Global markets have shown resilience recently, with major U.S. stock indexes rebounding and value stocks outperforming growth shares, driven by easing core inflation and strong bank earnings. In this context, the appeal of penny stocks—often representing smaller or newer companies—remains noteworthy for investors seeking unique opportunities in a diverse market landscape. While the term "penny stock" might seem outdated, these investments can still offer significant potential when supported by robust financial health, presenting an intriguing option for those looking to uncover hidden value in promising firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$615.75M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £150.44M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £791.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.415 | £181.48M | ★★★★★☆ |

Click here to see the full list of 5,727 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain, with a market cap of €331.33 million.

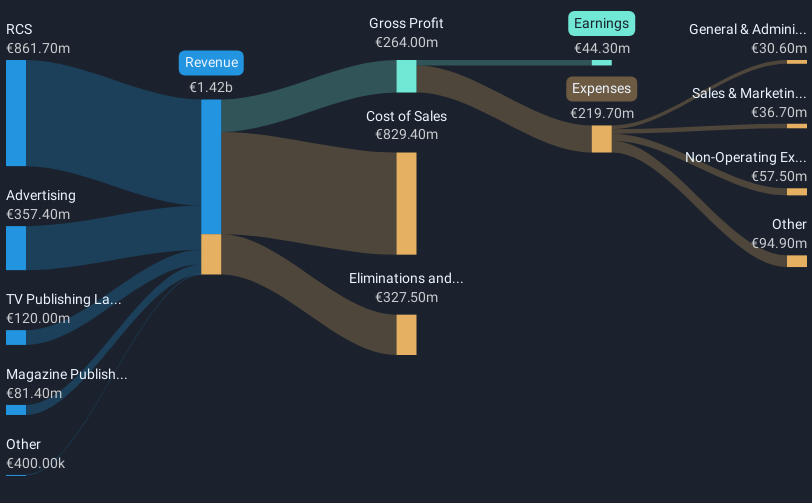

Operations: The company's revenue is primarily derived from RCS (€861.7 million), Advertising (€357.4 million), Magazine Publishing Cairo Editore (€81.4 million), and TV Publishing La7 and Network Operator (€120 million).

Market Cap: €331.33M

Cairo Communication S.p.A. operates with a market cap of €331.33 million, showing resilience despite a slight dip in revenue to €784.6 million for the nine months ended September 2024 compared to the previous year. The company has achieved significant earnings growth of 28% over the past year, surpassing its five-year average and industry benchmarks. Its debt-to-equity ratio has improved substantially over five years, and debt is well covered by operating cash flow. However, short-term assets fall short of covering liabilities, and dividends remain unstable. The board's extensive experience supports strategic stability amidst these challenges.

- Jump into the full analysis health report here for a deeper understanding of Cairo Communication.

- Assess Cairo Communication's future earnings estimates with our detailed growth reports.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across various international markets including China, Japan, the United States, and more, with a market cap of approximately HK$2.14 billion.

Operations: The company generates revenue of CN¥914.42 million from its computer graphics segment.

Market Cap: HK$2.14B

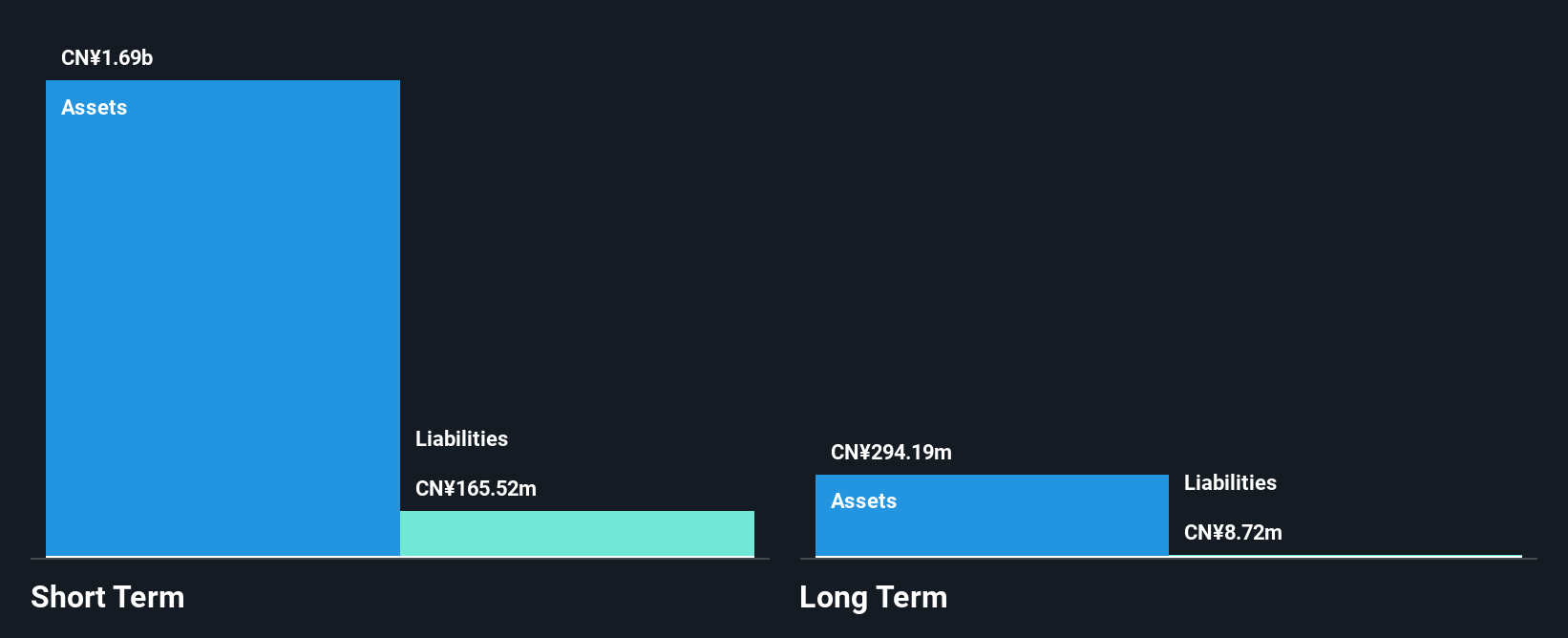

Qingci Games Inc., with a market cap of HK$2.14 billion, has strong financial stability, evidenced by short-term assets of CN¥1.6 billion covering both short-term and long-term liabilities. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a low debt-to-equity ratio of 1.1% and has more cash than total debt, ensuring a robust cash runway for over three years even if free cash flow decreases significantly. The management team and board are experienced, providing strategic guidance as earnings are forecasted to grow significantly at 116.36% per year despite current challenges.

- Unlock comprehensive insights into our analysis of Qingci Games stock in this financial health report.

- Understand Qingci Games' earnings outlook by examining our growth report.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIRA Capital Public Company Limited, along with its subsidiaries, offers financial advisory services in Thailand and has a market capitalization of THB7.77 billion.

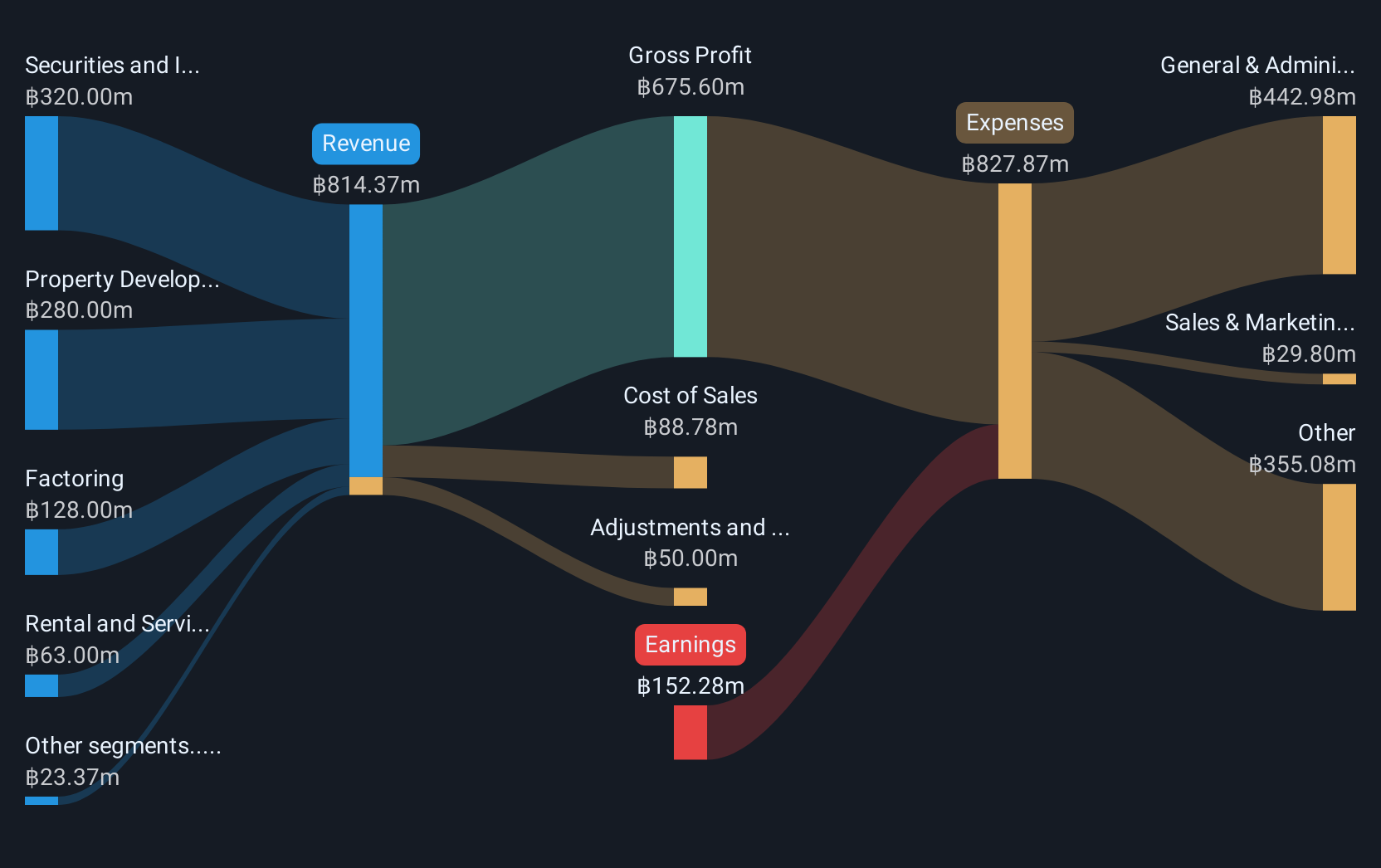

Operations: The company's revenue is derived from several segments, including Factoring (THB180 million), Property Development (THB266 million), Advisory and Investment Banking (THB18 million), Securities and Investment Business (THB357 million), and Rental and Service Business excluding Property Development (THB105 million).

Market Cap: THB7.77B

AIRA Capital, with a market cap of THB7.77 billion, reported third-quarter revenue of THB315.59 million, up from THB208.72 million the previous year, yet remains unprofitable with a net loss of THB50.13 million. The company has experienced management and board teams but faces challenges due to high volatility and increased debt levels—net debt to equity at 76.9%. Despite these hurdles, AIRA's short-term assets exceed liabilities by a significant margin (THB5.6 billion vs THB4.6 billion), providing financial stability alongside a cash runway exceeding one year based on current free cash flow trends.

- Click here to discover the nuances of AIRA Capital with our detailed analytical financial health report.

- Evaluate AIRA Capital's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 5,727 Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CAI

Cairo Communication

Operates as a communication company primarily in Italy and Spain.

Undervalued with solid track record and pays a dividend.