- Turkey

- /

- Capital Markets

- /

- IBSE:HUBVC

Middle Eastern Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

Amidst concerns over a global trade war and its impact on Gulf markets, investors are closely watching the Middle East's economic landscape. While the term "penny stocks" might seem outdated, these smaller or newer companies can still provide unique opportunities for growth. By focusing on those with strong financials, investors might discover promising prospects in this niche area of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.16 | ₪149.78M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.019 | ₪3.17B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.01 | SAR1.6B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.251 | ₪167.34M | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.52 | TRY1.3B | ★★★★★☆ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.603 | ₪17.01M | ★★★★★★ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.80 | TRY504M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.26 | AED9.57B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.415 | ₪537.12M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.807 | ₪75.3M | ★★★★★★ |

Click here to see the full list of 92 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Insurance Company P.J.S.C. provides insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally, with a market cap of AED157.20 million.

Operations: Union Insurance Company P.J.S.C. does not report specific revenue segments.

Market Cap: AED157.2M

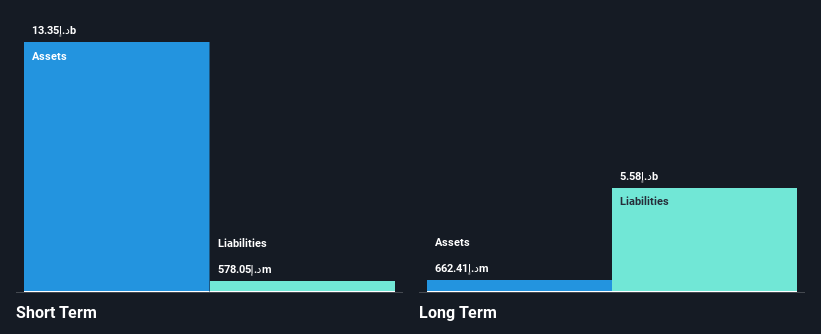

Union Insurance Company P.J.S.C. has shown significant improvement by transitioning from a net loss to a net income of AED 38.31 million for the year ended December 31, 2024, with earnings per share rising to AED 0.116. The company is debt-free and its short-term assets of AED821.2 million comfortably cover its short-term liabilities but fall short against long-term liabilities of AED1.3 billion. Despite having an experienced board, the management team is relatively new with an average tenure of 1.2 years, and the stock remains highly volatile compared to other AE stocks over recent months.

- Get an in-depth perspective on Union Insurance Company P.J.S.C's performance by reading our balance sheet health report here.

- Assess Union Insurance Company P.J.S.C's previous results with our detailed historical performance reports.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets in sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.95 billion.

Operations: The company's revenue from private investments, excluding Waha Land, amounts to AED150.11 million.

Market Cap: AED2.95B

Al Waha Capital PJSC, with a market cap of AED2.95 billion, has demonstrated mixed financial performance. Despite achieving profitability over the past five years, recent earnings have declined to AED 381.28 million from AED 440.1 million the previous year, reflecting a challenging period for growth. The company maintains high-quality earnings and has reduced its debt-to-equity ratio significantly over five years, now holding more cash than total debt. However, its dividend yield of 6.33% is not well supported by free cash flow and operating cash flow remains negative, indicating potential liquidity concerns despite strong asset coverage of liabilities.

- Navigate through the intricacies of Al Waha Capital PJSC with our comprehensive balance sheet health report here.

- Explore historical data to track Al Waha Capital PJSC's performance over time in our past results report.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment trust, focusing on investing in high-growth potential companies, with a market cap of TRY504 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi generates revenue from its fund management activities, amounting to -TRY1.15 million.

Market Cap: TRY504M

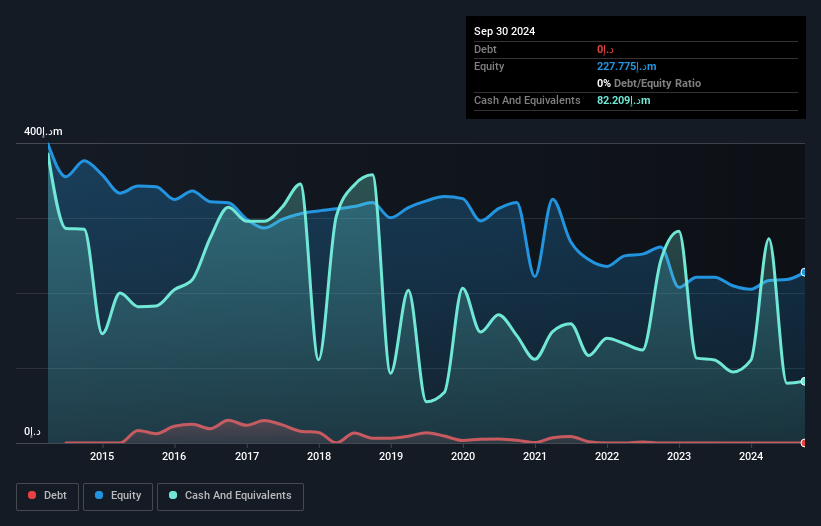

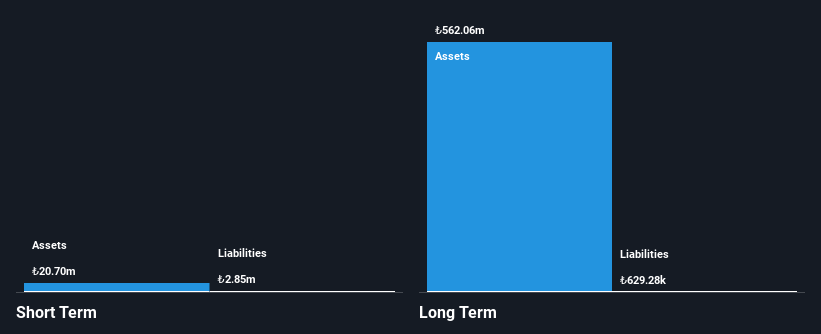

Hub Girisim Sermayesi Yatirim Ortakligi, with a market cap of TRY504 million, operates as a venture capital investment trust and is currently pre-revenue, generating less than US$1 million. The company recently became profitable due to a significant one-off gain of TRY51.1 million in the last 12 months ending June 2024. Despite this, HUBVC's earnings have declined by an average of 24.1% annually over five years. The stock's price-to-earnings ratio is attractively low at 3.3x compared to the Turkish market average of 16.2x, though its share price has been highly volatile recently.

- Click here to discover the nuances of Hub Girisim Sermayesi Yatirim Ortakligi with our detailed analytical financial health report.

- Gain insights into Hub Girisim Sermayesi Yatirim Ortakligi's past trends and performance with our report on the company's historical track record.

Make It Happen

- Discover the full array of 92 Middle Eastern Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Girisim Sermayesi Yatirim Ortakligi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:HUBVC

Hub Girisim Sermayesi Yatirim Ortakligi

Hub Girisim Sermayesi Yatirim Ortakligi A.S.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives