- Hong Kong

- /

- Capital Markets

- /

- SEHK:329

Discovering Opportunities: OCI International Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policy changes, investors are exploring various avenues to capitalize on new opportunities. Penny stocks, often overlooked due to their smaller market presence, continue to offer potential for significant returns when backed by strong financials. Despite being a somewhat outdated term, these stocks represent companies that can provide value and growth opportunities not always found in larger firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.78 | MYR135.97M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.92 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR761.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

Click here to see the full list of 5,766 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

OCI International Holdings (SEHK:329)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OCI International Holdings Limited is an investment holding company offering asset management services in Hong Kong and the People's Republic of China, with a market cap of HK$659.89 million.

Operations: The company's revenue is primarily derived from trading of wines and beverages (HK$64.64 million), asset management (HK$27.19 million), and investment and financial advisory services (HK$0.53 million), while securities trading and investments contributed negatively (-HK$11.05 million).

Market Cap: HK$659.89M

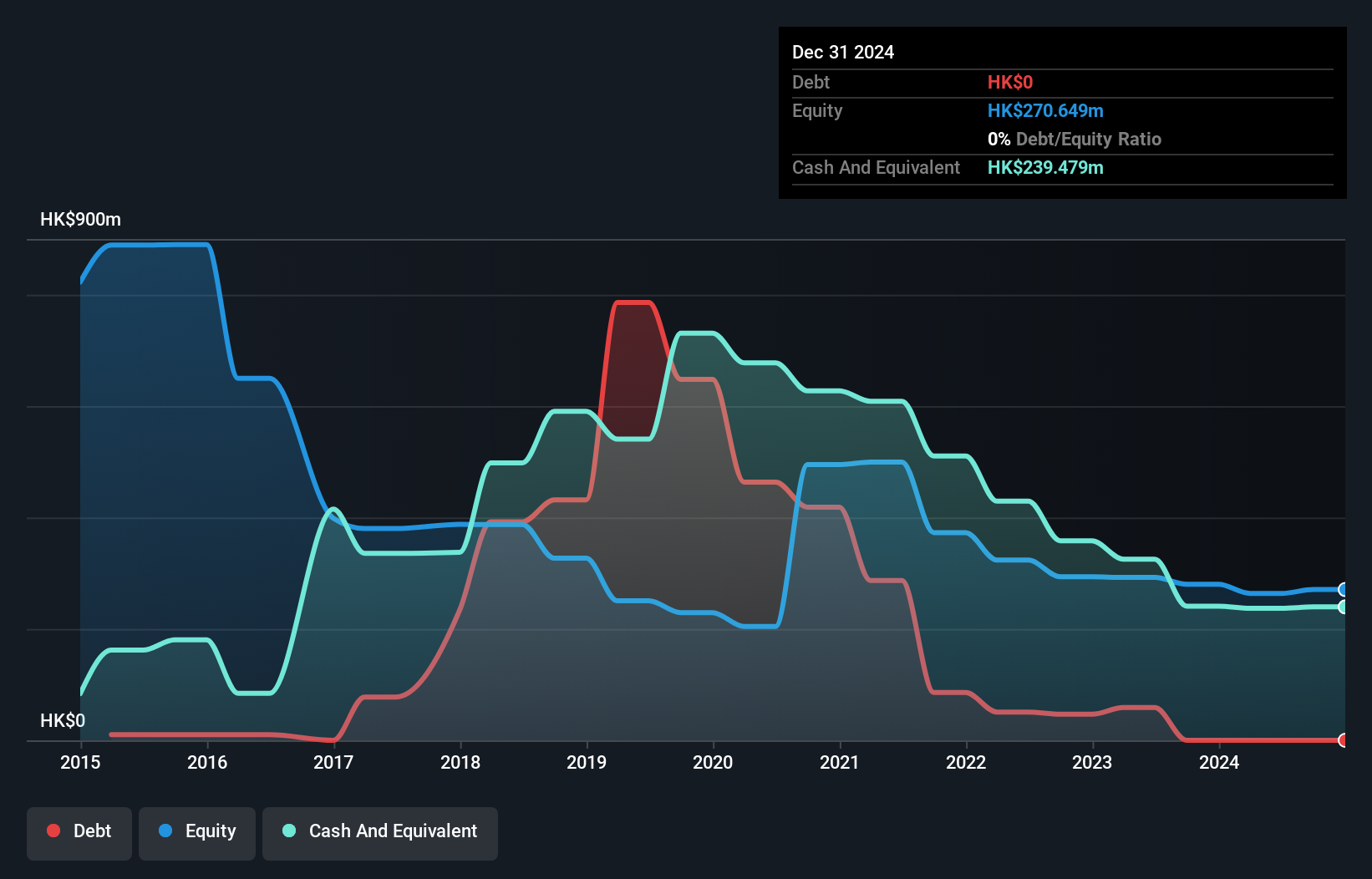

OCI International Holdings has faced challenges with a reported net loss of HK$16.25 million for the first half of 2024, primarily due to a significant net fair value loss on financial assets. Despite this, the company remains debt-free and its short-term assets exceed liabilities, offering some financial stability. While unprofitable, OCI has reduced losses over five years and maintains a positive cash flow with sufficient runway exceeding three years if current conditions persist. The board is experienced; however, management's average tenure is short at one year, indicating recent changes in leadership.

- Click to explore a detailed breakdown of our findings in OCI International Holdings' financial health report.

- Gain insights into OCI International Holdings' historical outcomes by reviewing our past performance report.

Kindstar Globalgene Technology (SEHK:9960)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kindstar Globalgene Technology, Inc. is an investment holding company offering clinical testing services in the People’s Republic of China with a market capitalization of approximately HK$1.13 billion.

Operations: The company generates revenue from various clinical testing services in China, including Hematology Testing (CN¥591.37 million), Neurology Testing (CN¥96.80 million), Maternity-Related Testing (CN¥54.42 million), Routine Testing (CN¥49.78 million), Genetic Disease and Rare Diseases (CN¥47.27 million), Infectious Diseases (CN¥43.73 million), Oncology Testing (CN¥17.89 million), and Scientific Research Services and CRO activities (CN¥28.06 million).

Market Cap: HK$1.13B

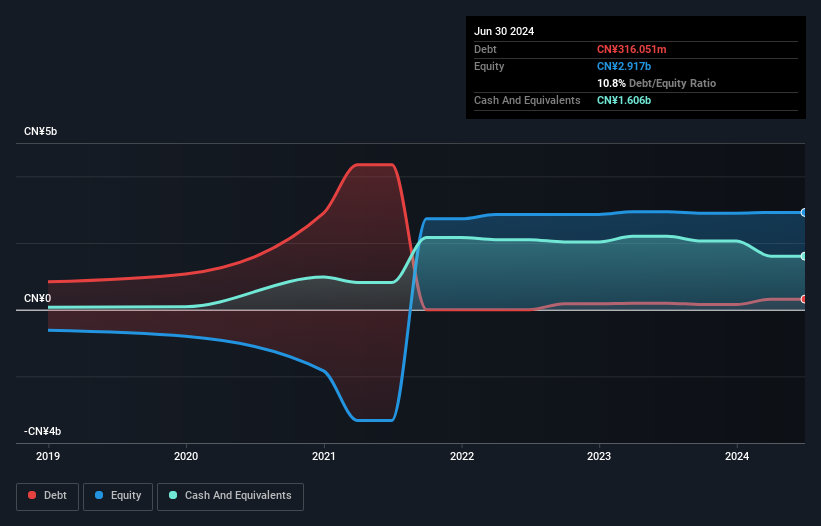

Kindstar Globalgene Technology, Inc. has shown resilience with a market capitalization of approximately HK$1.13 billion, despite facing declining earnings, reporting CN¥11.9 million net income for the first half of 2024 compared to CN¥43.98 million the previous year. The company benefits from diverse revenue streams across clinical testing services in China and maintains positive shareholder equity after past deficits. While profit margins have decreased to 1%, Kindstar's short-term assets significantly exceed both short and long-term liabilities, providing a stable financial footing. Recent management changes include appointing Dr. Jian-Bing FAN as chief scientific officer to drive R&D innovation.

- Dive into the specifics of Kindstar Globalgene Technology here with our thorough balance sheet health report.

- Understand Kindstar Globalgene Technology's earnings outlook by examining our growth report.

PEC (SGX:IX2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PEC Ltd. offers mechanical engineering and contracting services to industries such as oil and gas, energy, petrochemical, pharmaceutical, and oil and chemical terminals across Singapore, China, the Middle East, and internationally with a market cap of SGD164.24 million.

Operations: The company's revenue is primarily derived from Project Works at SGD285.08 million and Plant Maintenance and Related Services at SGD263.72 million.

Market Cap: SGD164.24M

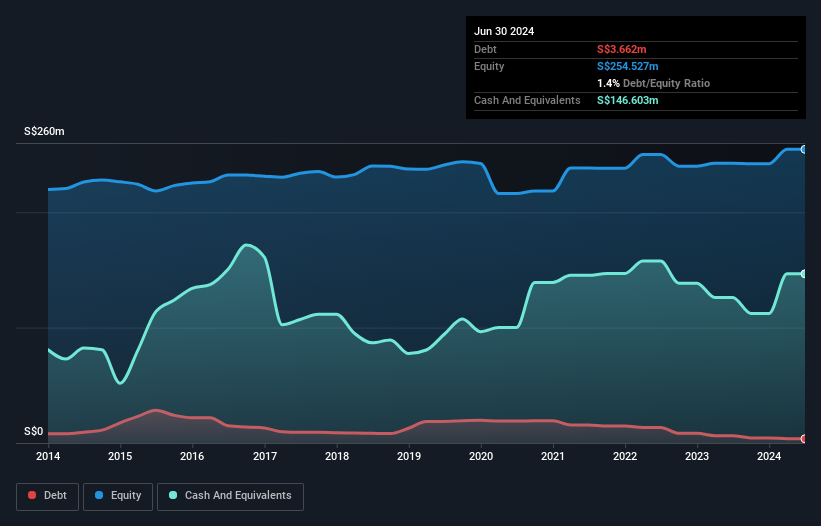

PEC Ltd. demonstrates financial stability with a market cap of SGD164.24 million and significant revenue streams from Project Works (SGD285.08 million) and Plant Maintenance (SGD263.72 million). The company has shown robust earnings growth, reporting net income of SGD16 million for the year ending June 2024, up from SGD6.77 million the previous year, indicating improved profit margins at 3.3%. PEC's debt is well covered by operating cash flow, and short-term assets exceed liabilities, suggesting sound liquidity management. Recent shareholder returns include a final dividend of 2 cents per share and a special dividend of 1.5 cents per share declared in October 2024.

- Click here to discover the nuances of PEC with our detailed analytical financial health report.

- Assess PEC's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Jump into our full catalog of 5,766 Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:329

OCI International Holdings

An investment holding company, provides asset management services in Hong Kong and People’s Republic of China.

Flawless balance sheet very low.