- Turkey

- /

- Capital Markets

- /

- IBSE:HUBVC

Middle Eastern Penny Stocks To Monitor In November 2025

Reviewed by Simply Wall St

As the Middle Eastern markets navigate softer oil prices, most Gulf indices have seen declines, with Saudi Arabia's benchmark index notably impacted. Despite these challenges, the allure of penny stocks remains strong for investors seeking growth opportunities at lower price points. Often representing smaller or newer companies, these stocks can offer significant potential when backed by solid financials and fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.79 | ₪271.72M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.06B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.31 | AED14.12B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.796 | AED2.27B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.811 | AED495.73M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market capitalization of AED5.78 billion.

Operations: The bank's revenue is primarily derived from its Treasury and Investments segment, contributing AED413.01 million, and its Retail and Corporate Banking segment, which accounts for AED423.61 million.

Market Cap: AED5.78B

National Bank of Umm Al-Qaiwain (PSC) demonstrates a stable financial foundation with an appropriate Loans to Assets ratio of 40% and a low bad loans level at 0.9%. Despite its earnings growth slowing to 10.4% over the past year, below its five-year average, the bank maintains high-quality earnings and has not diluted shareholders recently. The Price-To-Earnings ratio of 10.1x suggests it is valued attractively compared to the AE market average. Recent earnings reports show net income improvement, with third-quarter net income rising to AED150.75 million from AED114.56 million in the previous year, indicating steady performance amidst market volatility.

- Jump into the full analysis health report here for a deeper understanding of National Bank of Umm Al-Qaiwain (PSC).

- Assess National Bank of Umm Al-Qaiwain (PSC)'s previous results with our detailed historical performance reports.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment trust in Turkey with a market cap of TRY778.40 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. has not reported any specific revenue segments.

Market Cap: TRY778.4M

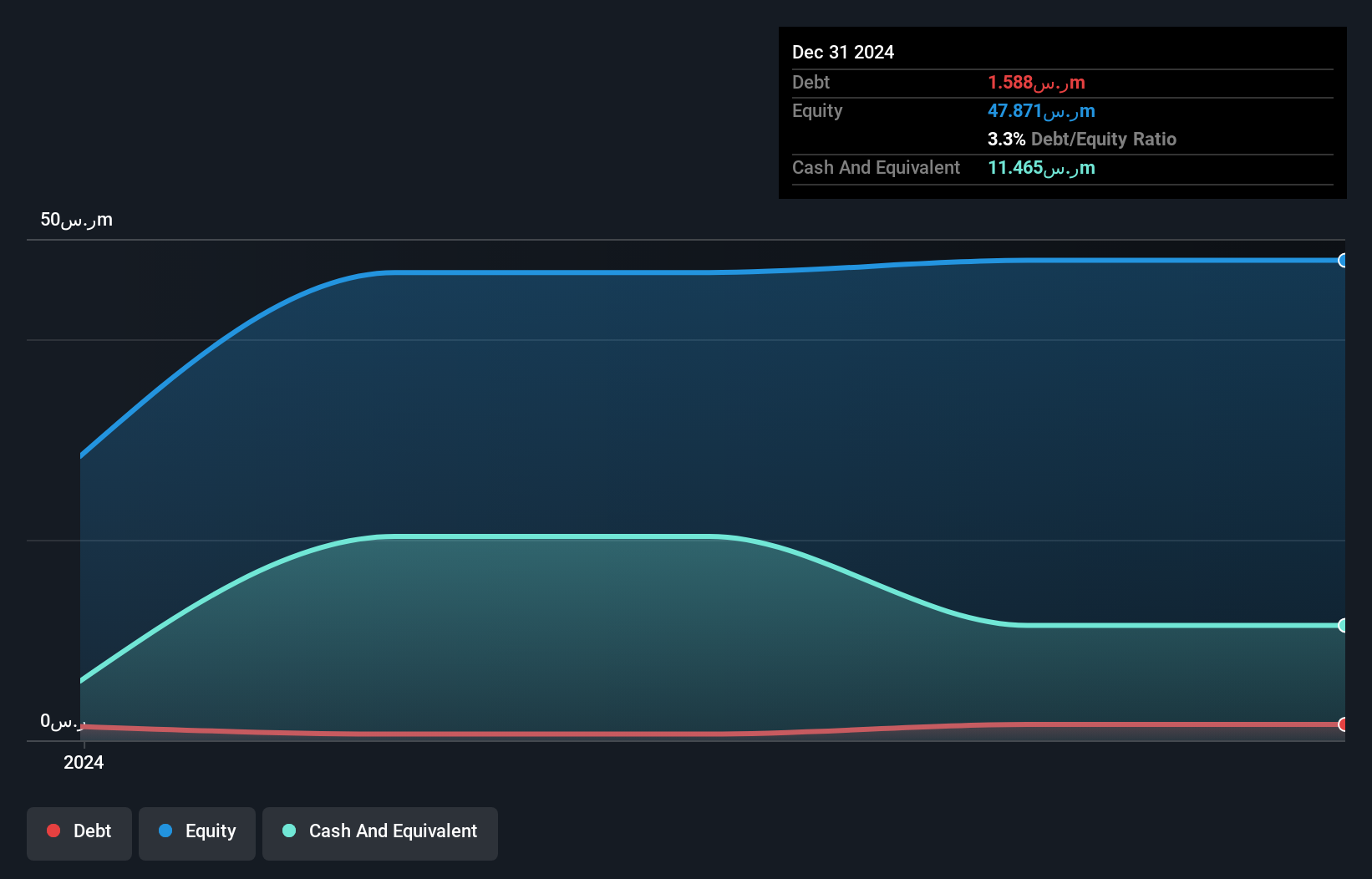

Hub Girisim Sermayesi Yatirim Ortakligi A.S., a venture capital investment trust in Turkey, operates with a market cap of TRY778.40 million but remains pre-revenue, generating less than US$1 million. Despite being unprofitable, the company has maintained a positive free cash flow and possesses sufficient cash runway for over three years without incurring debt. Recent earnings reports indicate an increase in sales to TRY2.23 million for the nine months ended September 30, 2025; however, net losses widened significantly to TRY301.63 million from TRY114.24 million year-over-year, reflecting ongoing financial challenges amidst high share price volatility and an inexperienced board.

- Unlock comprehensive insights into our analysis of Hub Girisim Sermayesi Yatirim Ortakligi stock in this financial health report.

- Explore historical data to track Hub Girisim Sermayesi Yatirim Ortakligi's performance over time in our past results report.

Neft Alsharq For Chemical Industry (SASE:9605)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neft Alsharq For Chemical Industry Company specializes in the manufacturing and sale of industrial motor oils, as well as lithium and calcium greases, with a market capitalization of SAR72.50 million.

Operations: The company generates revenue primarily from its Oil Sales Sector, amounting to SAR74.96 million.

Market Cap: SAR72.5M

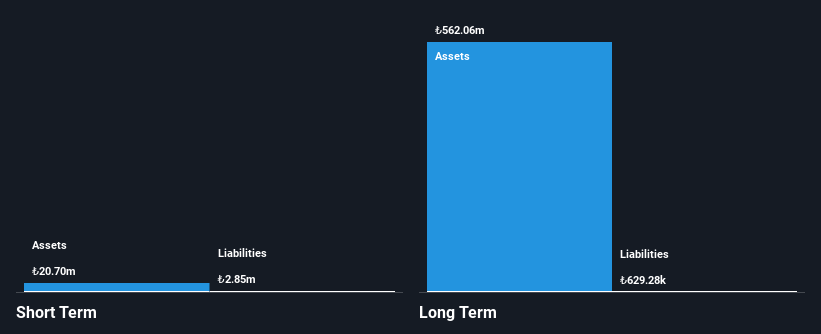

Neft Alsharq For Chemical Industry, with a market cap of SAR72.50 million, primarily generates revenue from its Oil Sales Sector, reporting SAR35.65 million in sales for the half year ending June 2025. Despite this growth compared to last year's figures, the company experienced a net loss of SAR1.91 million versus a prior net income of SAR0.32 million, highlighting profitability challenges amidst declining profit margins and low return on equity (0.9%). While short-term assets cover both short and long-term liabilities comfortably, high volatility persists alongside negative operating cash flow impacting debt coverage capabilities despite satisfactory net debt to equity ratio (4.4%).

- Click to explore a detailed breakdown of our findings in Neft Alsharq For Chemical Industry's financial health report.

- Gain insights into Neft Alsharq For Chemical Industry's historical outcomes by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 79 Middle Eastern Penny Stocks here.

- Curious About Other Options? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Girisim Sermayesi Yatirim Ortakligi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:HUBVC

Hub Girisim Sermayesi Yatirim Ortakligi

Hub Girisim Sermayesi Yatirim Ortakligi A.S.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026