In recent weeks, global markets have shown resilience despite the U.S. government shutdown, with small-cap stocks in particular benefiting from expectations of potential interest rate cuts by the Federal Reserve. The Russell 2000 Index has notably outperformed larger indices like the S&P 500, highlighting a favorable environment for small-cap companies that are typically more sensitive to changes in interest rates. In this context, identifying promising small-cap stocks involves looking for those with strong fundamentals and positive insider activity, which can signal confidence in their potential growth amidst current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.0x | 1.3x | 31.97% | ★★★★★★ |

| Bumitama Agri | 10.3x | 1.5x | 49.44% | ★★★★☆☆ |

| Bytes Technology Group | 17.8x | 4.5x | 10.01% | ★★★★☆☆ |

| Speedy Hire | NA | 0.3x | 19.47% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.03% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 13.13% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 20.91% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -73.36% | ★★★★☆☆ |

| GDI Integrated Facility Services | 19.0x | 0.3x | -0.39% | ★★★☆☆☆ |

| Cettire | NA | 0.4x | 9.71% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

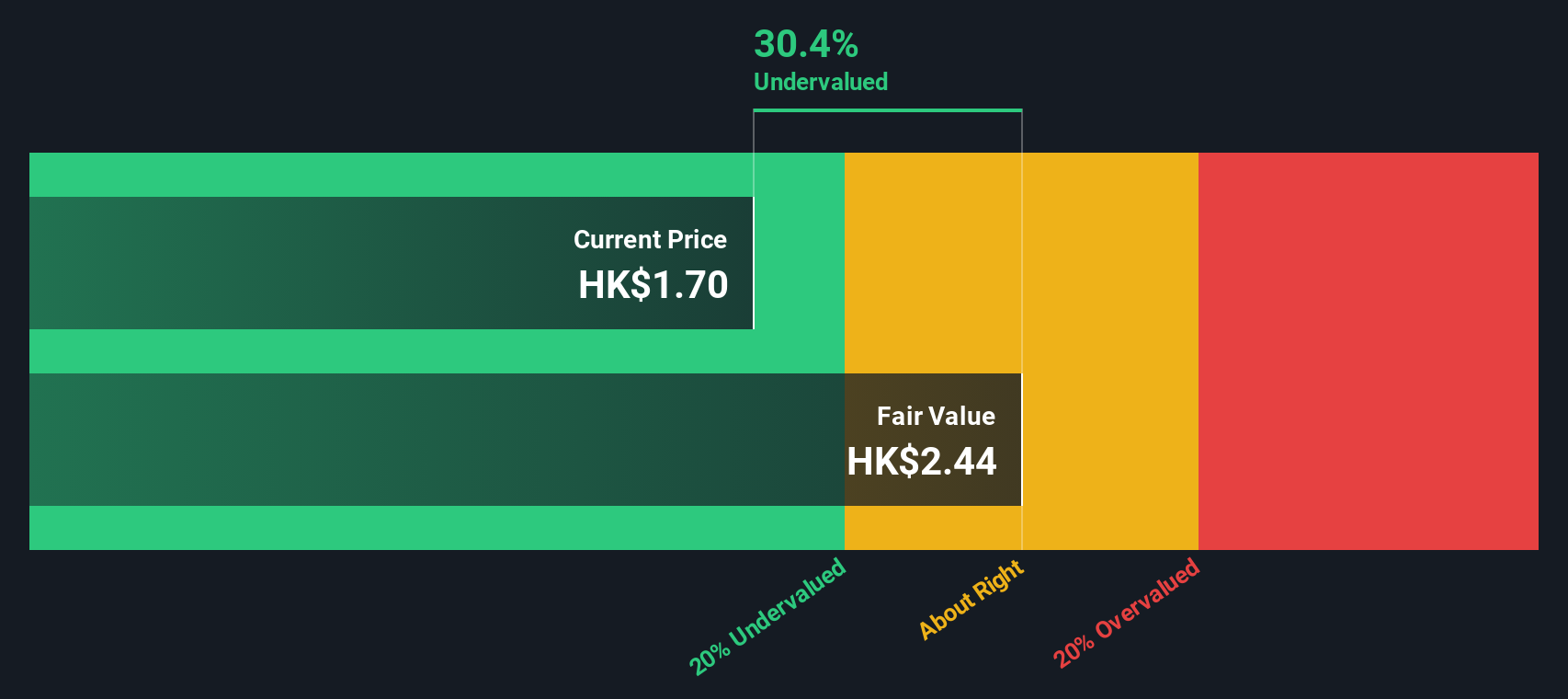

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sinofert Holdings is a leading integrated agricultural input company in China, focusing on the production and distribution of fertilizers, with a market capitalization of approximately CN¥4.88 billion.

Operations: Sinofert Holdings generates revenue primarily from its Basic Business and Growth Business segments, with the latter contributing significantly to overall revenue. A notable trend is observed in the gross profit margin, which has shown an increase over time, reaching 12.84% as of June 2025. The company faces substantial cost of goods sold (COGS), which impacts its profitability despite improvements in gross margins. Operating expenses are also a key component of its cost structure, including significant allocations for sales and marketing as well as general and administrative expenses.

PE: 8.2x

Sinofert Holdings, a smaller player in its industry, has shown insider confidence through Tielin Wang's purchase of 450,000 shares for CNY 640,000 in August 2025. Despite relying on higher-risk external borrowing for funding, the company reported increased sales of CNY 14.7 billion and net income of CNY 1.1 billion for the first half of 2025. With earnings expected to grow annually by over 15%, Sinofert's potential remains promising amidst recent executive changes enhancing governance expertise.

- Delve into the full analysis valuation report here for a deeper understanding of Sinofert Holdings.

Understand Sinofert Holdings' track record by examining our Past report.

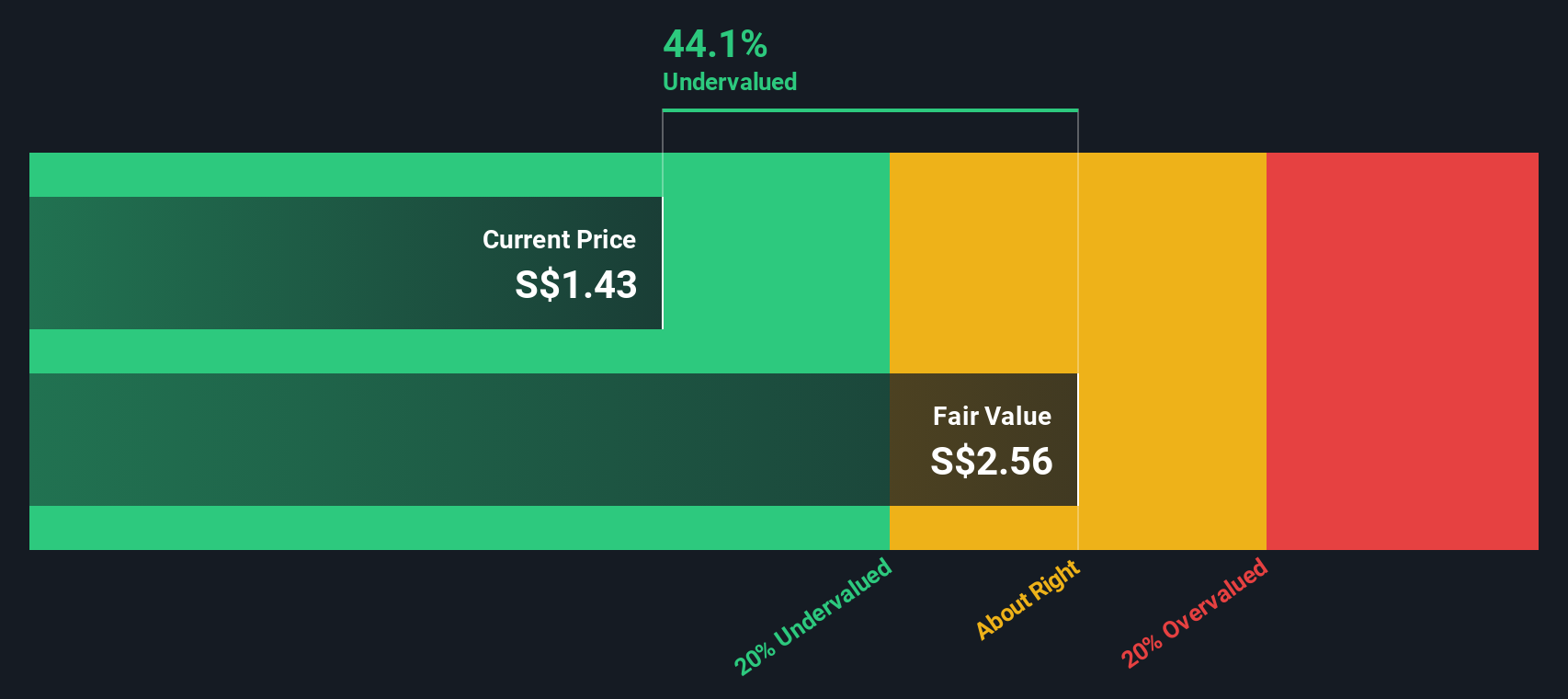

Bumitama Agri (SGX:P8Z)

Simply Wall St Value Rating: ★★★★☆☆

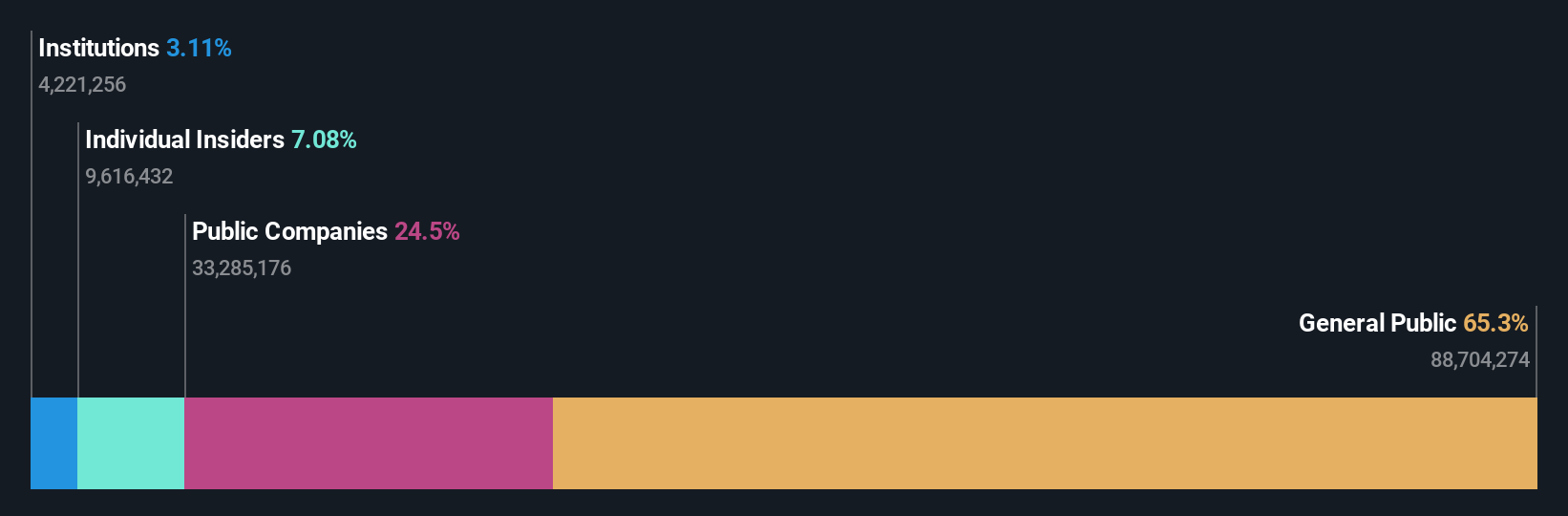

Overview: Bumitama Agri is a company engaged in the cultivation of oil palm plantations and the production of crude palm oil, with a market capitalization of approximately S$1.44 billion.

Operations: The primary revenue stream for the company is from its Plantations and Palm Oil Mills segment, generating IDR 18.87 billion. The cost of goods sold (COGS) has been a significant expense, amounting to IDR 13.57 billion in the latest period, impacting gross profit margins which have shown fluctuations over time, recently recorded at 28.12%. Operating expenses include general and administrative costs as well as sales and marketing expenses, contributing to overall financial performance. Net income margin has demonstrated variability across periods, reflecting changes in both operating efficiency and external factors affecting profitability.

PE: 10.3x

Bumitama Agri's sales surged to IDR 9.7 trillion for the first half of 2025, up from IDR 7.6 trillion last year, with net income climbing to IDR 1.3 trillion from IDR 857 billion. Basic earnings per share rose to IDR 730 from IDR 494, reflecting strong operational performance despite reliance on external borrowing for funding. Insider confidence was evident with recent share purchases in July and August, suggesting optimism about future growth prospects as earnings are projected to grow annually by over 10%.

- Click here and access our complete valuation analysis report to understand the dynamics of Bumitama Agri.

Assess Bumitama Agri's past performance with our detailed historical performance reports.

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sagicor Financial operates as a diversified financial services company with key segments in life insurance and financial services across various regions, including the Caribbean, Canada, and the United States, and has a market capitalization of approximately $1.95 billion.

Operations: Sagicor Financial's revenue is primarily derived from its operations in Canada, Jamaica, and life insurance services across various regions. The company has experienced fluctuations in its gross profit margin, with a notable increase to 52.64% by September 2023. Operating expenses have varied over time but are a significant component of the company's cost structure.

PE: 7.0x

Sagicor Financial, a smaller company in the financial sector, has shown potential for growth despite recent challenges. Earnings are forecasted to grow 13.78% annually, although profit margins have decreased from 25.2% to 5.5%. The appointment of David Noel as Executive Vice President and COO could enhance operational strategy across the Caribbean. Insider confidence is evident with Gilbert Palter's purchase of 25,317 shares valued at US$207,668 in September 2025, reflecting belief in future prospects despite current net losses and reliance on external borrowing for funding.

Seize The Opportunity

- Unlock more gems! Our Undervalued Global Small Caps With Insider Buying screener has unearthed 107 more companies for you to explore.Click here to unveil our expertly curated list of 110 Undervalued Global Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trading of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives