- Finland

- /

- Consumer Durables

- /

- HLSE:FSKRS

3 Companies That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets experience a resurgence with cooling inflation and robust bank earnings propelling U.S. stocks higher, value stocks have notably outperformed growth shares, particularly in sectors like energy and financials. This environment presents an intriguing opportunity to explore companies that may be priced below their estimated value, offering potential for investors who are keen on identifying undervalued stocks amidst the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.96 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥1809.00 | ¥3611.35 | 49.9% |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.40 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1112.30 | ₹2216.41 | 49.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK92.60 | DKK184.75 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5875.00 | ¥11690.54 | 49.7% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.82 | CA$3.63 | 49.8% |

| Coeur Mining (NYSE:CDE) | US$6.36 | US$12.67 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

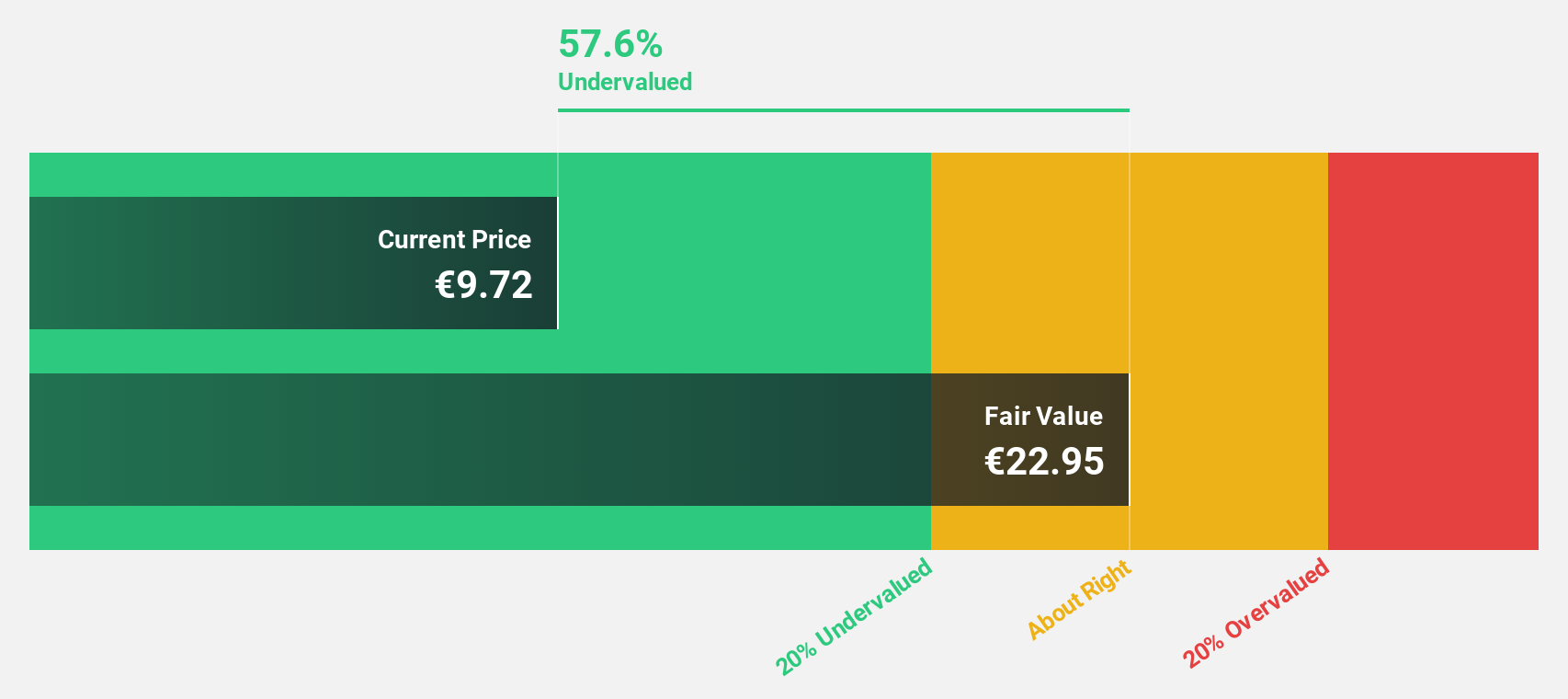

Ibersol S.G.P.S (ENXTLS:IBS)

Overview: Ibersol S.G.P.S. operates a network of restaurants in Portugal, Spain, and Angola through its subsidiaries, with a market cap of €344.90 million.

Operations: The company's revenue is derived from Counters (€172.83 million), Restaurants (€111.42 million), and Concessions, Travel, and Catering (€168.70 million).

Estimated Discount To Fair Value: 35%

Ibersol S.G.P.S. is trading at €8.74, significantly below its estimated fair value of €13.44, suggesting it may be undervalued based on cash flows. Analysts agree the stock price could rise by 44.5%. Despite lower profit margins this year (3.1% vs 4.6% last year), earnings are expected to grow over 20% annually, outpacing the Portuguese market's growth rate of 5.4%. Recent earnings reports show improved sales and net income compared to last year.

- In light of our recent growth report, it seems possible that Ibersol S.G.P.S' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Ibersol S.G.P.S' balance sheet health report.

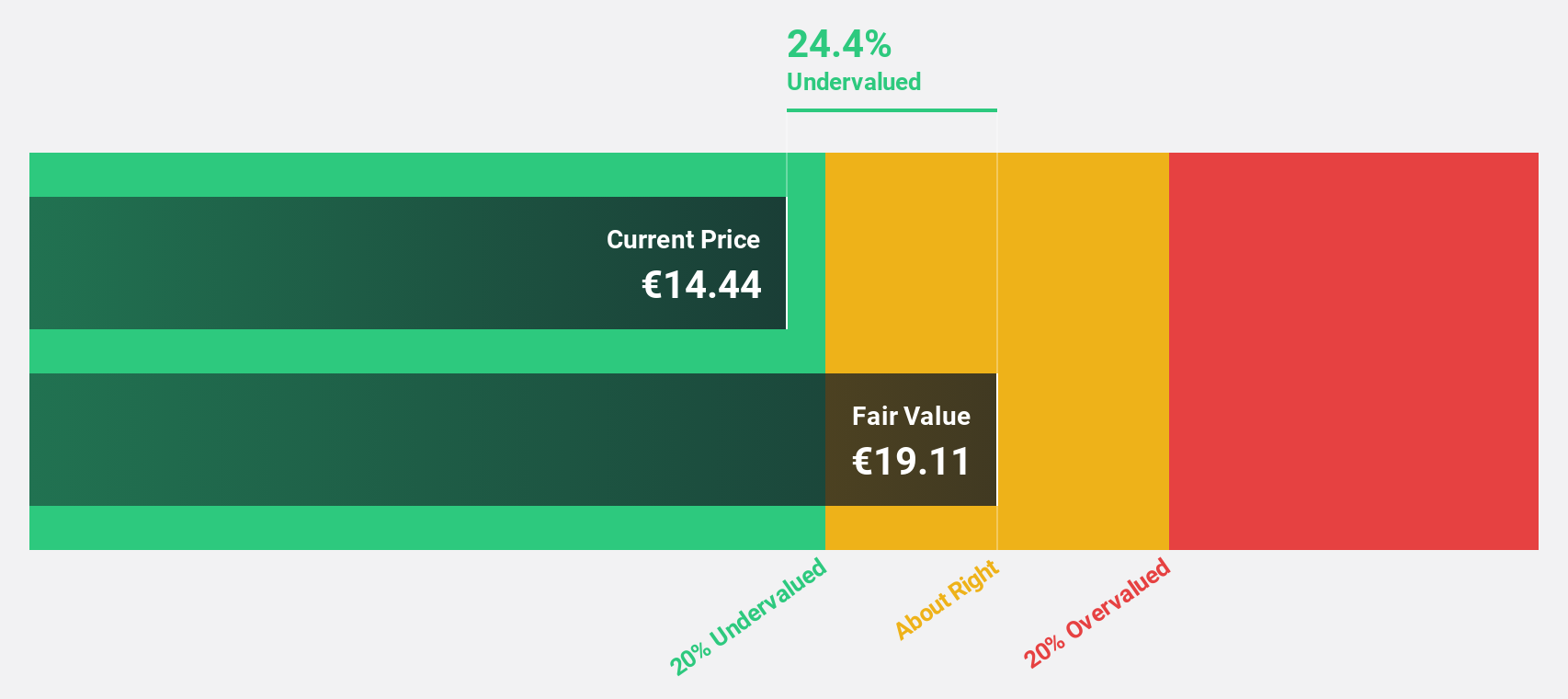

Fiskars Oyj Abp (HLSE:FSKRS)

Overview: Fiskars Oyj Abp manufactures and markets consumer products for indoor and outdoor living across Europe, the Americas, and the Asia Pacific with a market cap of €1.18 billion.

Operations: The company's revenue segments include Vita at €609.50 million and Fiskars at €551.50 million.

Estimated Discount To Fair Value: 26.2%

Fiskars Oyj Abp is trading at €14.86, below its estimated fair value of €20.14, indicating potential undervaluation based on cash flows. Despite a challenging year with a net loss of €9.7 million for the first nine months and lower profit margins, earnings are expected to grow significantly at 81.8% annually, outpacing the Finnish market's growth rate of 14.7%. The company has initiated share repurchases and plans to reorganize into two independent entities by April 2025.

- Insights from our recent growth report point to a promising forecast for Fiskars Oyj Abp's business outlook.

- Click here to discover the nuances of Fiskars Oyj Abp with our detailed financial health report.

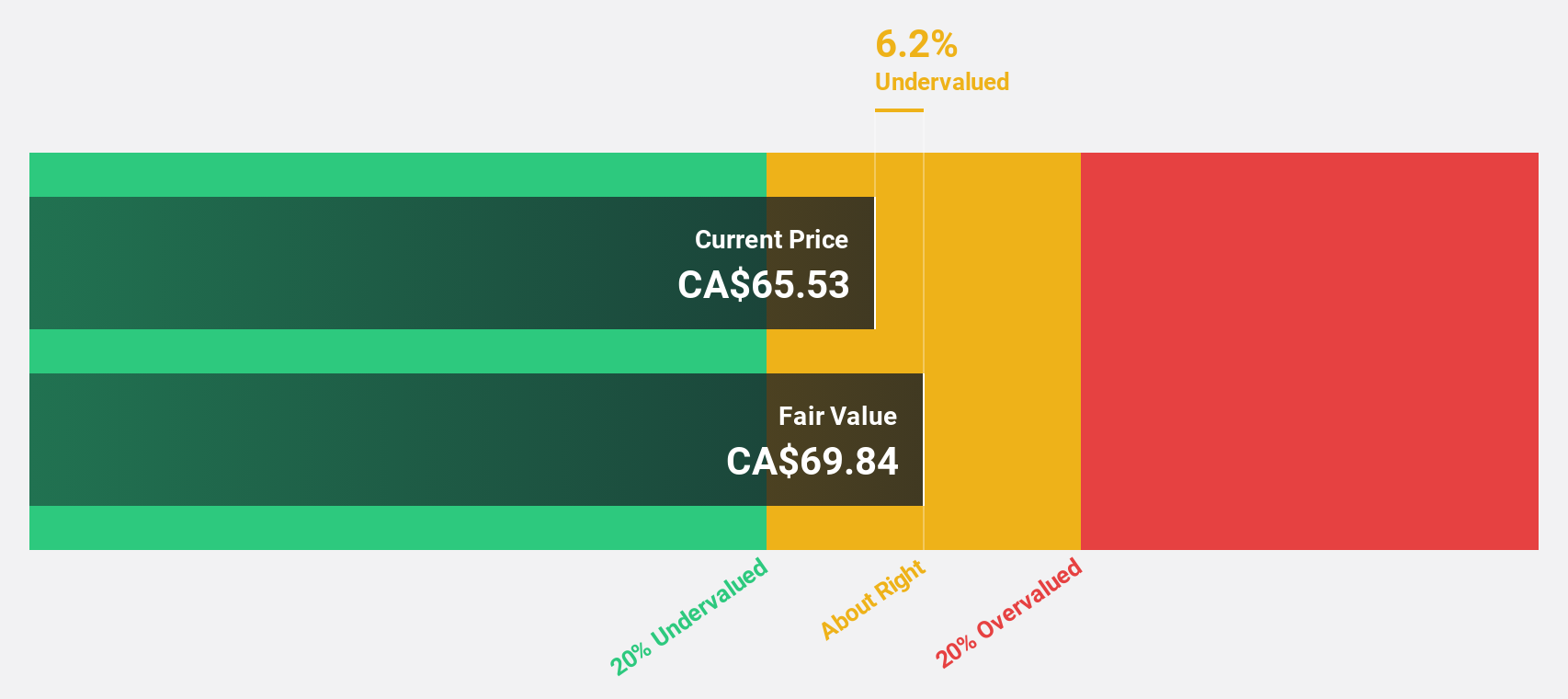

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace, aviation services, equipment, and manufacturing sectors globally, with a market cap of CA$2.63 billion.

Operations: The company generates revenue from two main segments: CA$1.01 billion from Manufacturing and CA$1.61 billion from Aerospace & Aviation.

Estimated Discount To Fair Value: 35.1%

Exchange Income Corporation, trading at CA$54.61, is significantly undervalued with an estimated fair value of CA$84.10. Despite a modest 1.5% earnings growth last year, its earnings are forecast to grow substantially at 26.7% annually over the next three years, outpacing the Canadian market's average growth rate. However, interest payments are not well covered by earnings and dividends remain unsustainable relative to free cash flows and current profits.

- Our growth report here indicates Exchange Income may be poised for an improving outlook.

- Take a closer look at Exchange Income's balance sheet health here in our report.

Key Takeaways

- Get an in-depth perspective on all 863 Undervalued Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSKRS

Fiskars Oyj Abp

Manufactures and markets consumer products for indoor and outdoor living in Europe, the Americas, and the Asia Pacific.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives