- China

- /

- Commercial Services

- /

- SZSE:000711

Unveiling Undiscovered Gems with Potential in January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. indices showing resilience despite economic uncertainties such as a contracting Chicago PMI and revised GDP forecasts, investors are increasingly focused on uncovering opportunities within the small-cap sector. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially when broader market sentiment presents both challenges and openings for discerning investors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Linc (OM:LINC)

Simply Wall St Value Rating: ★★★★★★

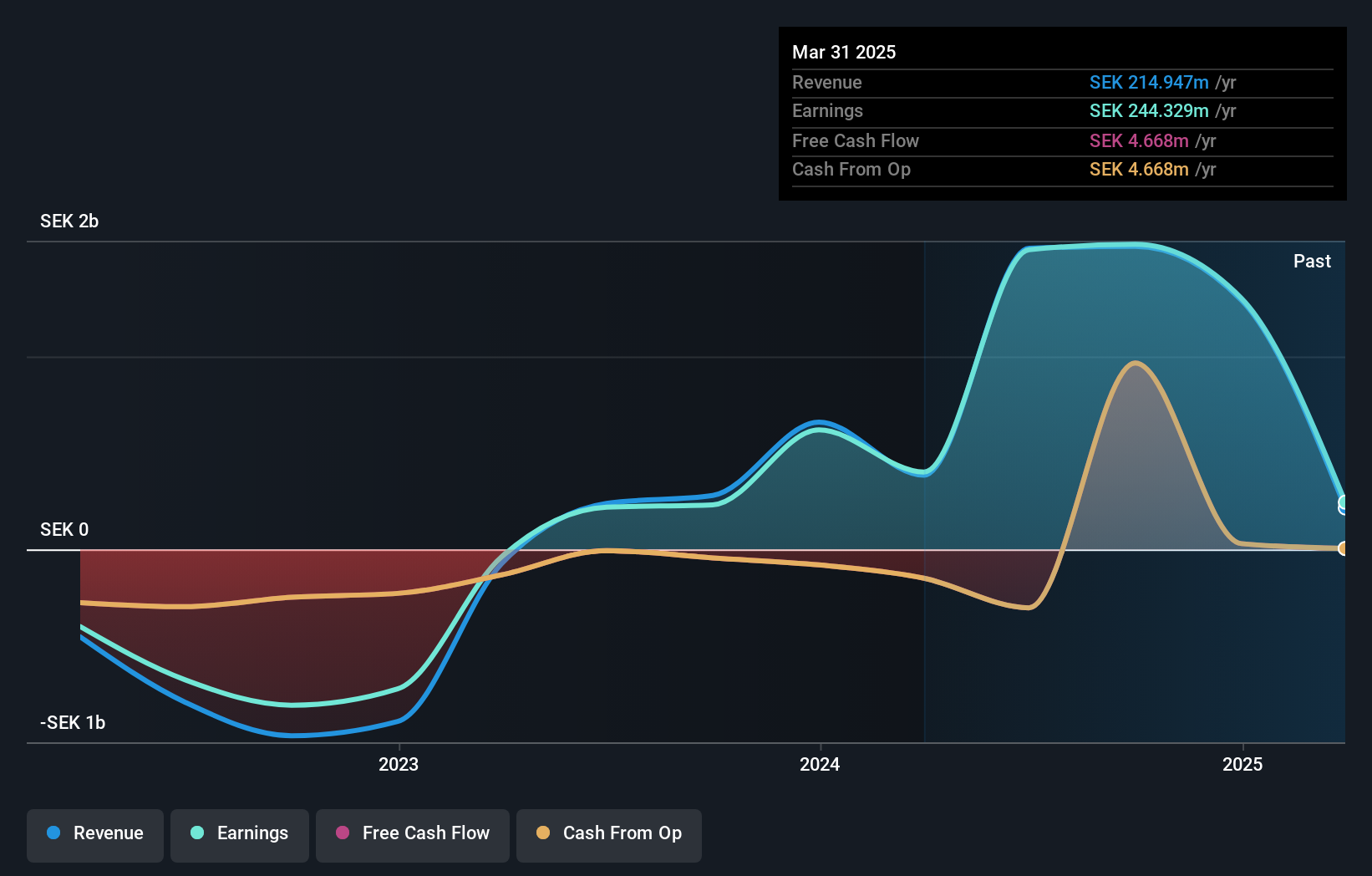

Overview: Linc AB is a private equity and venture capital firm focusing on early and mature stage investments in pharmaceutical, life-science, and med-tech companies, with a market cap of approximately SEK5.25 billion.

Operations: Linc AB generates revenue primarily from its listed holdings, amounting to SEK1.55 billion, with a smaller contribution from unlisted holdings at SEK14.88 million.

Linc, a small cap player in the capital markets, stands out with its impressive earnings growth of 585.3%, significantly surpassing the industry average of 93.7%. Despite being debt-free and boasting a low price-to-earnings ratio of 3.3x compared to Sweden's market average of 23.3x, it faces challenges like significant insider selling recently and being dropped from the OMX Nordic All-Share Index. The company reported a net income surge to SEK 1,090 million for nine months ending September 2024, up from SEK 129 million last year, yet quarterly revenue dipped to SEK 18 million from SEK 28 million previously.

- Unlock comprehensive insights into our analysis of Linc stock in this health report.

Evaluate Linc's historical performance by accessing our past performance report.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

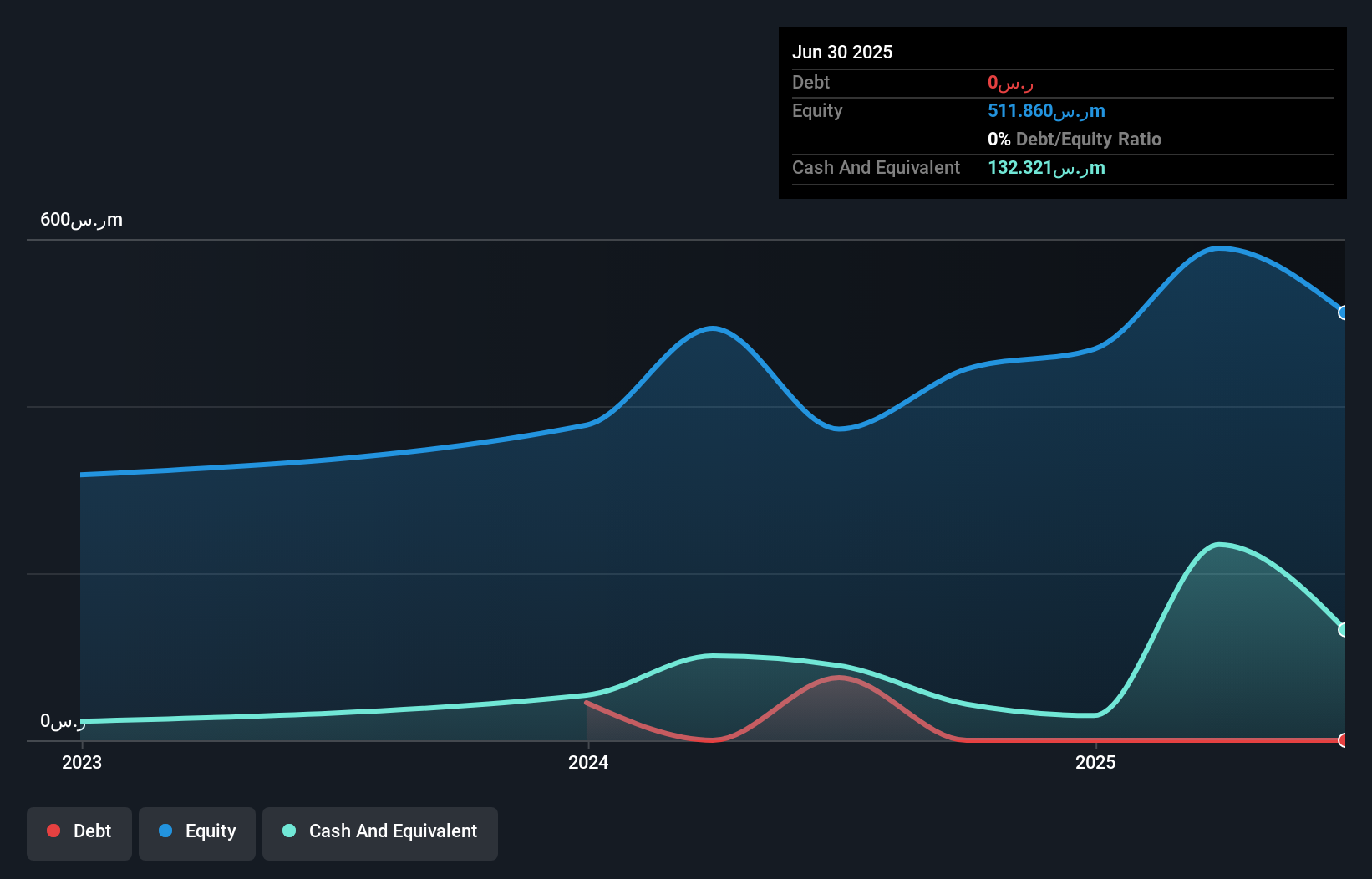

Overview: Al Majed for Oud Company operates in the wholesale and retail perfume trade across Saudi Arabia and the Gulf countries, with a market capitalization of SAR3.74 billion.

Operations: The primary revenue stream for Al Majed for Oud comes from its retail trade in perfumes, generating SAR905.97 million.

Al Majed for Oud, a niche player in the fragrance industry, stands out with its debt-free balance sheet and a price-to-earnings ratio of 21.3x, which is below the South African market average of 23.1x. Over the past year, earnings surged by 22.9%, outpacing the Specialty Retail industry's growth rate of 18%. The company also enjoys high-quality earnings and positive free cash flow, with recent levered free cash flow reported at US$263 million as of September 2024. Despite these strengths, its share price has been highly volatile over the last three months.

- Click here and access our complete health analysis report to understand the dynamics of Al Majed for Oud.

Examine Al Majed for Oud's past performance report to understand how it has performed in the past.

Kingland TechnologyLtd (SZSE:000711)

Simply Wall St Value Rating: ★★★★★★

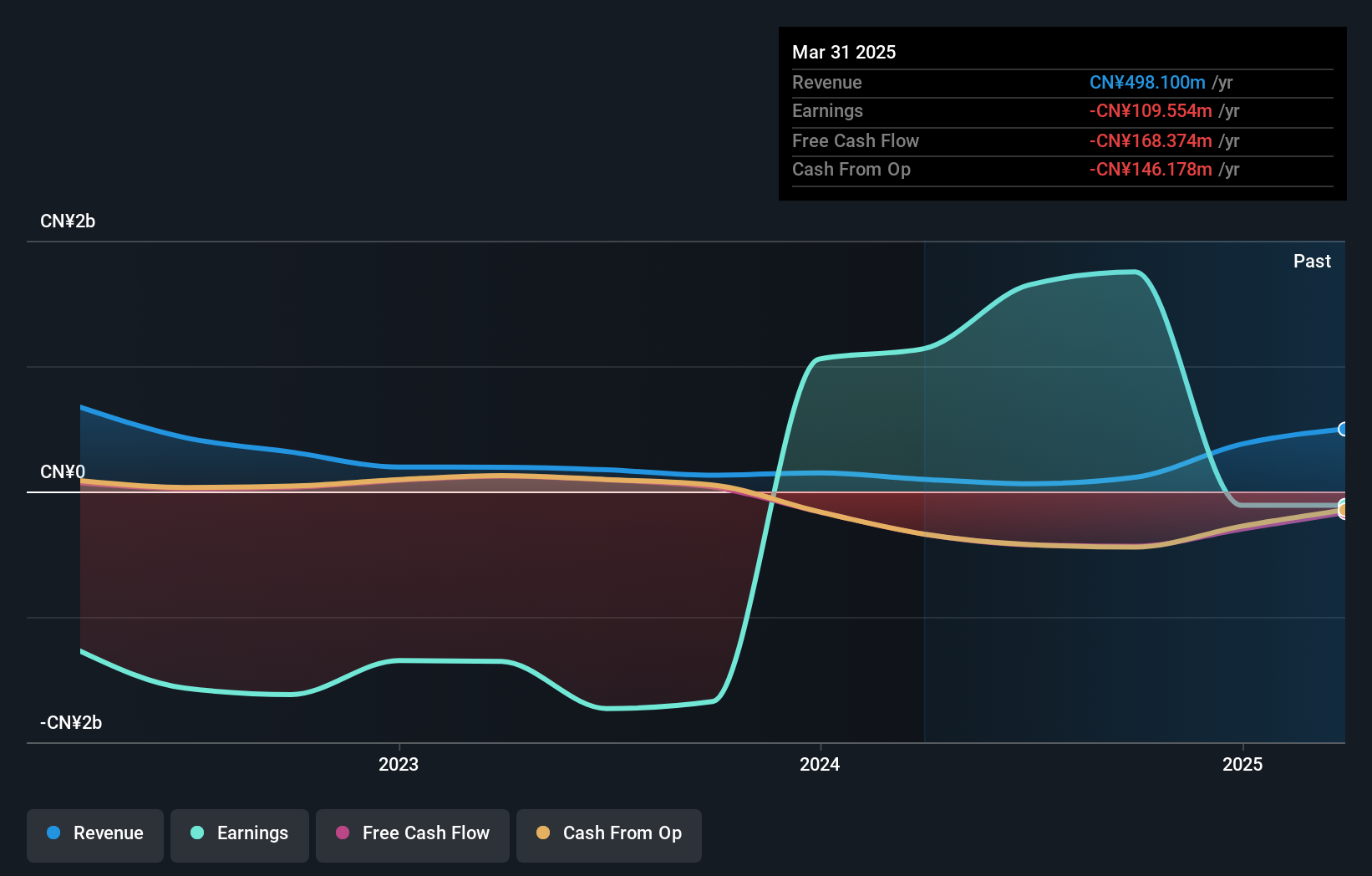

Overview: Kingland Technology Co., Ltd. offers ecological environment solutions in China and has a market capitalization of CN¥4.46 billion.

Operations: Kingland Technology Co., Ltd.'s revenue streams are primarily derived from its ecological environment solutions in China. The company has a market capitalization of CN¥4.46 billion.

Kingland Technology has caught attention with its recent profitability, contrasting the broader Commercial Services industry's 0.9% growth. Its price-to-earnings ratio of 2.5x undercuts the CN market's average of 32.8x, indicating potential undervaluation. Notably debt-free, it eliminates concerns over interest coverage and showcases a high level of non-cash earnings quality. Despite reporting a net loss of CNY 65 million for nine months in 2024, this marks an improvement from CNY 762 million the previous year, suggesting better cost management or revenue strategies might be at play. Recent shareholder meetings and acquisitions highlight active corporate governance and strategic realignments.

- Delve into the full analysis health report here for a deeper understanding of Kingland TechnologyLtd.

Assess Kingland TechnologyLtd's past performance with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 4662 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingland TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000711

Kingland TechnologyLtd

Provides solutions for the ecological environment in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives