Global markets have been experiencing fluctuations as investors react to the potential policy shifts of the incoming Trump administration, with sectors like financials and energy benefiting, while others such as healthcare face challenges. In this context, penny stocks—often representing smaller or emerging companies—continue to capture investor interest due to their potential for significant value growth. While the term "penny stocks" might seem outdated, these investments remain relevant for those seeking opportunities in companies with solid financial foundations and promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.775 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.97 | THB1.49B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$70.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

Click here to see the full list of 5,816 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

STI Education Systems Holdings (PSE:STI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: STI Education Systems Holdings, Inc. operates through its subsidiaries to offer a variety of educational services in the Philippines and has a market capitalization of approximately ₱11.29 billion.

Operations: The company generates revenue of ₱4.70 billion from its educational services, which include schools, colleges, and universities.

Market Cap: ₱11.29B

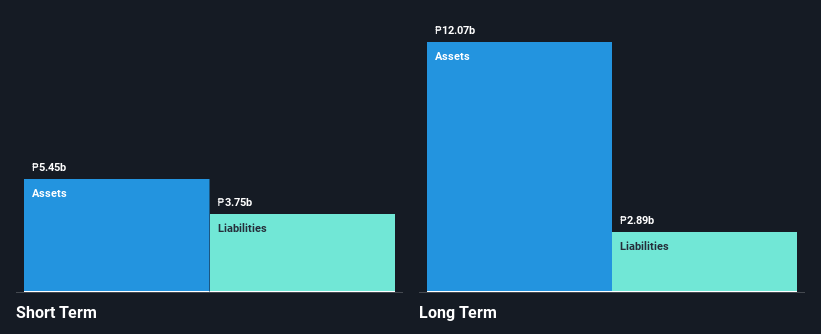

STI Education Systems Holdings, Inc. has demonstrated robust financial growth, with revenue reaching ₱4.70 billion and net income at ₱1.59 billion for the year ended June 2024. The company has effectively reduced its debt to equity ratio from 52.7% to 27.4% over five years, maintaining satisfactory net debt levels and covering interest payments well with EBIT (7.7x coverage). Its short-term assets exceed both long-term and short-term liabilities, supporting financial stability. Despite a low return on equity of 15.2%, STI's earnings have grown significantly by 82.8% over the past year, outpacing industry averages, while maintaining stable weekly volatility and high-quality earnings without shareholder dilution.

- Jump into the full analysis health report here for a deeper understanding of STI Education Systems Holdings.

- Gain insights into STI Education Systems Holdings' historical outcomes by reviewing our past performance report.

Vibrant Group (SGX:BIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vibrant Group Limited is an investment holding company involved in integrated logistics, real estate, and financial services globally with a market cap of SGD40.93 million.

Operations: The company's revenue is primarily derived from its Freight and Logistics segment at SGD132.00 million, followed by Financial Services at SGD5.20 million, and Real Estate at SGD7.25 million.

Market Cap: SGD40.93M

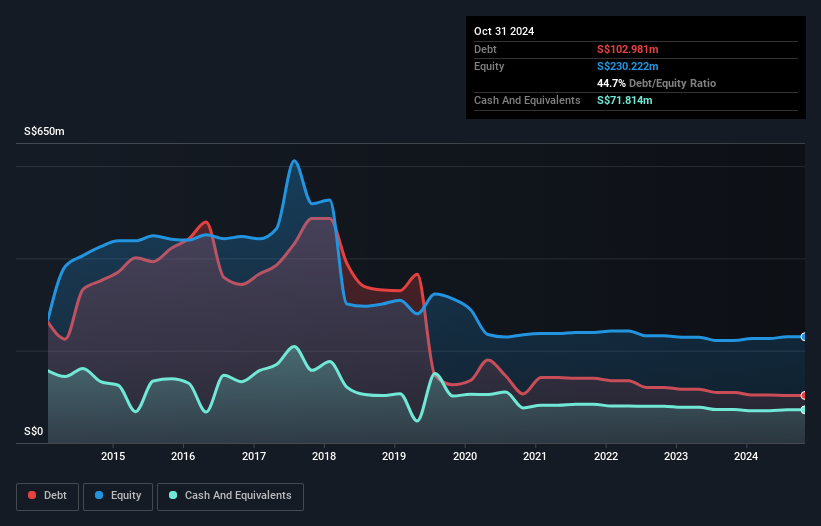

Vibrant Group Limited, with a market cap of SGD40.93 million, primarily generates revenue from its Freight and Logistics segment at SGD132 million. The company has seen a significant earnings growth of 242.9% over the past year despite a decline in earnings by 26.2% annually over five years, indicating potential volatility in performance. Its debt is well covered by operating cash flow (29.9%), but short-term assets only cover short-term liabilities while long-term liabilities remain uncovered. Recent board changes include the appointment of Ms. Tan Siok Chin as Lead Independent Director, enhancing governance structure amidst ongoing financial challenges and opportunities for growth within its sectors.

- Dive into the specifics of Vibrant Group here with our thorough balance sheet health report.

- Explore historical data to track Vibrant Group's performance over time in our past results report.

APAC Realty (SGX:CLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: APAC Realty Limited is an investment holding company offering real estate services in Singapore, Indonesia, Vietnam, and internationally with a market cap of SGD136.50 million.

Operations: The company's revenue primarily comes from Real Estate Brokerage Income, amounting to SGD554.50 million, supplemented by Rental Income of SGD2.35 million.

Market Cap: SGD136.5M

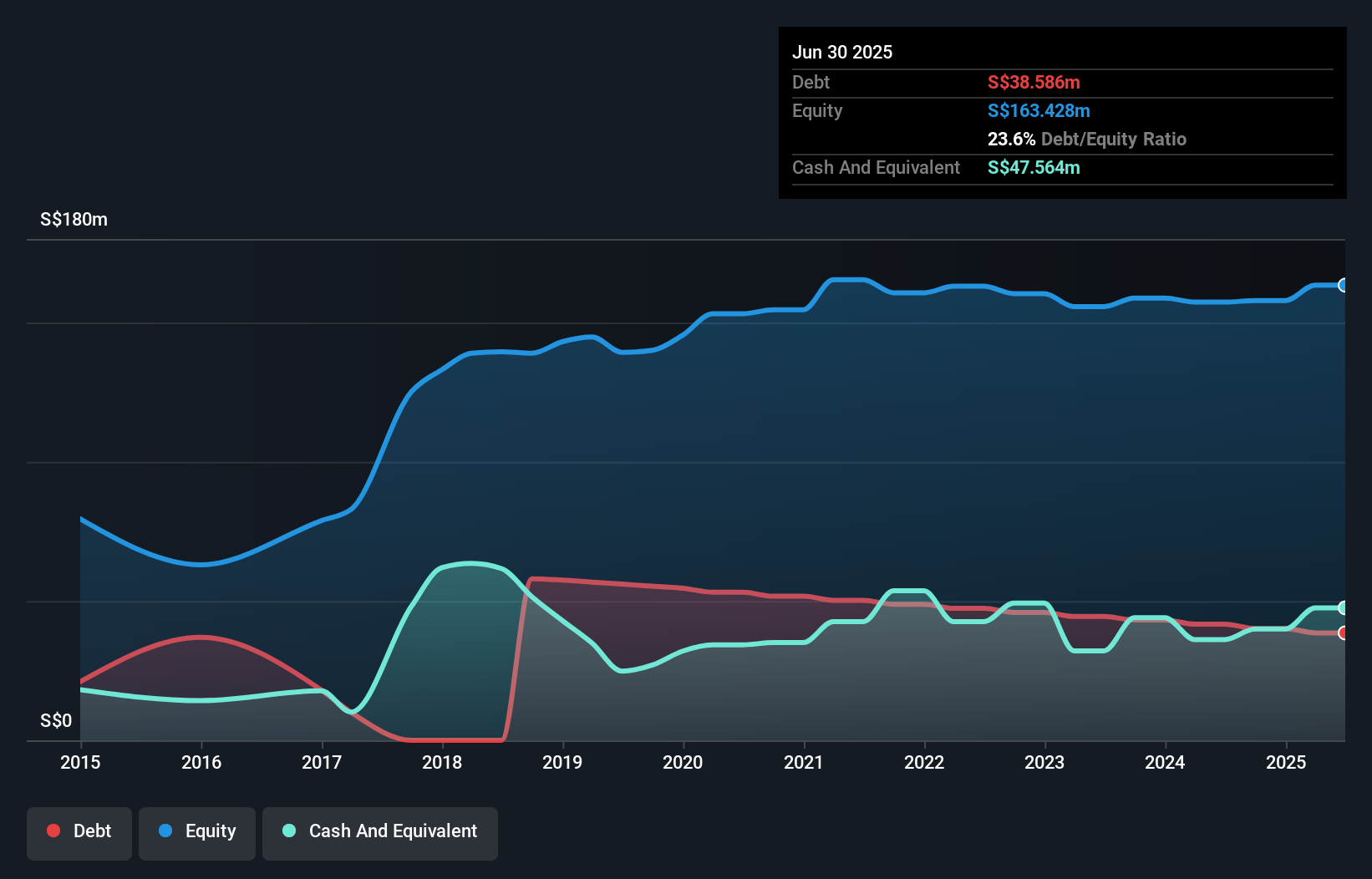

APAC Realty Limited, with a market cap of SGD136.50 million, derives significant revenue from Real Estate Brokerage Income (SGD554.50 million), supplemented by Rental Income (SGD2.35 million). The company maintains a satisfactory net debt to equity ratio of 3.5%, and its interest payments are well covered by EBIT at 8.5 times coverage, indicating financial stability despite low return on equity at 6.3%. Recent board changes include the resignation of Mr. Andrew Scobie Hawkyard as Non-Independent and Non-Executive Director for personal reasons, which may impact governance dynamics but not operational capabilities directly linked to its core revenue streams.

- Click here and access our complete financial health analysis report to understand the dynamics of APAC Realty.

- Gain insights into APAC Realty's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Unlock more gems! Our Penny Stocks screener has unearthed 5,813 more companies for you to explore.Click here to unveil our expertly curated list of 5,816 Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vibrant Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BIP

Vibrant Group

An investment holding company, engages in the integrated logistics, real estate, and financial services worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives