Fraser and Neave, Limited (SGX:F99) will pay a dividend of S$0.015 on the 6th of June. Based on this payment, the dividend yield will be 3.7%, which is fairly typical for the industry.

Check out our latest analysis for Fraser and Neave

Fraser and Neave's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, Fraser and Neave was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

If the trend of the last few years continues, EPS will grow by 5.4% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 52%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

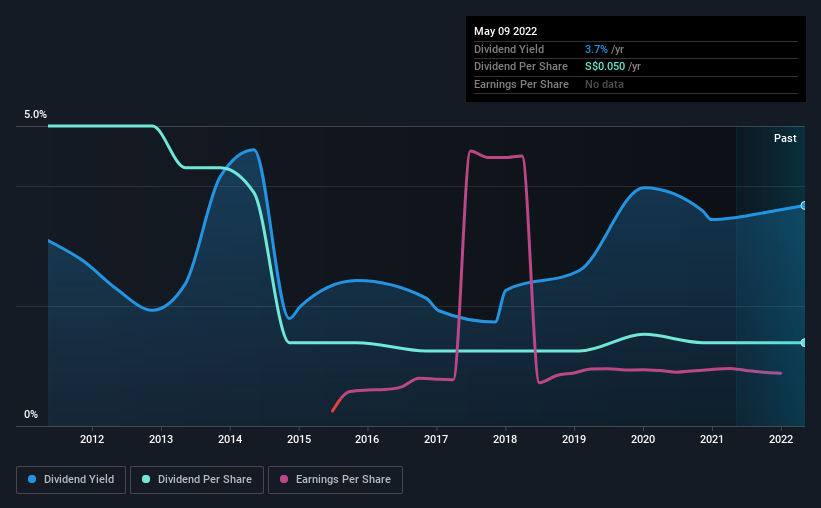

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from S$0.18 in 2012 to the most recent annual payment of S$0.05. This works out to a decline of approximately 72% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

We Could See Fraser and Neave's Dividend Growing

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Fraser and Neave has grown earnings per share at 5.4% per year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Fraser and Neave (1 is potentially serious!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F99

Fraser and Neave

Engages in the food and beverage, and publishing and printing businesses in Singapore, Malaysia, Thailand, Vietnam, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026