- Hong Kong

- /

- Consumer Services

- /

- SEHK:3978

3 Asian Value Stocks Trading Up To 48.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets navigate a landscape of economic uncertainties, including U.S.-China trade tensions and monetary policy shifts, Asian equities present intriguing opportunities for value investors. In this environment, identifying undervalued stocks becomes crucial as investors seek companies with strong fundamentals that are trading below their intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Tenchen Controls (SHSE:603085) | CN¥9.88 | CN¥19.33 | 48.9% |

| Yangtze Optical Fibre And Cable Limited (SEHK:6869) | HK$36.68 | HK$72.75 | 49.6% |

| Shanghai Conant Optical (SEHK:2276) | HK$38.02 | HK$75.70 | 49.8% |

| LITALICO (TSE:7366) | ¥1237.00 | ¥2421.92 | 48.9% |

| Jiangsu Xinquan Automotive TrimLtd (SHSE:603179) | CN¥66.19 | CN¥130.82 | 49.4% |

| Japan Eyewear Holdings (TSE:5889) | ¥2065.00 | ¥4080.86 | 49.4% |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥62.82 | CN¥125.87 | 50.1% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9200.00 | ₩17964.31 | 48.8% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥31.00 | CN¥61.23 | 49.4% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.19 | CN¥54.06 | 49.7% |

Let's review some notable picks from our screened stocks.

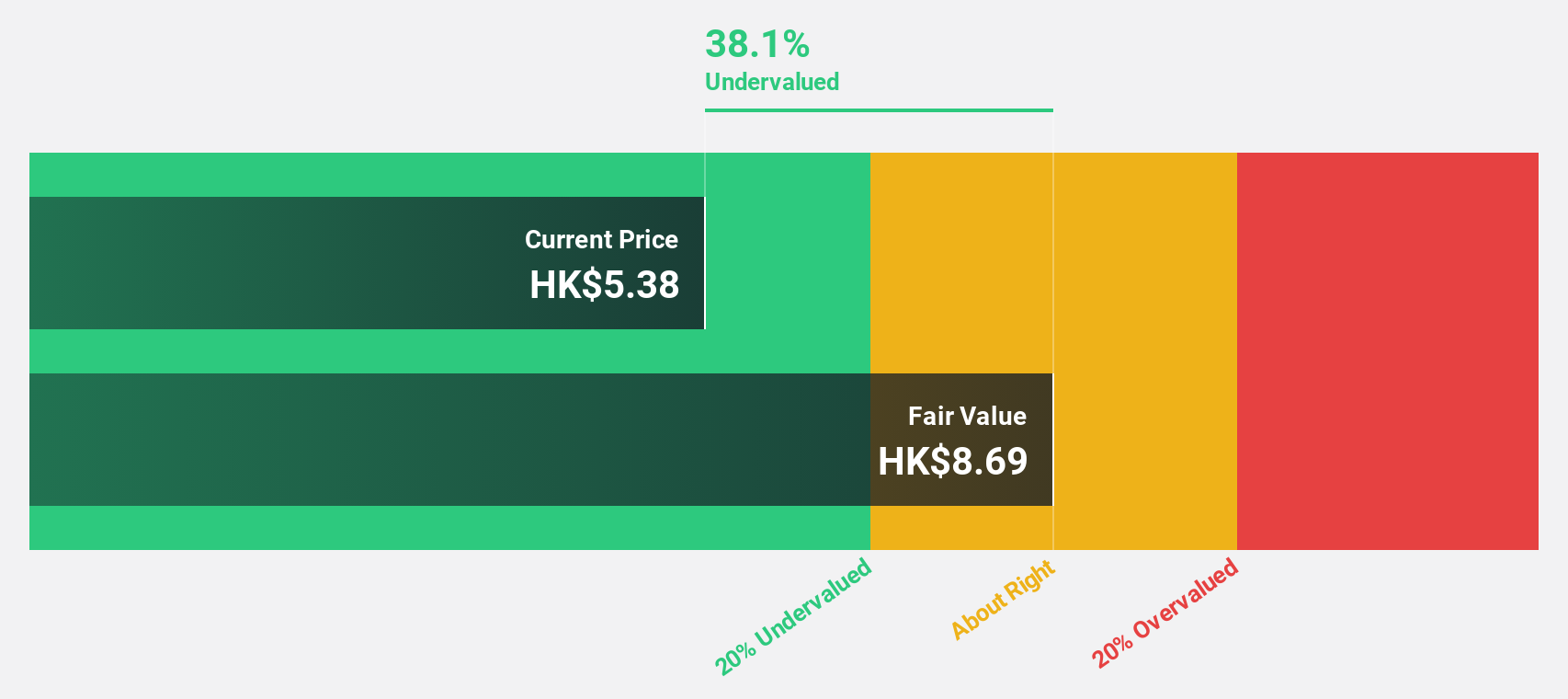

China Beststudy Education Group (SEHK:3978)

Overview: China Beststudy Education Group offers after-school education services for K-12 students in China and has a market cap of HK$3.93 billion.

Operations: The company's revenue primarily stems from its K-12 after-school education services, amounting to CN¥1.70 billion.

Estimated Discount To Fair Value: 38.9%

China Beststudy Education Group is trading at HK$5.31, significantly below its estimated fair value of HK$8.68, indicating potential undervaluation based on cash flows. Recent earnings show robust growth, with net income rising to CNY 151.26 million from CNY 54.53 million year-on-year, driven by improved education products and market expansion in key cities like Guangzhou and Shenzhen. However, the company's dividend track record remains unstable despite recent affirmations of interim dividends at HKD 0.118 per share.

- Insights from our recent growth report point to a promising forecast for China Beststudy Education Group's business outlook.

- Dive into the specifics of China Beststudy Education Group here with our thorough financial health report.

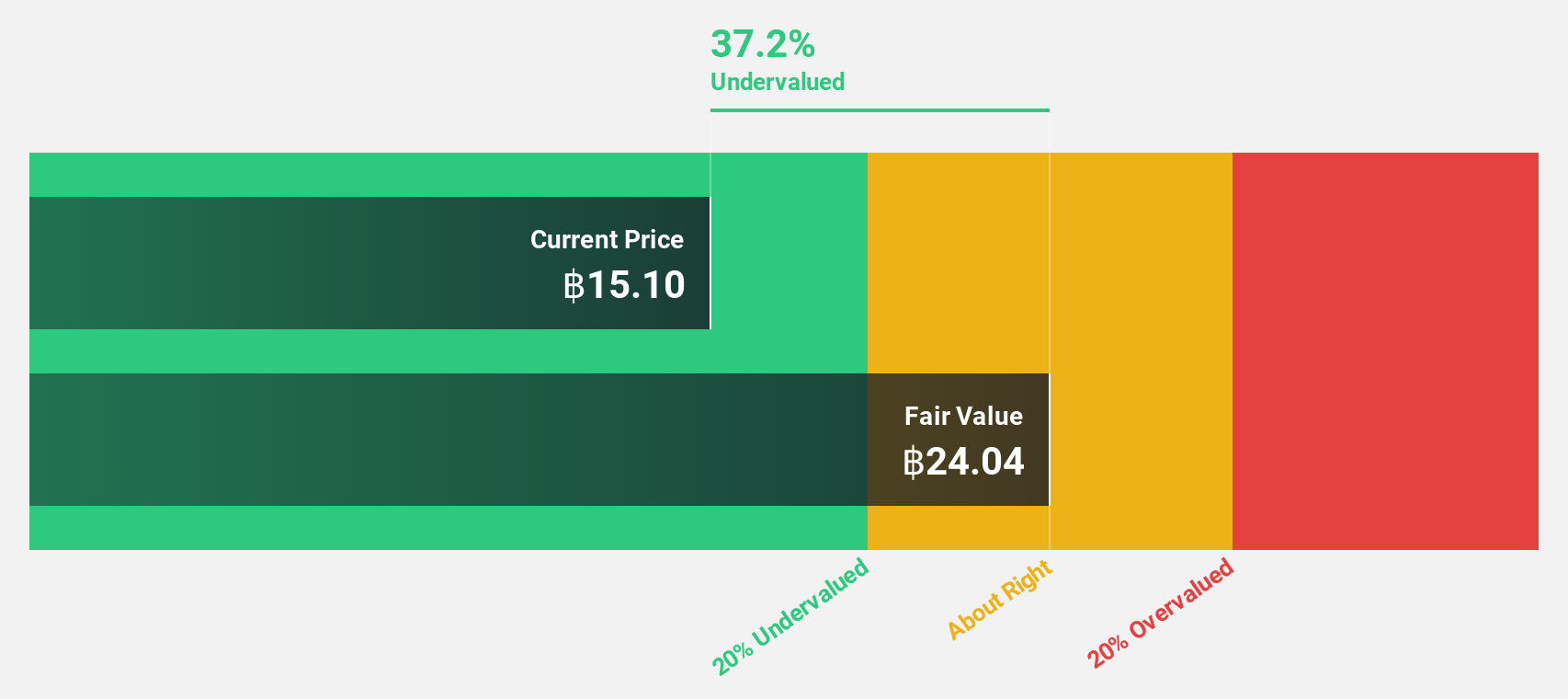

Aurora Design (SET:AURA)

Overview: Aurora Design Public Company Limited is a Thai company that trades gold jewelry, with a market cap of THB20.54 billion.

Operations: Aurora Design generates revenue primarily from the trading of gold jewelry, amounting to THB33.17 billion, and also from the trading of diamond jewelry, gems, and K-gold, which contributes THB1.29 billion.

Estimated Discount To Fair Value: 35.9%

Aurora Design is trading at THB 15.4, significantly below its estimated fair value of THB 23.9, highlighting potential undervaluation based on cash flows. Recent earnings demonstrate solid growth, with net income rising to THB 760.92 million from THB 619.37 million year-on-year, despite revenue growth forecasts being moderate at 8.4% annually. Analysts expect a stock price increase of 34%, although the company's debt coverage by operating cash flow remains a concern for investors seeking strong financial stability.

- Our earnings growth report unveils the potential for significant increases in Aurora Design's future results.

- Navigate through the intricacies of Aurora Design with our comprehensive financial health report here.

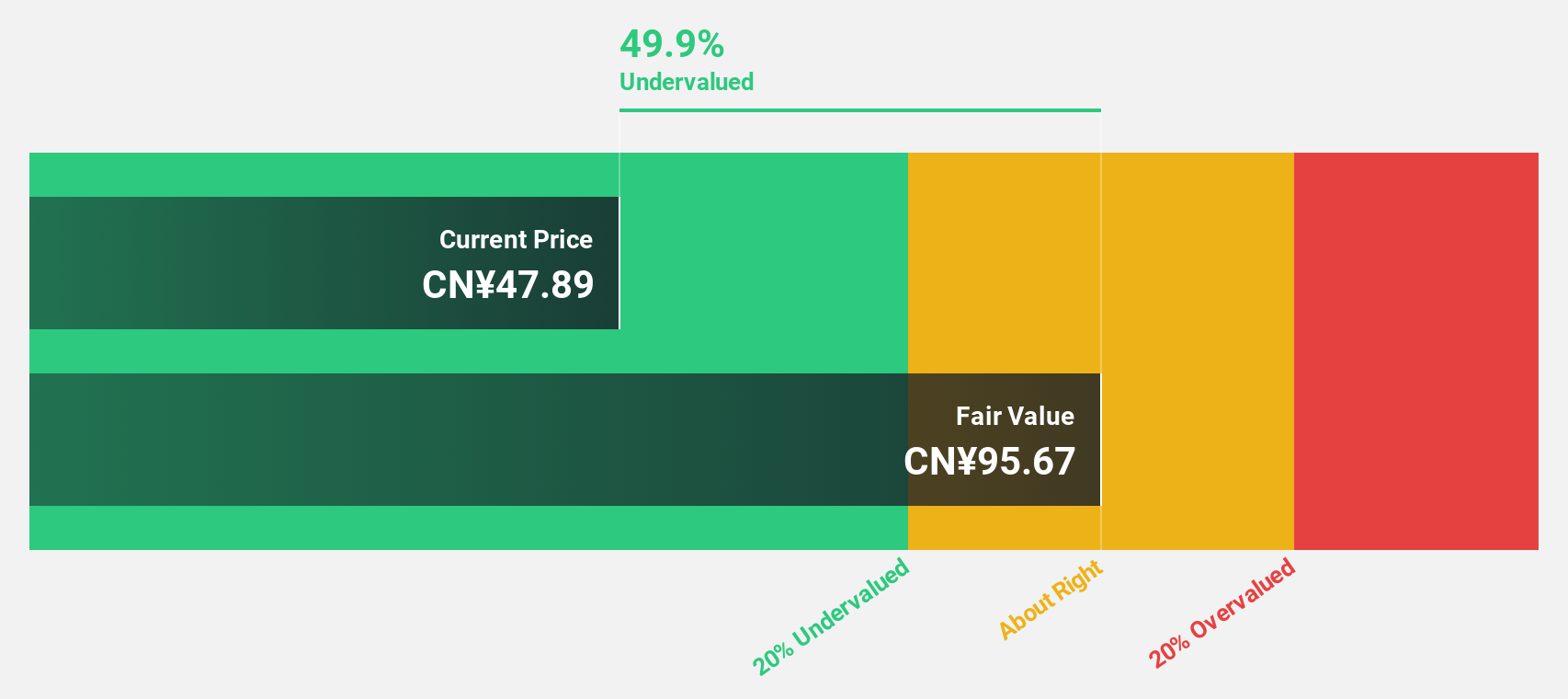

Anhui Ronds Science & Technology (SHSE:688768)

Overview: Anhui Ronds Science & Technology Incorporated Company offers machinery condition monitoring solutions for predictive maintenance in China, with a market cap of CN¥4.33 billion.

Operations: Anhui Ronds Science & Technology generates its revenue primarily from providing machinery condition monitoring solutions for predictive maintenance in China.

Estimated Discount To Fair Value: 48.6%

Anhui Ronds Science & Technology, trading at CN¥49.21, is significantly undervalued with an estimated fair value of CN¥95.6. Earnings surged by 87.6% over the past year, and future growth is promising with earnings expected to increase by 30.48% annually, outpacing the Chinese market average of 26.1%. Despite a history of unstable dividends and a forecasted low return on equity of 16.6%, recent financials show substantial improvements in net income and revenue compared to last year.

- Our comprehensive growth report raises the possibility that Anhui Ronds Science & Technology is poised for substantial financial growth.

- Click here to discover the nuances of Anhui Ronds Science & Technology with our detailed financial health report.

Make It Happen

- Unlock our comprehensive list of 277 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3978

China Beststudy Education Group

Provides after-school education services for K-12 student groups in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives