- Singapore

- /

- Real Estate

- /

- SGX:9CI

Weak Financial Prospects Seem To Be Dragging Down CapitaLand Investment Limited (SGX:9CI) Stock

It is hard to get excited after looking at CapitaLand Investment's (SGX:9CI) recent performance, when its stock has declined 3.6% over the past month. We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. Particularly, we will be paying attention to CapitaLand Investment's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CapitaLand Investment is:

4.3% = S$583m ÷ S$13b (Based on the trailing twelve months to June 2025).

The 'return' is the profit over the last twelve months. That means that for every SGD1 worth of shareholders' equity, the company generated SGD0.04 in profit.

Check out our latest analysis for CapitaLand Investment

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of CapitaLand Investment's Earnings Growth And 4.3% ROE

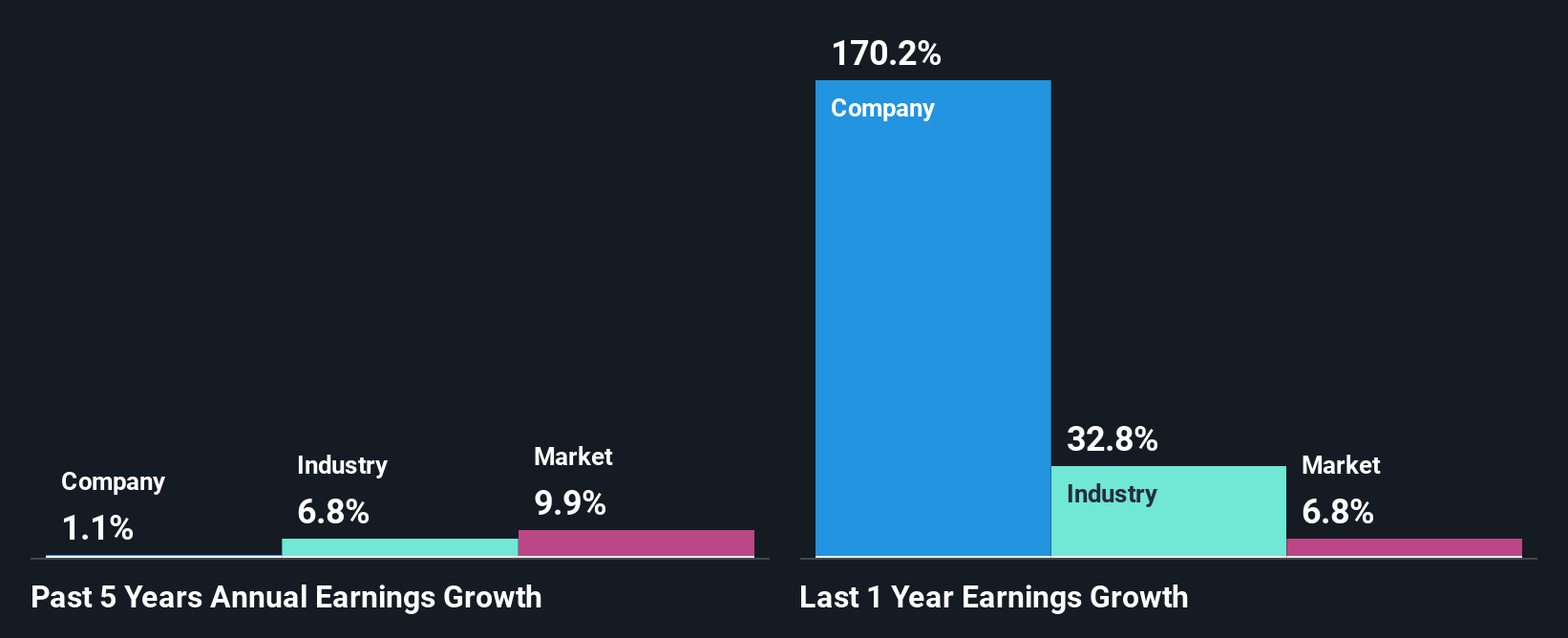

As you can see, CapitaLand Investment's ROE looks pretty weak. An industry comparison shows that the company's ROE is not much different from the industry average of 3.7% either. CapitaLand Investment's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared CapitaLand Investment's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 6.8% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if CapitaLand Investment is trading on a high P/E or a low P/E, relative to its industry.

Is CapitaLand Investment Efficiently Re-investing Its Profits?

CapitaLand Investment has a three-year median payout ratio as high as 128% meaning that the company is paying a dividend which is beyond its means. The absence of growth in CapitaLand Investment's earnings therefore, doesn't come as a surprise. Paying a dividend beyond their means is usually not viable over the long term. That's a huge risk in our books. You can see the 3 risks we have identified for CapitaLand Investment by visiting our risks dashboard for free on our platform here.

Additionally, CapitaLand Investment has paid dividends over a period of four years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 79% over the next three years. As a result, the expected drop in CapitaLand Investment's payout ratio explains the anticipated rise in the company's future ROE to 5.8%, over the same period.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning CapitaLand Investment. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:9CI

CapitaLand Investment

Headquartered and listed in Singapore in 2021, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold.

Proven track record with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026