Do Directors Own GRP Limited (SGX:BLU) Shares?

Every investor in GRP Limited (SGX:BLU) should be aware of the most powerful shareholder groups. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes 'a business with enduring competitive advantages that is run by able and owner-oriented people'. So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

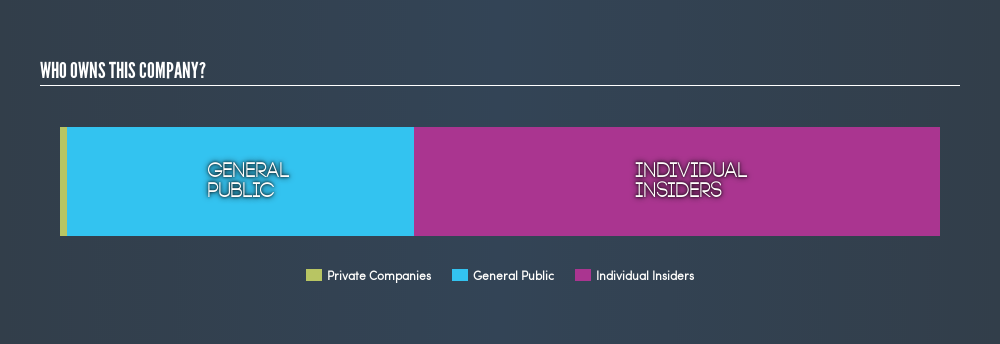

GRP is a smaller company with a market capitalization of S$31m, so it may still be flying under the radar of many institutional investors. In the chart below below, we can see that institutions don't own shares in the company. We can zoom in on the different ownership groups, to learn more about BLU.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for GRP

What Does The Lack Of Institutional Ownership Tell Us About GRP?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

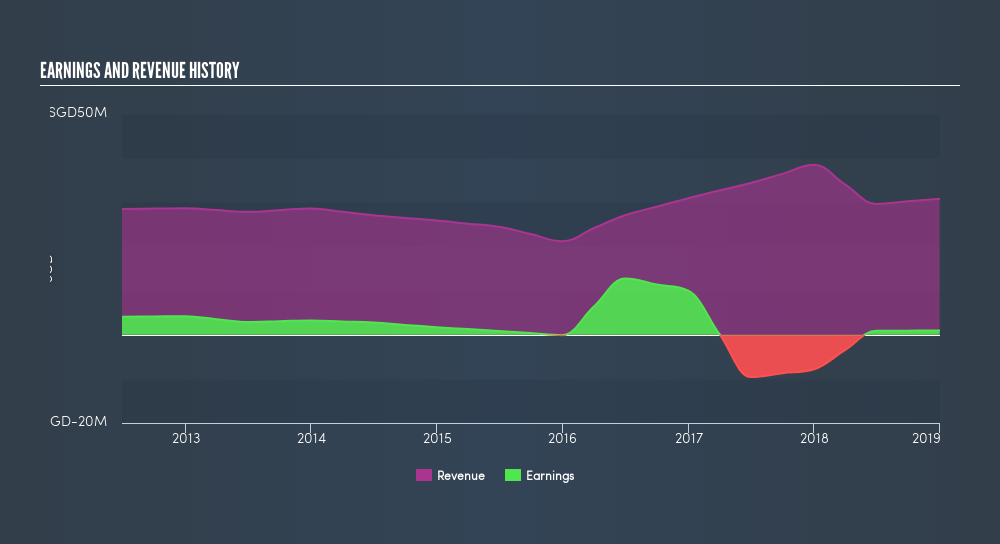

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of GRP, for yourself, below.

We note that hedge funds don't have a meaningful investment in GRP. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of GRP

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders own more than half of GRP Limited. This gives them effective control of the company. That means they own S$19m worth of shares in the S$31m company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 40% ownership, the general public have some degree of sway over BLU. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:BLU

GRP

An investment holding company, engages in the measuring instruments/metrology, hose and marine, and property development businesses in Singapore, Indonesia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)