MPACT (SGX:N2IU) Profit Margin Surge Reinforces Bull Case Despite Clouded Outlook

Reviewed by Simply Wall St

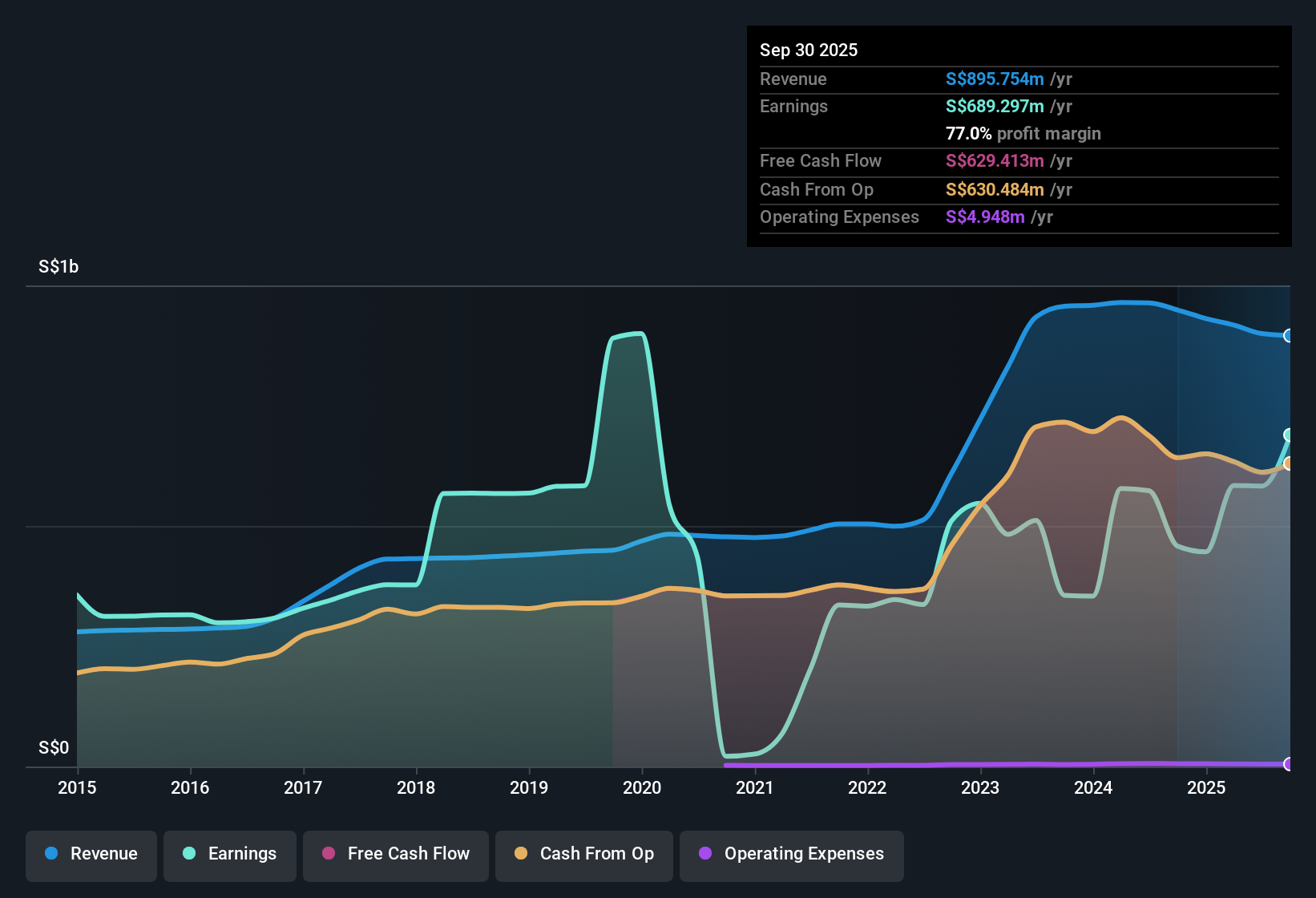

Mapletree Pan Asia Commercial Trust (SGX:N2IU) posted a standout net profit margin of 77.2% for the twelve months to September 2025, well above last year’s 48.3%, thanks to a one-off gain of SGD271.8 million. Over the past five years, the trust’s earnings expanded by an average of 26.3% per year, capped by an impressive 50.5% jump in the most recent year. As investors weigh these robust historical results, the outlook is more muted. Revenue is expected to grow just 2.3% per year, and earnings are projected to decline at -10.5% per year in the next three years.

See our full analysis for Mapletree Pan Asia Commercial Trust.Next, we will see how these headline figures do or do not align with the main narratives widely followed by investors and analysts.

See what the community is saying about Mapletree Pan Asia Commercial Trust

Debt Reduction Strengthens Margins

- MPACT lowered its gearing ratio from 40.5% to 37.7% after the divestment of Mapletree Anson. This positions the trust for reduced interest expenses and steadier profit margins.

- Analysts' consensus view is that this healthier balance sheet could enhance net margins, supporting future earnings even as overall revenue growth is expected to slow.

- Consensus highlights that continuous balance sheet improvements may offset some headwinds from slower top-line expansion.

- However, the benefit could be partially muted if asset sales are not matched by new income-generating investments, in line with consensus caution.

- Notably, despite the net margin boost from these efforts, analysts still expect profit margins to contract from 63.7% today to 50.4% in three years. This reflects a more balanced outlook.

Consensus expects any margin gains from lower debt will need to be matched by solid operating execution in order for net profits to meet forecasts over the next three years.

📊 Read the full Mapletree Pan Asia Commercial Trust Consensus Narrative.

Valuation Discount Versus Peers

- With a price-to-earnings (PE) ratio of 11.2x, MPACT trades at a substantial discount to both sector peers (17.9x) and the broader Asian REITs industry (17.3x). This is despite being below its DCF fair value of SGD2.92 per share.

- Analysts' consensus narrative suggests that this valuation gap could draw in value-seeking investors given the trust’s resilient core Singapore assets and ongoing property enhancements.

- Consensus points to improvements in key assets like VivoCity as a potential driver for closing part of this valuation gap.

- Industry comparisons reinforce that even with a muted near-term outlook, current pricing more than bakes in risk relative to typical REIT valuations.

Headwinds from Overseas Assets

- Overseas properties, particularly in Greater China and Japan, have seen deteriorating valuations and weaker leasing demand, as noted by consensus.

- Analysts' consensus narrative flags several challenges that could weigh on future results, despite domestic strength.

- Persistent headwinds such as negative rental reversions in China and the upcoming lease termination in Japan threaten overall occupancy and revenue. This supports the consensus view of pressure on earnings ahead.

- The trust’s high debt, while reduced, leaves it exposed if interest rates rise, potentially limiting the ability to sustain elevated margins and distributions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mapletree Pan Asia Commercial Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that stands out to you? Shape your own view and share your perspective in just a few minutes. Do it your way

A great starting point for your Mapletree Pan Asia Commercial Trust research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Mapletree Pan Asia Commercial Trust faces persistent overseas property headwinds, muted revenue growth, and declining profit margins as higher debt continues to weigh on its outlook.

If you want to focus on companies with less leverage and stronger financial health, check out solid balance sheet and fundamentals stocks screener (1982 results) built for more resilient investment opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:N2IU

Mapletree Pan Asia Commercial Trust

Mapletree Pan Asia Commercial Trust (“MPACT”) is a real estate investment trust (“REIT”) positioned to be the proxy to key gateway markets of Asia.

Established dividend payer and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)