The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like XMH Holdings (SGX:BQF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide XMH Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for XMH Holdings

How Fast Is XMH Holdings Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that XMH Holdings' EPS went from S$0.036 to S$0.11 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

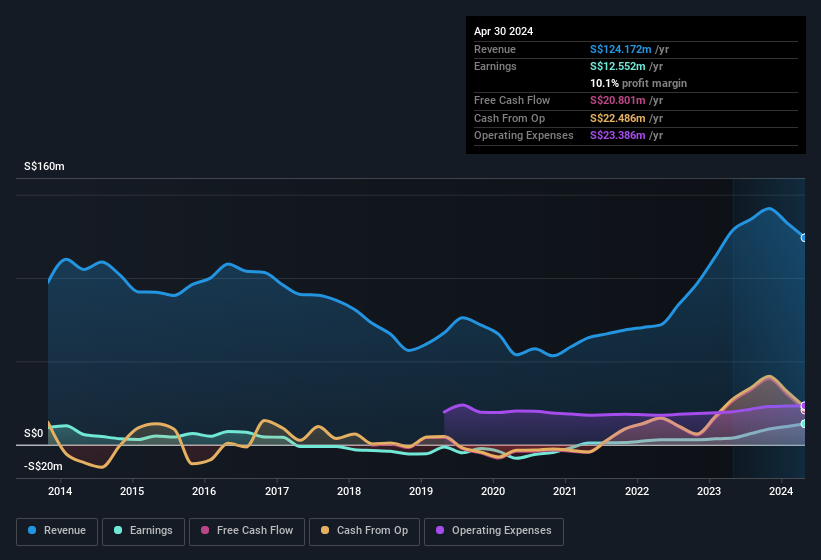

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. XMH Holdings' EBIT margins have actually improved by 8.8 percentage points in the last year, to reach 16%, but, on the flip side, revenue was down 3.5%. That's not a good look.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since XMH Holdings is no giant, with a market capitalisation of S$38m, you should definitely check its cash and debt before getting too excited about its prospects.

Are XMH Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for XMH Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Chairman & MD Tin Yeow Tan paid S$732m, for stock at S$18,354 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for XMH Holdings will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 97%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at S$37m at the current share price. That's nothing to sneeze at!

Should You Add XMH Holdings To Your Watchlist?

XMH Holdings' earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe XMH Holdings deserves timely attention. You still need to take note of risks, for example - XMH Holdings has 2 warning signs we think you should be aware of.

The good news is that XMH Holdings is not the only stock with insider buying. Here's a list of small cap, undervalued companies in SG with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BQF

XMH Holdings

An investment holding company, provides diesel engine, propulsion, and power generating solutions for customers in the marine and industrial sectors in Singapore, Indonesia, Malaysia, Vietnam, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives