- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

Spotlight On 3 Global Penny Stocks With Market Caps Under US$700M

Reviewed by Simply Wall St

Global markets have been experiencing mixed performances, with major U.S. stock indexes reaching all-time highs amid the Federal Reserve's interest rate cuts, while technology stocks faced renewed valuation concerns. In such a fluctuating market landscape, identifying investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, though sometimes overlooked due to their vintage connotation, can still present valuable opportunities in smaller or newer companies with strong balance sheets and long-term prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.49 | SGD13.74B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.61 | $354.61M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.95 | A$135.3M | ✅ 4 ⚠️ 3 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$243.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,612 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.92 billion.

Operations: The company generates revenue of SGD1.53 billion from its supermarket operations selling consumer goods.

Market Cap: SGD3.92B

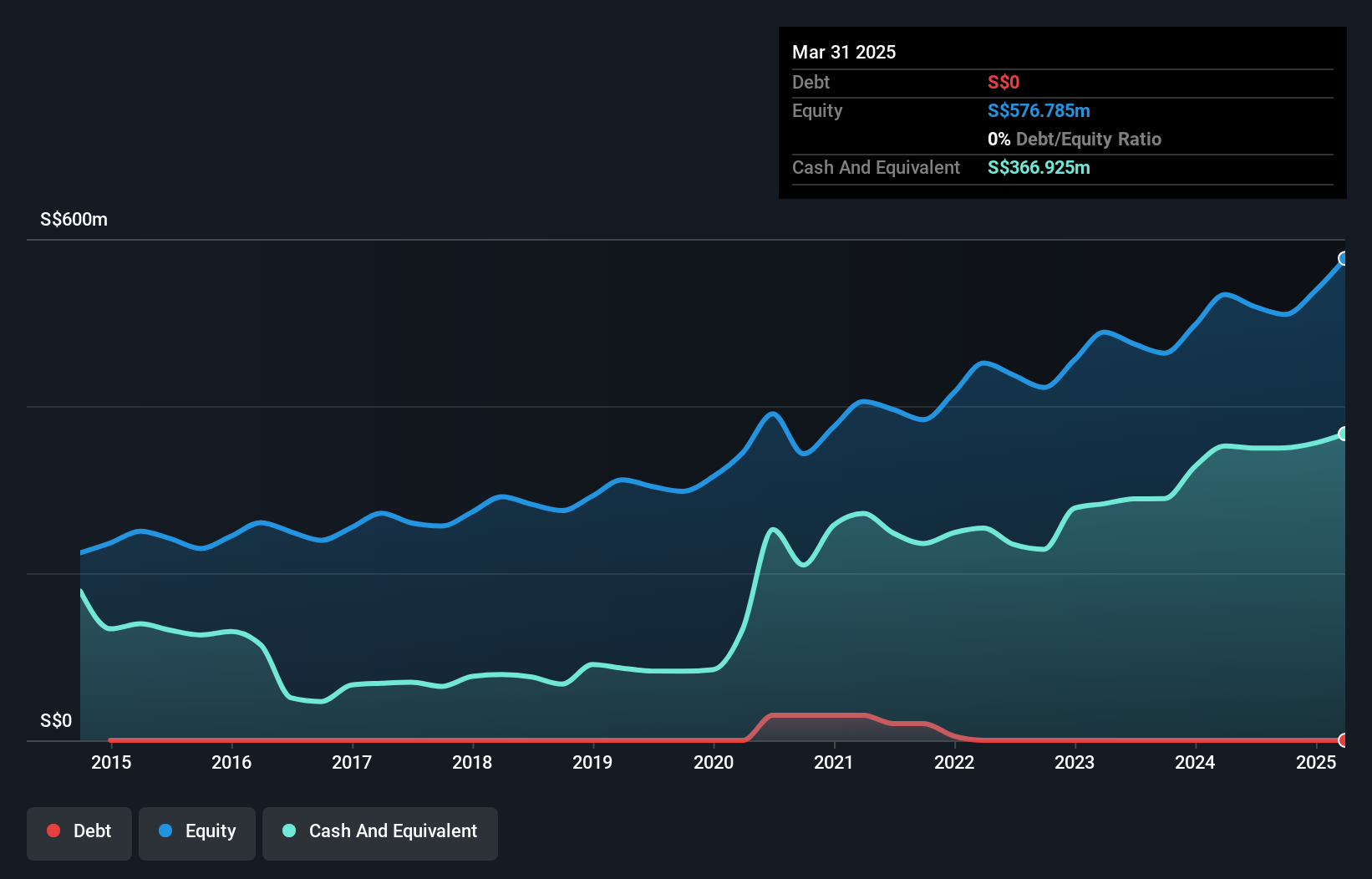

Sheng Siong Group Ltd, with a market cap of SGD3.92 billion, operates debt-free and boasts a seasoned management team with an average tenure of 8.6 years. The company's short-term assets (SGD499.2M) comfortably cover both its short-term (SGD312.8M) and long-term liabilities (SGD67.2M). Despite a stable weekly volatility of 3%, the company has shown modest earnings growth of 1.4% over the past year, underperforming the industry average but maintaining high-quality earnings and a strong return on equity at 25.9%. Recent results show increased sales and net income for Q3 2025 compared to last year, reflecting steady operational performance despite an unstable dividend track record.

- Click here to discover the nuances of Sheng Siong Group with our detailed analytical financial health report.

- Learn about Sheng Siong Group's future growth trajectory here.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd focuses on constructing and operating water treatment and environmental protection projects, as well as energy-saving and clean energy transformation initiatives in China, with a market cap of CN¥3.92 billion.

Operations: Heilongjiang Interchina Water Treatment Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.92B

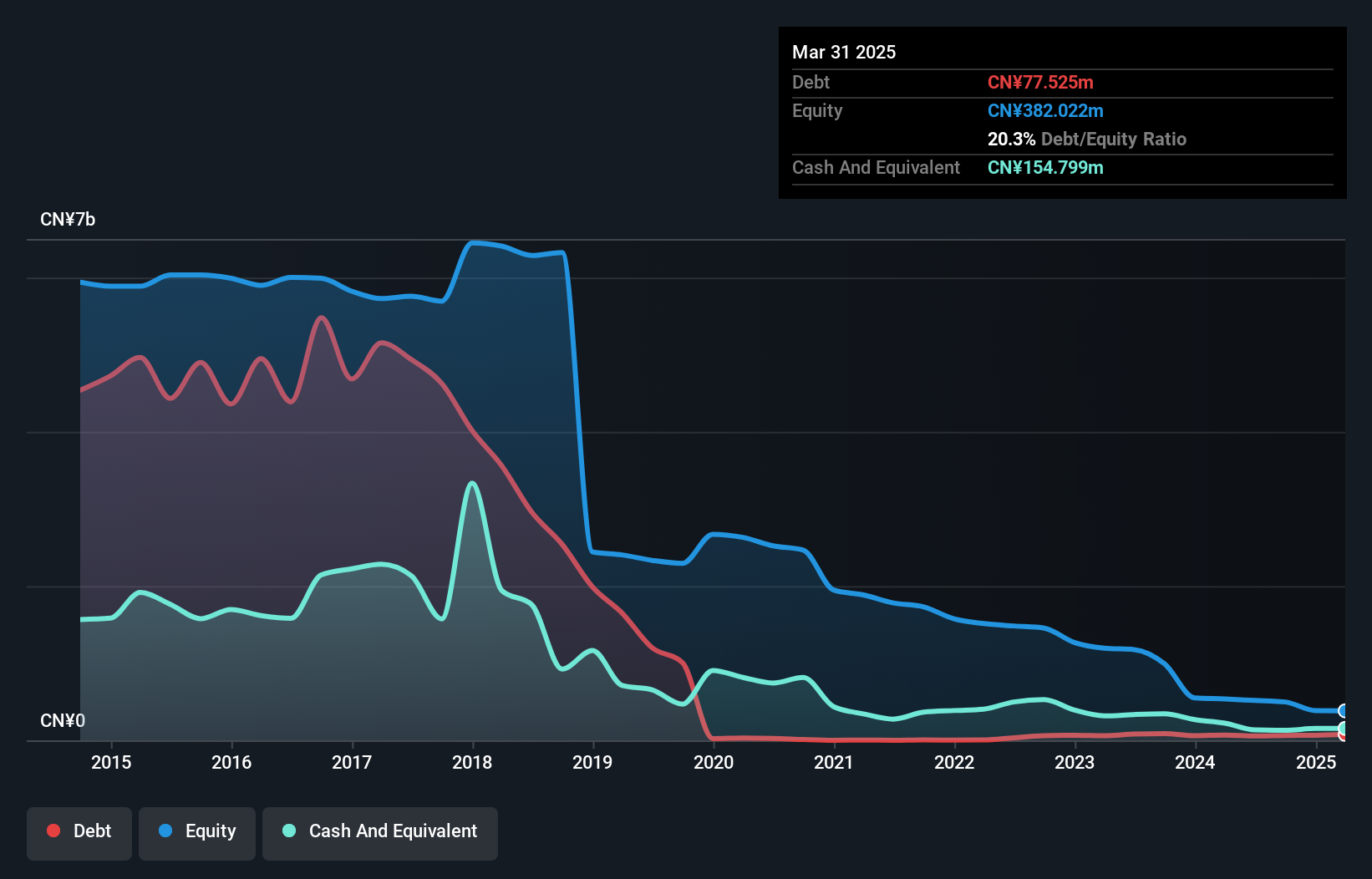

Heilongjiang Interchina Water Treatment Co., Ltd, with a market cap of CN¥3.92 billion, has shown financial resilience despite recent challenges. The company became profitable over the past five years but reported a net loss of CN¥16.14 million for the nine months ended September 2025, impacted by a significant one-off loss of CN¥20.8 million. Its short-term assets (CN¥1.2 billion) exceed both short-term and long-term liabilities, indicating strong liquidity management. Though its return on equity is low at 0.4%, debt levels have decreased significantly to 1.8% from 6.4% over five years, supported by adequate operating cash flow coverage at 46.7%.

- Dive into the specifics of Heilongjiang Interchina Water TreatmentLtd here with our thorough balance sheet health report.

- Gain insights into Heilongjiang Interchina Water TreatmentLtd's past trends and performance with our report on the company's historical track record.

Elec-Tech International (SZSE:002005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Elec-Tech International Co., Ltd. manufactures and sells small household appliances and LED products both in China and internationally, with a market cap of CN¥4.65 billion.

Operations: Elec-Tech International Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.65B

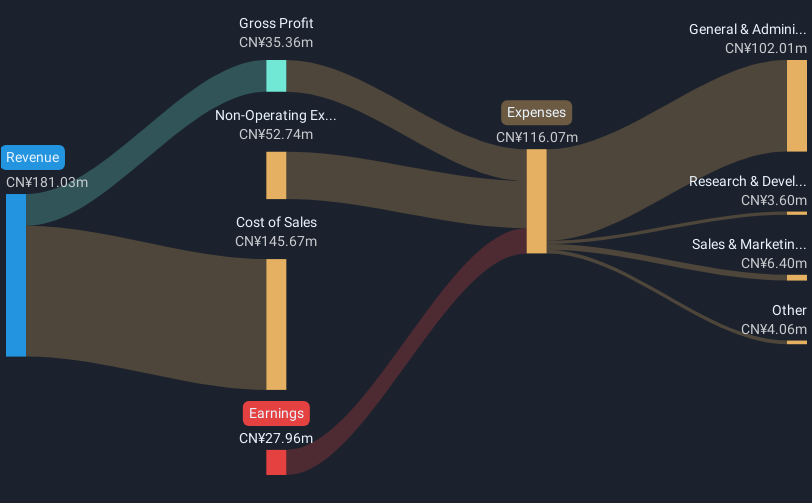

Elec-Tech International Co., Ltd. has demonstrated financial improvement, reporting a net income of CN¥90.15 million for the nine months ending September 2025, reversing a prior year's loss. Despite this progress, the company remains unprofitable overall and faces challenges with short-term liabilities exceeding assets by CN¥113.7 million. The debt to equity ratio has risen significantly over five years to 19.4%, yet cash reserves exceed total debt, providing some financial stability with a cash runway sufficient for over a year at current free cash flow levels. Shareholders have not faced significant dilution recently, although management experience is limited with an average tenure of 1.2 years on the board.

- Click to explore a detailed breakdown of our findings in Elec-Tech International's financial health report.

- Gain insights into Elec-Tech International's historical outcomes by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 3,612 Global Penny Stocks selection here.

- Looking For Alternative Opportunities? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)