- United Arab Emirates

- /

- Banks

- /

- ADX:NBQ

Discovering National Bank of Umm Al-Qaiwain (PSC) Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. consumer confidence dipping and major indices showing mixed results, investors are keenly evaluating opportunities across various sectors. In this context, penny stocks—often representing smaller or less-established companies—remain an intriguing option for those seeking potential value and growth. Despite their somewhat outdated label, these stocks can still offer significant opportunities when backed by strong financials, making them a compelling choice for investors looking to explore under-the-radar companies with promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.095 | £789.32M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$43.17B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.17B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,829 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market cap of AED4.30 billion.

Operations: The company generates revenue primarily from Treasury and Investments, amounting to AED418.58 million, and Retail and Corporate Banking, contributing AED192.74 million.

Market Cap: AED4.3B

National Bank of Umm Al-Qaiwain (PSC) presents a mixed picture for investors interested in penny stocks. The bank's earnings have grown at 12.5% annually over the past five years, though recent growth slowed to 5.5%, lagging behind the broader banking industry. With a Price-to-Earnings ratio of 8.6x, it is valued below the AE market average, suggesting potential undervaluation. However, its Return on Equity is low at 8.9%, and it faces challenges with high non-performing loans at 4.2%. Despite stable funding from customer deposits and an experienced board, dividend sustainability remains uncertain due to an unstable track record.

- Jump into the full analysis health report here for a deeper understanding of National Bank of Umm Al-Qaiwain (PSC).

- Examine National Bank of Umm Al-Qaiwain (PSC)'s past performance report to understand how it has performed in prior years.

Marco Polo Marine (SGX:5LY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Marco Polo Marine Ltd. is an integrated marine logistics company operating in Singapore, Indonesia, Taiwan, Thailand, Malaysia and internationally with a market cap of SGD198.94 million.

Operations: The company generates revenue through Ship Chartering Services amounting to SGD71.93 million and Ship Building and Repair Services totaling SGD51.60 million.

Market Cap: SGD198.94M

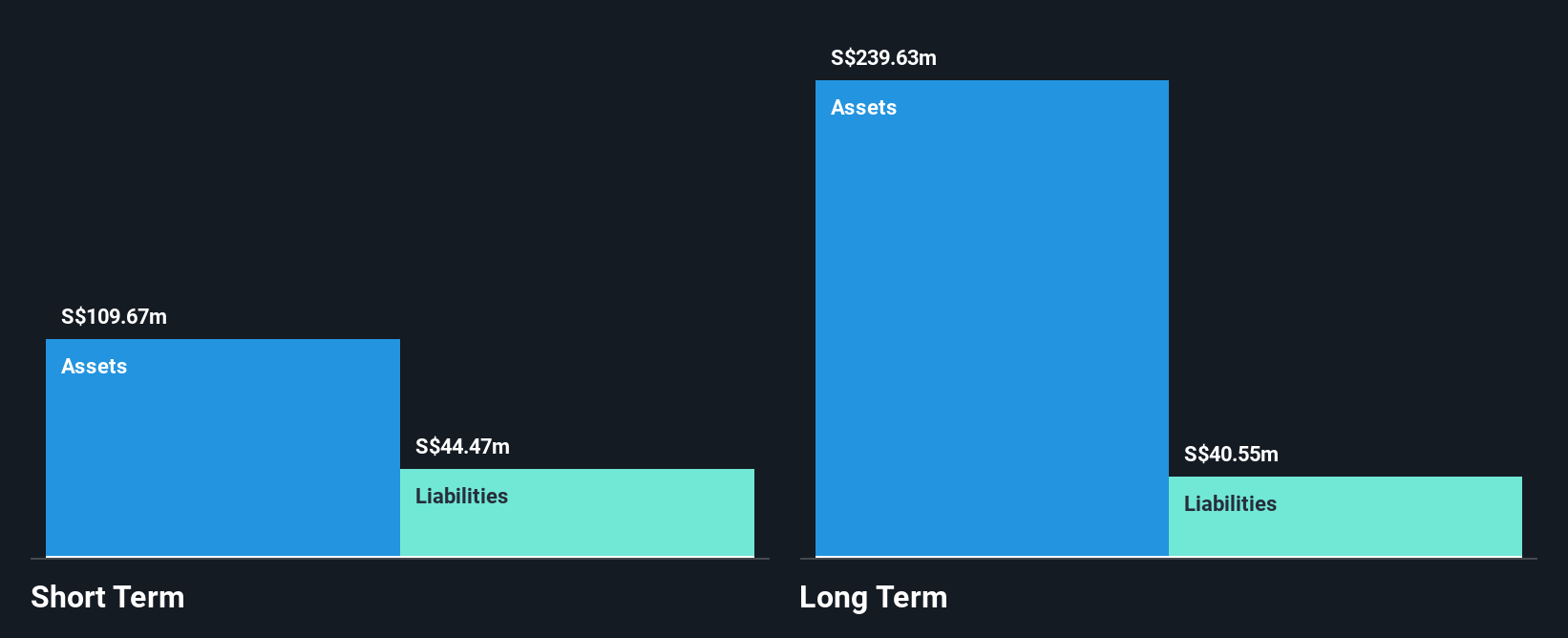

Marco Polo Marine Ltd. offers a compelling case for penny stock investors with its stable revenue streams from ship chartering and shipbuilding services, totaling SGD 123.53 million in the past year. Despite a slight decline in net income to SGD 21.7 million, the company maintains strong financial health, with short-term assets exceeding both short and long-term liabilities significantly. The company's debt is well-covered by operating cash flow, and it has more cash than total debt, indicating solid liquidity management. Recent board changes underscore an experienced leadership team poised to navigate future challenges effectively.

- Unlock comprehensive insights into our analysis of Marco Polo Marine stock in this financial health report.

- Review our growth performance report to gain insights into Marco Polo Marine's future.

Shanghai Lonyer Data (SHSE:603003)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Lonyer Data Co., Ltd. engages in the trading of oil products in China and has a market capitalization of approximately CN¥1.92 billion.

Operations: The company generates revenue of CN¥2.09 billion from its operations within China.

Market Cap: CN¥1.92B

Shanghai Lonyer Data Co., Ltd. presents a mixed picture for penny stock investors. With a market cap of CN¥1.92 billion and recent revenue of CN¥1.15 billion, the company has seen declining sales compared to the previous year, leading to a net loss of CN¥82.17 million from a prior net income position. Despite its unprofitability, Shanghai Lonyer maintains more cash than total debt and possesses sufficient short-term assets to cover both short- and long-term liabilities. The company has not experienced significant shareholder dilution recently, and its board is experienced with an average tenure of 7.6 years.

- Click here to discover the nuances of Shanghai Lonyer Data with our detailed analytical financial health report.

- Learn about Shanghai Lonyer Data's historical performance here.

Taking Advantage

- Click through to start exploring the rest of the 5,826 Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Umm Al-Qaiwain (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NBQ

National Bank of Umm Al-Qaiwain (PSC)

Engages in the provision of retail and corporate banking services in the United Arab Emirates.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives