- Singapore

- /

- Industrial REITs

- /

- SGX:BUOU

SGX Value Picks Highlight 3 Stocks That May Be Trading At A Discount

Reviewed by Simply Wall St

As the Singapore market navigates a landscape of mixed economic signals and investor sentiment, discerning potential opportunities becomes crucial for investors seeking value. In this context, identifying undervalued stocks—those trading below their intrinsic worth—can offer promising prospects, particularly when broader market conditions reflect cautious optimism or uncertainty.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.71 | SGD7.30 | 35.5% |

| Digital Core REIT (SGX:DCRU) | US$0.58 | US$0.82 | 28.9% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.12 | SGD1.99 | 43.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.84 | SGD1.43 | 41.1% |

| Seatrium (SGX:5E2) | SGD1.97 | SGD3.03 | 35% |

Let's uncover some gems from our specialized screener.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages a portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion across Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market cap of S$4.21 billion.

Operations: Frasers Logistics & Commercial Trust generates revenue from its diversified portfolio of 107 industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

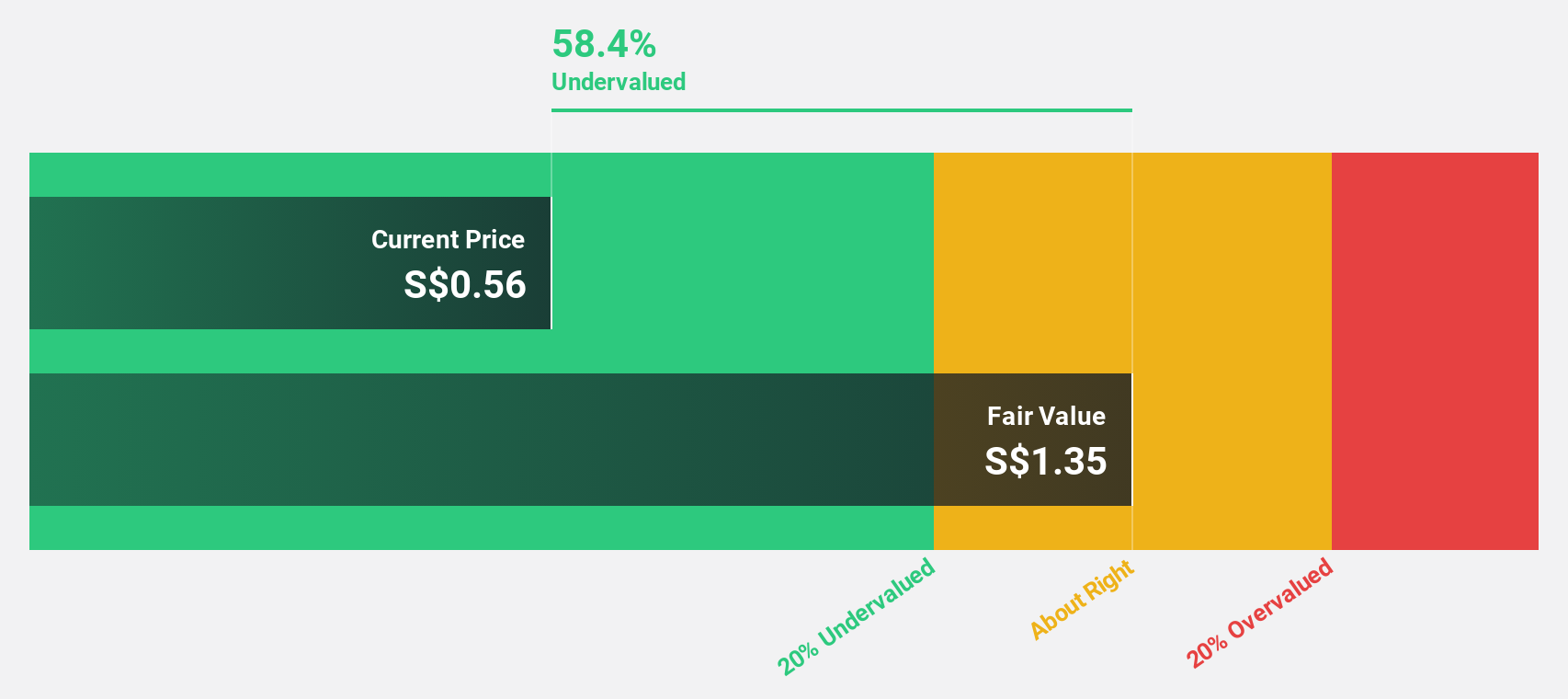

Estimated Discount To Fair Value: 43.6%

Frasers Logistics & Commercial Trust is trading at S$1.12, significantly below its estimated fair value of S$1.99, presenting a potential undervaluation based on cash flows. Despite an unstable dividend history and operating cash flow not fully covering debt, revenue is forecast to grow at 6.2% annually, outpacing the Singapore market's average growth rate. Recent board changes aim to strengthen governance as it transitions leadership roles effective October 2024.

- Upon reviewing our latest growth report, Frasers Logistics & Commercial Trust's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Frasers Logistics & Commercial Trust's balance sheet health report.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD546.91 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company generates revenue from several segments, including Sydrogen (SGD1.40 million), Nanofabrication (SGD18.37 million), Advanced Materials (SGD153.32 million), and Industrial Equipment (SGD28.71 million).

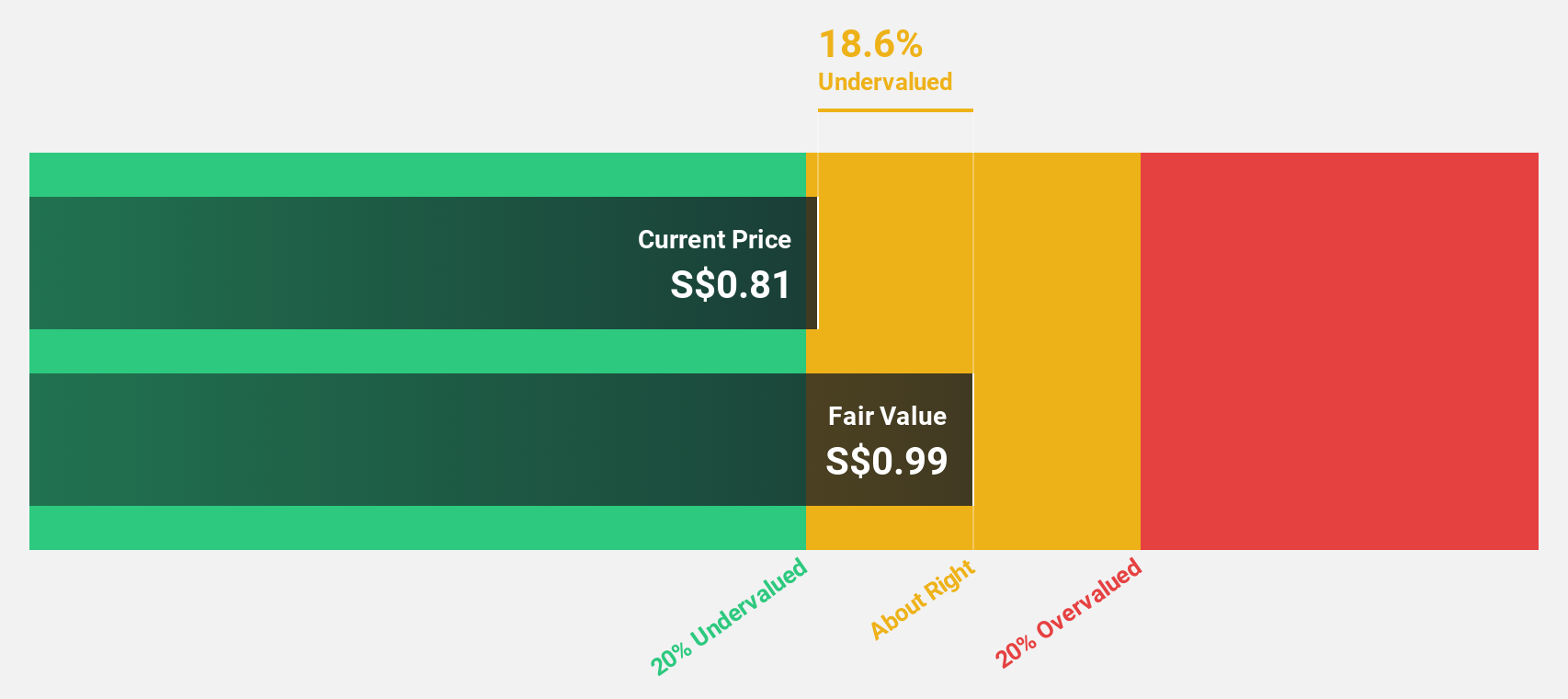

Estimated Discount To Fair Value: 41.1%

Nanofilm Technologies International, trading at SGD 0.84, is significantly undervalued compared to its estimated fair value of SGD 1.43, suggesting potential based on cash flows. Despite a challenging first half with a net loss of SGD 3.74 million and lower profit margins than last year, earnings are expected to grow substantially faster than the Singapore market over the next three years. Recent board changes may support strategic adjustments amid these financial dynamics.

- Insights from our recent growth report point to a promising forecast for Nanofilm Technologies International's business outlook.

- Unlock comprehensive insights into our analysis of Nanofilm Technologies International stock in this financial health report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.68 billion.

Operations: The company's revenue segments comprise SGD4.34 billion from Commercial Aerospace, SGD2.01 billion from Urban Solutions & Satcom, and SGD4.54 billion from Defence & Public Security.

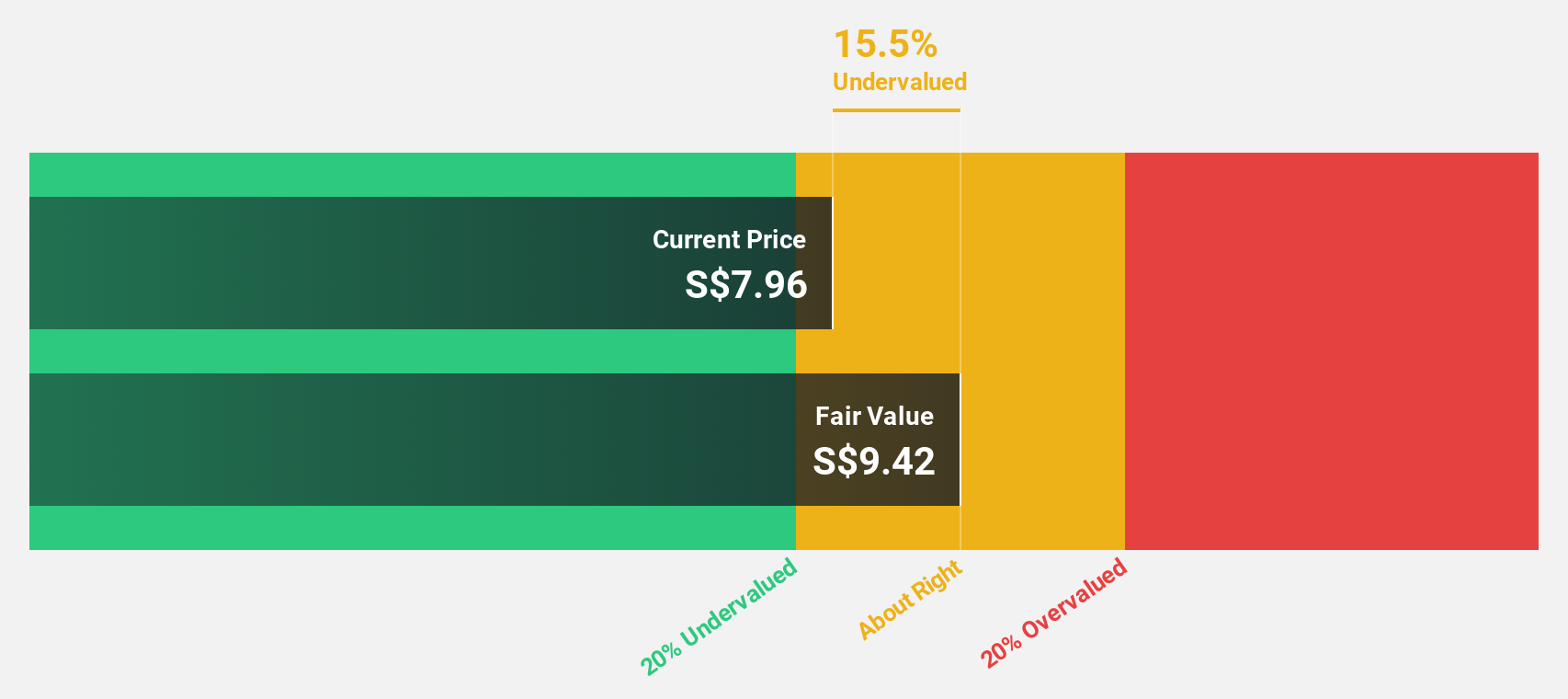

Estimated Discount To Fair Value: 35.5%

Singapore Technologies Engineering is trading at S$4.71, significantly below its estimated fair value of S$7.30, reflecting potential undervaluation based on cash flows. Recent earnings growth of 19.9% and anticipated revenue growth of 6.4% annually suggest strong future performance relative to the Singapore market. However, its debt coverage by operating cash flow remains a concern despite strategic alliances enhancing its cybersecurity capabilities and a robust earnings outlook with forecasted profit growth outpacing the market average.

- Our growth report here indicates Singapore Technologies Engineering may be poised for an improving outlook.

- Dive into the specifics of Singapore Technologies Engineering here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 5 Undervalued SGX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BUOU

Frasers Logistics & Commercial Trust

Frasers Logistics & Commercial Trust (“FLCT”) is a Singapore-listed real estate investment trust with a portfolio comprising 114 industrial and commercial properties, worth approximately S$6.8 billion, diversified across five major developed markets – Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives