- Philippines

- /

- Food and Staples Retail

- /

- PSE:RRHI

Insider Buying Highlights These 3 Undervalued Small Caps For Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have been navigating a complex environment marked by fluctuating indices and economic indicators. The S&P 600, a key benchmark for small-cap companies, has faced pressures from broader market sentiment and competitive concerns in the tech sector, yet opportunities remain for discerning investors. Identifying promising stocks often involves looking at those with strong fundamentals that can weather economic shifts and capitalize on strategic insider activities.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 21.9x | 5.6x | 24.62% | ★★★★★★ |

| Maharashtra Seamless | 11.1x | 1.7x | 48.17% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 40.24% | ★★★★★☆ |

| Gamma Communications | 23.2x | 2.4x | 36.48% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 12.7x | 2.1x | 39.00% | ★★★★☆☆ |

| Logistri Fastighets | 12.4x | 8.8x | 40.61% | ★★★★☆☆ |

| CVS Group | 27.4x | 1.1x | 44.15% | ★★★★☆☆ |

| Franchise Brands | 39.2x | 2.0x | 28.72% | ★★★★☆☆ |

| Optima Health | NA | 1.4x | 47.65% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 13.0x | 4.2x | 6.89% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

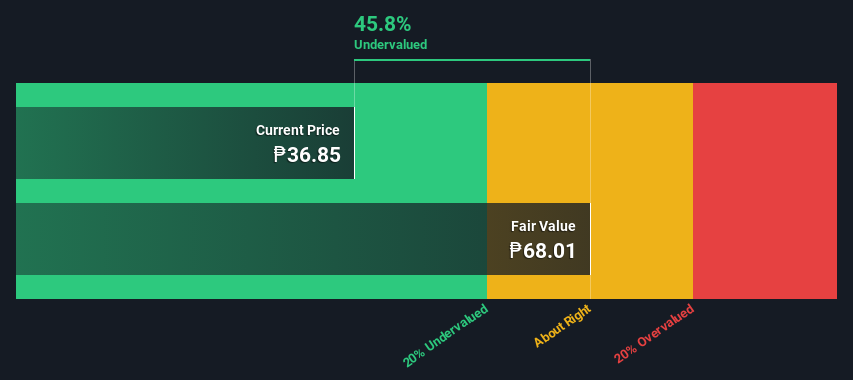

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Robinsons Retail Holdings operates a diverse range of retail formats including department stores, specialty stores, drugstores, and DIY outlets with a market capitalization of ₱119.58 billion.

Operations: The company generates revenue primarily from its Department Store, Specialty Stores, Drug Store Division, and Do It Yourself (DIY) segments. Over the analyzed periods, gross profit margin showed a gradual increase from 22.52% to 23.87%. Operating expenses are significant and include costs such as depreciation and amortization, sales and marketing, with general and administrative expenses being the largest component. The net income margin has fluctuated but recently reached 4.72%.

PE: 5.5x

Robinsons Retail Holdings, a small cap stock, recently saw insider confidence with Gina Roa-Dipaling purchasing 10,000 shares for approximately ₱349,500 in January 2025. The company faces challenges as earnings are forecasted to decline by an average of 11% annually over the next three years. Despite relying entirely on external borrowing for funding, recent amendments to their bylaws reflect strategic adaptability. Investors should consider these dynamics when evaluating potential growth and value within this sector.

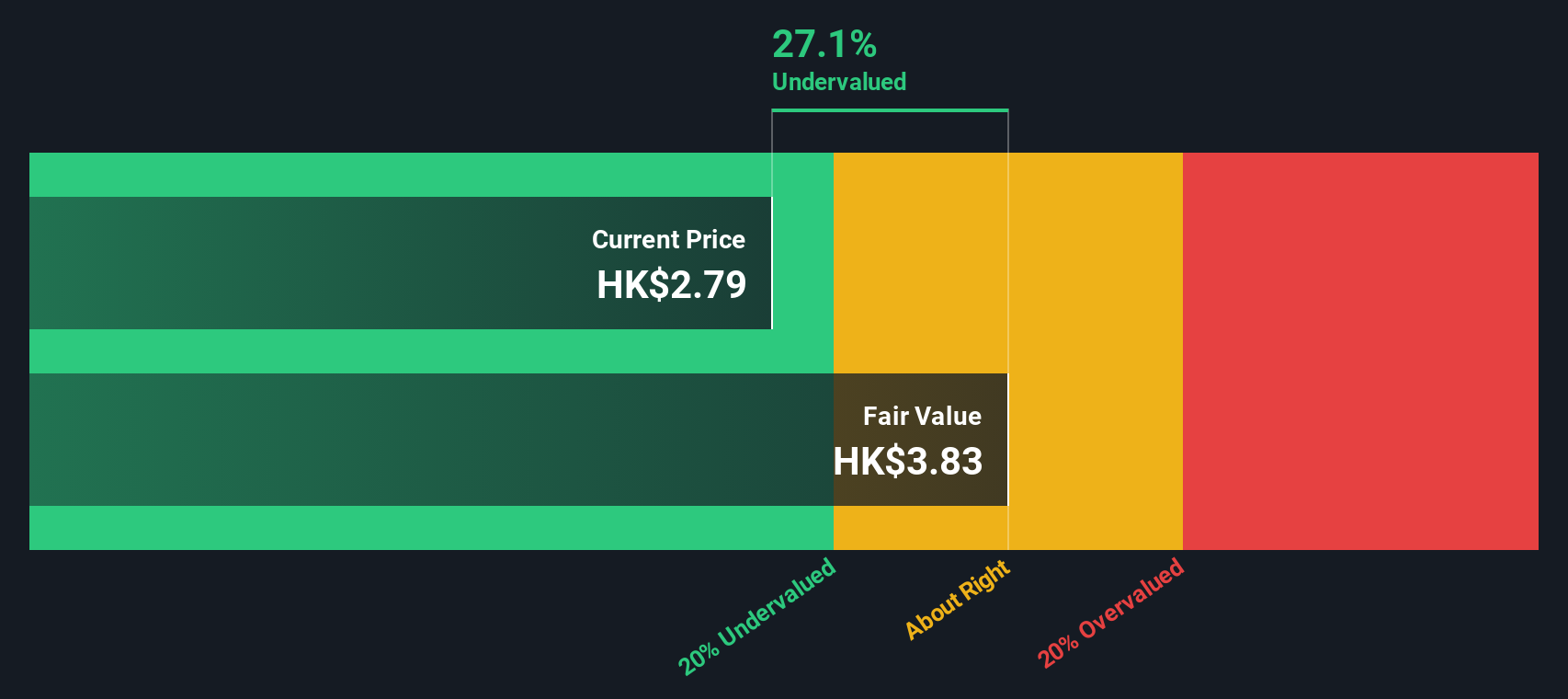

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ming Yuan Cloud Group Holdings is a technology company that provides cloud services and on-premise software solutions, with a market capitalization of CN¥7.63 billion.

Operations: The company generates revenue primarily from Cloud Services and On-premise Software and Services, with Cloud Services contributing significantly more. Over recent periods, the gross profit margin has shown some fluctuations, reaching a high of 81.44% in December 2022 before decreasing to 79.64% by June 2024. Operating expenses are substantial, driven mainly by Sales & Marketing and R&D expenses.

PE: -16.0x

Ming Yuan Cloud Group Holdings, a smaller company in the tech sector, has caught attention with insider confidence demonstrated by Xiaohui Chen's purchase of 2 million shares for approximately US$4.88 million. This move suggests belief in the company's potential despite its reliance on riskier external borrowing for funding. Recent changes include appointing Ernst & Young as auditors, which may enhance financial transparency. Earnings are projected to grow annually by 59%, indicating promising prospects ahead.

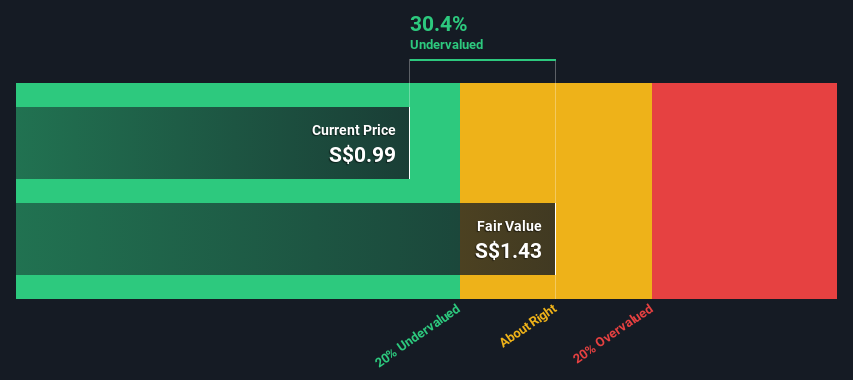

CapitaLand India Trust (SGX:CY6U)

Simply Wall St Value Rating: ★★★★★★

Overview: CapitaLand India Trust primarily invests in and manages business space properties, with a market capitalization of SGD 1.79 billion.

Operations: The primary revenue stream is from investment properties tenanted for business space, generating SGD 277.88 million. The cost of goods sold (COGS) is SGD 72.27 million, resulting in a gross profit margin of 73.99%. Operating expenses are recorded at SGD 30.69 million, with non-operating expenses significantly impacting net income due to a negative value of SGD -263.86 million, contributing to a net income margin of 157.90%.

PE: 3.2x

CapitaLand India Trust, a small cap company in the real estate sector, has shown significant insider confidence with recent share purchases. For the full year ended December 31, 2024, they reported net income of S$438.78 million, up from S$147.43 million previously. Despite high-risk funding through external borrowing and forecasts indicating a potential decline in earnings by an average of 43.4% annually over three years, their strategic expansion into data centers across key Indian cities promises diversification and potential growth opportunities for investors.

- Unlock comprehensive insights into our analysis of CapitaLand India Trust stock in this valuation report.

Assess CapitaLand India Trust's past performance with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Undervalued Small Caps With Insider Buying list of 181 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RRHI

Robinsons Retail Holdings

Operates as a multi-format retail company in the Philippines.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives