- Singapore

- /

- Capital Markets

- /

- SGX:YF8

Spotlight On PSG Corporation And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, major U.S. indexes have reached record highs, buoyed by optimism around trade policies and AI investments. Amidst this backdrop, investors are increasingly interested in exploring diverse opportunities across different market segments. While the term 'penny stocks' may seem outdated, these smaller or newer companies can still offer significant potential when backed by solid financials. In this article, we will examine three such penny stocks that stand out for their financial strength and growth potential in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, along with its subsidiary PSGC (Lao) Sole Company Limited, operates in turnkey engineering, procurement, and construction (EPC) and large-scale construction projects in Thailand and the Lao People’s Democratic Republic, with a market cap of THB24.70 billion.

Operations: The company's revenue is derived from its plant and building construction segment, which generated THB4.62 billion.

Market Cap: THB24.7B

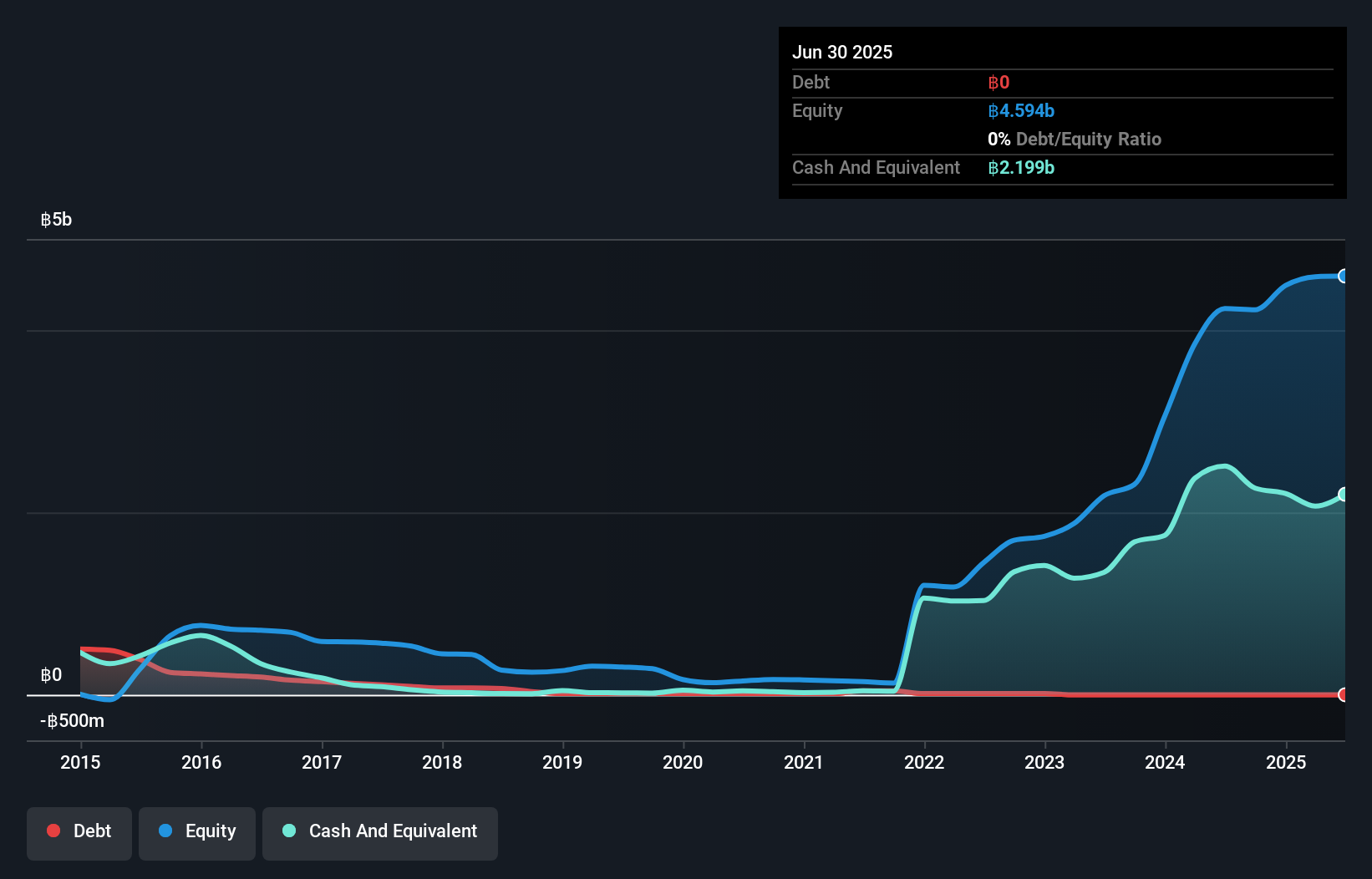

PSG Corporation, with a market cap of THB24.70 billion, operates in the EPC sector and has demonstrated impressive earnings growth of 217.9% over the past year, far outpacing industry averages. Despite its high volatility and slightly reduced profit margins compared to last year, PSG's financial health is robust with no debt and strong asset coverage of liabilities. The company's recent earnings report shows significant revenue growth for both the third quarter and nine months ended September 2024, although net income for Q3 was lower than the previous year due to fluctuating profit margins.

- Get an in-depth perspective on PSG Corporation's performance by reading our balance sheet health report here.

- Understand PSG Corporation's track record by examining our performance history report.

BRC Asia (SGX:BEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BRC Asia Limited, with a market cap of SGD795.62 million, is involved in the prefabrication of steel reinforcement for concrete across Singapore and several international markets including Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, and India.

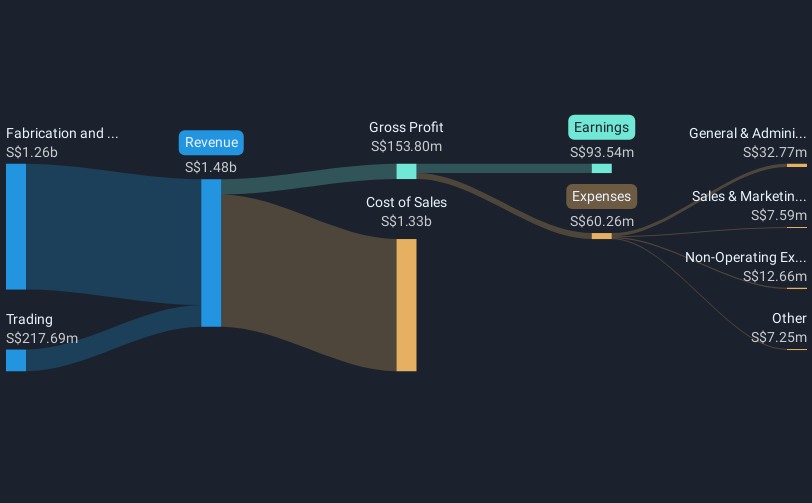

Operations: The company generates revenue primarily from two segments: Fabrication and Manufacturing, which accounts for SGD1.26 billion, and Trading, contributing SGD217.69 million.

Market Cap: SGD795.62M

BRC Asia Limited, with a market cap of SGD795.62 million, has shown solid financial performance despite challenges in revenue growth. Its earnings increased by 23.5% over the past year, surpassing industry averages, and net profit margins improved from 4.7% to 6.3%. The company maintains a satisfactory net debt to equity ratio of 6.1%, with short-term assets comfortably covering both short and long-term liabilities. While BRC's dividends have been unstable historically, it plans to declare significant dividends at its upcoming AGM on January 27, 2025, reflecting confidence in its financial stability and cash flow management capabilities.

- Unlock comprehensive insights into our analysis of BRC Asia stock in this financial health report.

- Examine BRC Asia's earnings growth report to understand how analysts expect it to perform.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in the People's Republic of China and Singapore, with a market cap of SGD1.57 billion.

Operations: The company generates revenue of SGD303.66 million from its investment business activities.

Market Cap: SGD1.57B

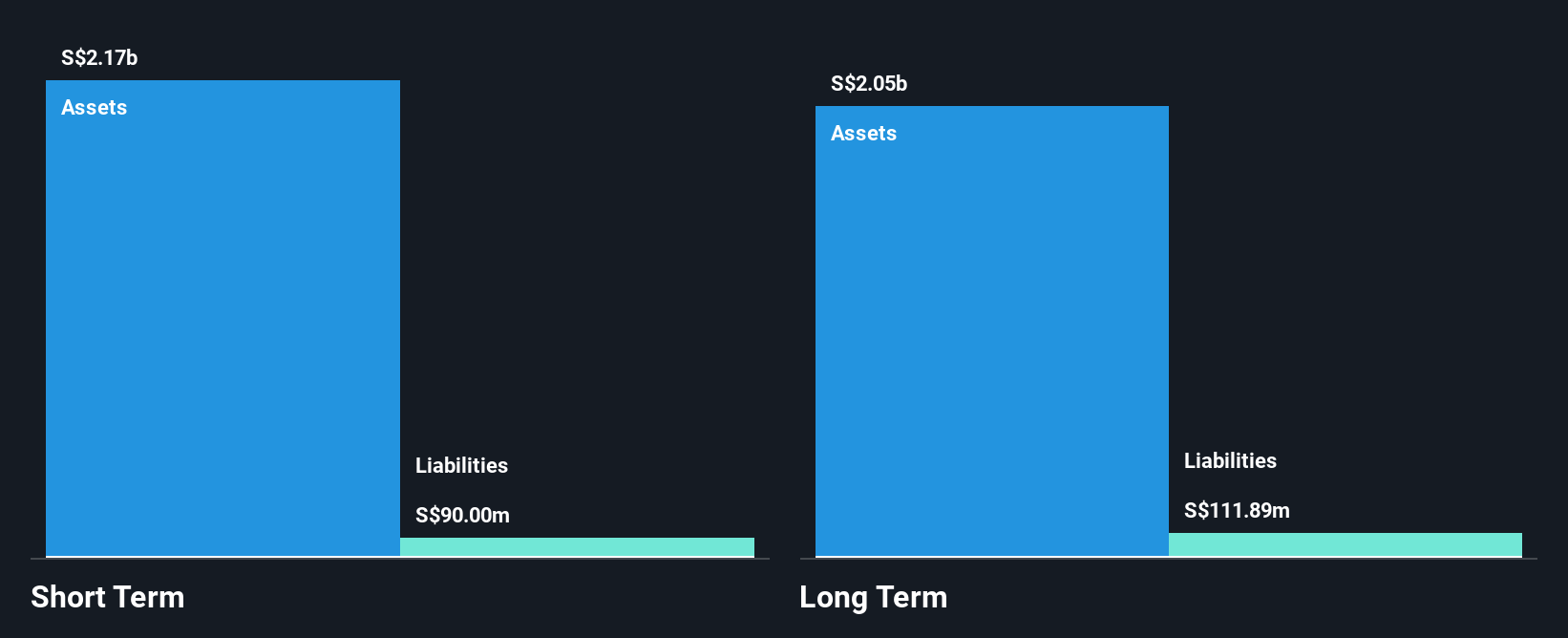

Yangzijiang Financial Holding, with a market cap of SGD1.57 billion, operates in investment activities across China and Singapore. It has stable weekly volatility and is trading below its estimated fair value. Despite a large one-off loss of SGD73.2 million affecting recent results, the company maintains strong financial health with short-term assets exceeding both short and long-term liabilities significantly. Its debt is well covered by operating cash flow, and it holds more cash than total debt. Recent share repurchase activities reflect strategic capital management but follow negative earnings growth trends over the past year.

- Take a closer look at Yangzijiang Financial Holding's potential here in our financial health report.

- Understand Yangzijiang Financial Holding's earnings outlook by examining our growth report.

Seize The Opportunity

- Unlock more gems! Our Penny Stocks screener has unearthed 5,705 more companies for you to explore.Click here to unveil our expertly curated list of 5,708 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:YF8

Yangzijiang Financial Holding

An investment holding company, engages in the investment-related activities in the People's Republic of China and Singapore.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives