- China

- /

- Electronic Equipment and Components

- /

- SHSE:688551

Exploring High Growth Tech Stocks This January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets reflect a mixed sentiment with U.S. stocks closing the year on a strong note despite some volatility, while economic indicators like the Chicago PMI and GDP forecasts highlight ongoing challenges. In this dynamic environment, identifying high growth tech stocks requires careful consideration of factors such as innovation potential and market adaptability, making them appealing options amid fluctuating economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Integrity Technology Group (SHSE:688244)

Simply Wall St Growth Rating: ★★★★★☆

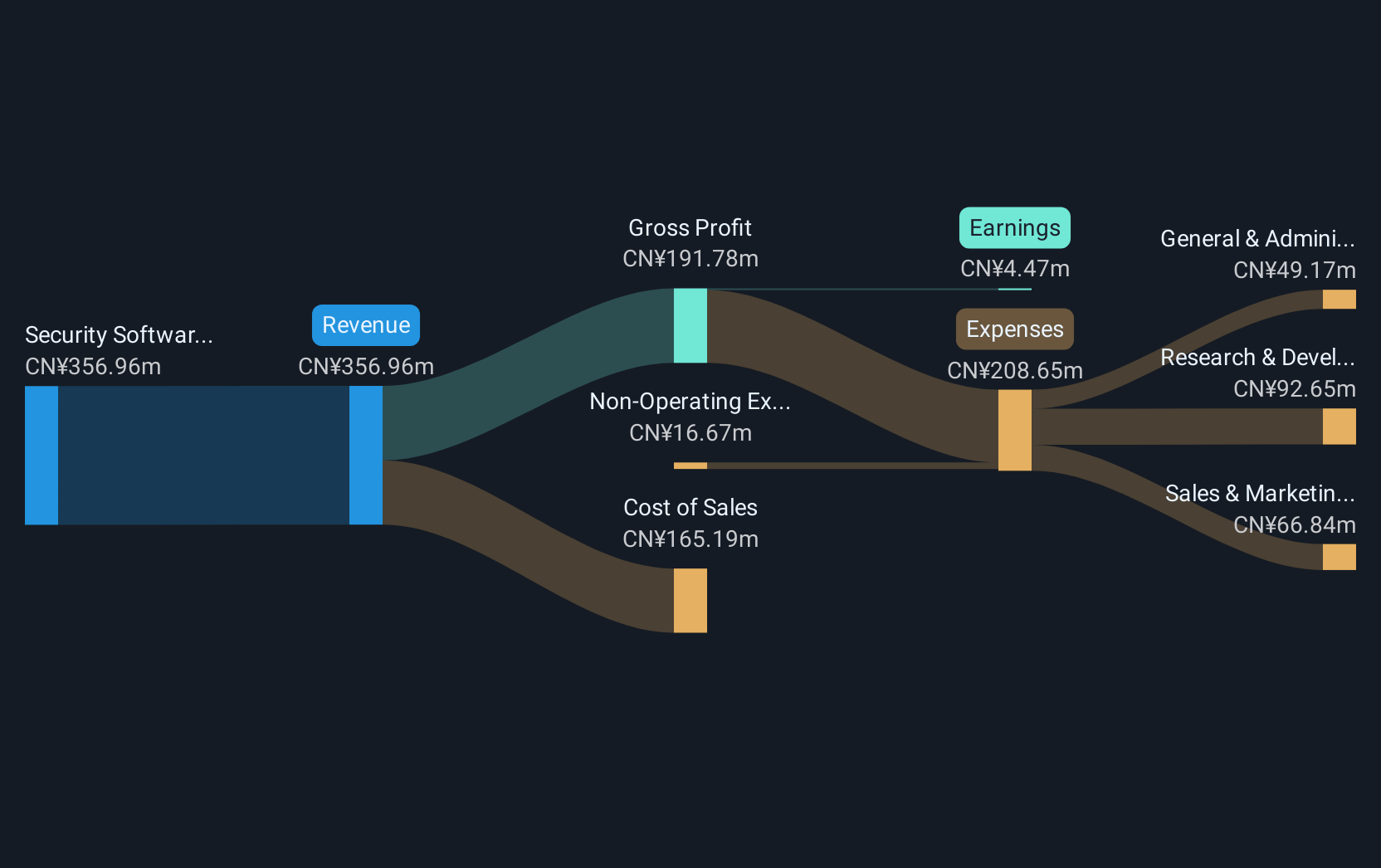

Overview: Integrity Technology Group Inc. is a network security enterprise offering network security solutions in China, with a market capitalization of CN¥2.45 billion.

Operations: Integrity Technology Group generates revenue primarily from its Security Software & Services segment, amounting to CN¥398.07 million. The company focuses on providing network security solutions within the Chinese market.

Integrity Technology Group, despite a challenging fiscal period marked by a net loss of CNY 31.58 million, up from CNY 30.49 million the previous year, demonstrates robust potential with an expected annual revenue growth rate of 28.6%. This figure notably surpasses the broader Chinese market's average of 13.5%, positioning the firm favorably within its sector. Furthermore, anticipated earnings growth at an impressive rate of 51.9% annually could signal recovery and operational optimization ahead. These projections are tempered by current financial strains evident in their recent earnings report and a significant one-off gain of CN¥15.4M that skewed past earnings data, suggesting some volatility in their financial health. However, with strategic focus on R&D—evidenced by substantial investment relative to revenue—the company is poised to innovate and potentially lead in high-growth tech sectors despite short-term hurdles.

Hangzhou Raycloud TechnologyLtd (SHSE:688365)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Raycloud Technology Co., Ltd is an e-commerce software and service technology company with operations in China and internationally, holding a market cap of approximately CN¥4.82 billion.

Operations: Raycloud generates revenue primarily from its internet software and services segment, amounting to CN¥476.40 million.

Hangzhou Raycloud TechnologyLtd has demonstrated resilience and potential for growth, evidenced by a reduction in net loss to CNY 55.74 million from CNY 91.87 million year-over-year, alongside maintaining stable sales figures around CNY 352.63 million. The firm's commitment to innovation is underscored by its R&D investments, which are crucial for staying competitive in the tech sector. Despite current financial strains and market volatility, Raycloud's projected earnings growth of 71.3% annually outpaces the broader Chinese market forecast of 25%, positioning it for potential leadership in its field if it continues on this trajectory.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

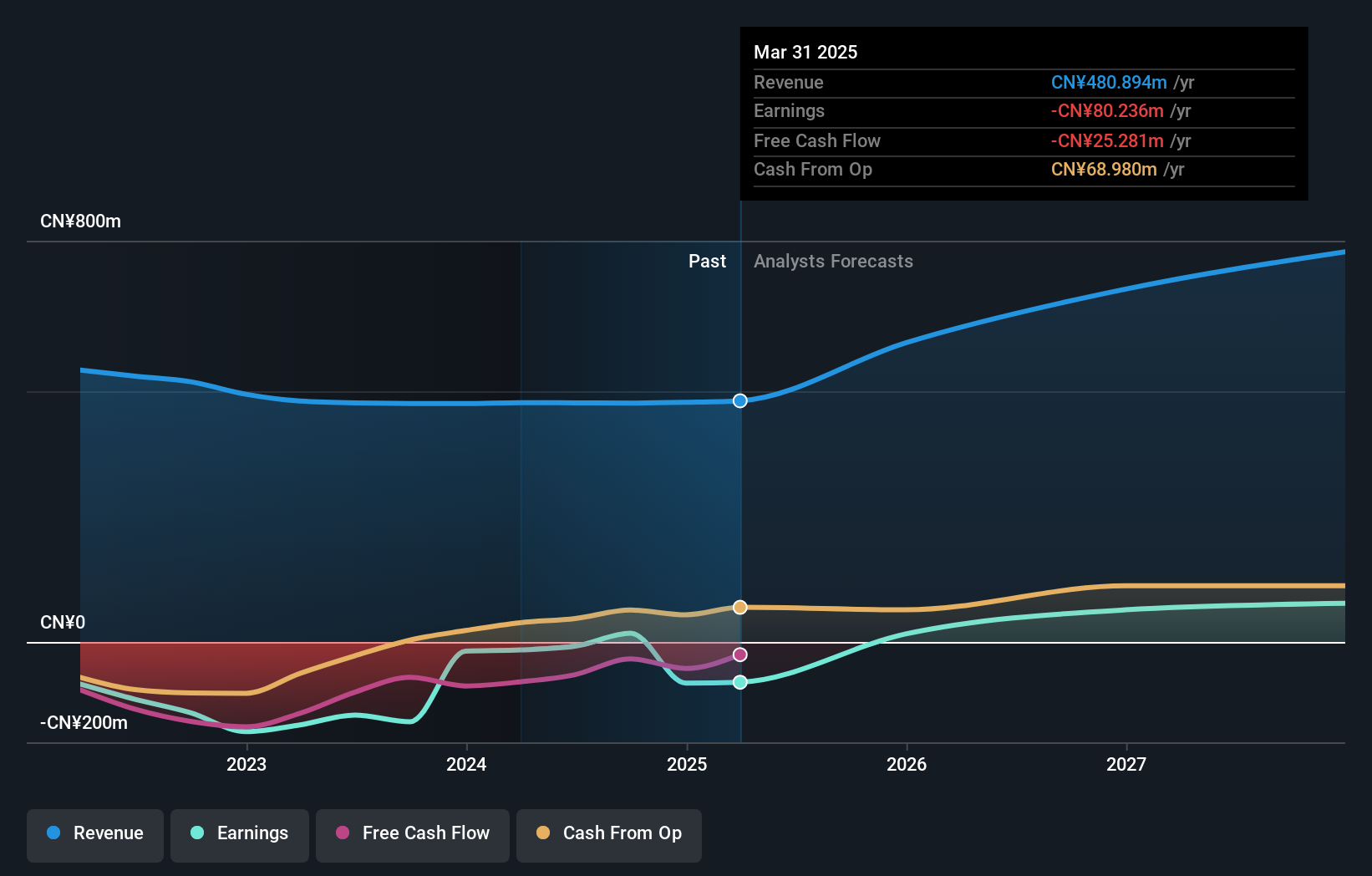

Overview: Hefei Kewell Power System Co., Ltd. is involved in the manufacture and sale of test power supplies and systems in China, with a market capitalization of approximately CN¥2.23 billion.

Operations: Hefei Kewell Power System Co., Ltd. focuses on the production and distribution of test power supplies and systems within China. The company operates with a market capitalization of around CN¥2.23 billion, reflecting its established presence in this niche sector.

Hefei Kewell Power System has been actively enhancing shareholder value, as evidenced by its recent share repurchases totaling CNY 20.3 million, reflecting a strategic commitment to bolster investor confidence. Despite a dip in net income from CNY 75.33 million to CNY 51.64 million year-over-year, the company's revenue growth remains robust at 35.5% annually, outpacing the broader Chinese market's growth rate of 13.5%. This performance is underpinned by significant investments in R&D, crucial for sustaining innovation and competitiveness in the rapidly evolving tech landscape.

Where To Now?

- Embark on your investment journey to our 1267 High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Kewell Power SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688551

Hefei Kewell Power SystemLtd

Provides testing equipment for test systems and intelligent manufacturing equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives