- Slovenia

- /

- Hospitality

- /

- LJSE:SAVR

Take Care Before Jumping Onto Sava, druzba za upravljanje in financiranje, d.d. (LJSE:SAVR) Even Though It's 61% Cheaper

Sava, druzba za upravljanje in financiranje, d.d. (LJSE:SAVR) shares have had a horrible month, losing 61% after a relatively good period beforehand. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

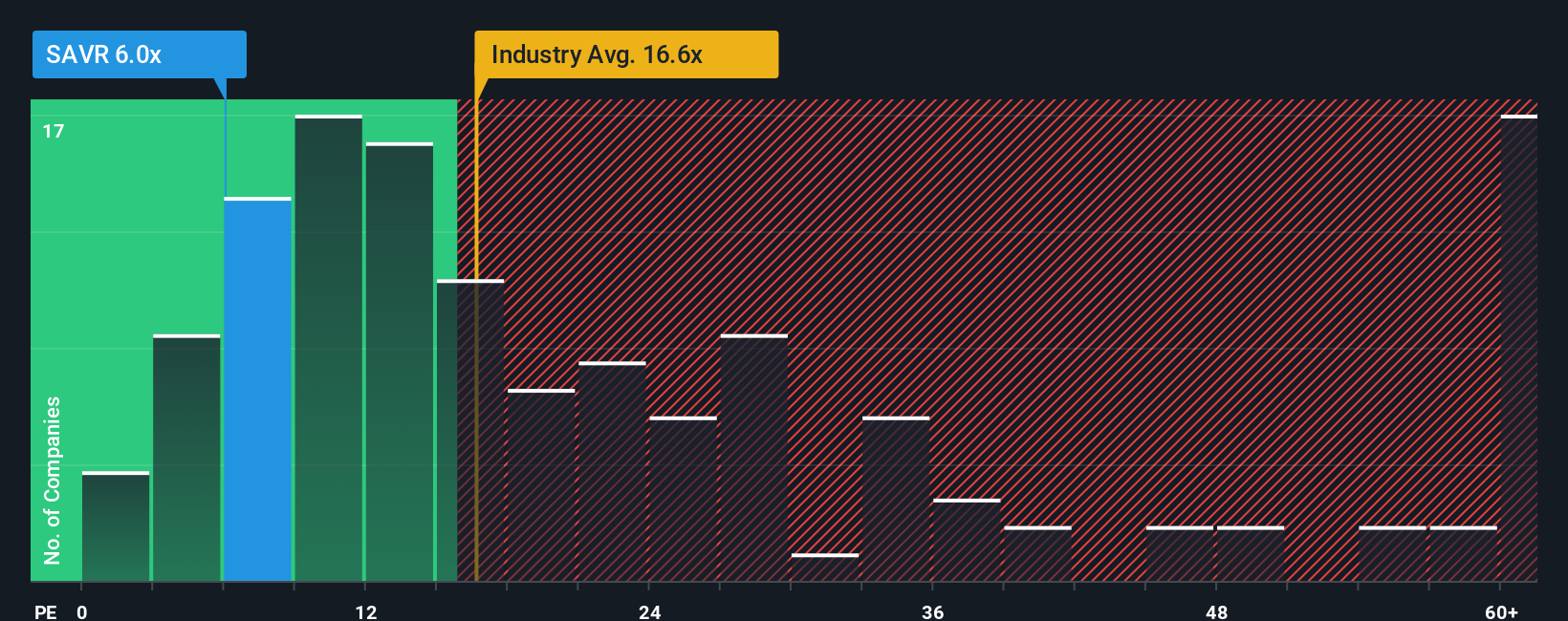

Since its price has dipped substantially, Sava druzba za upravljanje in financiranje d.d may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6x, since almost half of all companies in Slovenia have P/E ratios greater than 11x and even P/E's higher than 14x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Sava druzba za upravljanje in financiranje d.d certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Sava druzba za upravljanje in financiranje d.d

Is There Any Growth For Sava druzba za upravljanje in financiranje d.d?

There's an inherent assumption that a company should underperform the market for P/E ratios like Sava druzba za upravljanje in financiranje d.d's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 274% last year. Pleasingly, EPS has also lifted 158% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

In contrast to the company, the rest of the market is expected to decline by 0.4% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Sava druzba za upravljanje in financiranje d.d's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Bottom Line On Sava druzba za upravljanje in financiranje d.d's P/E

Sava druzba za upravljanje in financiranje d.d's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sava druzba za upravljanje in financiranje d.d currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Sava druzba za upravljanje in financiranje d.d (2 make us uncomfortable!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:SAVR

Sava druzba za upravljanje in financiranje d.d

Engages in the tourism business in Slovenia.

Good value with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion