- Japan

- /

- Auto Components

- /

- TSE:5191

3 High-Yield Dividend Stocks With Up To 7.5% Yield

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty marked by rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve cut, investors are keenly observing indices like the Nasdaq, which has reached record highs despite broader market declines. Amidst this backdrop of fluctuating interest rates and mixed economic signals, high-yield dividend stocks emerge as attractive options for those seeking income stability; they offer potential returns through regular payouts even when market volatility persists.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1856 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dusit Thani Freehold and Leasehold Real Estate Investment Trust (SET:DREIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dusit Thani Freehold and Leasehold Real Estate Investment Trust is a real estate investment trust with a market cap of THB3.63 billion, focusing on managing a portfolio of hospitality-related properties.

Operations: Dusit Thani Freehold and Leasehold Real Estate Investment Trust generates revenue primarily from its leasing segment, which amounts to THB540.05 million.

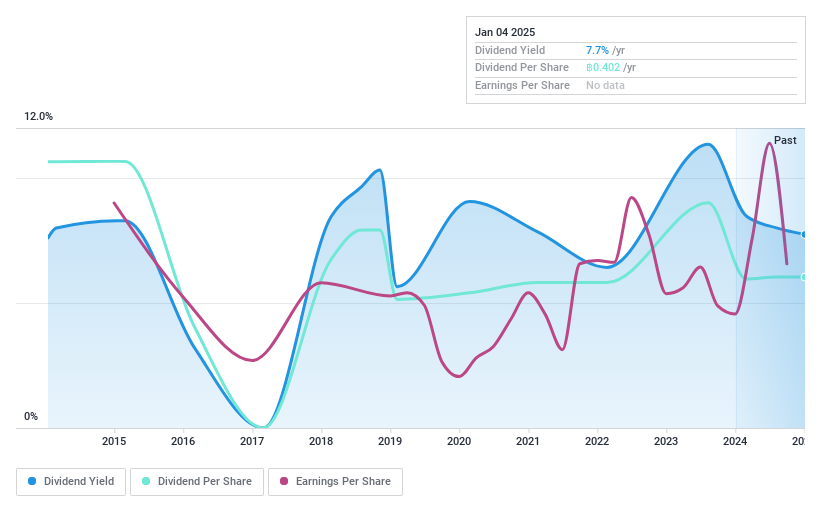

Dividend Yield: 7.6%

Dusit Thani Freehold and Leasehold Real Estate Investment Trust (DREIT) offers a high dividend yield of 7.89%, placing it in the top 25% of dividend payers in Thailand. Despite this, its dividends have been volatile over the past decade, with significant annual drops. While dividends are covered by earnings and cash flows, recent financial results show a net loss for Q3 2024 and reliance on new long-term loans secured against key assets to manage existing debts.

- Navigate through the intricacies of Dusit Thani Freehold and Leasehold Real Estate Investment Trust with our comprehensive dividend report here.

- The analysis detailed in our Dusit Thani Freehold and Leasehold Real Estate Investment Trust valuation report hints at an deflated share price compared to its estimated value.

Sumitomo Riko (TSE:5191)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Riko Company Limited manufactures and sells automotive parts, with a market cap of ¥162.49 billion.

Operations: Sumitomo Riko Company Limited generates revenue from the manufacture and sale of automotive parts.

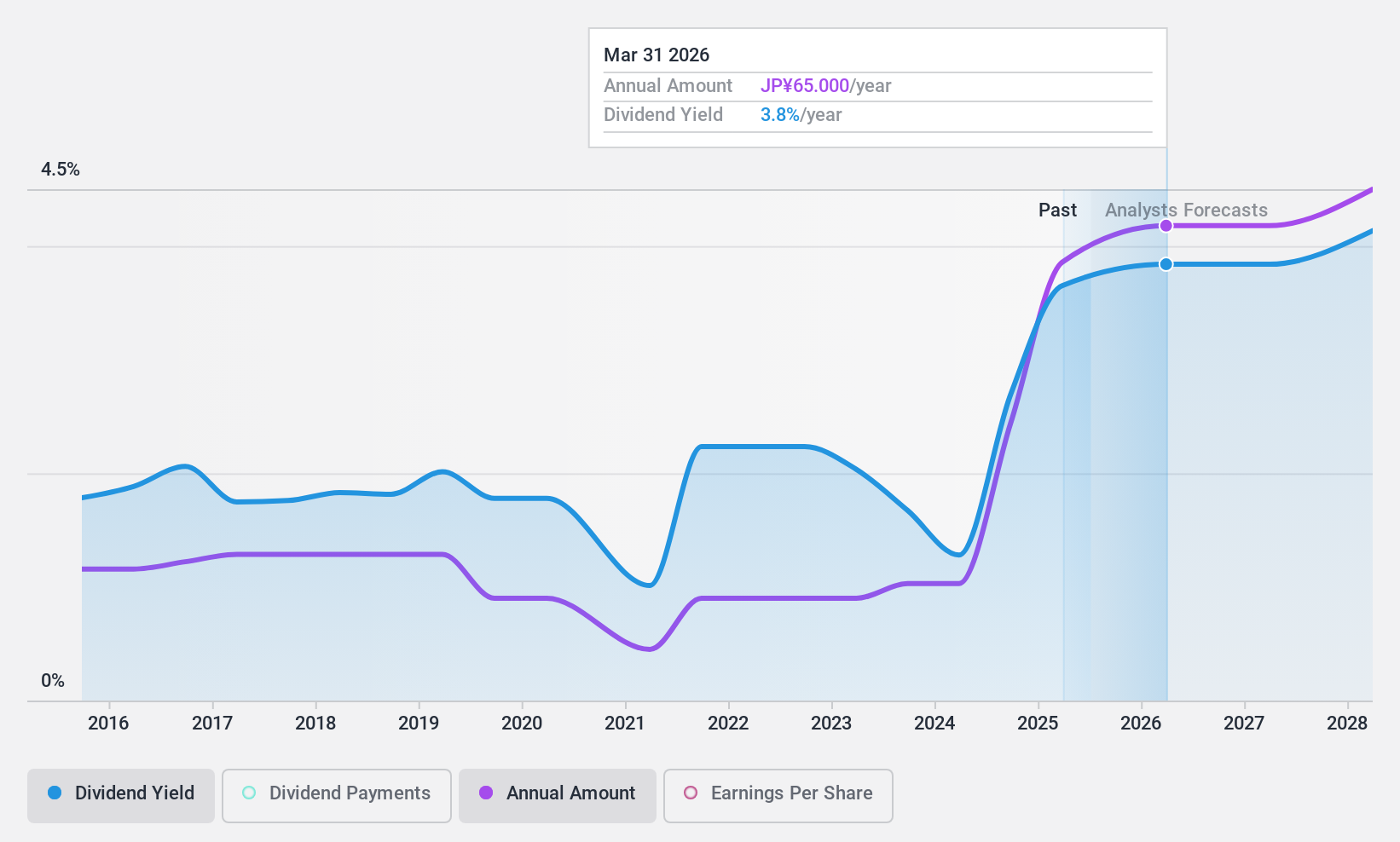

Dividend Yield: 3.3%

Sumitomo Riko's dividend yield of 3.31% is below the top 25% in Japan, and its dividend history over the past decade has been volatile with periods of significant annual drops. Despite this instability, dividends are well covered by earnings and cash flows, with low payout ratios of 23.6% and 17.4%, respectively. The company's earnings grew by ¥32 million last year but are forecast to decline over the next three years, potentially impacting future dividends.

- Unlock comprehensive insights into our analysis of Sumitomo Riko stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sumitomo Riko shares in the market.

Yamaichi ElectronicsLtd (TSE:6941)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamaichi Electronics Co., Ltd. is a company that manufactures and sells test, connector, and optical-related products both in Japan and internationally, with a market cap of ¥45.84 billion.

Operations: Yamaichi Electronics Co., Ltd.'s revenue is derived from its manufacturing and sales activities in the test, connector, and optical-related product segments across domestic and international markets.

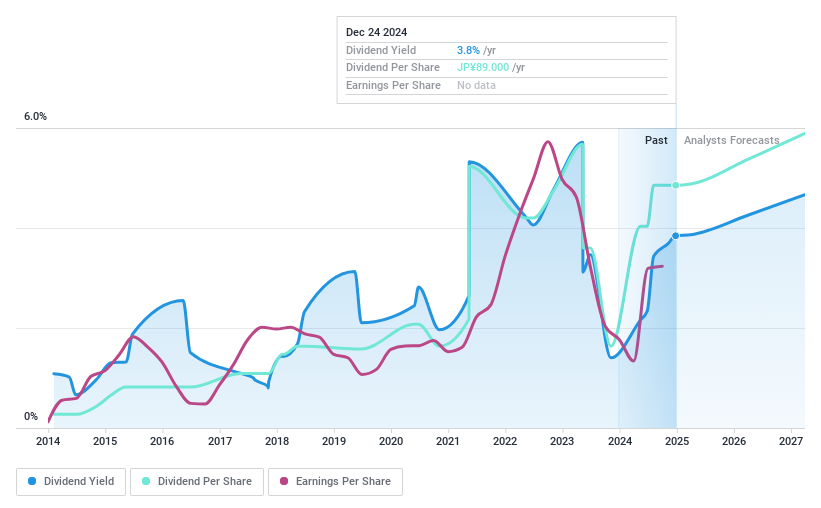

Dividend Yield: 3.9%

Yamaichi Electronics' dividend yield of 3.86% ranks in the top 25% in Japan, supported by a low payout ratio of 5.4%, ensuring coverage by earnings and cash flows (39.9%). However, its dividend history has been unreliable over the past decade with volatility exceeding annual drops of 20%. Despite recent share buybacks totaling ¥999.98 million for 1.77% of shares, the company's highly volatile share price might concern some investors seeking stability.

- Take a closer look at Yamaichi ElectronicsLtd's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Yamaichi ElectronicsLtd is priced lower than what may be justified by its financials.

Seize The Opportunity

- Delve into our full catalog of 1856 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5191

Flawless balance sheet, good value and pays a dividend.