- Japan

- /

- Healthcare Services

- /

- NSE:7488

Jerónimo Martins SGPS And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and near-record highs in major U.S. stock indexes, investors are increasingly seeking stability through dividend stocks. In this environment, companies that consistently offer reliable dividends can provide a steady income stream, making them an attractive option for those looking to balance growth with income potential.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.44% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

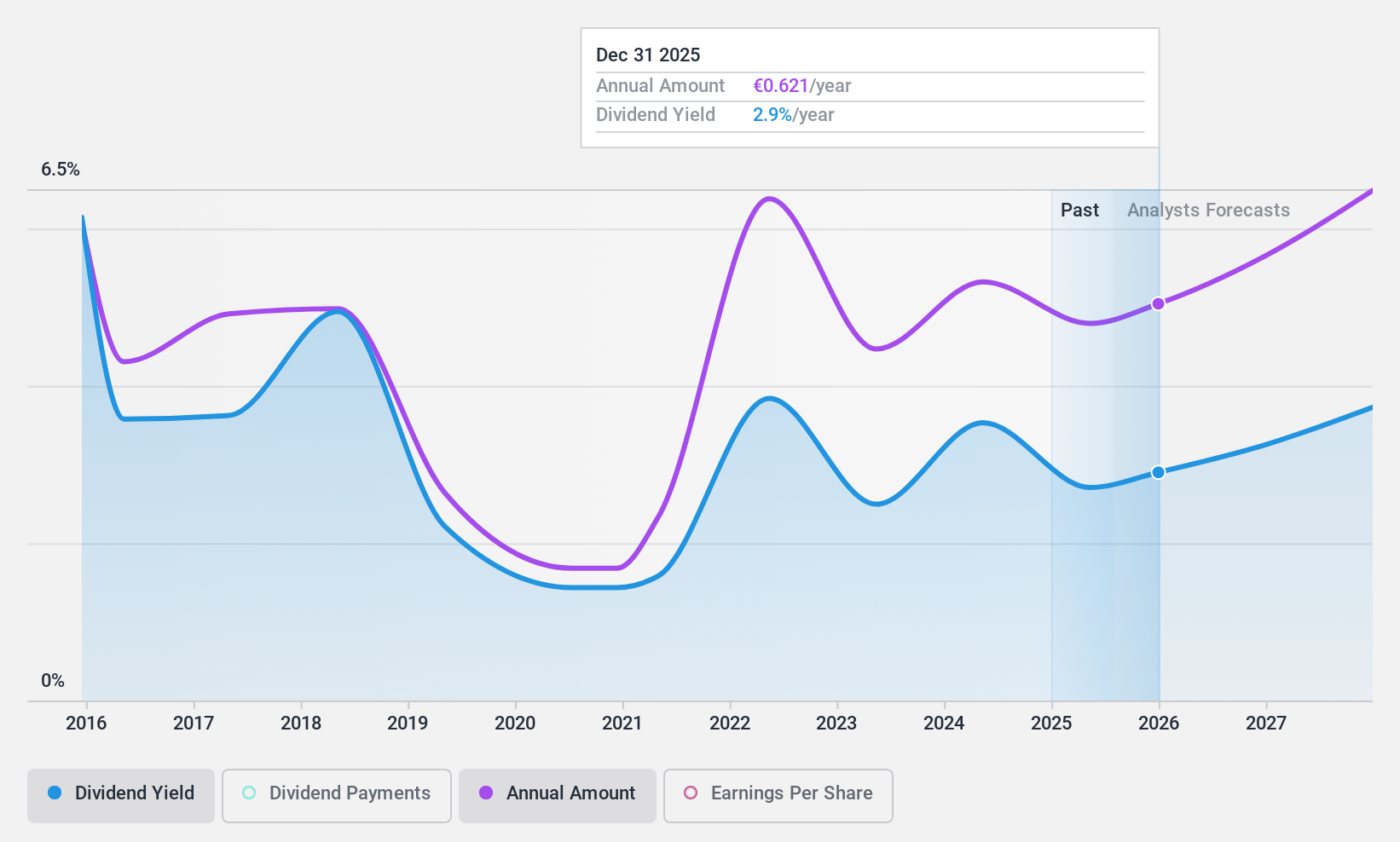

Jerónimo Martins SGPS (ENXTLS:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jerónimo Martins SGPS operates in the food distribution and specialized retail sectors across Portugal, Poland, and Colombia, with a market cap of €12.53 billion.

Operations: Jerónimo Martins SGPS generates revenue primarily from its retail operations in Poland (€23.15 billion) and Colombia (€2.81 billion).

Dividend Yield: 3.3%

Jerónimo Martins SGPS offers dividend payments covered by earnings with a payout ratio of 64.5% and cash flows at 87.6%, suggesting sustainability despite an unstable track record over the past decade. Although dividends have grown, they remain volatile, with a yield of 3.28%, lower than top-tier Portuguese payers at 6.39%. The stock trades significantly below its estimated fair value, indicating potential for capital appreciation alongside dividend income.

- Click here and access our complete dividend analysis report to understand the dynamics of Jerónimo Martins SGPS.

- Our valuation report unveils the possibility Jerónimo Martins SGPS' shares may be trading at a discount.

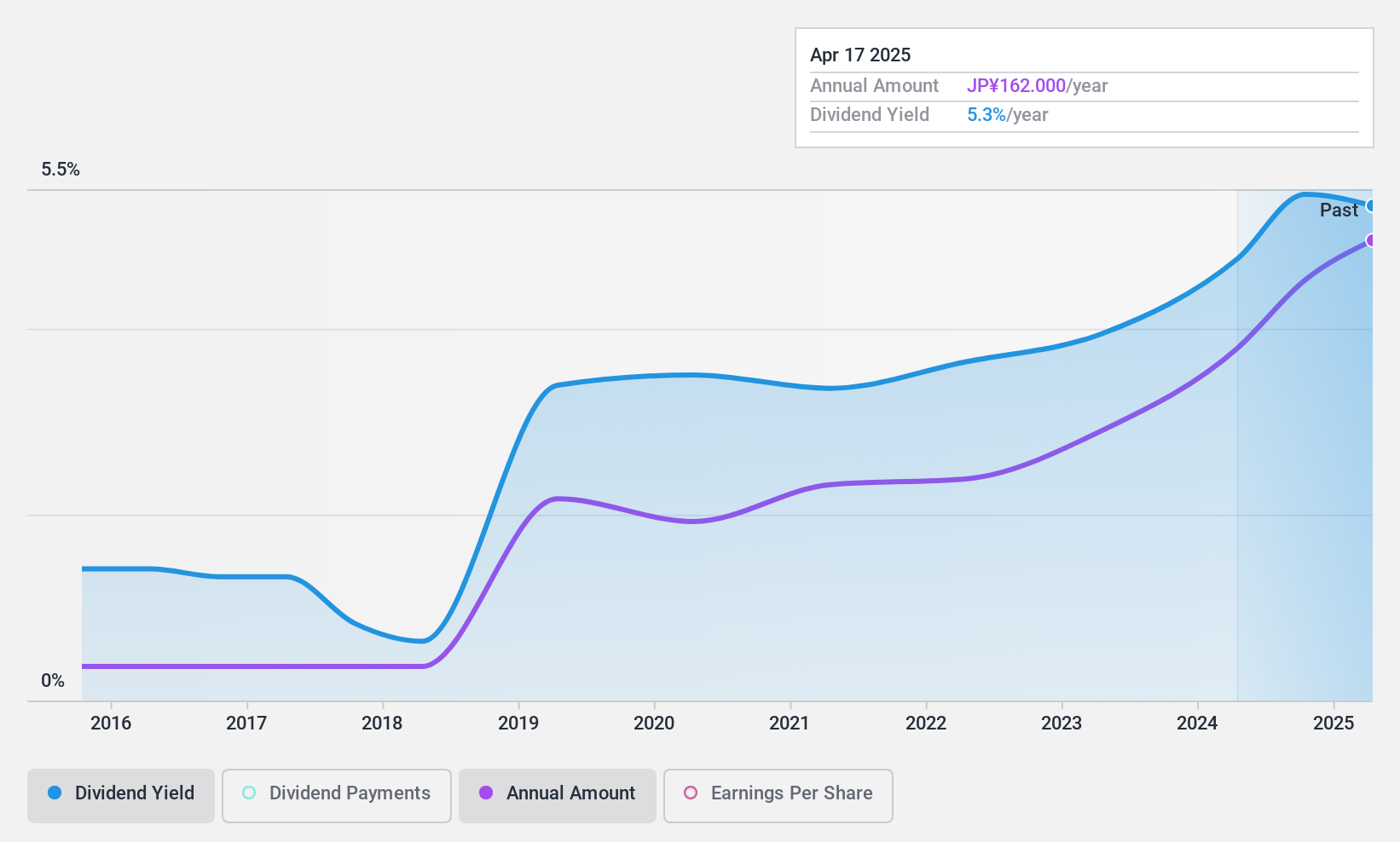

Yagami (NSE:7488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yagami Inc. is a specialized trading company focused on the educational market in Japan with a market cap of ¥15.87 billion.

Operations: Yagami Inc.'s revenue segments include Educational Materials at ¥3.45 billion, School Supplies at ¥2.78 billion, and Technology Solutions at ¥1.92 billion.

Dividend Yield: 5.4%

Yagami's dividend yield of 5.42% ranks in the top 25% of Japanese payers but isn't well covered by earnings, with a high payout ratio of 97.6%. However, a cash payout ratio of 66.2% suggests coverage by cash flows. Over the past decade, dividends have been stable and growing without volatility. Trading at over half its estimated fair value may offer potential for capital gains, though sustainability concerns persist due to earnings coverage issues.

- Get an in-depth perspective on Yagami's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Yagami's current price could be quite moderate.

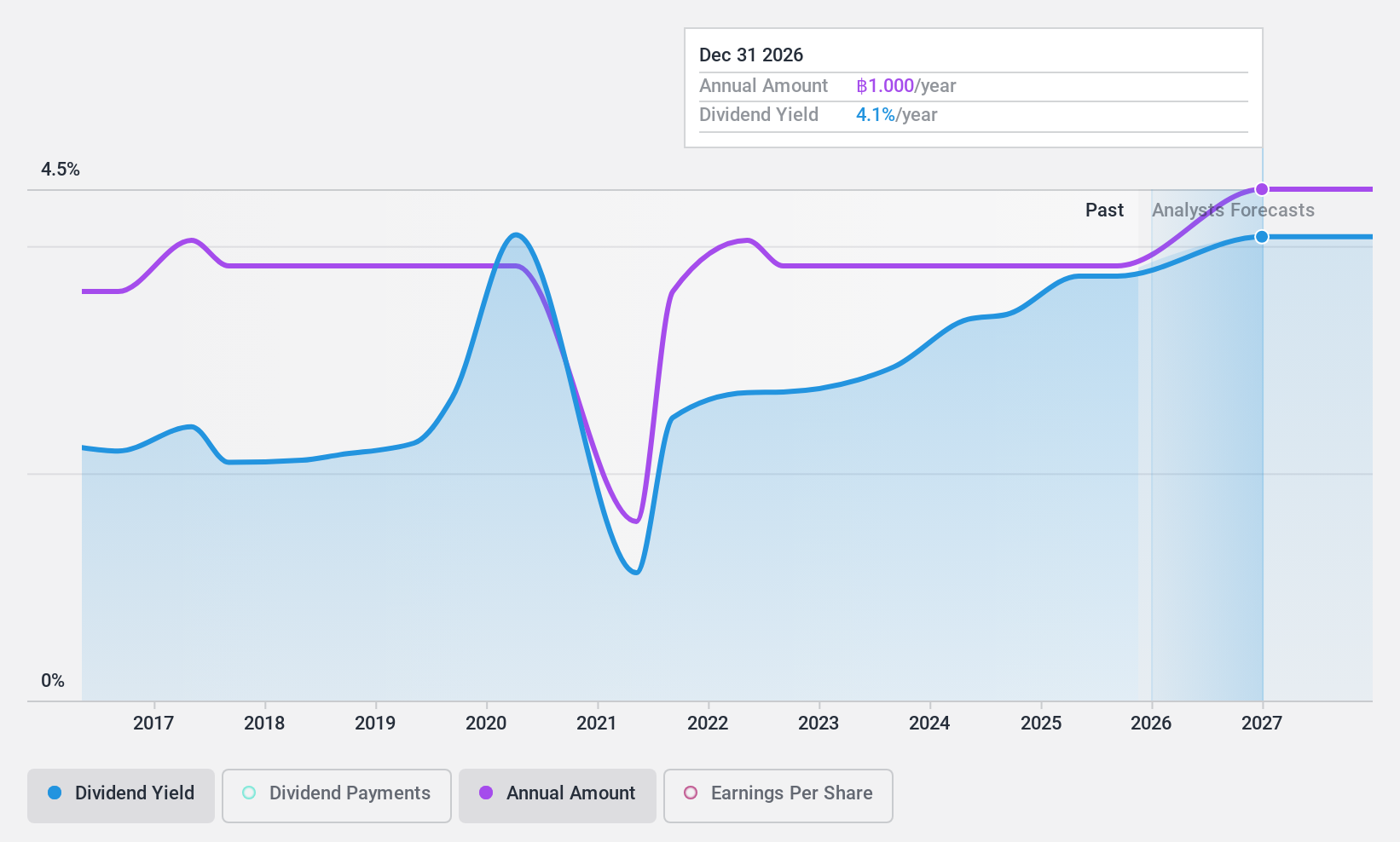

Bank of Ayudhya (SET:BAY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ayudhya Public Company Limited, along with its subsidiaries, offers a range of commercial banking products and services to individuals, corporates, small and medium-sized businesses, and financial institutions, with a market cap of approximately THB174.33 billion.

Operations: Bank of Ayudhya Public Company Limited generates revenue through its diverse offerings in commercial banking, catering to individuals, corporates, small and medium-sized enterprises, and financial institutions.

Dividend Yield: 3.6%

Bank of Ayudhya's dividend yield of 3.59% is modest compared to the top payers in Thailand, but its dividends are well covered by a low payout ratio of 20.1%. Despite past volatility and an unstable track record, dividend payments have grown over the last decade. The bank trades at a significant discount to its estimated fair value, although concerns remain due to a high level of bad loans at 4%.

- Click to explore a detailed breakdown of our findings in Bank of Ayudhya's dividend report.

- Our valuation report here indicates Bank of Ayudhya may be undervalued.

Make It Happen

- Click through to start exploring the rest of the 1982 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSE:7488

Yagami

Operates as a specialized trading company in the educational market Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives