- Japan

- /

- Diversified Financial

- /

- TSE:8424

Johnson Electric Holdings And 2 Other Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of rate cuts by the ECB and SNB, alongside expectations for a similar move by the Fed, investors are witnessing mixed performances across major indices. While growth stocks have recently outperformed value stocks, largely driven by gains in technology shares like Tesla and Alphabet, the broader market remains cautious amid economic data indicating stalled inflation progress and a cooling labor market. In such an environment, dividend stocks can offer stability and income potential to portfolios. These types of investments are particularly appealing when navigating uncertain times as they provide regular income streams regardless of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1856 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

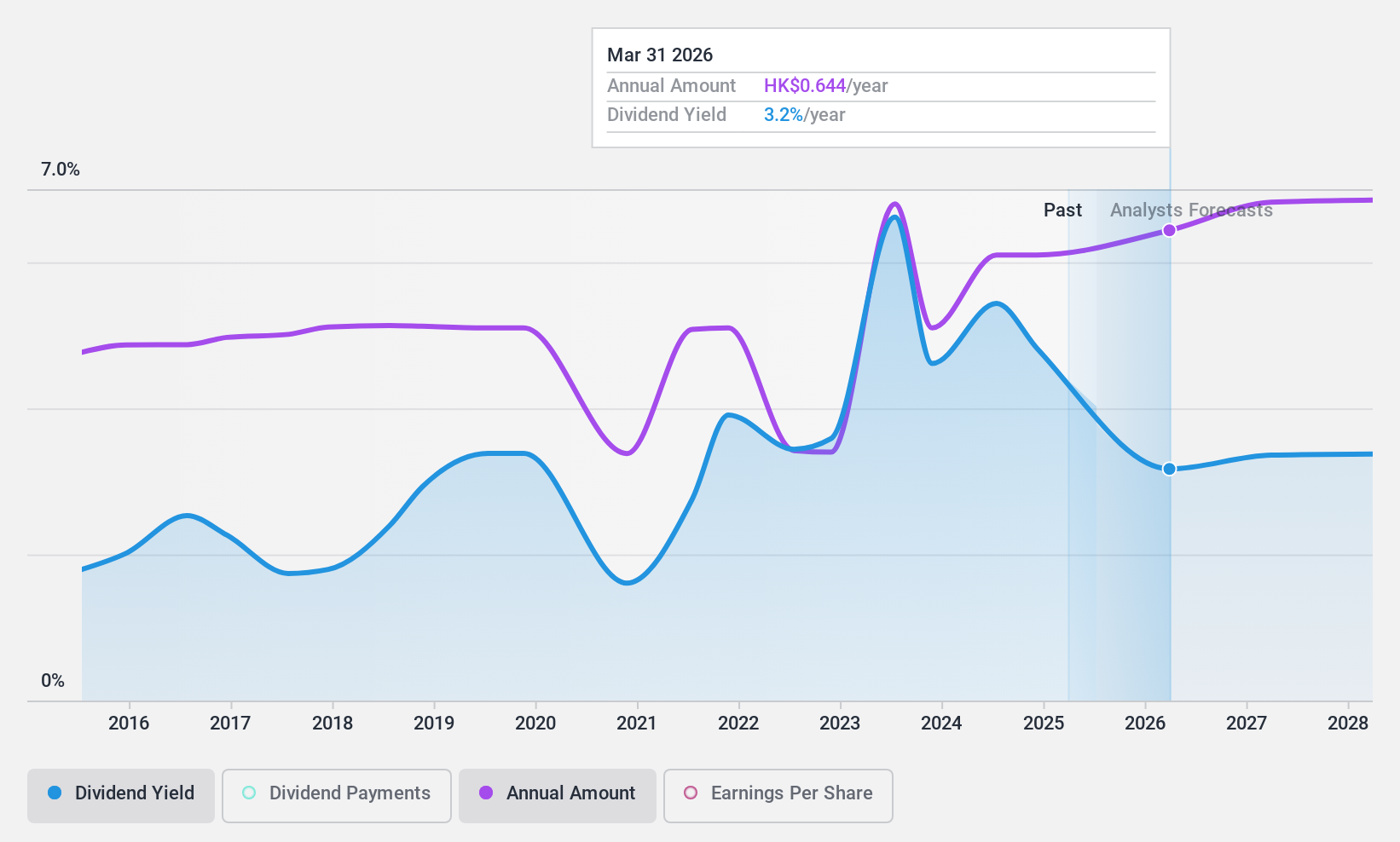

Johnson Electric Holdings (SEHK:179)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Johnson Electric Holdings Limited is an investment holding company that manufactures and sells motion systems globally, with a market cap of HK$9.74 billion.

Operations: Johnson Electric Holdings Limited generates revenue primarily from the Auto Parts & Accessories segment, amounting to $3.73 billion.

Dividend Yield: 5.6%

Johnson Electric Holdings announced an interim dividend of HK$0.17 per share, with a payment date in January 2025. Despite a history of volatile dividends, the company's current payout ratio of 30.3% indicates strong earnings coverage, complemented by a low cash payout ratio of 22.5%. Recent earnings showed improvement with net income rising to US$129.61 million from US$120.15 million year-over-year, suggesting financial stability supporting future dividend payments despite past inconsistencies.

- Get an in-depth perspective on Johnson Electric Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Johnson Electric Holdings' current price could be quite moderate.

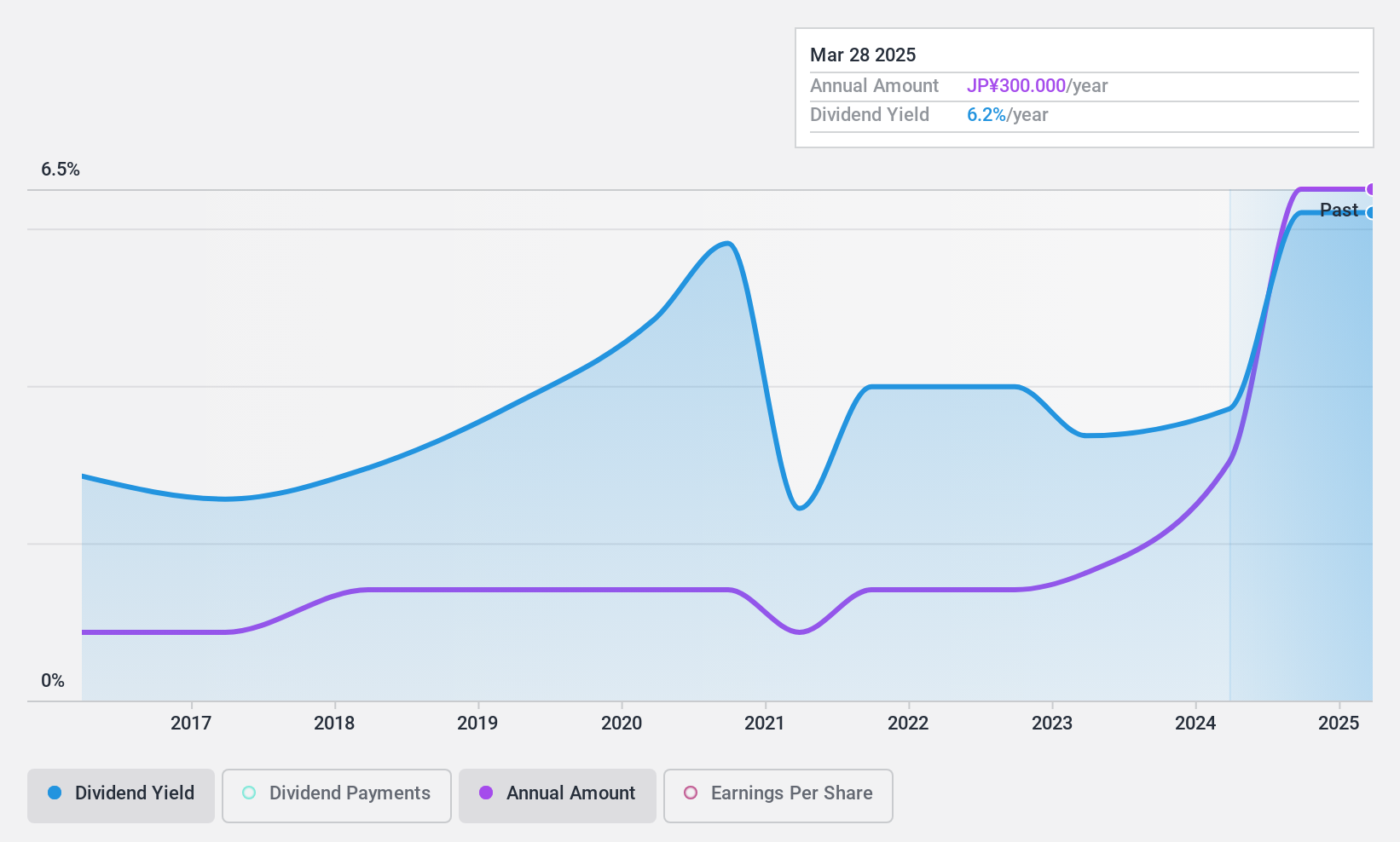

Araya Industrial (TSE:7305)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Araya Industrial Co., Ltd. manufactures and sells steel products both in Japan and internationally, with a market cap of ¥26.17 billion.

Operations: Araya Industrial Co., Ltd. generates revenue from its steel pipe related segment at ¥42.77 billion, bicycle related activities at ¥306 million, and real estate rentals and other services at ¥611 million.

Dividend Yield: 6.1%

Araya Industrial's dividend payments have been volatile over the past decade, yet they have shown growth. The dividends are well-covered by earnings and cash flows, with payout ratios of 61.7% and 53%, respectively. Despite a lower profit margin this year (3.2% from 4.8%), the stock trades at a significant discount to its estimated fair value, offering an attractive yield of 6.11%, placing it in the top quartile among Japanese dividend payers.

- Unlock comprehensive insights into our analysis of Araya Industrial stock in this dividend report.

- The analysis detailed in our Araya Industrial valuation report hints at an inflated share price compared to its estimated value.

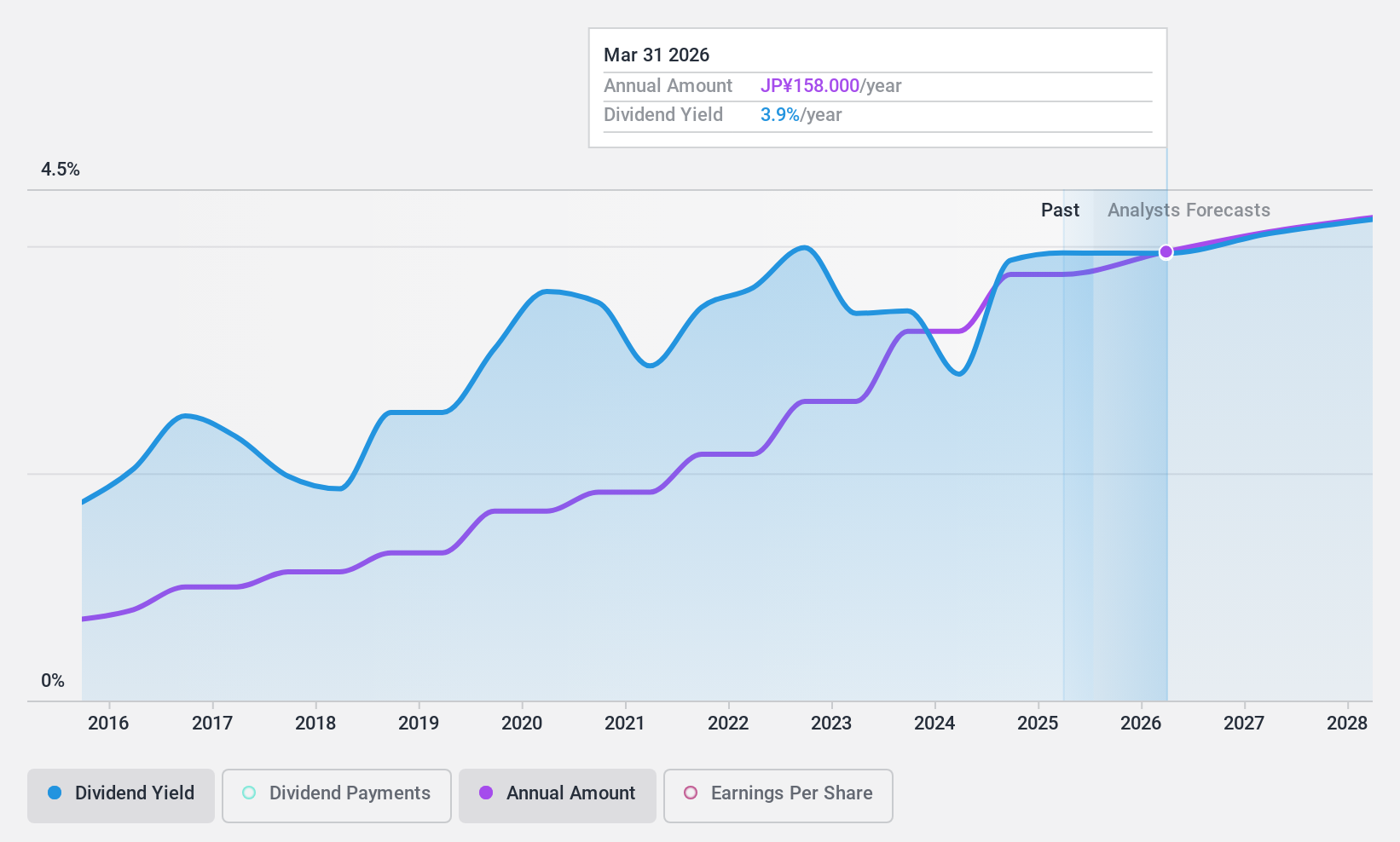

Fuyo General Lease (TSE:8424)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fuyo General Lease Co., Ltd. operates in the leasing and installment sales sector both in Japan and internationally, with a market cap of ¥338.72 billion.

Operations: Fuyo General Lease Co., Ltd. generates revenue primarily through its Lease and Installment segment, which accounts for ¥596.80 billion, complemented by its Financing segment contributing ¥43.41 billion.

Dividend Yield: 3.9%

Fuyo General Lease's dividends have been stable and growing over the past decade, with a payout ratio of 30.1%, indicating coverage by earnings despite lacking free cash flow coverage. The dividend yield of 3.94% ranks in the top 25% among Japanese dividend payers, though concerns arise from insufficient cash flow to cover debt obligations. Trading at a substantial discount to its estimated fair value enhances its appeal relative to peers and industry standards.

- Click here to discover the nuances of Fuyo General Lease with our detailed analytical dividend report.

- Our valuation report here indicates Fuyo General Lease may be undervalued.

Summing It All Up

- Investigate our full lineup of 1856 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8424

Fuyo General Lease

Engages in the leasing and instalment sales business in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives