- Singapore

- /

- Healthcare Services

- /

- SGX:BSL

Exploring November 2024's Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In a week marked by heightened economic activity and mixed signals from key indices, small-cap stocks have demonstrated resilience, outperforming their larger counterparts amidst cautious earnings reports and fluctuating market sentiments. As the S&P 600 SmallCap Index navigates these turbulent waters, investors are increasingly eyeing opportunities within this segment, particularly those stocks that exhibit strong fundamentals and insider buying trends. Identifying such stocks often involves assessing their financial health and potential for growth in the context of current economic indicators.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.5x | 0.8x | 27.65% | ★★★★★☆ |

| Maharashtra Seamless | 9.8x | 1.7x | 36.41% | ★★★★★☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.42% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 40.70% | ★★★★☆☆ |

| NCL Industries | 12.5x | 0.5x | -35.26% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.8x | 0.7x | 30.54% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.8x | 1.7x | -46.73% | ★★★☆☆☆ |

| Avia Avian | 17.7x | 4.1x | 4.15% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Bajel Projects | 255.4x | 2.0x | 26.89% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

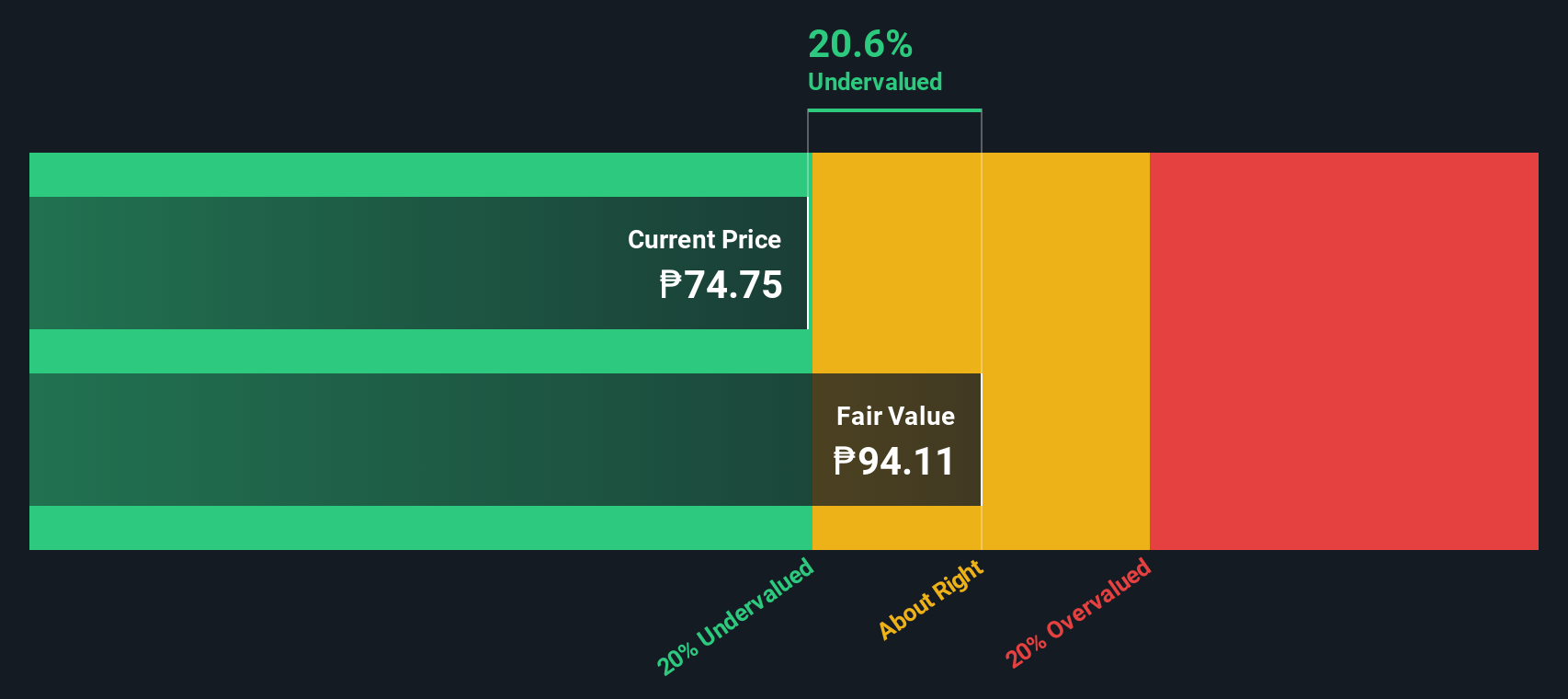

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank operates as a full-service bank in the Philippines, providing a range of financial products and services across segments such as branch banking, consumer banking, commercial banking, treasury operations, and others.

Operations: Branch Banking is the primary revenue stream, contributing significantly to total income. The company experiences a Gross Profit Margin of 98.88%, indicating efficient cost management relative to revenue generation. Operating expenses are largely driven by General & Administrative costs and Sales & Marketing efforts, impacting overall profitability.

PE: 4.8x

Asia United Bank, a smaller player in the banking sector, recently showcased insider confidence with share purchases over the past year. Their second-quarter earnings reported on August 14, 2024, revealed net income growth to PHP 2.89 billion from PHP 2.11 billion a year prior, reflecting solid financial health despite having a high non-performing loan ratio of 2%. Participation in industry events like the World Financial Innovation Series underscores their commitment to innovation and strategic positioning for future growth.

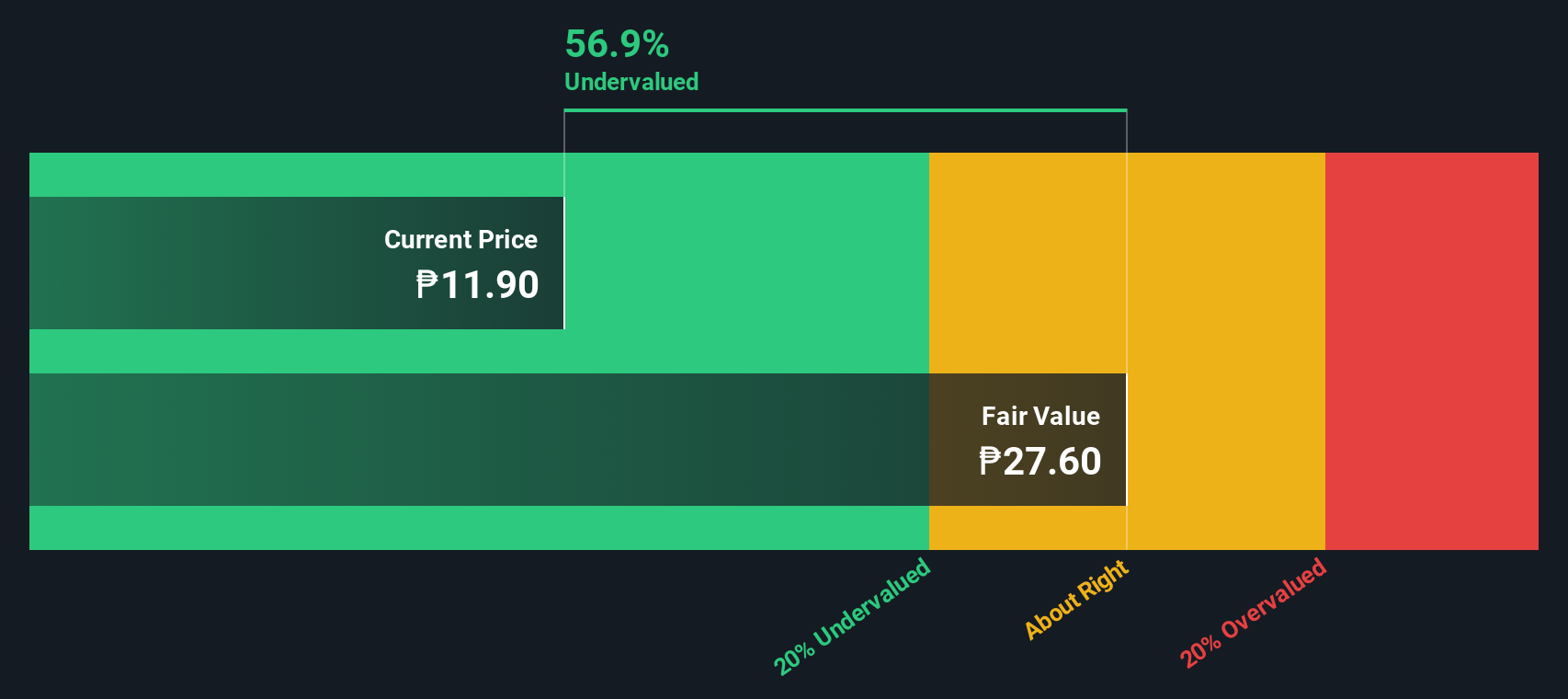

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pryce is engaged in the business of manufacturing and selling industrial gases, as well as operating memorial parks, with a market capitalization of approximately ₱10.34 billion.

Operations: Pryce generates revenue primarily from its operations, with a notable gross profit margin trend reaching 30.18% by mid-2024. The company's cost of goods sold (COGS) consistently accounts for the majority of expenses, impacting profitability. Operating expenses are significant, with sales and marketing as well as general and administrative costs being key components. Non-operating expenses also contribute to overall financial performance, influencing net income outcomes over time.

PE: 6.8x

Pryce Corporation's recent earnings reveal a promising trajectory, with third-quarter net income rising to PHP 831.73 million from PHP 692.28 million year-on-year, alongside increased sales and revenue figures. Insider confidence is evident as they acquired 45,000 shares valued at PHP 234,001 in August, indicating potential growth belief. Despite relying on external borrowing for funding—a riskier strategy—Pryce declared a dividend increase of PHP 0.20 per share for early 2025 payouts, showcasing financial resilience and shareholder commitment.

- Delve into the full analysis valuation report here for a deeper understanding of Pryce.

Explore historical data to track Pryce's performance over time in our Past section.

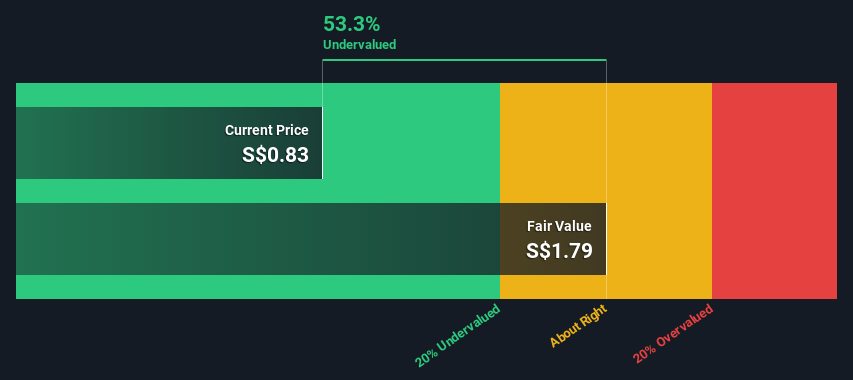

Raffles Medical Group (SGX:BSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Raffles Medical Group operates a network of hospitals, insurance services, and healthcare services, with a market cap of approximately SGD 2.09 billion.

Operations: Raffles Medical Group generates revenue primarily through its Hospital Services, Insurance Services, and Healthcare Services. The company has experienced fluctuations in its gross profit margin, which reached a peak of 55.07% in the second quarter of 2023 before declining to 44.22% by mid-2024. Operating expenses have consistently increased over time, impacting overall profitability.

PE: 27.3x

Raffles Medical Group, a smaller company in the healthcare sector, has seen insider confidence with recent share purchases, signaling potential value perception. Despite a dip in profit margins from 18.3% to 8.7%, earnings are expected to grow by 12.62% annually. The company's reliance on external borrowing adds risk but also highlights its growth ambitions without customer deposits backing it up financially. With Q3 results reported on November 1, future performance will be closely watched for further insights into its trajectory.

- Dive into the specifics of Raffles Medical Group here with our thorough valuation report.

Understand Raffles Medical Group's track record by examining our Past report.

Turning Ideas Into Actions

- Explore the 181 names from our Undervalued Small Caps With Insider Buying screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BSL

Raffles Medical Group

Provides integrated private healthcare services primarily in Singapore, Greater China, Vietnam, Cambodia, and Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives