Mount Everest Gold Group Leads 3 Asian Penny Stocks To Watch

Reviewed by Simply Wall St

As Asian markets navigate a complex economic landscape, characterized by evolving trade dynamics and shifting monetary policies, investors are increasingly seeking opportunities beyond traditional large-cap stocks. Penny stocks, though an older term, continue to represent smaller or newer companies that can offer significant potential when backed by strong financial fundamentals. By focusing on those with robust balance sheets and clear growth prospects, investors may find valuable opportunities in these often-overlooked segments of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.04 | THB3.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.55 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.59 | HK$2.16B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.64 | SGD259.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.22 | HK$2.04B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.72 | THB9.54B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mount Everest Gold Group (SEHK:1815)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mount Everest Gold Group Company Limited is an investment holding company that designs and sells gold, silver, colored gemstones, gem-set, and other jewellery products in the People’s Republic of China with a market cap of approximately HK$2.31 billion.

Operations: The company's revenue is primarily generated from its New Jewellery Retail segment, amounting to CN¥157.57 million.

Market Cap: HK$2.31B

Mount Everest Gold Group has recently turned profitable, with a projected net profit of RMB 70-80 million for the first half of 2025, reversing a previous loss. This improvement is largely driven by increased sales and higher margins in its New Jewellery Retail segment due to rising gold prices and low-cost inventory. The company's balance sheet is strong, with more cash than debt and short-term assets exceeding liabilities. However, interest coverage remains low at 1.5 times EBIT, and management's average tenure is only 1.3 years, suggesting limited experience within the team despite stable share price volatility over the past year.

- Click to explore a detailed breakdown of our findings in Mount Everest Gold Group's financial health report.

- Examine Mount Everest Gold Group's past performance report to understand how it has performed in prior years.

Plan B Media (SET:PLANB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Plan B Media Public Company Limited, with a market cap of THB22.91 billion, operates in Thailand offering advertising media production services through its subsidiaries.

Operations: Plan B Media generates its revenue from advertising media, contributing THB2.22 billion, and engagement marketing, which accounts for THB9.79 billion.

Market Cap: THB22.91B

Plan B Media's recent earnings report highlights stable revenue growth, with THB4.52 billion in sales for the first half of 2025, up from THB4.16 billion a year prior. The company remains debt-free, enhancing financial flexibility and reducing risk exposure. Despite high weekly volatility compared to other Thai stocks, Plan B Media maintains strong short-term asset coverage over liabilities and has not experienced shareholder dilution recently. However, its return on equity at 12.1% is considered low by industry standards. The management team is experienced with an average tenure of 5.6 years, supporting operational stability amidst market fluctuations.

- Take a closer look at Plan B Media's potential here in our financial health report.

- Gain insights into Plan B Media's future direction by reviewing our growth report.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market cap of SGD680.24 million.

Operations: The company's revenue is primarily derived from building construction (SGD137.48 million), workers dormitory operations (SGD84.26 million), property development in Singapore (SGD76.46 million), fund management (SGD43.72 million), corporate activities (SGD3.55 million), PBSA operations (SGD2.12 million), and property development in Australia (SGD0.93 million).

Market Cap: SGD680.24M

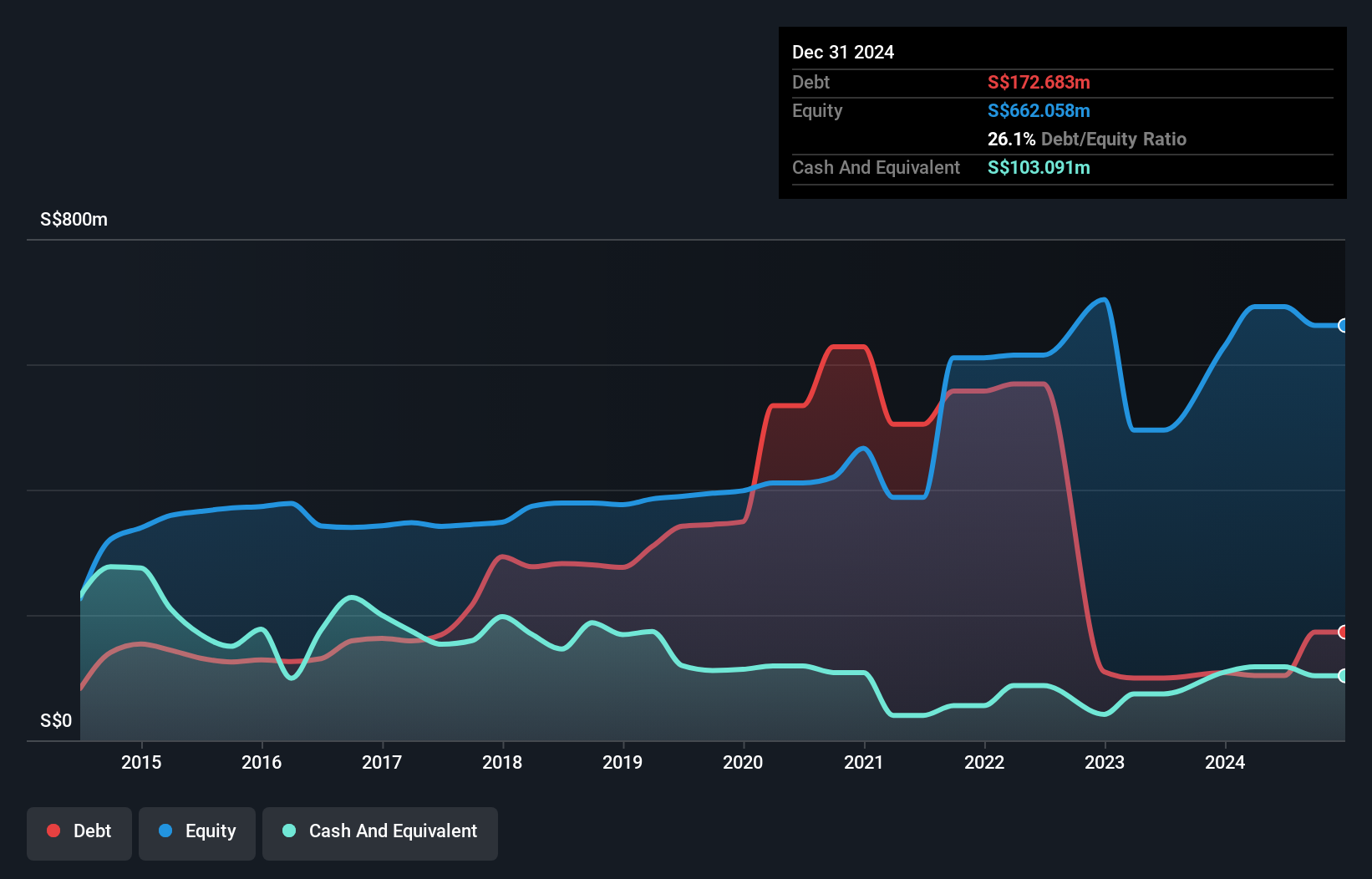

Wee Hur Holdings has demonstrated a mixed financial performance recently. The company reported sales of SGD155.97 million for the first half of 2025, showing growth from the previous year, yet net income declined to SGD38.66 million due to a significant one-off loss impacting earnings quality. Despite this, Wee Hur's debt management is strong with cash exceeding total debt and interest payments well covered by EBIT. While profit margins have decreased from last year, the firm's seasoned management team and board provide stability. Recent business expansion in Australia through a new subsidiary could enhance future revenue streams in fund management.

- Dive into the specifics of Wee Hur Holdings here with our thorough balance sheet health report.

- Gain insights into Wee Hur Holdings' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Dive into all 968 of the Asian Penny Stocks we have identified here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PLANB

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives