- Japan

- /

- Marine and Shipping

- /

- TSE:9104

Leading Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy adjustments, with the ECB and SNB cutting rates and expectations rising for a U.S. Fed rate cut, investors are closely watching indices like the Nasdaq Composite, which recently hit a record high despite broader market declines. In this environment of mixed economic signals and sector performances, dividend stocks can offer stability through consistent income streams, making them an attractive consideration for those seeking to balance growth with reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1849 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

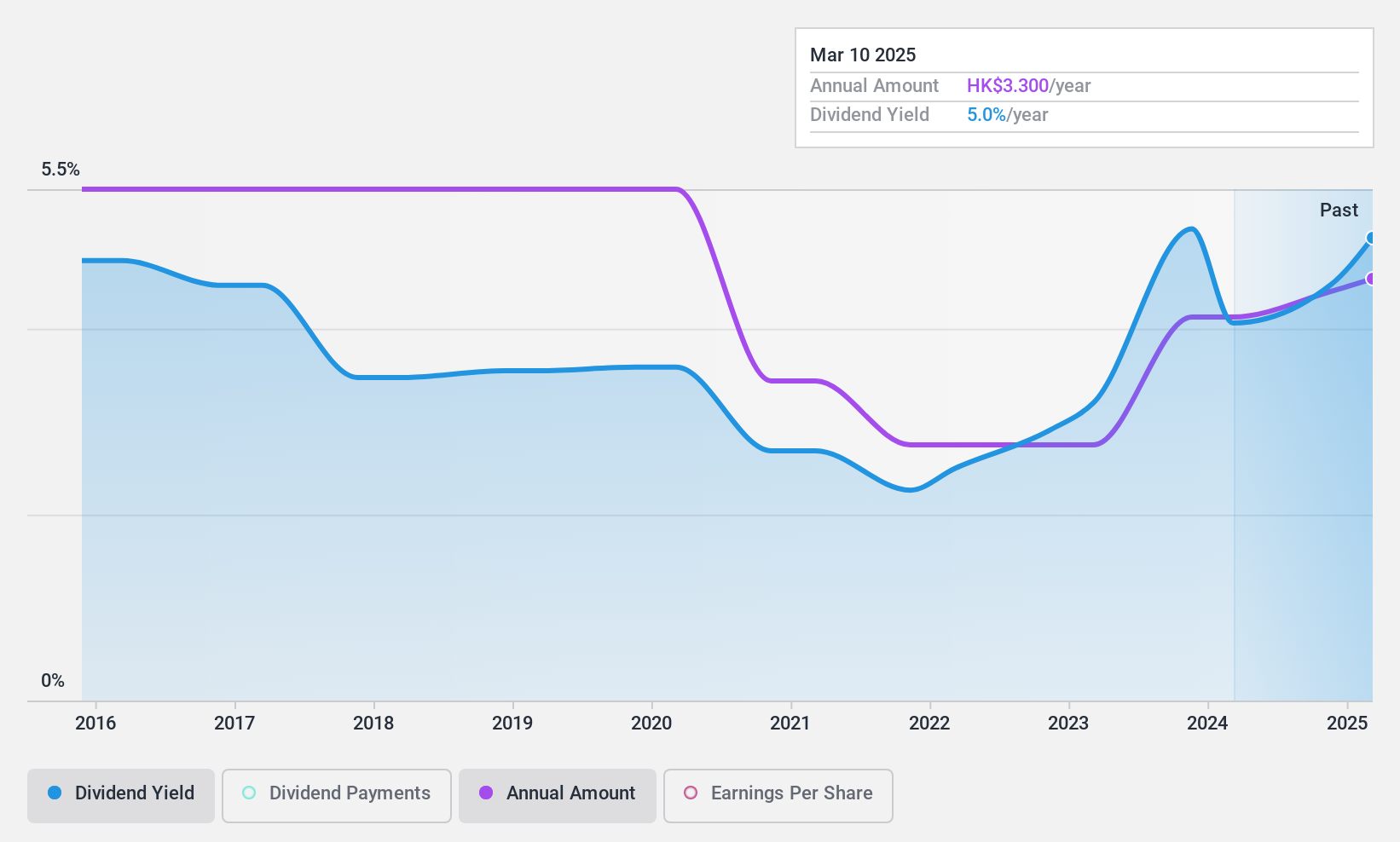

Guoco Group (SEHK:53)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guoco Group Limited is an investment holding company involved in principal investment, property development, hospitality and leisure, and financial services across Hong Kong, China, the UK, Continental Europe, Singapore, Australasia, and other international markets with a market cap of HK$23.18 billion.

Operations: Guoco Group's revenue is primarily derived from its hospitality and leisure segment at $1.34 billion, followed by property development and investment at $1.33 billion, and principal investment contributing $163.81 million.

Dividend Yield: 4.5%

Guoco Group's recent approval of a final dividend of HK$2.70 per share highlights its commitment to returning value to shareholders, supported by a low cash payout ratio of 14.7%, indicating strong coverage by free cash flow. Despite this, the company's dividend history is volatile, with past fluctuations exceeding 20%. Earnings growth remains modest at 4.5% over the past year, and dividends are well-covered with a payout ratio of 29.1%.

- Click here to discover the nuances of Guoco Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Guoco Group shares in the market.

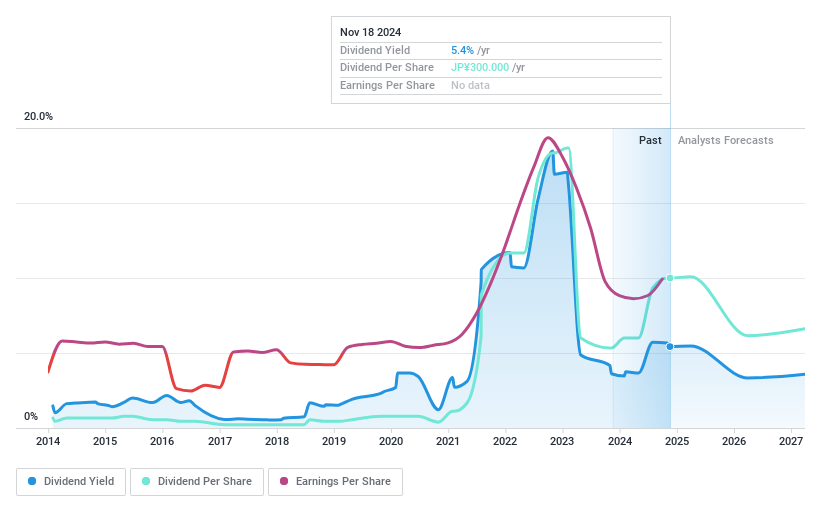

Mitsui O.S.K. Lines (TSE:9104)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui O.S.K. Lines, Ltd. operates in the marine transportation industry both in Japan and globally, with a market cap of ¥1.87 trillion.

Operations: Mitsui O.S.K. Lines, Ltd.'s revenue segments include the Energy Business at ¥515.10 billion, the Dry Bulk Business at ¥420.16 billion, the Product Transport Business - Car Carriers, Terminal and Logistics, Ferries and Coastal RORO Ships at ¥579.82 billion, the Product Transport Business - Container Ships at ¥60.42 billion, the Ferry· Coastal RORO Ship and Cruise Business at ¥66.69 billion, and Connection Businesses (excluding Real Estate) at ¥88.02 billion.

Dividend Yield: 5.7%

Mitsui O.S.K. Lines offers a dividend yield of 5.75%, ranking in the top 25% in Japan, but its reliability is questionable due to past volatility and lack of free cash flow coverage. Despite this, recent dividend increases and a low payout ratio of 29.4% suggest earnings can support payouts. The company plans share buybacks worth ¥100 billion to enhance shareholder value, indicating a strategic focus on returns amidst revised earnings forecasts for fiscal year-end March 2025.

- Take a closer look at Mitsui O.S.K. Lines' potential here in our dividend report.

- The valuation report we've compiled suggests that Mitsui O.S.K. Lines' current price could be quite moderate.

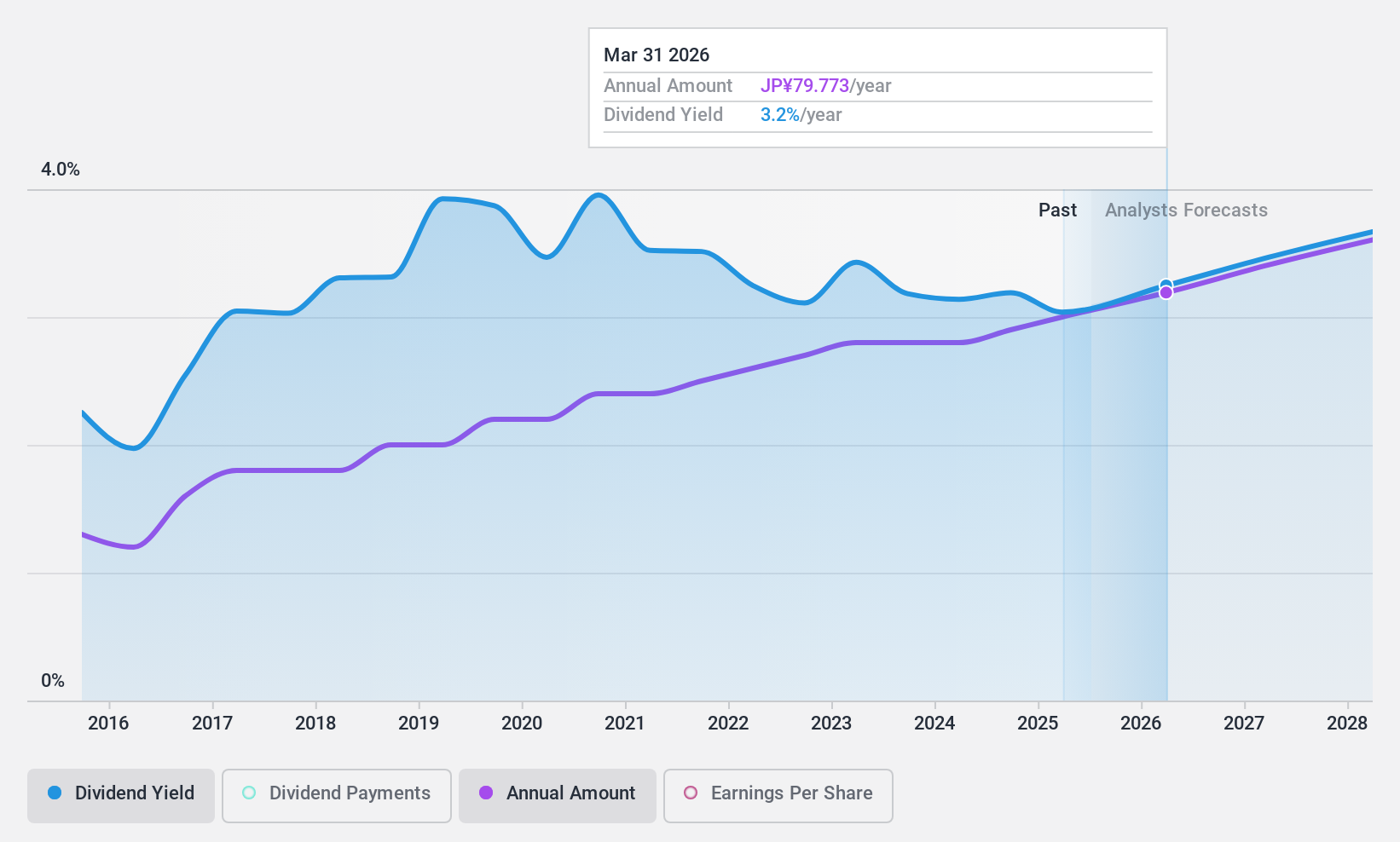

KDDI (TSE:9433)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KDDI Corporation provides telecommunications services both in Japan and internationally, with a market capitalization of approximately ¥10.05 trillion.

Operations: KDDI Corporation's revenue segments include telecommunications services provided domestically and internationally.

Dividend Yield: 3%

KDDI's dividend yield of 3% falls short of Japan's top 25% payers, but it is well-covered by both earnings and cash flows, with payout ratios of 46.7% and 24.1%, respectively. Despite past volatility in dividends, recent increases suggest potential stability. The company has initiated a share buyback program worth ¥100 billion to enhance shareholder returns amid changing business conditions and announced fixed-income offerings totaling ¥210 billion to support its financial strategy.

- Dive into the specifics of KDDI here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that KDDI is priced lower than what may be justified by its financials.

Summing It All Up

- Get an in-depth perspective on all 1849 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Engages in the marine transportation business in Japan and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives