- Thailand

- /

- Oil and Gas

- /

- SET:TOP

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape of economic resilience and inflationary pressures, investors are increasingly drawn to the stability offered by dividend stocks. In such an environment, selecting stocks that combine reliable dividend yields with strong fundamentals can be a prudent strategy for those looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.48% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1046 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

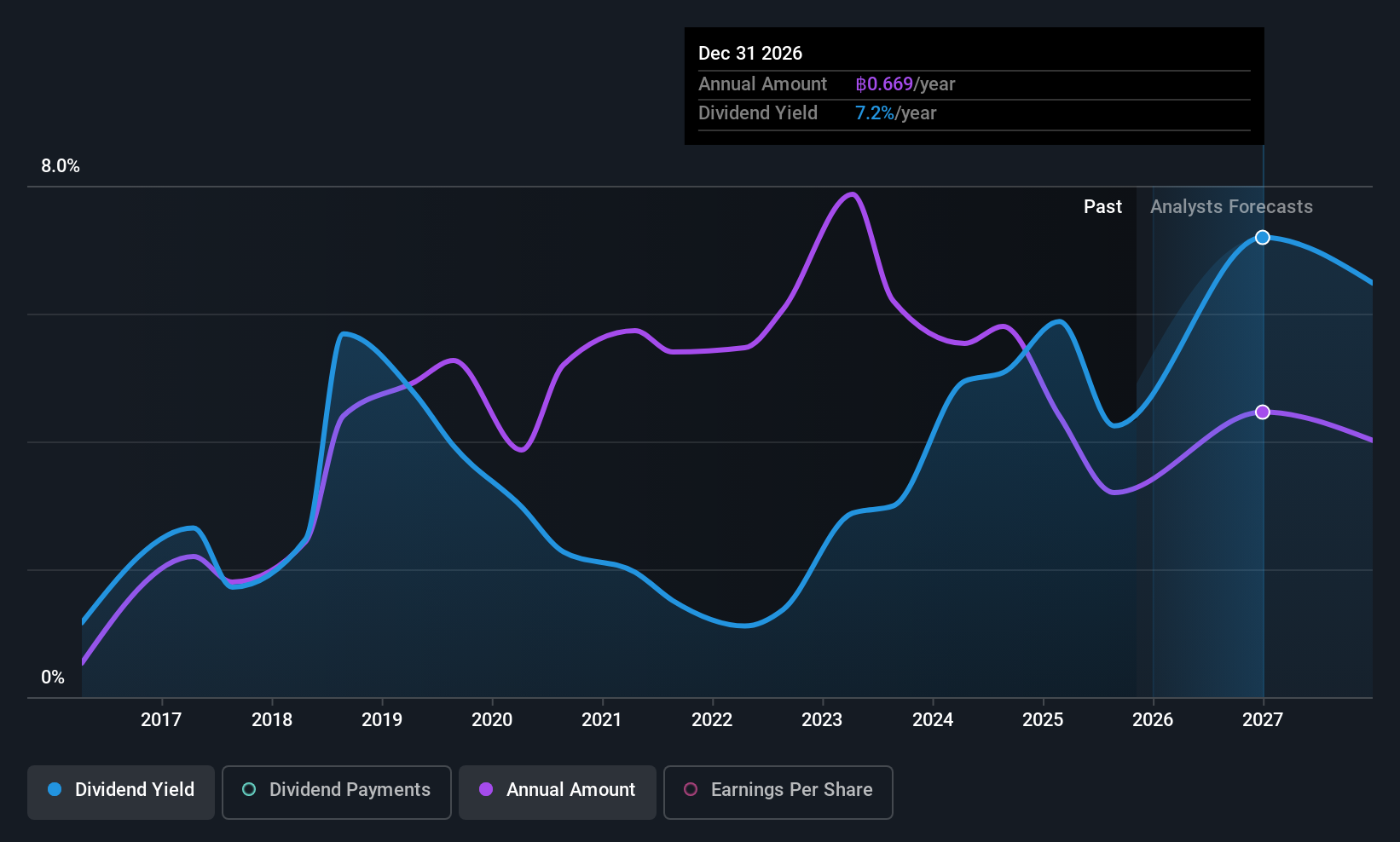

JMT Network Services (SET:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JMT Network Services Public Company Limited, along with its subsidiaries, offers debt tracking and collection services for financial institutions and entrepreneurs in Thailand and has a market cap of THB12.99 billion.

Operations: JMT Network Services Public Company Limited generates revenue primarily from its Non-Performing Accounts Receivable Management Business, which accounts for THB4.09 billion, and its Debt Collection Business, contributing THB199 million.

Dividend Yield: 5.4%

JMT Network Services' recent earnings reveal a decline, with third-quarter net income at THB 231.34 million compared to THB 429.91 million last year. Despite a reasonable payout ratio of 62.8%, its dividend yield of 5.39% is below the top tier in Thailand, and dividends have been volatile over the past decade. However, dividends are covered by both earnings and cash flows, indicating some level of sustainability despite an unstable track record.

- Navigate through the intricacies of JMT Network Services with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that JMT Network Services is priced higher than what may be justified by its financials.

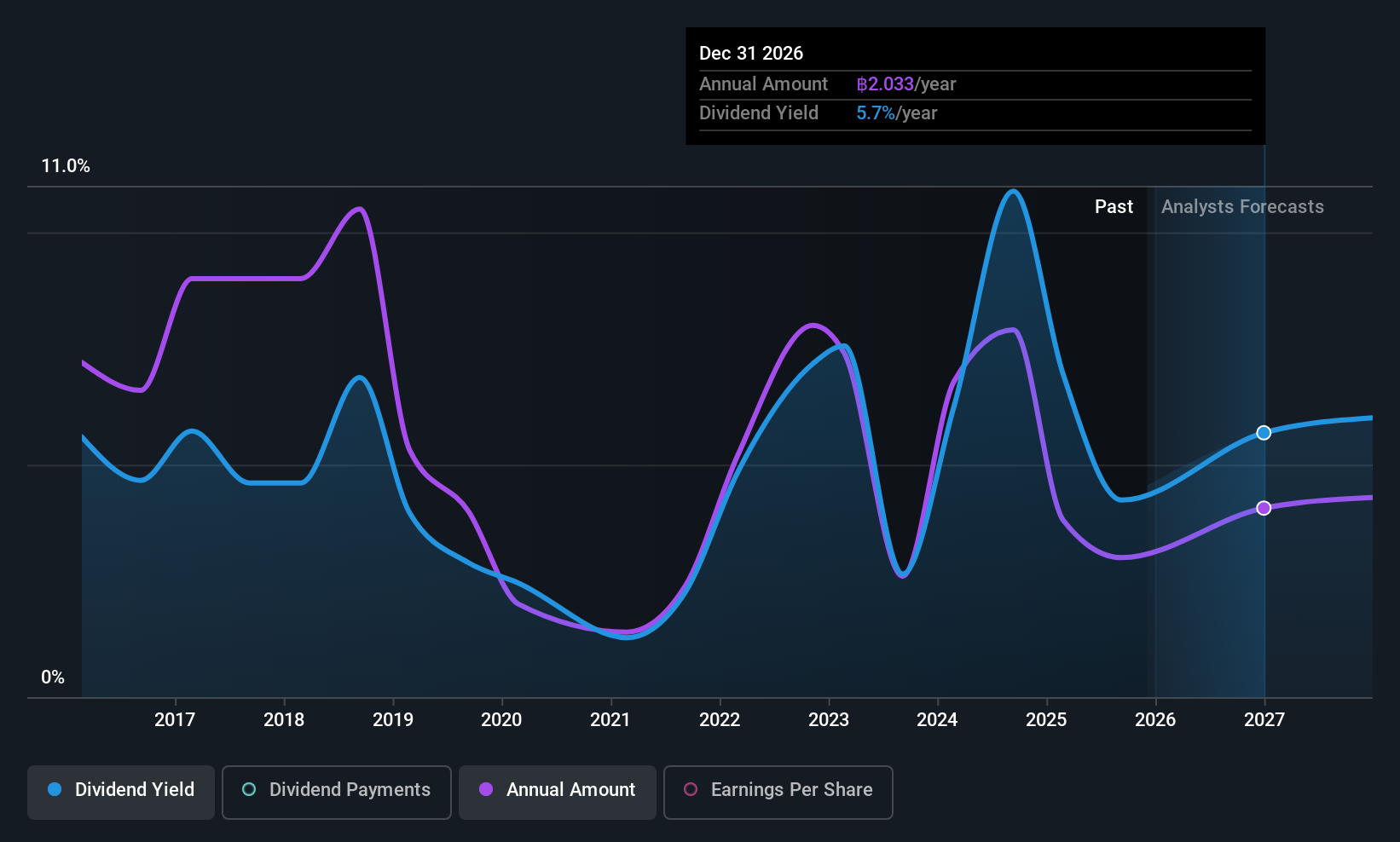

Thai Oil (SET:TOP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Oil Public Company Limited operates in oil refining, distribution, petrochemicals, and lube base oil sectors both in Thailand and internationally, with a market cap of approximately THB80.98 billion.

Operations: Thai Oil's revenue segments include Oil Refinery (THB427.89 billion), Aromatics and Lab (THB60.29 billion), Solvent (THB16.71 billion), Lube Base Oil Refinery (THB22.35 billion), and Power Generation (THB11.07 billion).

Dividend Yield: 4.1%

Thai Oil's dividend payments have been volatile over the past decade, with a current yield of 4.14%, below Thailand's top dividend payers. Despite this, dividends are well-covered by earnings (payout ratio: 22.5%) and cash flows (cash payout ratio: 9.6%). The company faces declining earnings forecasts but has improved its financial position by repurchasing US$300 million in debt, suggesting efforts to manage its high debt levels effectively.

- Delve into the full analysis dividend report here for a deeper understanding of Thai Oil.

- Our comprehensive valuation report raises the possibility that Thai Oil is priced lower than what may be justified by its financials.

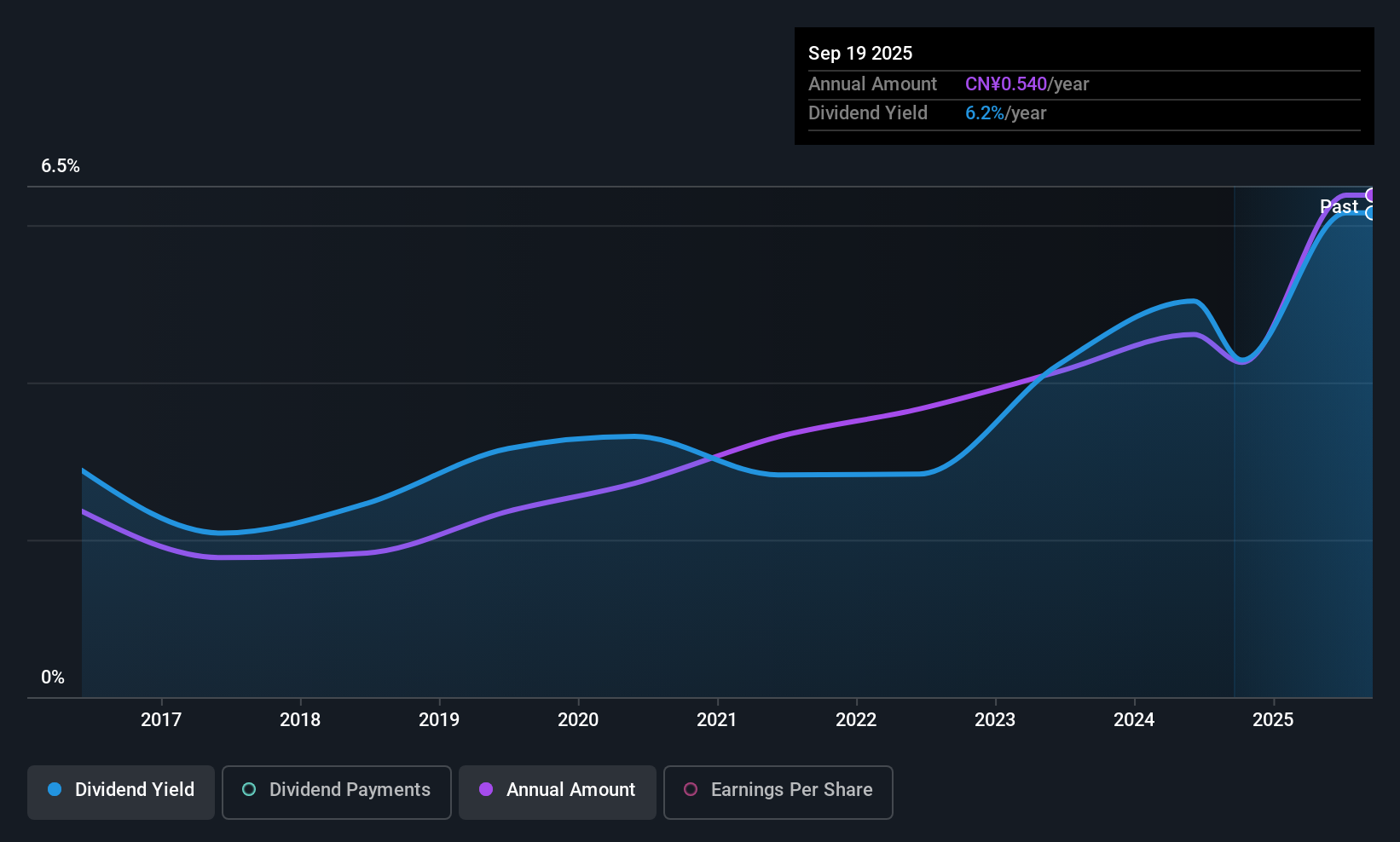

Xi'an Shaangu Power (SHSE:601369)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xi'an Shaangu Power Co., Ltd. is a system solutions and service provider in the distributed energy field, operating both in China and internationally, with a market cap of CN¥16.11 billion.

Operations: Xi'an Shaangu Power Co., Ltd. generates revenue through its operations as a provider of system solutions and services in the distributed energy sector across domestic and international markets.

Dividend Yield: 5.8%

Xi'an Shaangu Power offers a dividend yield of 5.78%, placing it among the top 25% of dividend payers in China, though its payments have been volatile over the past decade. The company's payout ratio is reasonable at 74.1%, yet high cash payout ratio (221.6%) indicates dividends aren't well-covered by cash flows, raising sustainability concerns. Recent earnings show slight declines, with net income at CNY 617.48 million for nine months ending September 2025, compared to CNY 666.17 million previously.

- Click to explore a detailed breakdown of our findings in Xi'an Shaangu Power's dividend report.

- The valuation report we've compiled suggests that Xi'an Shaangu Power's current price could be quite moderate.

Turning Ideas Into Actions

- Click here to access our complete index of 1046 Top Asian Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thai Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TOP

Thai Oil

Engages in the oil refining and distributions, petrochemicals, lube base oil, and other businesses in Thailand and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026