Global markets have been buoyant, with major benchmarks reaching record highs following a U.S. election outcome that has stirred hopes for economic growth and regulatory easing. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite being considered somewhat outdated. These stocks can offer unique opportunities for growth at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.36B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.11M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.84 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6025 | A$72.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

Click here to see the full list of 5,795 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Yangzhou Guangling District Taihe Rural Micro-finance (SEHK:1915)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yangzhou Guangling District Taihe Rural Micro-finance Company Limited provides loans to agriculture, rural areas, and farmers in the People’s Republic of China with a market cap of HK$288 million.

Operations: The company's revenue segment is primarily from its loan business, which generated -CN¥569.20 million.

Market Cap: HK$288M

Yangzhou Guangling District Taihe Rural Micro-finance, with a market cap of HK$288 million, operates in the loan business sector. Despite being debt-free and having short-term assets (CN¥861.9M) that exceed its liabilities, the company remains unprofitable with increasing losses over the past five years at a rate of 65.3% per year. Its management team is seasoned; however, recent board changes highlight potential governance challenges. The stock's high volatility and lack of earnings growth present risks typical for such investments in penny stocks, compounded by its negative return on equity (-0.58%).

- Get an in-depth perspective on Yangzhou Guangling District Taihe Rural Micro-finance's performance by reading our balance sheet health report here.

- Gain insights into Yangzhou Guangling District Taihe Rural Micro-finance's historical outcomes by reviewing our past performance report.

Mewah International (SGX:MV4)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mewah International Inc. is an investment holding company that manufactures, refines, and sells vegetable oil products across various regions including Malaysia, Singapore, Asia, Africa, the Middle East, Pacific Oceania, the United States, and Europe with a market cap of SGD412.68 million.

Operations: The company's revenue is primarily derived from its Bulk segment, contributing $2.97 billion, and the Consumer Pack segment, which accounts for $1.20 billion.

Market Cap: SGD412.68M

Mewah International, with a market cap of SGD412.68 million, shows mixed financial health typical of penny stocks. Its revenue is substantial, driven by its Bulk and Consumer Pack segments at US$2.97 billion and US$1.20 billion respectively. Despite this, recent negative earnings growth (-55.3%) contrasts with past five-year annual growth of 15.9%. The company's debt management has improved, reducing its debt to equity ratio from 71.5% to 55.2%, although operating cash flow coverage remains weak (13.4%). While short-term assets exceed liabilities comfortably, low return on equity (5.7%) suggests limited profitability improvement potential in the near term.

- Dive into the specifics of Mewah International here with our thorough balance sheet health report.

- Evaluate Mewah International's historical performance by accessing our past performance report.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD409.95 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.39 billion, complemented by contributions of CN¥203 million from Heating Power and CN¥25.06 million from Waste Treatment.

Market Cap: SGD409.95M

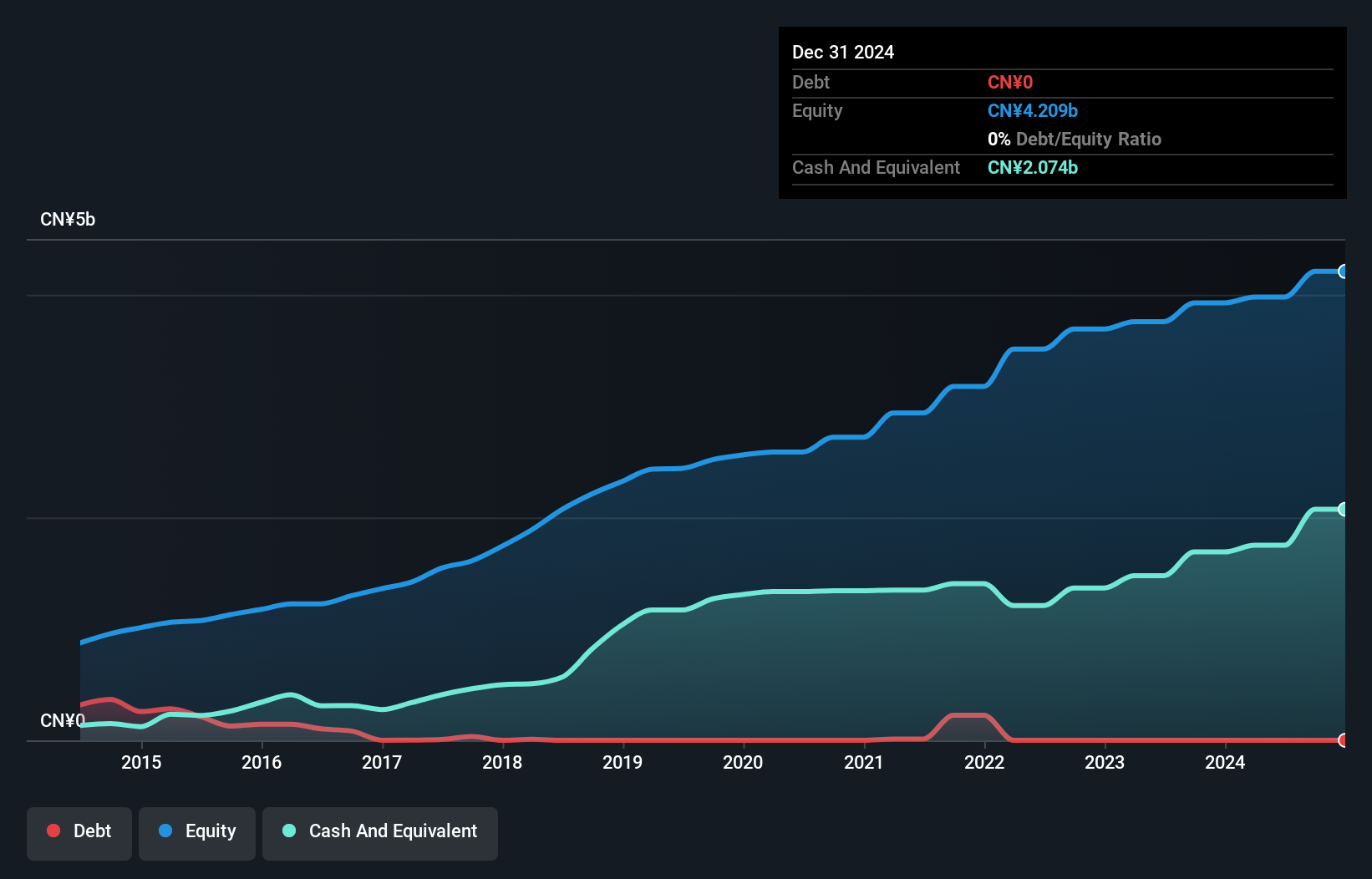

China Sunsine Chemical Holdings, with a market cap of SGD409.95 million, demonstrates financial characteristics relevant to penny stocks. Its primary revenue stream from the Rubber Chemicals segment amounts to CN¥4.39 billion, supplemented by smaller contributions from Heating Power and Waste Treatment. The company is debt-free, alleviating concerns over interest payments and long-term liabilities. However, recent negative earnings growth (-10.5%) contrasts with its five-year annual growth of 5.3%, and its return on equity remains low at 9.2%. Despite trading significantly below estimated fair value (76%), its dividend track record is unstable and net profit margins have declined year-on-year.

- Unlock comprehensive insights into our analysis of China Sunsine Chemical Holdings stock in this financial health report.

- Evaluate China Sunsine Chemical Holdings' prospects by accessing our earnings growth report.

Taking Advantage

- Click this link to deep-dive into the 5,795 companies within our Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives