In the current global market environment, characterized by cautious Fed commentary and political uncertainties, investors are navigating a landscape where U.S. stocks have experienced declines despite strong economic data. As interest rate expectations shift and inflation forecasts adjust, dividend stocks can offer a measure of stability and income potential in uncertain times. When considering dividend stocks, it's important to focus on those with robust financial health and sustainable payout ratios that can weather market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

AAPICO Hitech (SET:AH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AAPICO Hitech Public Company Limited manufactures and distributes automobile parts, dies, and jigs in Thailand, China, Malaysia, and Portugal with a market cap of THB5.07 billion.

Operations: AAPICO Hitech Public Company Limited generates revenue primarily from the manufacture of auto parts, contributing THB20.73 billion, and from sales of automobiles and provision of automobile repair services, which account for THB9.73 billion.

Dividend Yield: 7.7%

AAPICO Hitech's dividend yield of 7.72% places it in the top 25% of payers in Thailand, but its dividends are not well covered by free cash flow, with a high cash payout ratio of 114.3%. Despite growth over the past decade, dividends have been volatile and unreliable due to inconsistent earnings coverage. Recent buyback activity completed at THB 377.14 million may impact future dividend sustainability given declining profits and revenues reported for Q3 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of AAPICO Hitech.

- The analysis detailed in our AAPICO Hitech valuation report hints at an deflated share price compared to its estimated value.

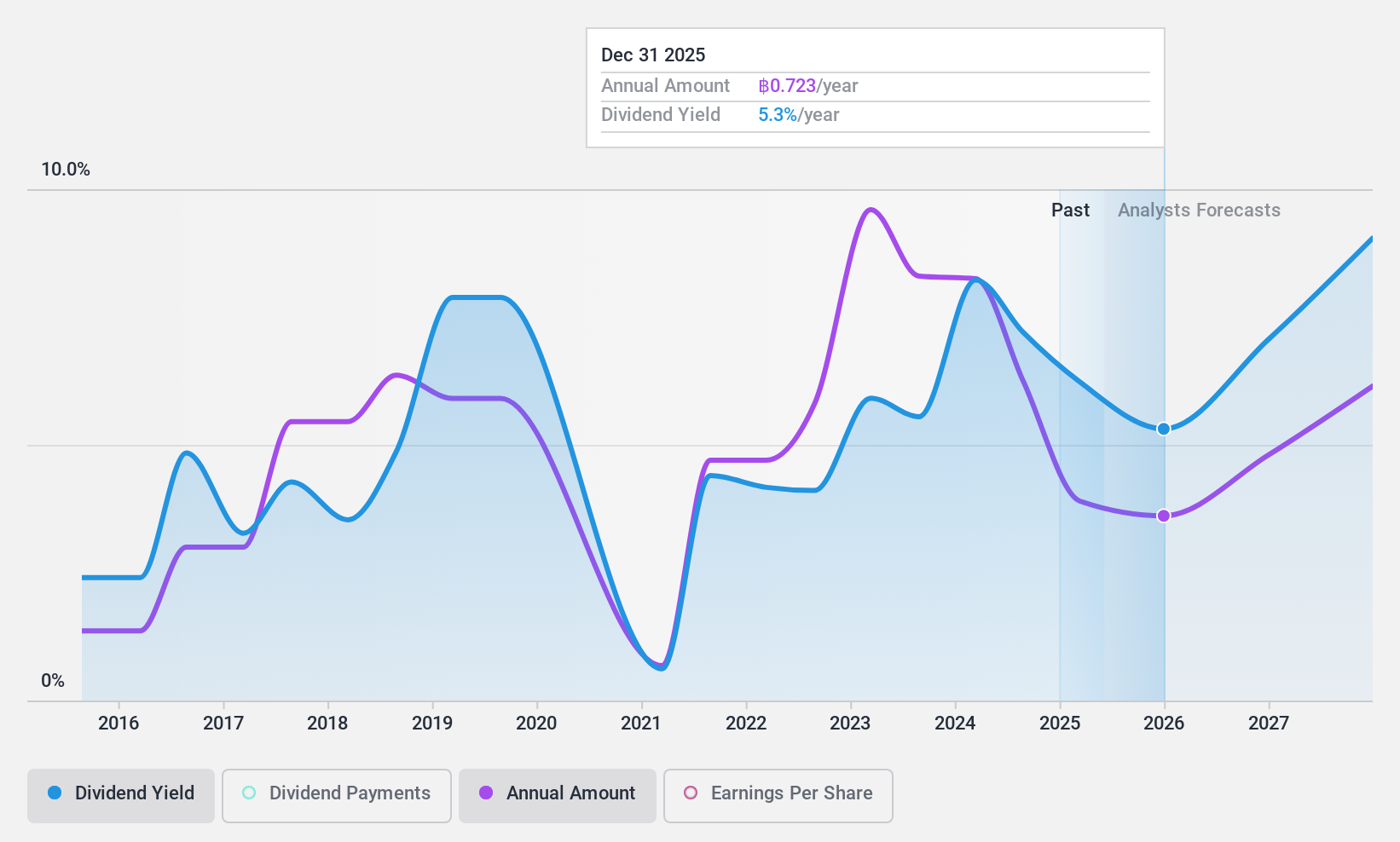

Sappe (SET:SAPPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sappe Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of health food and beverage products across Asia, Europe, the United States, and other international markets; it has a market cap of THB20.64 billion.

Operations: Sappe Public Company Limited generates its revenue primarily from Health Drinking Products, amounting to THB6.29 billion, and Coconut Products, contributing THB410.98 million.

Dividend Yield: 3.1%

Sappe's dividend yield of 3.09% is lower than the top 25% in Thailand, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flow with a high cash payout ratio of 1040.3%. Despite recent revenue growth to THB 5.61 billion for the nine months ending September 2024, earnings coverage remains a concern for long-term dividend sustainability amidst mixed analyst expectations on price targets.

- Delve into the full analysis dividend report here for a deeper understanding of Sappe.

- Our valuation report unveils the possibility Sappe's shares may be trading at a discount.

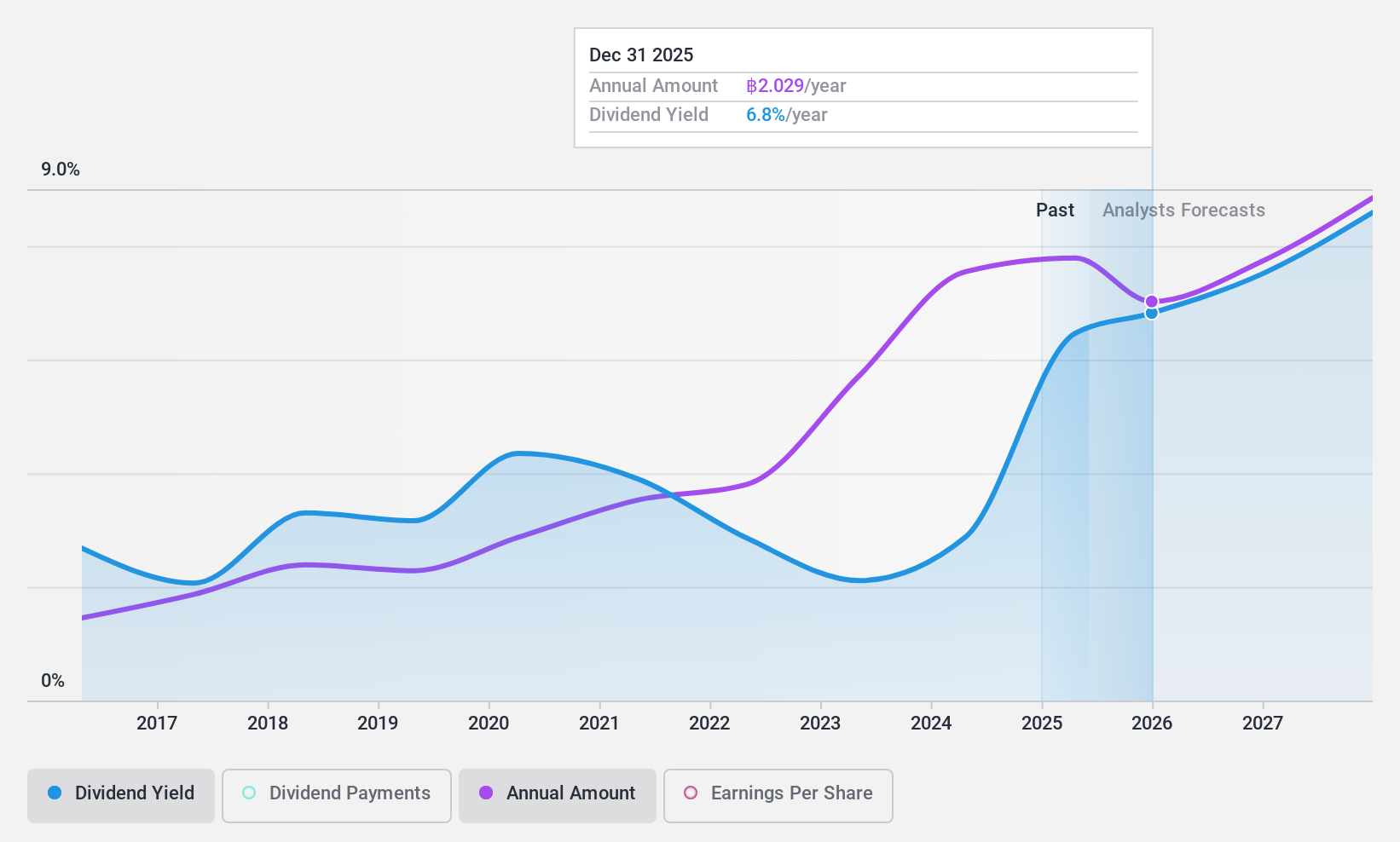

Press Kogyo (TSE:7246)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Press Kogyo Co., Ltd. manufactures and sells automotive and construction machinery parts both in Japan and internationally, with a market cap of ¥52.91 billion.

Operations: Press Kogyo Co., Ltd. generates revenue primarily from its Automotive Related Business, which accounts for ¥160.17 billion, and its Construction Machinery Related Business, contributing ¥33.33 billion.

Dividend Yield: 5.1%

Press Kogyo's dividend yield of 5.14% ranks in the top 25% of Japanese dividend payers, with a sustainable payout ratio of 37.1%. However, dividends have been volatile over the past decade. Recent earnings guidance was lowered due to declining demand across key markets, impacting financial forecasts for March 2025. Despite this, a special dividend was announced, revising the annual dividend to ¥32 per share, including a ¥5 commemorative payment.

- Dive into the specifics of Press Kogyo here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Press Kogyo is priced lower than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 1962 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SAPPE

Sappe

Manufactures and distributes health drinking, food, and coconut products in Asia, Europe, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives