Top Asian Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by mixed economic signals and evolving monetary policies, investors are increasingly focusing on growth opportunities within the region. In this context, companies with high insider ownership often attract attention due to the potential alignment of interests between management and shareholders, which can be particularly appealing in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★★

Overview: APR Co., Ltd. manufactures and sells cosmetic products for men and women, with a market cap of ₩9.54 trillion.

Operations: The company's revenue is segmented into Cosmetics at ₩1.25 billion, Coordination at -₩285.69 million, and Apparel Fashion at ₩43.61 million.

Insider Ownership: 34.7%

APR Co., Ltd. is trading below its estimated fair value, suggesting potential for upside. Despite recent share price volatility, the company forecasts robust revenue growth of 30.5% annually, outpacing the broader market. Earnings are also expected to rise significantly at 34.6% per year over the next three years with a very high projected return on equity of 50.7%. However, its dividend yield of 2.82% is not well covered by free cash flows, indicating possible sustainability concerns. Recent events include participation in multiple investor conferences and completion of a share buyback program worth KRW 30 billion (approximately US$22 million).

- Unlock comprehensive insights into our analysis of APR stock in this growth report.

- Our valuation report here indicates APR may be overvalued.

Zhejiang Leapmotor Technology (SEHK:9863)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles in Mainland China and internationally, with a market cap of HK$95.90 billion.

Operations: The company generates revenue of CN¥47.57 billion from its activities in the production, research and development, and sales of new energy vehicles.

Insider Ownership: 14.6%

Zhejiang Leapmotor Technology exhibits significant growth potential, with revenue expected to rise 30.3% annually, surpassing market averages. Despite recent insider selling, the company has attracted substantial investment through a CNY 2.6 billion private placement. Recent sales figures show strong momentum with August vehicle sales growing over 88% year-on-year. The company turned profitable in the first half of 2025 with net income of CNY 33.03 million compared to a prior loss, indicating improving financial health and operational efficiency.

- Dive into the specifics of Zhejiang Leapmotor Technology here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Zhejiang Leapmotor Technology is priced lower than what may be justified by its financials.

Sheng Siong Group (SGX:OV8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.23 billion.

Operations: The company's revenue primarily comes from its supermarket operations selling consumer goods, amounting to SGD1.48 billion.

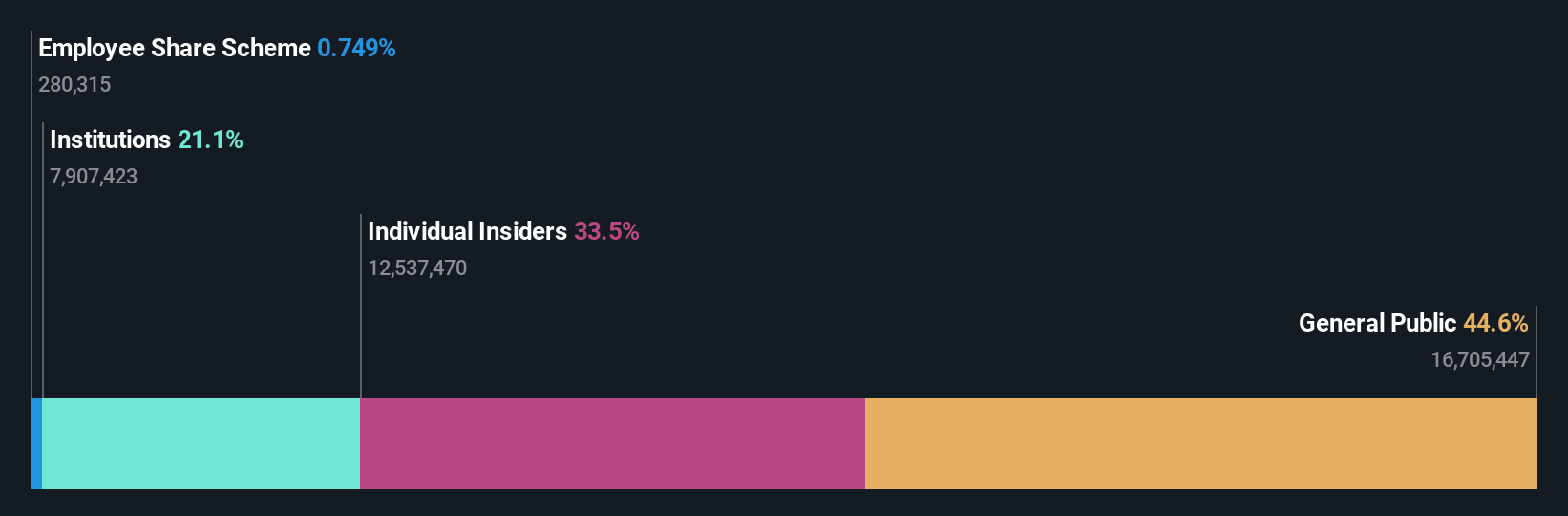

Insider Ownership: 26.5%

Sheng Siong Group shows moderate growth potential, with revenue expected to grow 5.6% annually, outpacing the Singapore market average of 3.8%. Recent earnings results reflect a steady increase in sales and net income, indicating operational stability. Despite an unstable dividend track record, the company recently affirmed an interim dividend payment. Trading significantly below fair value estimates suggests potential undervaluation. High insider ownership aligns interests with shareholders but lacks recent insider trading activity for further insights.

- Navigate through the intricacies of Sheng Siong Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Sheng Siong Group is trading beyond its estimated value.

Key Takeaways

- Delve into our full catalog of 617 Fast Growing Asian Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Leapmotor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9863

Zhejiang Leapmotor Technology

Engages in the research and development, production, and sale of new energy vehicles in Mainland China and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives