- Hong Kong

- /

- Capital Markets

- /

- SEHK:245

Spotlight On 3 Promising Penny Stocks With Over US$90M Market Cap

Reviewed by Simply Wall St

Global markets have recently experienced significant shifts, with U.S. stocks rallying to record highs following a "red sweep" in the elections, which has sparked investor optimism about potential economic growth and tax reforms. Amidst these broader market movements, penny stocks remain an intriguing investment area for those looking to explore opportunities outside traditional large-cap equities. Although often overlooked, these smaller or newer companies can offer substantial growth potential when underpinned by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.12 | THB1.72B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.96 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,738 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services across Hong Kong, Mainland China, Japan, and Canada with a market cap of HK$2.08 billion.

Operations: The company's revenue is derived from Investment Holding (HK$58.71 million), Asset Management (HK$16.56 million), and Securities Brokerage including Investment Banking (HK$9.04 million).

Market Cap: HK$2.08B

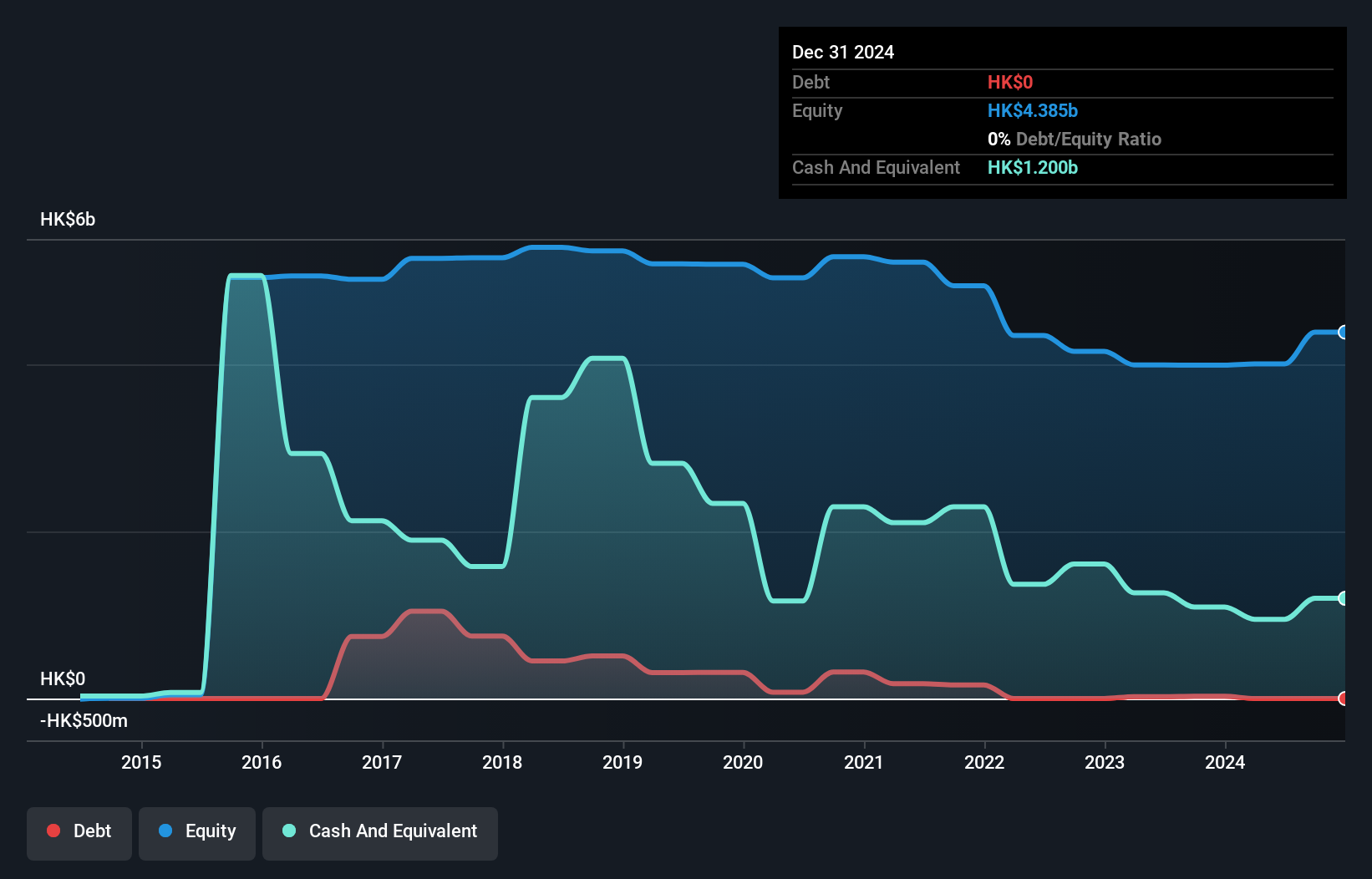

China Vered Financial Holding, with a market cap of HK$2.08 billion, operates in asset management and securities brokerage but remains unprofitable. Recent earnings showed a net loss of HK$20.78 million for the first half of 2024, though this was an improvement from the previous year. The company benefits from being debt-free and having ample cash reserves to sustain operations for over three years without additional funding needs. However, challenges include a lack of experienced leadership and shareholder dilution due to increased shares outstanding by 7.1% over the past year.

- Jump into the full analysis health report here for a deeper understanding of China Vered Financial Holding.

- Review our historical performance report to gain insights into China Vered Financial Holding's track record.

WebX International Holdings (SEHK:8521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WebX International Holdings Company Limited is an investment holding company that supplies functional knitted fabrics in the People's Republic of China and Hong Kong, with a market cap of HK$506.88 million.

Operations: The company generates revenue primarily from the sales of functional knitted fabrics, apparel, and yarns amounting to HK$120.39 million.

Market Cap: HK$506.88M

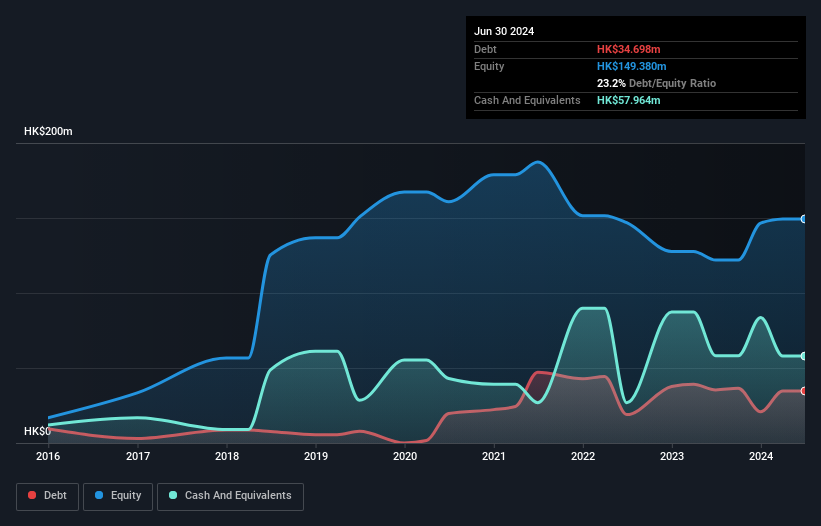

WebX International Holdings, with a market cap of HK$506.88 million, recently turned profitable, reporting a net income of HK$0.445 million for the first half of 2024 compared to a loss last year. The company's revenue increased to HK$58.82 million due to growth in cloud-based computing and internet traffic services. Despite this positive shift, challenges remain with negative operating cash flow and an inexperienced board averaging 1.3 years in tenure. The company has more cash than debt and short-term assets exceed both short-term and long-term liabilities, providing some financial stability amidst its low return on equity of 3.2%.

- Unlock comprehensive insights into our analysis of WebX International Holdings stock in this financial health report.

- Examine WebX International Holdings' past performance report to understand how it has performed in prior years.

Tiong Woon Corporation Holding (SGX:BQM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tiong Woon Corporation Holding Ltd is an investment holding company offering integrated services to the oil and gas, petrochemical, infrastructure, and construction sectors, with a market cap of SGD130.99 million.

Operations: The company's revenue is primarily derived from its Heavy Lift & Haulage segment, which generated SGD139.84 million, complemented by contributions from Marine Transportation at SGD3.97 million and Trading at SGD1.56 million.

Market Cap: SGD130.99M

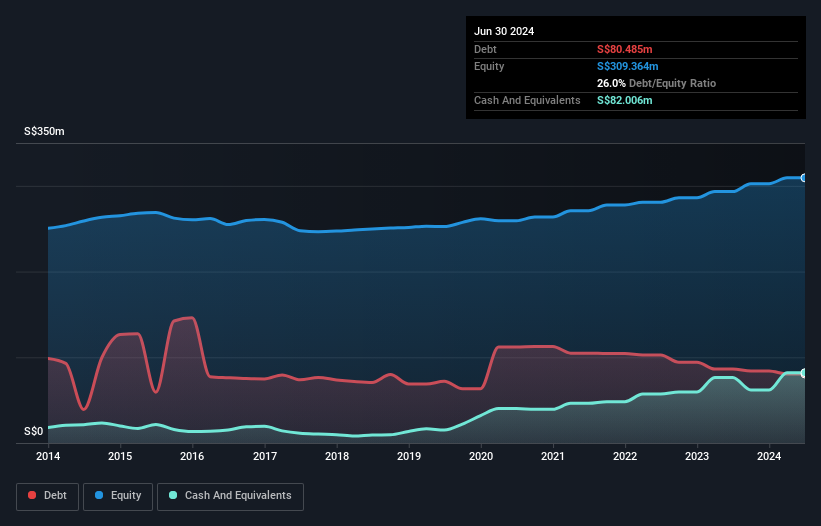

Tiong Woon Corporation Holding Ltd, with a market cap of SGD130.99 million, has shown solid financial performance in its Heavy Lift & Haulage segment, generating SGD139.84 million in revenue. The company's net profit margin improved to 12.7%, and earnings have grown significantly over the past five years at an annual rate of 25.8%. Recent board changes include the retirement of two independent directors and reconstitution of committees, potentially impacting governance dynamics. The company declared both a final dividend and a special dividend for FY2024, reflecting strong cash flow management as debt is well-covered by operating cash flow (48.9%).

- Dive into the specifics of Tiong Woon Corporation Holding here with our thorough balance sheet health report.

- Learn about Tiong Woon Corporation Holding's future growth trajectory here.

Summing It All Up

- Click here to access our complete index of 5,738 Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:245

China Vered Financial Holding

An investment holding company, provides asset management, consultancy, financing, and securities advisory and brokerage services in Hong Kong, Mainland China, Japan, and Canada.

Flawless balance sheet very low.