- China

- /

- Real Estate

- /

- SZSE:000838

3 Promising Penny Stocks With Market Cap Over US$600M

Reviewed by Simply Wall St

As global markets continue to reach record highs, investors are increasingly exploring diverse opportunities across various segments. Penny stocks, a term that refers to smaller or less-established companies, remain a compelling area for those seeking potential growth. Despite their historical connotations, these stocks can offer significant value when backed by strong financials and clear growth prospects. In this article, we examine three penny stocks that may present both stability and upside potential in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.98 | HK$43.83B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| V.S. Industry Berhad (KLSE:VS) | MYR1.07 | MYR4.14B | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market capitalization of SGD1.64 billion.

Operations: The company's revenue is primarily derived from Hospital Services (SGD337.82 million), Healthcare Services (SGD257.49 million), and Insurance Services (SGD163.78 million), along with contributions from Investment Holdings (SGD45.03 million).

Market Cap: SGD1.64B

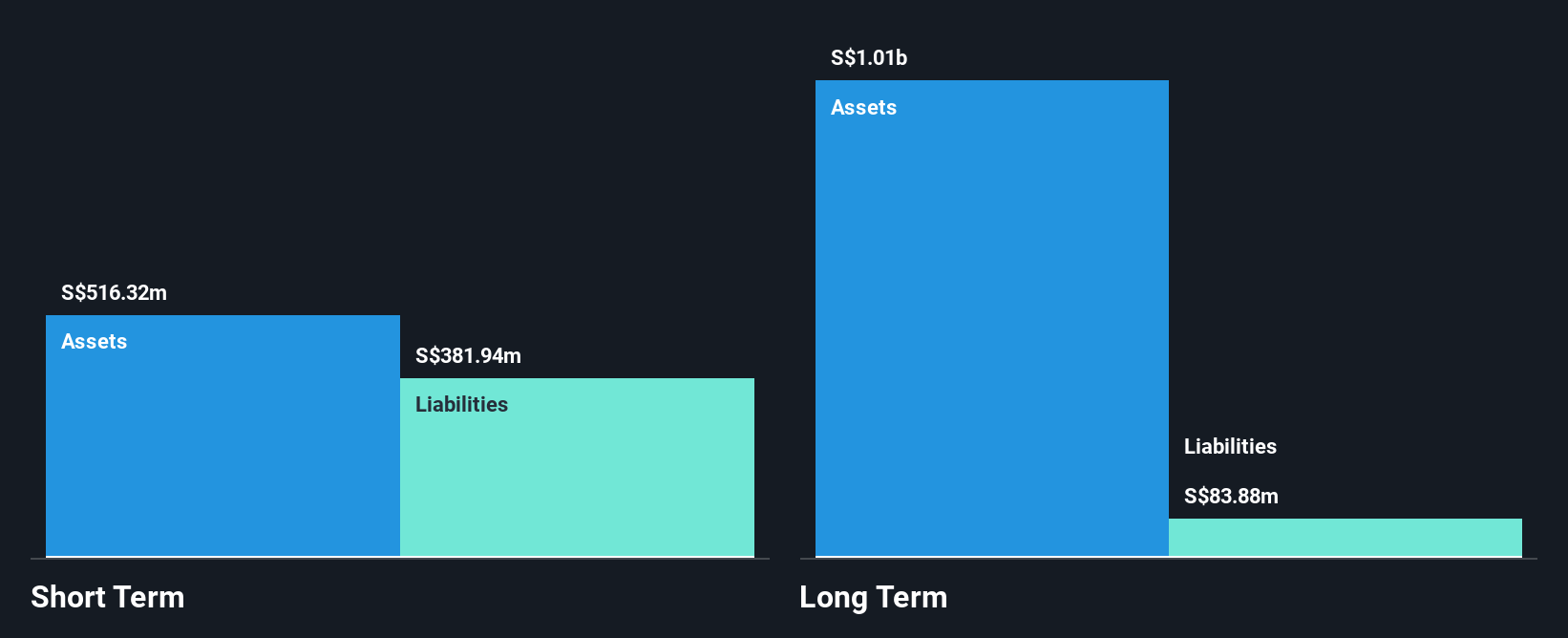

Raffles Medical Group, with a market cap of SGD1.64 billion, is notable for its diversified revenue streams across hospital, healthcare, and insurance services. Despite recent executive changes with the departure of its CFO, the company maintains stability through experienced interim leadership. Financially robust, Raffles Medical's short-term assets exceed both long-term and short-term liabilities, indicating strong liquidity. The company's debt is well covered by operating cash flow and has decreased over time, enhancing financial health. However, recent profit margins have declined compared to last year and earnings growth has been negative recently but are forecasted to grow annually by 12.62%.

- Click here and access our complete financial health analysis report to understand the dynamics of Raffles Medical Group.

- Evaluate Raffles Medical Group's prospects by accessing our earnings growth report.

CASIN Real Estate Development GroupLtd (SZSE:000838)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CASIN Real Estate Development Group Co., Ltd operates in the real estate sector, focusing on property development and management, with a market cap of CN¥3.71 billion.

Operations: The company generates its revenue primarily from China, amounting to CN¥1.45 billion.

Market Cap: CN¥3.71B

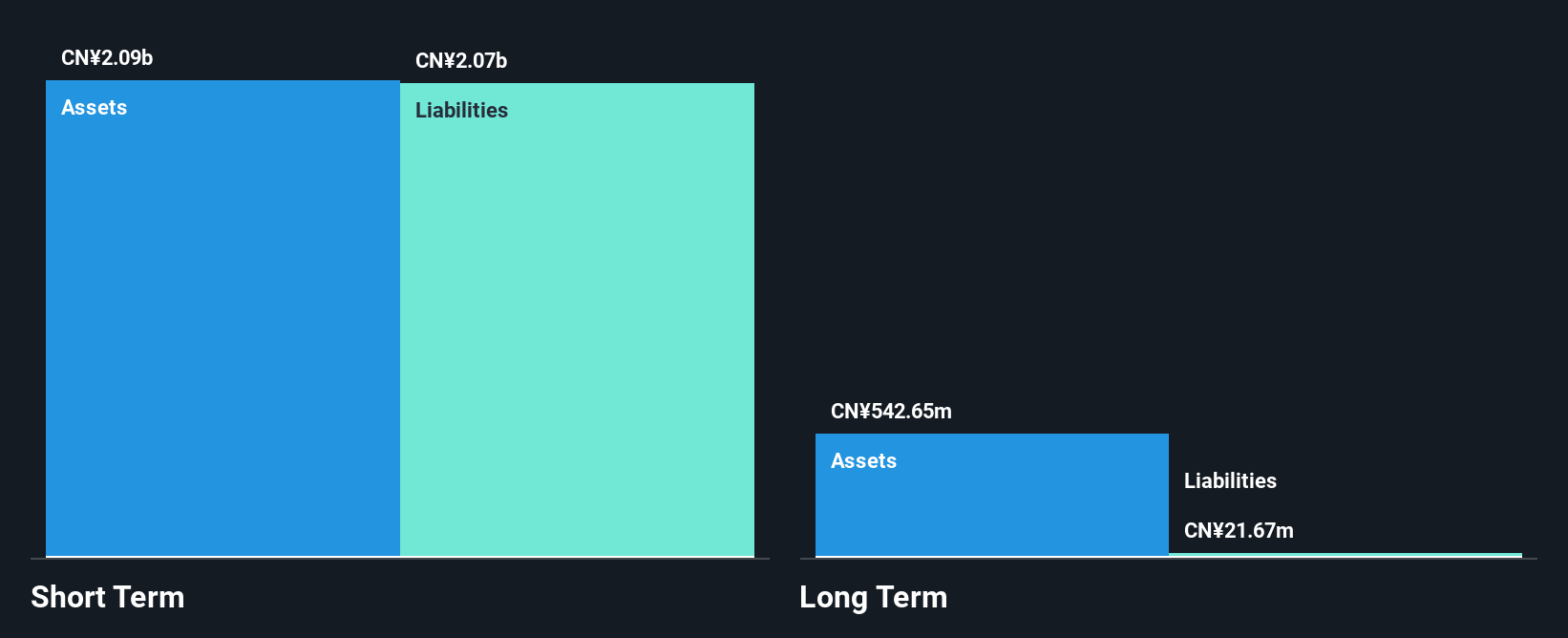

CASIN Real Estate Development Group Ltd. faces challenges with declining revenues, reporting CN¥748.32 million for the first nine months of 2024, down from CN¥3.32 billion the previous year, and a net loss of CN¥6.03 million compared to prior profits. Despite being unprofitable and experiencing increased losses over five years at a rate of 35.4% annually, the company maintains a satisfactory net debt to equity ratio of 29.8%. Short-term assets exceed both short-term and long-term liabilities, providing some financial stability; however, it has less than one year of cash runway if current trends continue without improvement in free cash flow reduction rates.

- Unlock comprehensive insights into our analysis of CASIN Real Estate Development GroupLtd stock in this financial health report.

- Gain insights into CASIN Real Estate Development GroupLtd's historical outcomes by reviewing our past performance report.

Shenzhen Glory MedicalLtd (SZSE:002551)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Glory Medical Co., Ltd. offers hospital construction and medical system integrated solutions both within China and internationally, with a market cap of CN¥3.03 billion.

Operations: There are no specific revenue segments reported for Shenzhen Glory Medical Co., Ltd.

Market Cap: CN¥3.03B

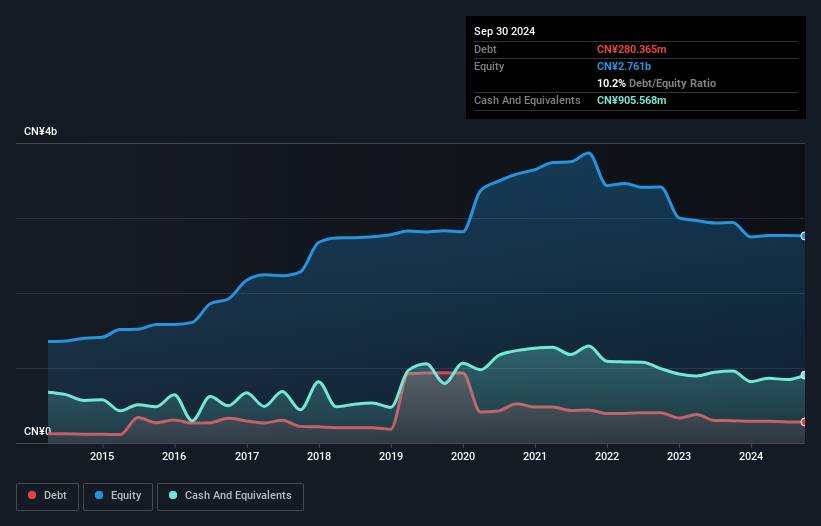

Shenzhen Glory Medical Co., Ltd. has shown financial resilience with short-term assets of CN¥1.9 billion surpassing both its short and long-term liabilities, indicating solid liquidity management. The company's debt to equity ratio has improved significantly over the past five years, now at 10.2%, while it holds more cash than total debt, suggesting prudent financial practices. Despite being unprofitable with a negative return on equity of -5.84%, the company reported revenue growth for the first nine months of 2024 to CN¥1,002.64 million from CN¥918.8 million in the previous year, reflecting some operational progress amidst ongoing challenges.

- Navigate through the intricacies of Shenzhen Glory MedicalLtd with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Shenzhen Glory MedicalLtd's track record.

Where To Now?

- Click here to access our complete index of 5,703 Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000838

CASIN Real Estate Development GroupLtd

CASIN Real Estate Development Group Co.,Ltd.

Excellent balance sheet and slightly overvalued.