- Finland

- /

- Capital Markets

- /

- HLSE:TITAN

Earnings Working Against Titanium Oyj's (HEL:TITAN) Share Price Following 26% Dive

The Titanium Oyj (HEL:TITAN) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

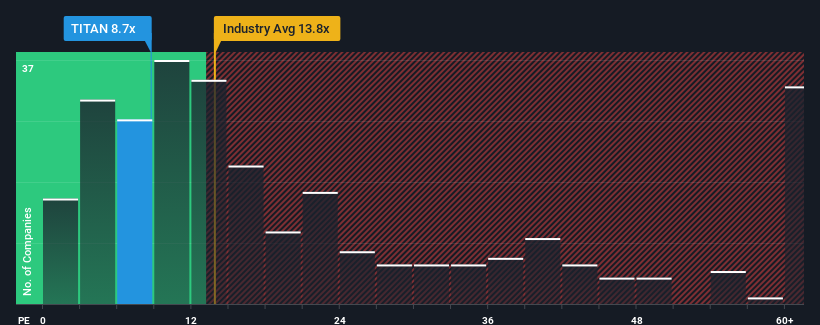

Although its price has dipped substantially, given about half the companies in Finland have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Titanium Oyj as a highly attractive investment with its 8.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Titanium Oyj has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Titanium Oyj

How Is Titanium Oyj's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Titanium Oyj's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.5% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 9.0% per annum as estimated by the sole analyst watching the company. Meanwhile, the broader market is forecast to expand by 14% each year, which paints a poor picture.

In light of this, it's understandable that Titanium Oyj's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Titanium Oyj's P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Titanium Oyj maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Titanium Oyj (2 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of Titanium Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Titanium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TITAN

Titanium Oyj

Provides investment and asset management services in Finland.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives