As global markets react to the Federal Reserve's recent interest rate cuts and mixed signals from central banks worldwide, Asian tech stocks are navigating a complex landscape shaped by concerns over technology valuations and AI infrastructure spending. In this dynamic environment, identifying high-growth opportunities involves focusing on companies with robust innovation capabilities and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Webzen (KOSDAQ:A069080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Webzen Inc. is a global gaming company involved in PC, online, and mobile gaming with a market cap of ₩401.41 billion.

Operations: Webzen Inc. generates revenue primarily from its entertainment software segment, amounting to ₩180.57 billion.

Webzen's recent engagement in industry conferences and shareholder meetings underscores its proactive approach in the gaming sector, despite a challenging year with earnings down by 55.2%. However, looking ahead, the company is poised for a rebound with expected annual earnings growth of 31.6% over the next three years, outpacing the Korean market average of 30.5%. This optimism is further supported by its robust revenue forecast, set to grow at 14% annually—surpassing Korea's market growth rate of 10.6%. Moreover, Webzen maintains a strong commitment to shareholders as evidenced by its consistent dividend payout announced for April next year. These strategic moves coupled with positive free cash flow indicate potential for recovery and growth in an increasingly competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of Webzen.

Understand Webzen's track record by examining our Past report.

Baiwang (SEHK:6657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baiwang Co., Ltd. offers enterprise digitalization solutions via its Baiwang Cloud platform in China, with a market capitalization of HK$3.40 billion.

Operations: The company generates revenue through its Internet Software & Services segment, amounting to CN¥725.25 million.

Baiwang's recent executive reshuffle, with Ms. Chen Jie stepping in as CEO, signals a strategic pivot at a crucial time when the company is aiming to capitalize on its robust annual revenue growth of 19% and an impressive earnings forecast growth of 106.6%. These changes come as Baiwang continues to invest heavily in R&D, dedicating substantial resources that represent significant percentages of its revenue—underscoring its commitment to innovation and market leadership in tech development. This focus on high-level executive management and aggressive growth strategies could well position Baiwang favorably within Asia’s competitive tech landscape, especially given the region's average market growth rate at 8.5%.

- Click here and access our complete health analysis report to understand the dynamics of Baiwang.

Evaluate Baiwang's historical performance by accessing our past performance report.

SVI (SET:SVI)

Simply Wall St Growth Rating: ★★★★☆☆

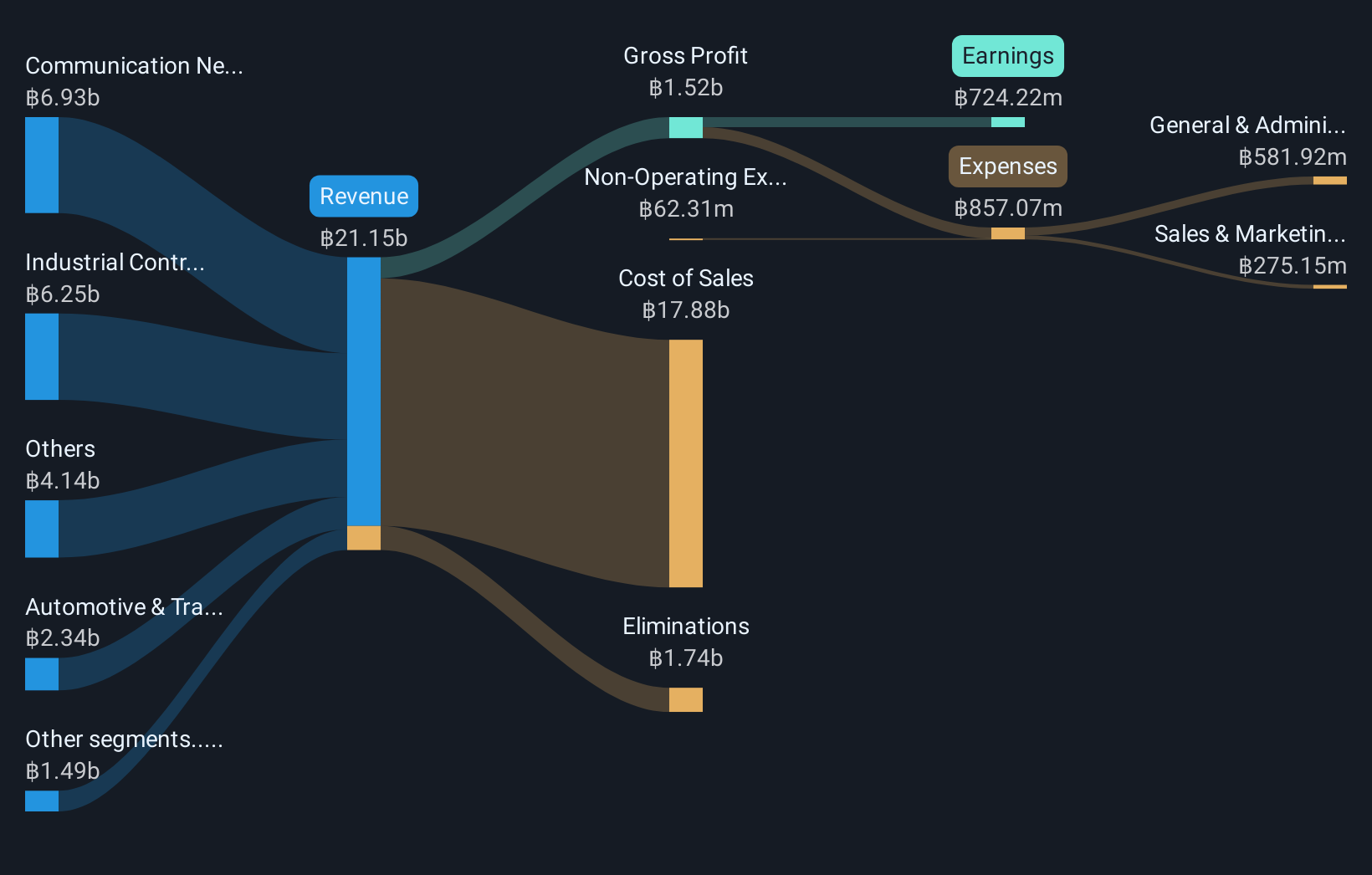

Overview: SVI Public Company Limited, along with its subsidiaries, offers electronic manufacturing services across Asia and Europe and has a market capitalization of THB15.61 billion.

Operations: SVI generates revenue primarily from its electronic manufacturing services, with key segments including Industrial Control System (THB6.78 billion), Communication Network (THB6.48 billion), Automotive & Transportation (THB2.25 billion), and Professional Audio and Video (THB1.47 billion).

SVI's recent performance underscores its resilience and potential in the tech sector, with a notable third-quarter net income increase to THB 269.74 million from THB 164.79 million year-over-year. This growth is part of a broader trend where SVI's annual revenue and earnings are projected to outpace the Thai market, with expected increases of 9.5% and 21.4% respectively. Despite challenges, including a sales dip over nine months, strategic moves like the proposed delisting suggest a recalibration towards more controlled, potentially profitable operations. Moreover, the acquisition by Pongsak Lothongkam could consolidate company ownership, offering strategic flexibility in navigating future tech landscapes.

- Take a closer look at SVI's potential here in our health report.

Assess SVI's past performance with our detailed historical performance reports.

Next Steps

- Discover the full array of 189 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SVI

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)