- Taiwan

- /

- Consumer Durables

- /

- TWSE:6807

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff pause, Asian indices have shown resilience, with Chinese stocks rallying on the news and Japan's markets experiencing modest gains. In this environment of cautious optimism, dividend stocks can offer a stable income stream and potential capital appreciation, making them an attractive consideration for investors seeking to navigate current market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.91% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.94% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.13% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.71% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.05% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.02% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

Click here to see the full list of 1247 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

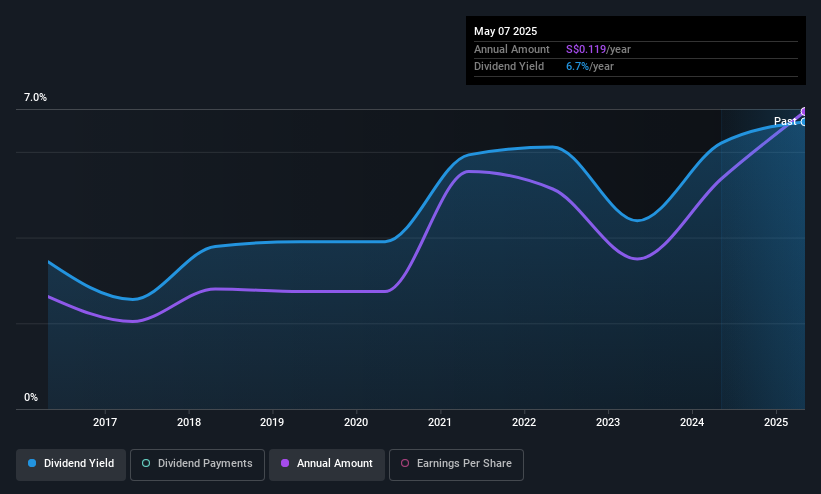

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and research services with a market capitalization of SGD1.67 billion.

Operations: The company's revenue primarily comes from Securities and Futures Broking and Other Related Services, totaling SGD631.69 million.

Dividend Yield: 6.6%

UOB-Kay Hian Holdings offers a dividend yield of 6.65%, placing it in the top 25% of Singaporean market dividend payers, though its payments have been volatile over the past decade. Despite a low payout ratio of 48.7%, dividends are not well covered by free cash flows, as the company lacks them entirely. Recent earnings growth and an increased annual dividend to S$0.119 per share highlight potential for income investors, but sustainability concerns remain due to non-cash earnings reliance.

- Delve into the full analysis dividend report here for a deeper understanding of UOB-Kay Hian Holdings.

- Upon reviewing our latest valuation report, UOB-Kay Hian Holdings' share price might be too pessimistic.

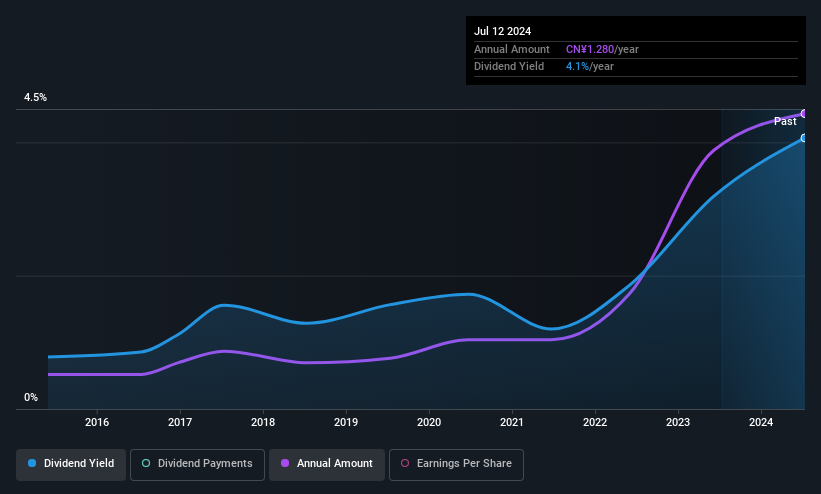

Tianjin Pharmaceutical Da Ren Tang Group (SHSE:600329)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited, along with its subsidiaries, produces and sells traditional Chinese and western medicine primarily in the People’s Republic of China, with a market cap of CN¥21.78 billion.

Operations: Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited generates revenue through the production and sale of traditional Chinese medicine, western medicine, and additional products within China.

Dividend Yield: 4%

Tianjin Pharmaceutical Da Ren Tang Group's dividend yield of 3.97% ranks it among the top 25% in China's market. Despite a low payout ratio of 44.2%, dividends are covered by earnings and cash flows, though past payments have been volatile. Recent earnings growth is notable; however, a decline in Q1 revenue to CNY 1.46 billion raises concerns about future stability. The board has recommended an RMB 12.80 per ten shares dividend for FY2024, reflecting ongoing commitment to shareholder returns amidst fluctuating performance.

- Unlock comprehensive insights into our analysis of Tianjin Pharmaceutical Da Ren Tang Group stock in this dividend report.

- Our valuation report here indicates Tianjin Pharmaceutical Da Ren Tang Group may be undervalued.

FY Group (TWSE:6807)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FY Group Ltd. is involved in the research, development, manufacture, and sale of indoor furniture across Taiwan, Europe, the United States, and Japan with a market cap of NT$4.46 billion.

Operations: FY Group Ltd.'s revenue primarily comes from its Furniture & Fixtures segment, totaling NT$5.17 billion.

Dividend Yield: 5.4%

FY Group's recent earnings report shows a solid financial performance with Q1 2025 net income rising to TWD 102.63 million from TWD 94.37 million the previous year, supporting its dividend strategy. The company declared a cash dividend of TWD 4.5 per share for FY2024, totaling TWD 243 million, with dividends covered by earnings (payout ratio: 50.7%) and cash flows (cash payout ratio: 56.6%). Its P/E ratio of 9.1x is favorable compared to the Taiwan market average of 18.7x, enhancing its appeal for value investors seeking reliable income streams in Asia's dividend landscape.

- Click here to discover the nuances of FY Group with our detailed analytical dividend report.

- The analysis detailed in our FY Group valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Dive into all 1247 of the Top Asian Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6807

FY Group

Engages in the research, development, manufacture, and sale of indoor furniture in Taiwan, Europe, the United States, and Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives