As global markets grapple with economic uncertainties and policy shifts, Asian stock markets have shown resilience despite challenges such as trade tensions and inflationary pressures. In this environment, dividend stocks in Asia can offer a stable source of income growth, making them an attractive option for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.08% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| PAX Global Technology (SEHK:327) | 9.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.26% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

Click here to see the full list of 1124 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hong Leong Asia (SGX:H22)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products in China, Singapore, Malaysia, and internationally with a market cap of SGD822.89 million.

Operations: Hong Leong Asia Ltd. generates revenue primarily from its Powertrain Solutions segment, which accounts for SGD3.55 billion, followed by Building Materials at SGD682.33 million.

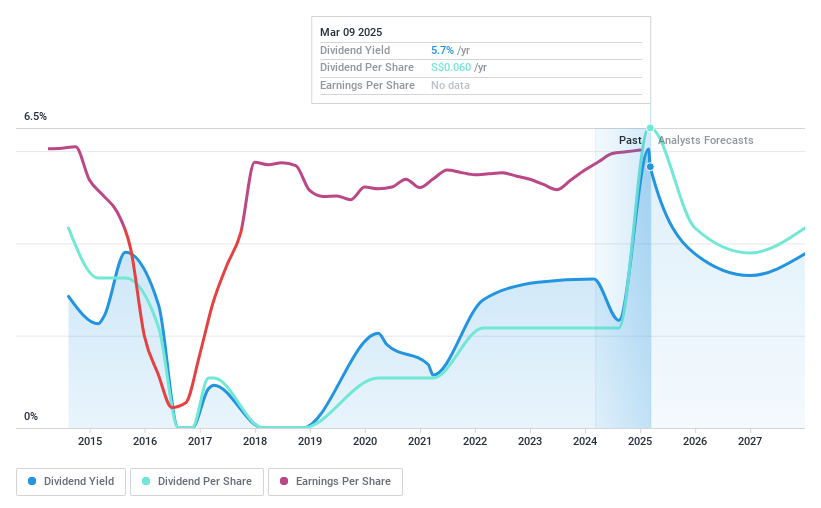

Dividend Yield: 5.5%

Hong Leong Asia's dividend sustainability is supported by a payout ratio of 34.2% and a cash payout ratio of 26.3%, indicating dividends are well-covered by earnings and cash flows. Despite recent earnings growth, dividends have been volatile over the past decade, with payments not consistently growing. The stock trades at a significant discount to its estimated fair value but offers a lower yield compared to top-tier dividend payers in Singapore.

- Dive into the specifics of Hong Leong Asia here with our thorough dividend report.

- Our expertly prepared valuation report Hong Leong Asia implies its share price may be lower than expected.

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property and hospitality sectors across various countries including Singapore, Australia, the UK, China, and others with a market cap of SGD4.83 billion.

Operations: UOL Group Limited's revenue is primarily derived from Property Development (SGD1.20 billion), Property Investments (SGD562.25 million), Technology Operations (SGD130.85 million), and Hotel Operations, which include Singapore (SGD501.71 million), Australia (SGD130.57 million), and Other regions (SGD186.29 million).

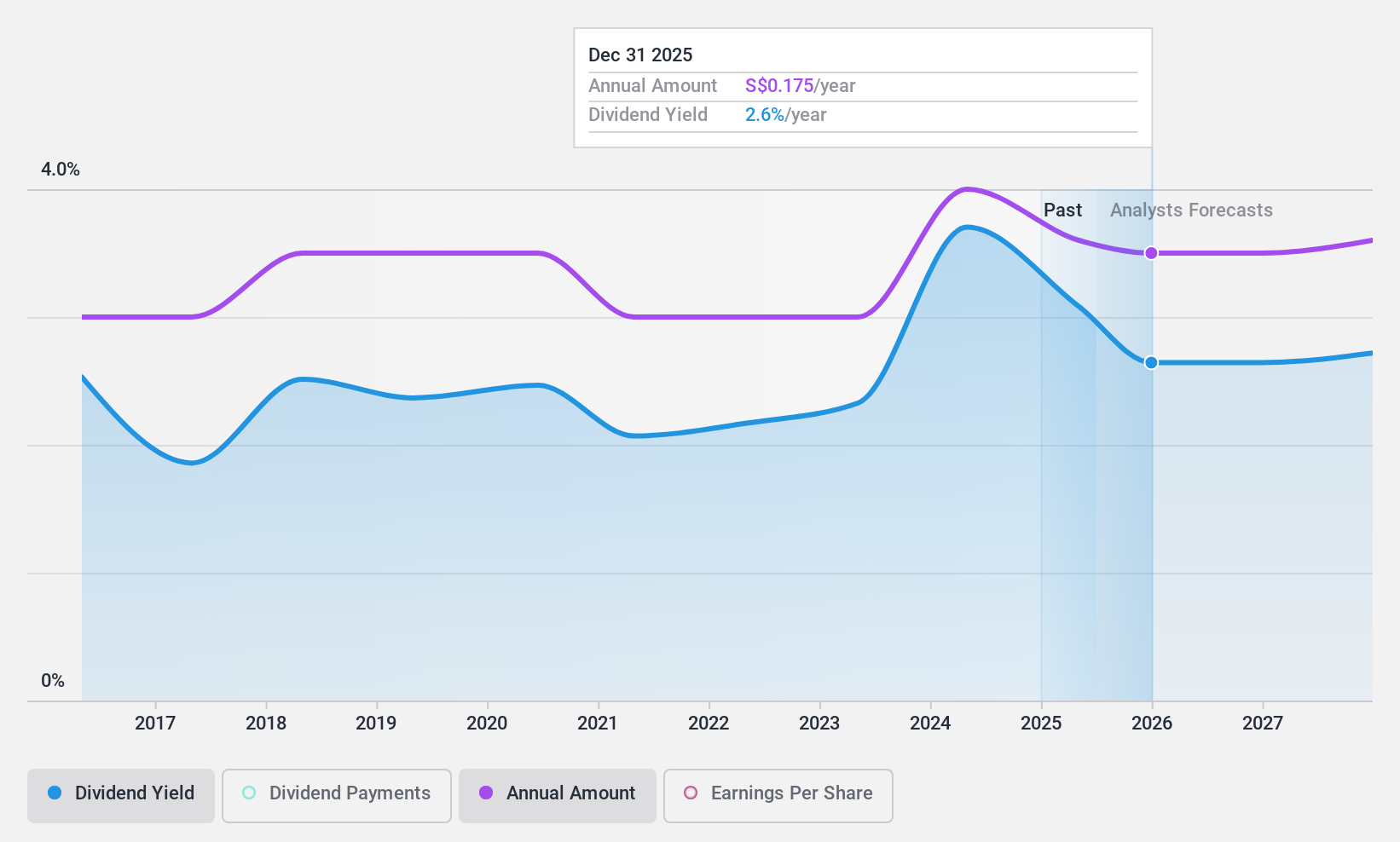

Dividend Yield: 3.1%

UOL Group's dividend stability and reliability are evident, with consistent growth over the past decade. Despite a lower yield of 3.15% compared to top Singaporean dividend payers, dividends are well-covered by earnings (42.5% payout ratio) and cash flows (22.9% cash payout ratio). The stock trades at a 20.3% discount to its estimated fair value, though recent profits declined from S$707.71 million to S$358.19 million year-over-year, impacting net margins significantly.

- Delve into the full analysis dividend report here for a deeper understanding of UOL Group.

- According our valuation report, there's an indication that UOL Group's share price might be on the cheaper side.

Ubright Optronics (TPEX:4933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ubright Optronics Corporation is a Taiwanese company that manufactures and sells optical films, with a market cap of NT$7.04 billion.

Operations: Ubright Optronics Corporation generates revenue primarily through its Manufacturing and Trading Business of Polishing Film, amounting to NT$2.76 billion.

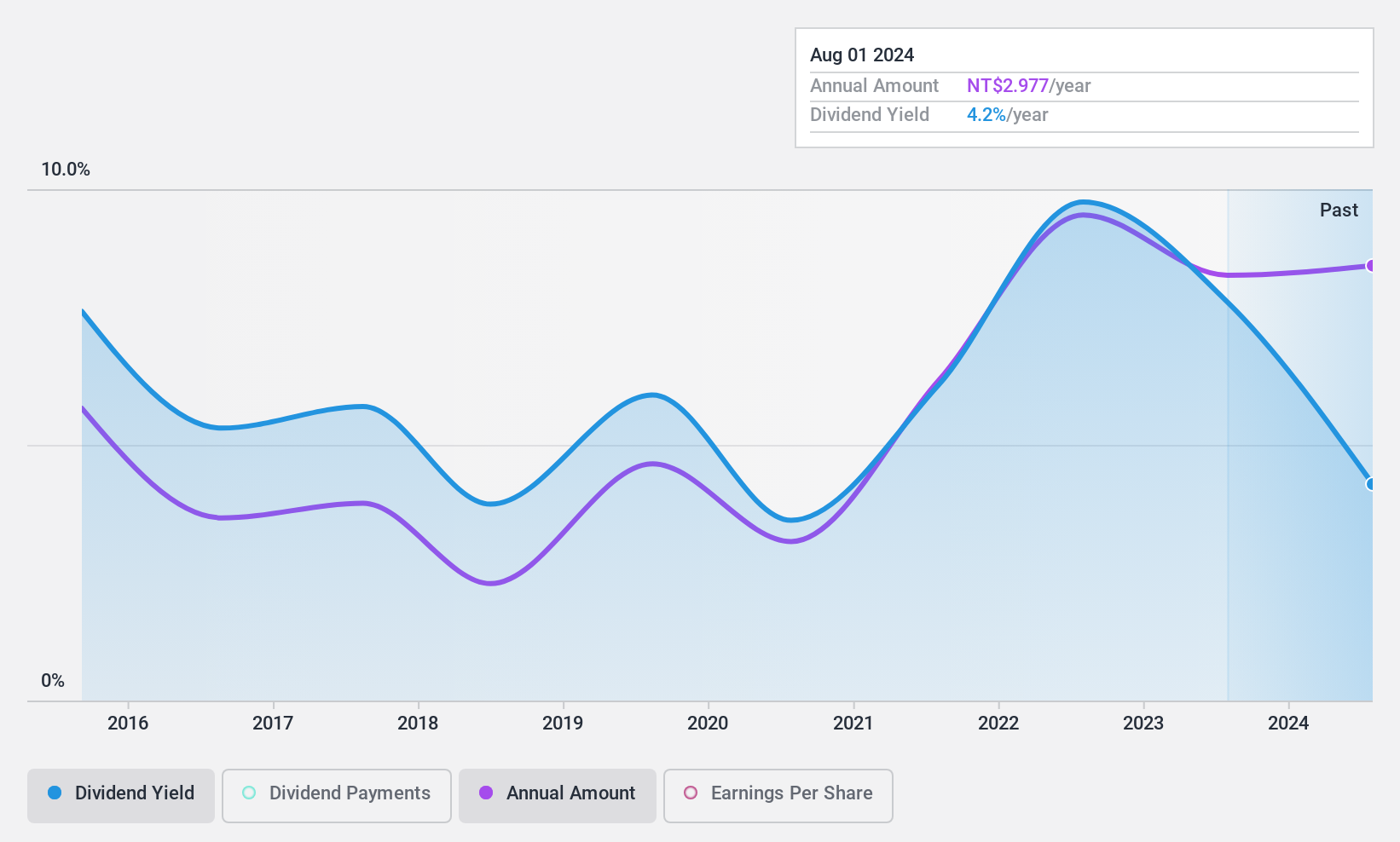

Dividend Yield: 3.5%

Ubright Optronics' dividend sustainability is supported by a payout ratio of 50.7% and a cash payout ratio of 58.8%. However, dividends have been volatile over the past decade, with inconsistent payments despite recent growth. The yield of 3.45% lags behind Taiwan's top dividend payers. Recent developments include establishing a subsidiary in Taiwan with an investment up to NT$500 million and executive changes that might impact strategic direction, adding uncertainty to future dividends.

- Navigate through the intricacies of Ubright Optronics with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Ubright Optronics shares in the market.

Where To Now?

- Click through to start exploring the rest of the 1121 Top Asian Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H22

Hong Leong Asia

An investment holding company, manufactures and distributes powertrain solutions and related products, building materials, and rigid packaging products in the People’s Republic of China, Singapore, Malaysia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.