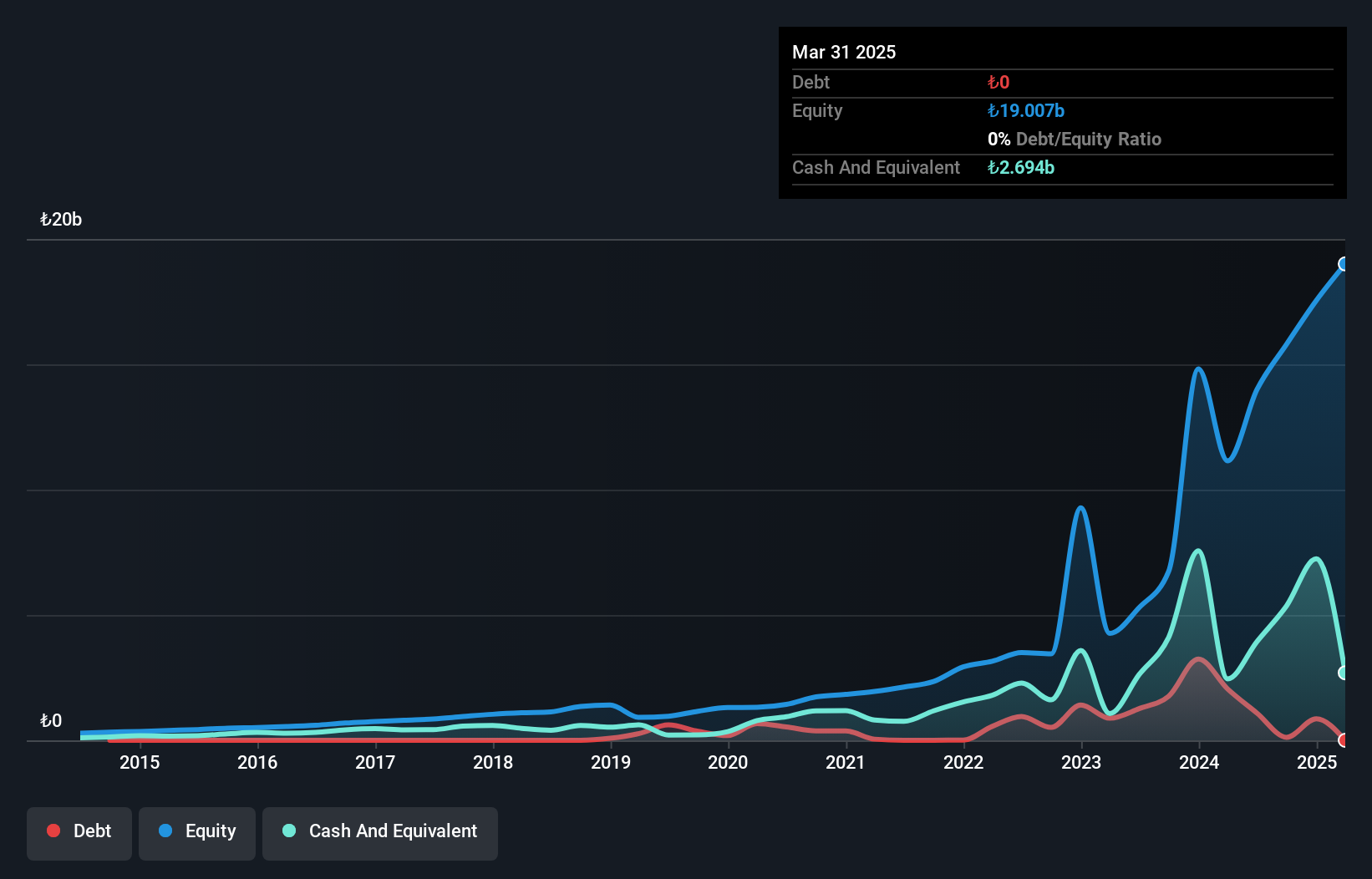

Türk Tuborg, a notable player in the beverage sector, has seen its debt to equity ratio drop from 37.3% to 16.6% over five years, reflecting improved financial health. The company boasts more cash than total debt and a competitive price-to-earnings ratio of 12.4x against the Turkish market's 21.8x. Recent earnings show sales of TRY 11,466 million for Q2, with net income slightly down at TRY 2,535 million compared to last year’s TRY 2,596 million. Despite this dip in quarterly net income, six-month figures reveal growth with net income rising from TRY 1,627 million to TRY 2,208 million.

- Dive into the specifics of Türk Tuborg Bira ve Malt Sanayii here with our thorough health report.

Understand Türk Tuborg Bira ve Malt Sanayii's track record by examining our Past report.

Fourth Milling (SASE:2286)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour and its byproducts, animal feed, and bran products with a market cap of SAR2.07 billion.

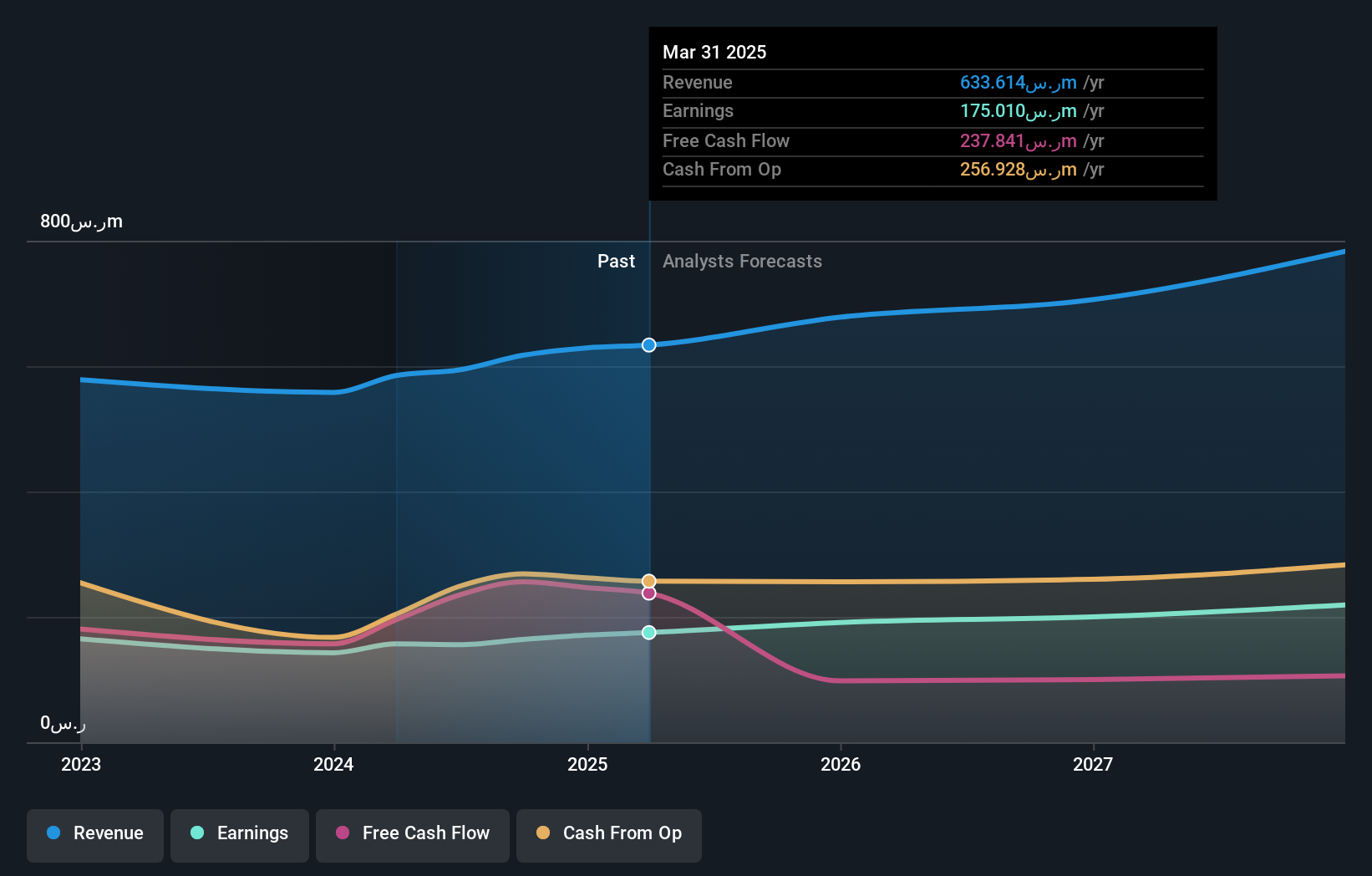

Operations: Fourth Milling generates revenue primarily from its food processing segment, reporting SAR637.41 million. The company's financial performance includes a notable net profit margin trend, which has shown significant variation over recent periods.

Fourth Milling, a notable player in the Middle East's food industry, showcases impressive financial health with earnings growth of 13% over the past year, outpacing the industry's 4.1%. The company remains debt-free and trades at approximately 34.2% below its estimated fair value. Recent performance highlights include second-quarter sales of SAR 140.6 million and net income of SAR 34.05 million, reflecting modest growth from last year’s figures. With a forecasted revenue growth rate of 6.26% annually and high-quality earnings reported consistently, Fourth Milling presents an intriguing opportunity for investors seeking value in emerging markets.

- Navigate through the intricacies of Fourth Milling with our comprehensive health report here.

Examine Fourth Milling's past performance report to understand how it has performed in the past.

Najran Cement (SASE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Najran Cement Company is involved in the manufacture and sale of cement products within the Kingdom of Saudi Arabia, with a market capitalization of SAR1.29 billion.

Operations: Revenue primarily stems from the manufacturing of cement, amounting to SAR543.05 million.

Najran Cement, a smaller player in the cement industry, has demonstrated notable financial resilience. Its earnings grew by 66.5% over the past year, outpacing the Basic Materials industry's 57%. The company's debt-to-equity ratio improved from 17.3% to 14.8% over five years, signaling prudent financial management with a satisfactory net debt to equity ratio of 13.8%. Recent executive changes include Engr. Ataa Abdulqader Bakkar stepping in as CEO from October 2025 for six months, bringing extensive industry experience which could steer strategic growth initiatives forward amidst evolving market dynamics and leadership restructuring efforts.

- Delve into the full analysis health report here for a deeper understanding of Najran Cement.

Explore historical data to track Najran Cement's performance over time in our Past section.

Seize The Opportunity

- Gain an insight into the universe of 203 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2286

Fourth Milling

Engages in the production, packaging, and sale of flour and its byproducts, animal feed, and bran products the Kingdom of Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives