Nurminen Logistics Oyj And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to adjust, recent easing in core U.S. inflation and robust earnings from major banks have propelled stock indices higher, despite challenges in retail sales and jobless claims. In this context, penny stocks—though an older term—remain a compelling area of investment due to their potential for significant growth when backed by solid financials. These smaller or newer companies can offer unique opportunities for investors seeking value beyond the mainstream market, with some standing out for their financial strength and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$615.75M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £147.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

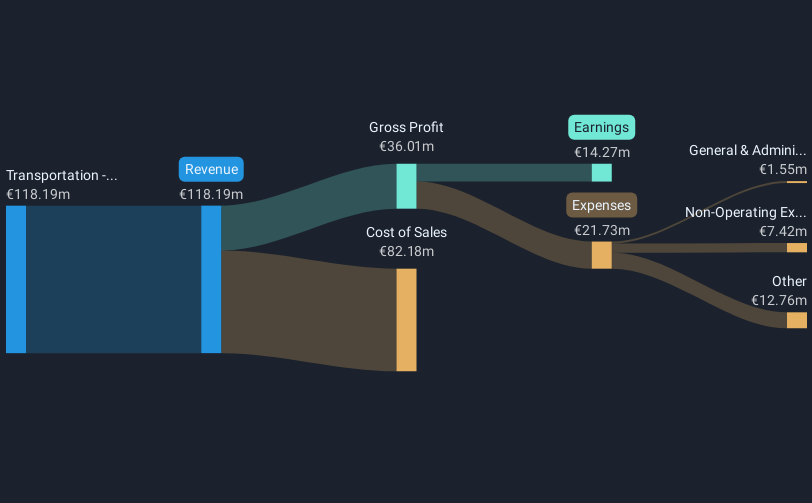

Overview: Nurminen Logistics Oyj offers logistics services in Finland, Russia, and the Baltic countries with a market cap of €88.77 million.

Operations: The company's revenue is primarily derived from its Transportation - Trucking segment, which generated €118.19 million.

Market Cap: €88.77M

Nurminen Logistics Oyj, with a market cap of €88.77 million, has shown significant earnings growth over the past year at 150.4%, surpassing its five-year average of 63.3% per year and outperforming the logistics industry growth rate. Despite short-term liabilities exceeding short-term assets by €1.5 million, the company's debt is well-covered by operating cash flow (82.7%), and it maintains an outstanding return on equity of 55.9%. However, recent guidance indicates net sales and operating profit for 2024 will be slightly below last year's levels due to reduced Baltic volumes from geopolitical disruptions affecting transportation routes.

- Click here and access our complete financial health analysis report to understand the dynamics of Nurminen Logistics Oyj.

- Gain insights into Nurminen Logistics Oyj's outlook and expected performance with our report on the company's earnings estimates.

Starflex (SET:SFLEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

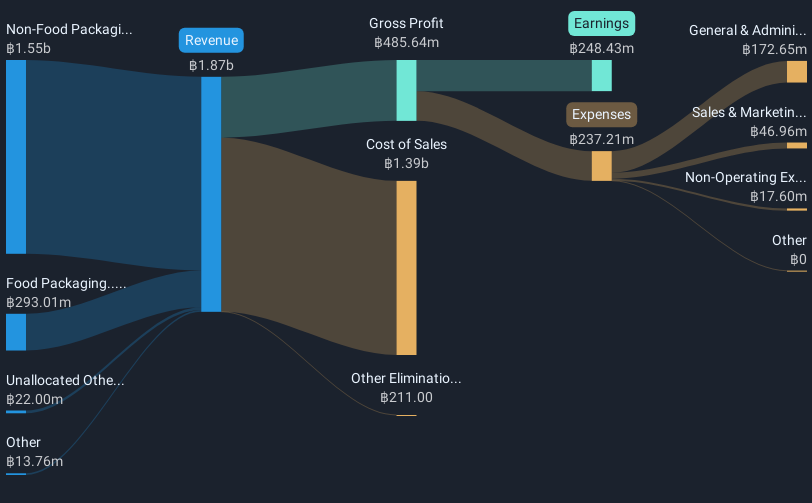

Overview: Starflex Public Company Limited manufactures and distributes flexible packaging products in Thailand, with a market cap of THB2.19 billion.

Operations: The company generates revenue primarily from Non-Food Packaging at THB1.55 billion and Food Packaging at THB293.01 million.

Market Cap: THB2.19B

Starflex Public Company Limited, with a market cap of THB2.19 billion, has demonstrated robust earnings growth, reporting a 43.4% increase over the past year, surpassing its five-year average of 15.1%. The company's net income for the third quarter rose to THB75.41 million from THB48.88 million a year prior, reflecting improved profit margins at 13.3% compared to last year's 9.6%. Despite high debt levels with a net debt-to-equity ratio of 56.3%, interest payments are well covered by EBIT (8.2x). Starflex's seasoned management and stable weekly volatility further bolster its investment profile in the penny stock segment.

- Dive into the specifics of Starflex here with our thorough balance sheet health report.

- Gain insights into Starflex's future direction by reviewing our growth report.

Oceanus Group (SGX:579)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oceanus Group Limited is an investment holding company that sells processed marine products, sugar, beverages, and other commodities across Singapore, Hong Kong, Macau, Thailand, and the People’s Republic of China with a market cap of SGD179.66 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for SGD343.36 million, complemented by Services contributing SGD5.56 million.

Market Cap: SGD179.66M

Oceanus Group Limited, with a market cap of SGD179.66 million, primarily generates revenue through its Distribution segment at SGD343.36 million. Despite being unprofitable and having a negative return on equity of -4.94%, Oceanus maintains sufficient cash runway for over three years, supported by positive free cash flow. The company's high net debt-to-equity ratio of 133.2% reflects elevated leverage, though short-term assets cover both short- and long-term liabilities comfortably. While earnings have declined significantly over the past five years, Oceanus benefits from an experienced management team with an average tenure of 5.2 years amidst increased stock volatility recently.

- Take a closer look at Oceanus Group's potential here in our financial health report.

- Explore historical data to track Oceanus Group's performance over time in our past results report.

Key Takeaways

- Access the full spectrum of 5,722 Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nurminen Logistics Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NLG1V

Nurminen Logistics Oyj

Provides logistics services in Finland, Russia, and Baltic countries.

Solid track record with excellent balance sheet.